rogermunibond

-

Posts

1,101 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by rogermunibond

-

-

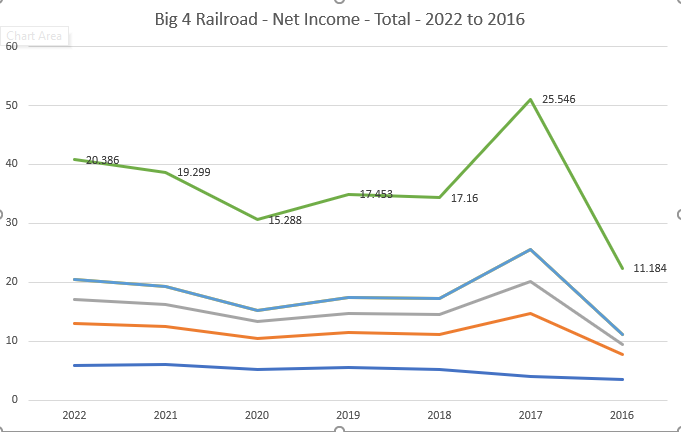

$ in Billions

-

Here's the HK Exchange shareholding disclosure page.

https://di.hkex.com.hk/di/NSSrchPerson.aspx?src=MAIN&lang=EN&g_lang=en

-

-

Charlie Munger was appointed to the Costco board shortly after the sale in Jan 1997, replacing the Carrefour CEO who previously was a Costco board member.

It's funny but Buffett likes to complain that he's so sick of hearing Charlie sing the merits of Costco and their retail model. Possibly because Charlie was pushing hard for Berkshire to buy the 10.8% stake that Carrefour was selling. Munger personally bought shares around that time and holds to this day.

-

Carrefour Profits on Stock Sale

Wall Street Journal, Eastern edition; New York, N.Y. [New York, N.Y]. 21 June 1996: No Page Citation.PARIS -- French retailer Carrefour SA said it made a profit of 700 million francs ($135.7 million) on the sale of its 10.8% stake in Price/Costco Inc., a discount retailer based in Issaquah, Wash.

Carrefour last month announced its intention to sell its 21 million Price/Costco shares. The sale was made at $19.50 a share, Carrefour said. In Nasdaq Stock Market trading, Price/Costco's shares rose 37.5 cents to $20.75.

-

FRA has an updated safety dashboard with train accidents data. This is not an uncommon occurrence, across all the lines A few years back when the Bakken oil boom was going on there were a number of high profile derailments/fires caused by tankers carrying crude oil.

-

-

20 hours ago, Spekulatius said:

The real problem with labor force participation is in the south:

https://fred.stlouisfed.org/release/tables?rid=446&eid=784070

Alabama, Arkansas, Kentucky, South Carolina, West Virginia, Mississippi .

All MAGA land.

The only Blue state coming close is Maine

Interesting I wonder if that cross correlates with disability claims

-

On 10/1/2021 at 3:26 PM, Brett said:

BTW, I'm writing a book on ten of Buffett's earliest investments (50s/60s). This is one of them. Happy to send a draft if you'd like.

Brett - do you have the Costco stake that was up for sale in the 1990s? IIRC Carrefour owned 10-20% of Costco and wanted to divest. At the time, Munger was familiar with Costco and I think he wanted Berkshire to acquire the stake but WEB decided against it. Probably a huge error of omission in retrospect.

-

State Farm with an auto underwriting loss of $4.57 billion in 3Q 2022. Worst quarter in 21 years.

-

Geico Underwriting

1Q2022 $178M loss

2Q2022 $487M loss

3Q2022 $759M loss

PGR Underwriting

1Q2022 $439M

2Q2022 $458M

3Q2022 $0.7M loss

Seems like Geico might have reduced underwriting quality?

-

Is now the time to take a small bet on the cannabis ETF?

Seems like chances of legalization are pretty low with a Republican House but...

-

GEICO's had pretty poor underwriting in certain states MD, VA, NJ, NY iirc.

Rates went up across the board in these states.

-

Maybe someone introduced Burry to Hussman

It's funny to describe someone with Aspergers as overdramatic.

-

-

-

1 hour ago, Xerxes said:

so then i guess i sold my shares to you in March 2020 ... LOL

so then i guess i sold my shares to you in March 2020 ... LOL

To make both of you feel better I owned NVDA from 2005 to 2012. And sold around $7.50 per share (split adjusted).

I reasoned that the GPU was just too cyclical based on the ups and downs of the console market. At that time Jensen's visionary views on computation and AI etc were an interesting distraction.

-

stockman500 - why does OPEN or OPAD or any other ibuying operation have better pricing insight than Z?

Why is their algo better on buying and selling to not lose money?

RDFN is continuing their ibuying program but they have better data.

-

Thanks, rather than order from one of the importers, I think I'll try some S. Florida growers first.

One of them offers Kesar mangos, which I was introduced to many years ago by a friend who got them from the Indian Embassy in DC. Unfortunately that channel for mangos dried up.

-

Thanks Pelagic - great information on the US mango varietals. I'll definitely have to look into getting a pre-order in for some of these varieties.

Here we have a lot of the Ataulfo mangos, which are certainly better than the Tommy Atkins.

Thanks Adesigar - I do sometimes get a bit of lip numbness from eating too many! Never tried soaking them though.

-

I've never tried to order Indian or Pakistani mango varieties online so wondering if the folks in this board have any favorite websites for this and any experience ordering from these sites. In the past, I've always gone around to the South Asian groceries in my area in April-May-June looking for Alphonso or other well regarded varieties.

As a devoted mango fan, the situation in the US has been stuck in limbo for too long. There was a good article in Vice on this topic back in 2018.

https://www.vice.com/en/article/gyw4zb/alphonso-best-mangoes-india-us

-

China's an authoritarian country, has central planning, has a central party that controls many things... but there are also 23 provincial govts, various municipal govts, etc. They all have had incentives to do things sometimes at odds with the central govt. Local and municipal govts had taxation authority removed from them back in the 1990s and so the primary means for them to raise revenues was through land sales to developers. Local and municipal govts also created off the books special financing vehicles that raised capital to buy up land and also sometimes to lend to developers. The financing vehicles and developers all raised capital and issue debt to WMP (wealth management products) which were sold by insurance companies to private investors and average citizens looking to earn a better return than in a bank savings account.

Lastly, China's hukou system which basically restricts rural migrants from owning property and living "legally" in cities is a mess. Loopholes to the hukou system often apply to semi-autonomous regions like Inner Mongolia etc (Ordos ghost city) which is why developers and local govts collaborate to build huge apartments there, hoping that rural migrants would pick up and leave their "illegal" life in a big eastern city and move out to Inner Mongolia or some other out of the way place.

-

Sold a position in BYDDY bought at $5 because in April 2020 the outlook for EV and their other businesses seemed to be negative. Partly driven by wanting to raise cash.

Lesson is to not raise cash during a pandemic? I think it could've worked out for you, if it dipped again.

Value - it did work out as the proceeds went into shopping center reit ROIC and JBGS and HEI. Just not as well as BYDDY worked out. Though I attribute most of that to a runup in the EV bubble.

The lesson for me is that I generally do better not acting to market events. I've held through drawdowns before.

-

Alta Rock has five positions.

Li Lu/Himalaya Capital - 13F - Q1-2021

in General Discussion

Posted

Stephen Hsu had a pretty interesting pod recently about LLMs

https://www.manifold1.com/episodes/chatgpt-llms-and-ai