gfp

-

Posts

4,812 -

Joined

-

Last visited

-

Days Won

8

Content Type

Profiles

Forums

Events

Posts posted by gfp

-

-

Sure seems like a long time to tie up that capital in exchange for less than 10% maximum return. I wouldn't be worried either that Berkshire will trade below 182 in a year and a half. But there is a chance that the shares are materially higher by then and I would rather participate on the long side of a great business where I can completely defer my gains tax indefinitely.

Sometimes long dated calls on the long side are attractive, but I never sell long dated puts. When Berkshire did it, they weren't required to post collateral. You are.

I've been writing puts aggressively on Berkshire. My favorite is an $18 premium for $200 strike January 2020 put. Break even price $182...in 2020. Feel pretty good about that one

-

Back at the BRK.B trough... Looks like you might get your shares this month Boilermaker!

Yes and I wrote a couple of more puts, expiration tomorrow strike price $192.50 for $0.75 per share.

Great minds think alike, but my sell order for two at .99 each never got filled.. (same contract)

-

Back at the BRK.B trough... Looks like you might get your shares this month Boilermaker!

-

You can also look at just the insider transactions by clicking the red link "Get insider transactions" for this 'issuer' or for this 'reporting owner'

Under this reporting owner, for Berkshire, you get the recent PSX sale, the Liberty Sirius accumulation, PSX purchases, etc..

Under this issuer, you get the insider transactions for BRK stock, which are primarily charity related. But sometimes there is an interesting one like Charlie transferring a huge block of his Berkshire stock near the exact bottom of the financial crisis to his children in exchange for a promissory note. Charlie's no dummy

https://www.sec.gov/Archives/edgar/data/1067983/000118143108063602/xslF345X03/rrd224408.xml

-

Good discussion there. Berkshire did have to report the Wells share sales within 3 days. Berkshire issued a press release and briefed Becky Quick on it just before the filings hit so people wouldn't freak out - "Berkshire selling Wells Fargo!" which would be seen as a big negative, especially given the headlines surrounding Wells recently..

https://www.sec.gov/Archives/edgar/data/72971/000120919117026722/xslF345X03/doc4.xml

-

The youtube ones should be more universal and easy to view (at least until CNBC notices that "LRT Capital Management" has ripped off their exclusive content...) Also the youtube ones seem to have been ripped from CNBC before they introduced the highlight reels.

Videos are also available on YouTube:

https://www.youtube.com/playlist?list=PL36RkdUSESoAsmo_xHvvsy55np9NX-rbN

-

They work perfectly for me in the United States on a Mac using safari. They use HTML5 through a company called JW Player.

If they don't load at all for you and you are not in the United States, it could have something to do with international permissions or lack thereof. Or you could be blocking HTML5 videos through an ad blocker, or have an old browser. Try it on your smartphone to see if that helps

Do you any of you have trouble with the videos loading? I have tried using different browsers, but nothing seems to help.

Thanks

-

They also added 'highlight reels' for the meetings, which are really great, quick ways to go through the meetings when you don't have time to systematically watch hours of footage

-

In thinking about Berkshire's continued buying of AAPL, it seems to me that Berkshire must have stopped buying. Berkshire would be required to report to the SEC if it crossed above ~245.7 million shares, which represented 5% as of the last 10Q. As Apple updates the share count to reflect repurchases, Berkshire will likely cross the 5% threshold and report an updated number for Berkshire ownership, but only following the publication of a new shares outstanding figure by Apple.

Or I could be wrong and a 13d could be filed any day showing Berkshire hitting 5%...

-

Just to clarify on this, Berkshire was not proposing to receive $2 more than other shareholders in their original option proposal. Their proposal was always going to result in Berkshire receiving the same consideration as other shareholders if a deal was consummated.

Berkshire has filed a 13D/A regarding USG. Scrolling to the notes section: Same holdings as before but they have given their proxy to the acquirer, Knauf, to accept the acquisition offer and clarified that their previous offer of a $42-strike call option on all their stock to Knauf at $2 price did not proceed. The $43.50 + 50¢ special dividend offer provides the same $44 return to all shareholders.

Courtesy Rocketfinancial email alerts

-

Good trade. I like BRK at 193.80 and I like $600... Either way is nice. Its great to sell these close dated options on a Friday (before holiday weekends are even better) - even though it's all supposed to be priced in, I find that once it becomes the week of expiry, people's appetite for allowing nice premium diminishes quickly.

Wrote 5 June 15 expiration 195 strike BRKB puts for $1.20 per share

-

According to GuruFocus, Prem has sold out his IPI shares at about $4.60. Given that he purchased at $1.20 less than a year ago, it seems like a great score. Where did this info come from though? He won't have to file his 13f for a couple of months, so what filing are they getting their info from?

They are getting their information from the SEC ->

https://www.sec.gov/cgi-bin/browse-edgar?CIK=IPI&owner=exclude&action=getcompany

The recent SC 13G/A filings show Fairfax reducing to zero.

Before they reduced their holdings below 10%, there were also more detailed Form 4s showing the trading prices ->

https://www.sec.gov/Archives/edgar/data/915191/000094787118000382/xslF345X03/ss90975_4.xml

https://www.sec.gov/Archives/edgar/data/915191/000094787118000394/xslF345X03/ss91496_4.xml

-

Dallas paper speculating the recent Homeservices deal could have been around $100 million all cash deal -

Warren was apparently friendly with the founder and expressed an interest in buying her company for many years.

-

I believe it. It was convertible debt, expensive money for uber to gain buffett’s Halo effect. With optionality on the upside for brk. And warren wanted to do far more than 3 billion in size. Dara tried to talk him down to 2 billion. It sounds plausible. I wonder what the interest rate was. 5-8%? I didn’t see the rate on uber ‘s term loan

-

Hey Mike,

I hadn't seen that Drew bought the jersey to loan to the school for display. What a guy. Saints have been fun again - Alvin Kamara is a blast to watch (and a nice guy you can bump into around town) and Drew still has a few great years left if he gets the help he needs. My buddy made his draperies, ha!

I wouldn't want a bunch of margin after a super long bull run either, but I suppose if BRK gets down to 170 or thereabouts I won't be able to resist doing the call option trade I've had good results with at that valuation several times in the past. Long LEAPS calls and probably some shorter dated calls as well. (I know, I know, buying options on the long side must feel so wrong to you! I'll make sure they are fairly deep in the money with low premiums)

Contrary to the post above, I don't foresee Berkshire's book value "dropping strongly" in anything but an all out rout. And I think a market panic ultimately makes BRK more valuable and solves many of the few "problems" BRK has putting capital to work. Retained earnings will largely offset most down years in the market...

Berkshire and Eurobank today. Liberty Global last week. Love BRK at $470 Billion. 10% of that is Apple alone

GFP,

Nice, I would have joined you but if I get assigned to all my naked puts (highly unlikely) I'll be on more margin than I would want in this market.

However, I could not completely resist so I wrote one $187.5-strike, Friday expiration put for $95! ;)

Geaux Saints,

Mike

PS Did you see where Drew Brees bought John Wooden's 1930s Purdue jersey?

-

Berkshire and Eurobank today. Liberty Global last week. Love BRK at $470 Billion. 10% of that is Apple alone

-

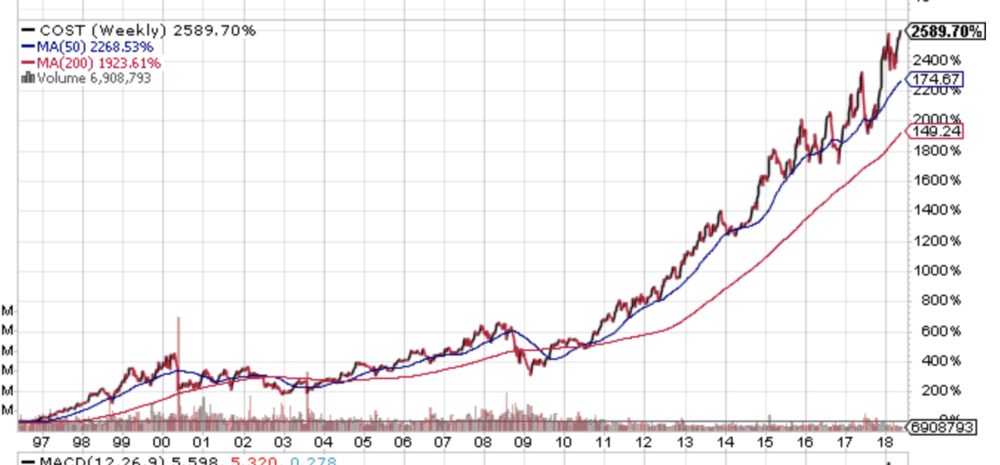

This link is the registration statement for the block of Costco Stock in question (momentarily called "PriceCostco" for a year following the merger with Sol Price's Price Club):

https://www.sec.gov/Archives/edgar/data/909832/0000912057-96-010651.txt

The partner was a subsidiary of Carrefour, the French hypermarket company. Carrefour owned 21.19 million shares, which was 9.7 - 10.8% of Costco around the mid nineties.

The offering ended up being for 19.5 million shares in this registration statement, so you can assume the block that Warren had a chance at was probably the 19.5 million shares.

I'm sure you could find some online calculator to tell you the total return with dividends of 19.5 million costco shares from approximately May 23, 1996 to the present. I assume there have been splits, but am not a Costco shareholder.

Guys,

I hadn't heard the story that Charlie Munger told on the CNBC interview about Warren and Charlie having the opportunity to purchase the french portion/division/interest in Costco many years back. Charlie said that he told Warren to "close his eyes and BUY IT." And Warren DID NOT/WOULD NOT buy it....

Does anyone know how much they would have made/profited had they purchased it? How large was the sin of omission?

Thanks.

edit -- I think it's as simple as 19.5 million shares at a split adjusted 10 bucks per share in May 1996, say 195 million for Berkshire. Without including dividends, the shares would be worth $3.9 Billion at 200/share today, 22 years later

second edit -- well I think the above is not exactly right. The shares were 20.875 / share for the offering, which would have cost Berkshire $407 million bucks for 19.5 million shares. They would now have 39 million shares at 200, so $7.8 Billion. At least I think this is correct...

More or less this attached image ->

-

Was there a catalyst I am missing for today's rise in FFH share price? Another insurer's results? Fairfax announcement / filing?

-

-

Holding company cash is earmarked for minority partner buyouts. Insurance float cash is probably mostly already put to work in similar duration to what the original poster hoped for. 1-2 year treasuries. I forget where they mentioned they had already put most of it to work in that part of the curve, but I read it on this board somewhere. It was quick to put it all to work, but it's still really short, laddered stuff probably. So I would assume they are steady buyers with maturing bills.

-

Hmmm.... To read this article you would think Berkshire didn't pay much to the tax man?!

-

well that article explains why our teenage son picked up the hard copy of the wall street journal yesterday morning and proclaimed that he was 'supposed to buy her a bottle of patron for mothers day.' makes sense now!

-

Yeah I agree - what a great service to provide to the groupies. I started at the oldest and am working through them as I have time. Apparently we have Steve Burke (BRK board member, runs NBC U, daddy ran ABC at cap cities) to thank for this generous act!

Funny thing is Warren has changed a lot in the way he speaks, he had a more serious personality in '94, spoke much faster, etc... Charlie was basically exactly the same!

This thing is amazing. Watched the 1994 meeting in entirety last night. Enjoyed it very much.

Bill Ackman asked a wiseass question about Citi.

-

It will be interesting to see how the use of public infrastructure / implied government subsidy of the trucking industry shakes out vs. the owned and privately built and maintained rail infrastructure. Obviously there are road use and diesel taxes on trucking currently, but it is nowhere near the level it will likely be in the future when states and governments are even more indebted and rail lobbyists are pointing to these driverless convoys clogging up the public roadways, blocking on-ramps for a thousand feet at a time, etc...

That said, I certainly feel better about owning the railroad out in the big wide open west, vs an eastern-only railroad. As mentioned, long distances help and there are some pretty long distances to travel from western ports, mines, etc...

Rail will never have a place delivering your Wayfair furniture to your town, but it will likely be delivering the container of Wayfair furniture from the port of long beach to the distribution centers for a long time.

What are you buying today?

in General Discussion

Posted

Yeah, what Mike said.. But it really does beg the question - how much do you think this bag of cash is going to fall [in market price] if Warren dies tomorrow? The company starts buying their own equity in size something like 12% below the current market price. Retains all earnings, so every passing day there is more money in the bag. There are other things that keep me up at night, being long or synthetic long Berkshire stock at 192.50 isn't one of them.