gfp

-

Posts

4,820 -

Joined

-

Last visited

-

Days Won

8

Content Type

Profiles

Forums

Events

Posts posted by gfp

-

-

Thanks Cigarbutt, I appreciate the thoughtful reply

-

I have a quick question. So in July Fairfax put $264.6 million into Brit as a capital contribution and Brit used that to purchase an 11.2% ownership interest form OMERS (and pay OMERS an accrued dividend owed). So it's like a share repurchase / retirement, where Fairfax's ownership goes up, but so does the ownership of the other remaining minority owners - right?

Why wouldn't Fairfax buy the shares from OMERS, which would increase Fairfax's ownership only?

Is the net effect the same? As in, the capital contribution raised FFH's ownership percentage and then the share cancellation resulted in the same percentage ownership dynamics for all parties as would have been the case if FFH just bought OMERS's shares directly?

-

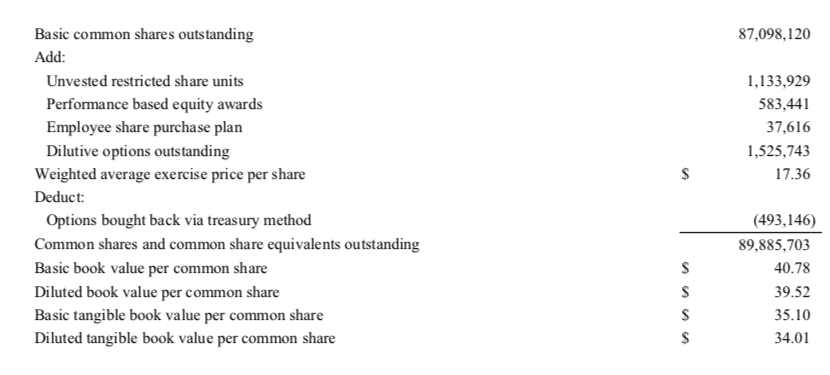

I suppose some of the rise could be associated with the Allied World acquisition. Maybe a call to IR would shed some light. From the final Allied World Annual Report (attached)

**Edit: I guess not, upon reading the merger agreement it sounds like all Allied World share based awards, RSU's, performance based share awards, options, etc ... were accelerated to fully vested and paid in cash or treated as shares under the merger agreement. I guess Fairfax just started giving out stock as compensation a lot more heavily in the last few years.

seems like they should have gone a little bit easier with the Teledyne references if they were going to handle issuance/repurchases this way. Setting yourself up for disappointment.

-

I get how options can be anti-dilutive, but how are share awards ever anti-dilutive?

-

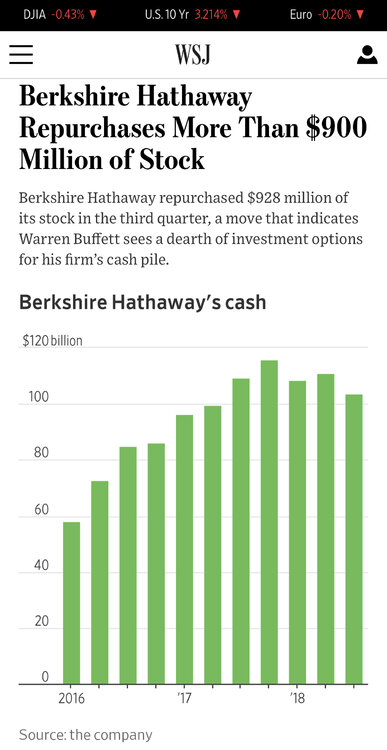

He doesn't want to influence the price of the stock very much. It is possible the price ceiling on the repurchase plan is tied to last reported book value, in which case it could be as high as 218 per B share currently. But it is equally possible that the ceiling remains at 208 or whatever it is and Warren is just wanting to buy the stock cheaper than others believed.

The limiting factor on repurchases in the 3rd quarter was the price. He would have repurchased a lot more stock if the price had stayed below the floor and their trader was able to be active every single trading day of the quarter. As it happened, the trader was only able to purchase shares for 14 trading days during the 3rd quarter.

-

I guess my point is that $1 retained is worth more than $1 any time Berkshire trades for more than book value. And if it trades close to or below book value, he would buy back as much stock as he could get his hands on. If the company trades at 1.01x book value, by definition a dollar retained is worth more than a dollar paid out (not even taking taxation into account)

-

I don't think they are options. I think they are restricted share awards - so the company does not receive any proceeds as they vest. They are amortized or whatever over their vesting periods and included as a compensation expense over time.

You may be picking up options issued in your share count. Options are not included in shares outstanding until they are exercised.

-

dividends are way closer than previously suspected

It really does seem like Warren's been really clear in pointing out that cash dividends do not make sense with Berkshire trading above book value. A dollar of after-tax earnings is worth less than a dollar if sent out in a cash dividend, or more than a dollar if retained. Despite there bing a ceiling price on their repurchase plan, I do think repurchases are the way he will go. And, of course, cash hasn't piled up the way many would have expected. We're still here at $100 Billion. One of these days he's going to buy a decent sized company.

-

Article on coming Q4 Michael loss estimates at BRK:

https://www.reinsurancene.ws/berkshire-hathaway-pegs-hurricane-michael-loss-at-up-to-550m/

-

Who knows. I doubt any of the equities are actually thought of as permanent holdings. He's tried to clarify that through updates to the 'owners manual' over the years. It's all available for sale if the business changes or the opportunity outweighs the benefit of the interest free loan from the government on the unrealized gains. The bar would be even lower now under current tax rates

Any idea does he see crApple as one of the Berkshires permanent investment like Amex/KO/WFC?

-

So here's my math:

9/30/2018 share count was 1,642,269 A share equivalents [2,463,403,858 B share equivalents] - from page 23 of the Q3 10Q

10/25/2018 share count was 1,641,681 A share equivalents [2,462,520,906 B share equivalents] - from front cover of Q3 10Q

So subsequent to quarter-end, they resumed repurchases and it was about $181 million worth of stock through 10/25. Which means they didn't stop in August because of a black-out period - they stopped because they have a ceiling price on their purchase plan.

* [sorry, should have included the difference, about 588 A share equivalents repurchased in Q4 up to 10/25, or 882,900 B shares eq.]

-

BK, USB and GS were all being accumulated the previous quarter and are logiical bets. Maybe something new. It’s funny the headlines saying stuff like this Rolfe quote from the WSJ:

What the buybacks signal, in a very big way, is that [Mr. Buffett’s] short list of putting prospective billions to work, either in private businesses or equities, outside of Apple, are nil,” said David Rolfe, chief investment officer of Wedgewood Partners Inc. in St. Louis, which owns Berkshire shares.No mention of the huge purchases of equities in the quarter or explanation of why the cash balance is declining and didn’t print $120 billion this quarter like it would have, absent massive buying of investments...

Just look at the equity portfolio’s growth in the past 12 months. They have been buying a lot to keep cash at $100 Billion

-----------

in other news, BNSF continues to roll over debt at extremely attractive rates. Look at this 30 year issuance from Q3 -

BNSF’s borrowings are primarily senior unsecured debentures. In the first nine months of 2018, BNSF issued $1.5 billion of senior unsecured debentures due in 2048, including $750 million in the third quarter. These debentures have a weighted average interest rate of 4.1%.Seems like all the borrowing lately is 2048-49 stuff -

In August 2018, BHFC issued $2.35 million of 4.2% senior notes due in 2048. Such borrowings are fully and unconditionally guaranteed by BerkshireIn July 2018, BHE issued $1.0 billion of 4.45% senior unsecured debt that matures in 2049. BHE subsidiaries also issued debt in July 2018, aggregating $1.05 billion and due in 2049.And the entire bond portfolio for a company with $736 Billion in invested assets is $17.8 billion at cost ($18.3 at market). An insurance company with a 2.5% allocation to fixed income.

-

Don’t use average as quarter end

-

Interesting... Call options on JBGS ?

-

Bloomberg finally picked up on the BAC purchase. I was surprised that nobody reported it. CNBC would rather tweet about Mark Cuban recommending that you should buy a years' worth of toothpaste at a time..

-

You would hope if he liked something in September he would still like it at much lower prices in October. I have thought he would buy JPM for a long time, but I gave up on that hope when Todd joined the board of directors of JPM. I am unclear if Todd being on the BoD at JPM would require Berkshire Hathaway to file with the SEC, but it might. Which would rule out JPM.

Too bad, because he's going to want a certain allocation to the banking business and its going to get harder for $1 trillion, 2 trillion, etc, Berkshire to do that if they are forced to keep selling most of them above 10%. 9% of JPM would have been a pretty good solution and you know he loves the management, loves the business, etc... Plus JPM was available at great prices for a really long time.

Since he was buying USB, BK and GS before the quarter, it seems logical he continued. But there could be new positions as well.

-

Yeah - that's what I'm getting at in the other thread. They purchased $17.657 Billion of equities in the quarter, and around $15 Billion of that is Banks, Insurance, Finance. And I think 200 million BAC shares is definitely part of it.

-

Is anyone else coming up with numbers that suggest Berkshire added 200 million BAC shares in the quarter? As in, used to own 700 million, now owns 900 million?

That would account for over $6 billion of the $15 Billion increase to cost basis in the category "Banks, insurance and finance." I have long speculated that he would add JPM, but with Todd on the board I would think he would have to file. Still a lot of "Banks Insurance and finance" that he bought during the quarter beyond just the BAC stock I am thinking he added.

I guess the other likely suspects would be USB, BK, and GS.

-

I mean, yeah, "one of the biggest quarters" is correct if you use an almost meaningless headline number under these new accounting rules. Even lowly Apple Inc just reported a pitiful $14 Billion net income quarter (must be embarrassing I know). Apple has made over $18 billion in a quarter (Q1) before, hence the "one of" language. [*edit - Apple made $20 Billion in the quarter ending December 2017]

But if you're going to focus on a meaningless headline number, why not use Berkshire's 2017 Q4, where the tax related gain added $29 Billion to Berkshire's actual earnings for the quarter.

"This is absolutely one of the biggest quarterly earnings reports that has ever come out of a United States corporation," said Bill Smead, chief executive of Smead Capital Management in Seattle, a Berkshire shareholder.

I believe he is talking about the headline number, but is his statement correct?

-

I'm not sure where I got 8 days from, I've been out all day. Perhaps it was an error in reading my notes. More likely, with the price cap that appears to have been in place, it was 11 trading days. If I remember what the hell I was thinking about when I wrote that I'll let you know..

But, yeah, as mentioned earlier - the 10Q on page 45 says, "Period" "August 7 through August 24:"

And he had mentioned in the original announcement that he would wait until everyone had the same information (after earnings were publicly released). Then he apparently waited one additional day, potentially for the reason I speculated in my previous post.

The gist is that Berkshire isn't buying back anywhere close to 25% of the average daily volume. And there appears to be a price cap, likely based on a multiple of book value so it may change quarter to quarter. Did the 'soft floor' just become a 'soft ceiling' ? LOL

-

The october repurchase activity can be estimated by using the 10/25 share counts, accounting for A to B conversions, and estimating the "missing" shares. It won't be spot on, because like you mention there are other factors that effect share count, but when there is a reduction in the number of outstanding shares we can safely assume that is from net share repurchases. All the other factors that effect share count would generally lead to small increases in share count.

It's out.

http://www.berkshirehathaway.com/qtrly/3rdqtr18.pdf

Buybacks have been less significant than I thought. If I read things correctly, 2 805 A-share equivalents have been bought back in August and September (around 840 Million USD). For October until the 25th, there has been an equivalent of 588.4 A-shares bought back. The neat total so far is that Berkshire bought back stock for approximately one billion USD.

I have a slightly different number, but similar conclusion to you. Total B-equivalents of 4,476,692 repurchased for $928 million during the quarter, for an average price of $207.3. I'm not sure where you are seeing the October numbers. It seems you are drawing conclusions from the reported share-count at Oct 25? I think that's reasonable, but there could easily be other factors that affect share counts aside from repurchases, as there were this quarter as well. Buyback was a little underwhelming. The rest of the earnings are rather good though. So good report overall, IMO.

-

So the way I read it is that they were only active for 14 trading days during the quarter: August 7th - August 24th, from which you can estimate the cap price in their repurchase instructions. During those 14 trading days they repurchased approximately $927.566 million worth of stock, for an average of about $66.25 million worth per trading day.

No further repurchase activity during the quarter.

Then, subsequent to quarter end, up until October 25th, they were back in the market, repurchasing approximately $181 million worth of stock in 8 trading days, for an average of about $22.625 million worth of stock per day. This is consistent with the estimated cap price that can be divined by the August repurchase activity.

They did not repurchase anything the first day the were allowed to, August 6th, probably because they had a one day delay starting trading on the 10b5-1 plan I assume they are using.

It's out.

http://www.berkshirehathaway.com/qtrly/3rdqtr18.pdf

Buybacks have been less significant than I thought. If I read things correctly, 2 805 A-share equivalents have been bought back in August and September (around 840 Million USD). For October until the 25th, there has been an equivalent of 588.4 A-shares bought back. The neat total so far is that Berkshire bought back stock for approximately one billion USD.

-

Man, I used to be interested in this company but they are not looking good. They will lose Sam's when that comes up for renewal and I would not be surprised if Amazon drops them at the first opportunity. SYF is basically the antithesis of 'relentlessly focused on pleasing the customer.'

bought more SYF, looks like an overreaction to the WMT news.

-

"one that got away" - Bloomberg article on Berkshire's interest in acquiring WPP Group in 2012

Buffett/Berkshire - general news

in Berkshire Hathaway

Posted

Greg Abel already running the place!

https://www.bloomberg.com/news/articles/2018-11-08/berkshire-s-egan-nabs-a-more-delicious-position-at-see-s-candies