-

Posts

282 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Posts posted by maplevalue

-

-

1 minute ago, BG2008 said:

3) hedge the interest rate exposure by shorting some 10-30 year debt (can really backfire if rates go even lower)

This is essentially what Bridgewater has been saying. Buy things which benefit if nominal GDP goes higher and sell nominal bonds against it.

-

33 minutes ago, thepupil said:

As an example, Bank of America owns $600-$700 billion of "Debt Securities", about 2/3 of which is Agency MBS. In no world, is Bank of America comparing its MBS holdings to the prospect of buying multifamily. They're totally different. As for why they won't hold cash, well they're earning $10-$11 billion of interest on that portfolio which is low, but it's far more than zero.

Yes of course BAML which is a leveraged entity is not comparing MBS to multifamily. But for 'real money' investors they would definitely be comparing them. Take for example the RBC Balanced mutual fund (somewhat representative of what the average person/institution would own). 65% equity, 35% FI with 71% of the FI in government bonds...so 71% of the FI allocation is more-or-less guaranteed to lose money in real terms...not sustainable! If rates persist here you will see more entities seek 'fixed-income like' securities like MF rentals instead of government/corporate bonds.

-

@Gregmal You are spot on. My background is in fixed-income and I bought my first multifamily REIT this year!

Multifamily rentals produce cashflows very similar to that of inflation protected bonds. The main difference is that if you take the cap rate + inflation expectations it far, far, exceeds the expected return on inflation protected bonds, or pretty much any investment grade bond. As real yields stay low you will see more and more asset managers who previously had large fixed income allocations follow the 'cash is trash' theme and shift into this space. Some recent examples from Canada:

CPP join venture to build multifamily rentals - March 2021OTPP owned Cadillac Fairview partners to develop/acquire multifamily rentals - June 2019

-

Not news but do not think this has been brought up with respect to Fairfax on this thread yet. One of the promises from the Liberals (who are poised to be reelected) 2021 platform

QuoteRaise corporate income taxes on the largest, most profitable banks and insurance companies who earn more than $1 billion per year and introduce a temporary Canada Recovery Dividend that these companies would pay in recognition of the fact they have recovered faster and stronger than many other industries.

Seems like it's unclear how it will apply to international profits vs. domestic profits. Some of the recent weakness in CAD financials has been attributed to this. Fairfax I assume would be subject to this.

-

Quicken.

I had to do this because over time I had moved brokerages, account numbers changed, and wanted to include partner's accounts.

You have to import everything in which is a pain, but once its setup you only need to update it with new trades. Some brokers, like IB, let you import your account information directly into it.

It then lets you calculate IRRs for each year (i.e. your 2013, 2014, 2015 IRRs), as well as a total IRR. IRR is probably the right measure to use for performance.

As well if you want to calculate 'simple' returns it will tell you for each period (monthly/quarterly/annually) what the starting value was, inflows, outflows, and ending market value, so then you can calculate a simple return yourself.

-

If you are a student you may have access (through your library) to Mergent Online. This database has a section called Investext which has analyst reports for many publicly traded companies. Looking at initiating coverage reports on stocks you are interested in a good way to get started.

-

8 hours ago, glider3834 said:

If we have a hypothetical situation where there is a large sudden increase (I wish:) in the price of Fairfax shares - could there be situation for example where hedge funds (who are short Fairfax via total return swaps) become buyers of common stock to offset their exposure OR where the counterparties that are writing OTM (over-the counter) call options start buying the underlying shares to also offset their risk. Could there be a feedback loop or squeeze type situation or would all these parties (hedge funds or option writers) again use derivatives to manage their exposures to effectively avoid buying the underlying shares where liquidity may be limited?

Very unlikely in my opinion. My best guess is that the TRS is constructed so that right now there is some investment bank long the exact number of shares Fairfax has the TRS for. If the price goes up the bank wires money to Fairfax, if it goes down the bank demands payments from Fairfax. On net the investment bank's position is neutral.

-

In Canada you can see the volume, buying bank, and selling bank for trades on the TSX (e.g. https://money.tmx.com/en/quote/FFH/trade-history). I believe the US is similar. In terms of the clients behind the trade the only people that would know that are the sales-traders at the investment banks that did the trade (possibly these people won't even know).

-

1 Canadian Stock That’s So Cheap, it’s Embarrassing: https://www.fool.ca/2021/08/31/1-canadian-stock-thats-so-cheap-its-embarrassing/

Truly embarrassing!

-

After Powell's comments at Jackson Hole US10Y real yields at -1.09% (https://www.cnbc.com/quotes/US10YTIP).

I may sound like a broken record, but with rates this low there is simply no alternative to stocks. Interest rates may change, but individuals' need to earn a decent return to meet their savings goals do not. Let the bull market continue!

-

Putnam Investments acquiring Toys’R’Us Canada from Fairfax: https://www.bnnbloomberg.ca/putnam-investments-acquiring-toys-r-us-canada-from-fairfax-1.1641921

Farmers Edge Announces 200k Share Purchase by Fairfax Financial Holdings: https://www.businesswire.com/news/home/20210818005642/en/Farmers-Edge-Announces-200k-Share-Purchase-by-Fairfax-Financial-Holdings

-

Here is a selection of threads posted on General in the past several months (some of them by you):

All of these threads, and this one, have the same theme of "the market is too high", "rates are too low", "what we have now cannot last". That is, all of these threads represent the consensus fear among investors that the market is overvalued.

Markets time and time again tend to have price action which moves exactly opposite to what consensus opinion is, and we have seen it again this year as in the midst of huge levels of uncertainty the SP500 is at an all time high. I truly believe the pain trade is for the market, expensive as it is, is for it to continue becoming more expensive. Since the pain train often is the direction of travel, we are likely to go higher!

-

Obviously it pops a few days after earnings since the market is waiting for the COBF Fairfax 2021 thread analysis before transacting.

-

Gundlach discussing Fed stimulus' impact on stocks near the start of this video.

US10Y real yields back plumbing the lows of -1.08%.

-

FFH (PB discount getting silly)

MRG.UN (real yields in US crazy low + immigration/return of international students to Canada in fall should help with rents)

-

NTDOY starting position. Seems to be reasonably valued and also acts as a nice hedge if COVID takes longer than the market expects to go away.

-

17 hours ago, Viking said:

The bond market looks wild to me

the article states $12 trillion in bonds currently trade at a negative yield. Makes sense that some of that would shift to equities.

the article states $12 trillion in bonds currently trade at a negative yield. Makes sense that some of that would shift to equities.

Total stock market capitalization in US approx 75% of total bond market capitalization (source https://finance.zacks.com/bond-market-size-vs-stock-market-size-5863.html). When a huge portion of the US bond market becomes effectively uninvestable for anyone with a semi-reasonable return goal (iShares US Aggregate Bond ETF with avg duration of 6.5yrs and avg YTM of 1.45% = I hope investors like losing money in real terms!) the amount of money that needs to move out of fixed income and into other asset classes (namely stocks) is staggering. US 10yr real rates at -1% can do lots of crazy things!

-

I am looking for a free source of quotes for a stocks on the Tokyo Stock Exchange. IB offers these for a fee, but I only need to make one trade so would rather not subscribe (and also forget about cancelling). Are there any websites like Yahoo Finance which offers free live quotes (and bid/ask) for US stocks for Japan? Googling this was unsuccessful!

-

1 hour ago, muscleman said:

I have been making a case for a repeat of the dot-com bubble top this year since last October but recently I think that the top has been postponed till next year.

I am fully invested right now and expect to ride on a historical asset bubble. But when it is about to burst, I am gonna run quickly.

US 10Y real yield at 4% around the peak of the tech bubble vs. -0.85% now so this run could put 2000 to shame!

-

Sold remaining shares of VVL - Vanguard Global Value Factor ETF. The reopening trades seems to have been played out/is reversing.

-

2 hours ago, Gregmal said:

Buffett has been saying for over half a decade that if the 10 year is 2%, then stocks are massively undervalued. The 10 year is currently 1.5%. The rest of the world is 0 or negative.

This this this.

Stock market valuations hinge on interest rates. Currently the 10yr real yield in the United States is -0.84%. Throw this into a DCF model and it breaks down. If you believe rates can stay here (I tend to believe this) stocks could go much much higher. Baby boomers need to earn a reasonable return to meet their retirement goals; they can't do it in govt bonds or corporate bonds so the forward real earnings yield of +2.5% on stocks seems like a good deal.

Major risk to this outlook is on the political side if elected officials rein in the central banks. Low probability scenario in my mind since what politician doesn't like free money?

-

54 minutes ago, no_free_lunch said:

It doesn't have to be commodities as an inflation hedge. I think a REIT with long duration debt should hold up ok. You probably get smoked at first but inflation should push through to rents which will drive the ev EBITDA multiple down.

Agree with you here. Some commodities can actually be a poor inflation hedge if technology is rapidly pushing production costs down.

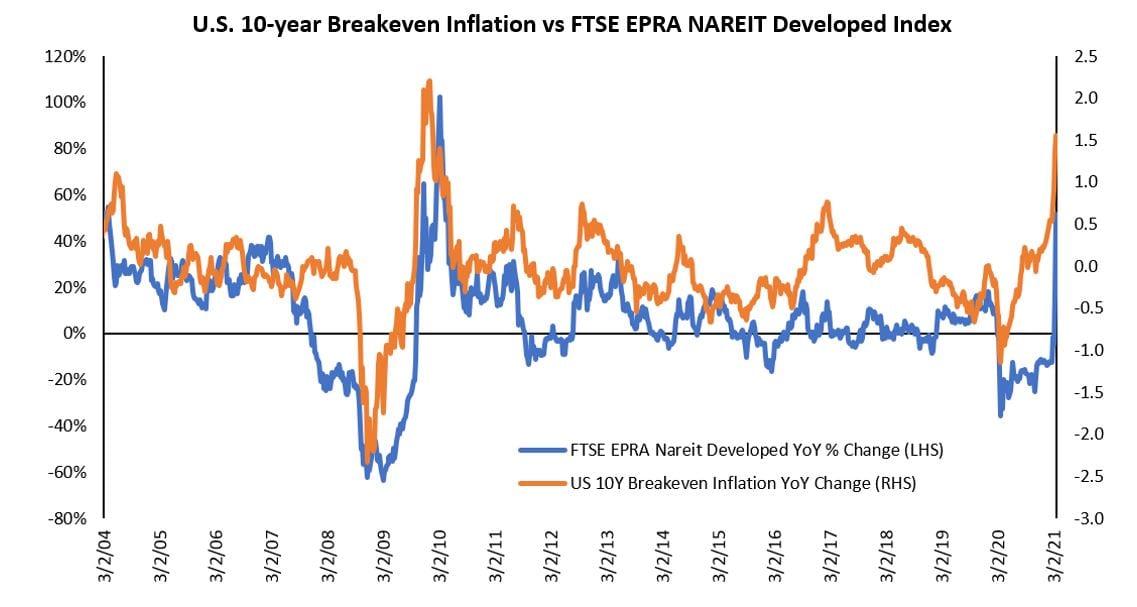

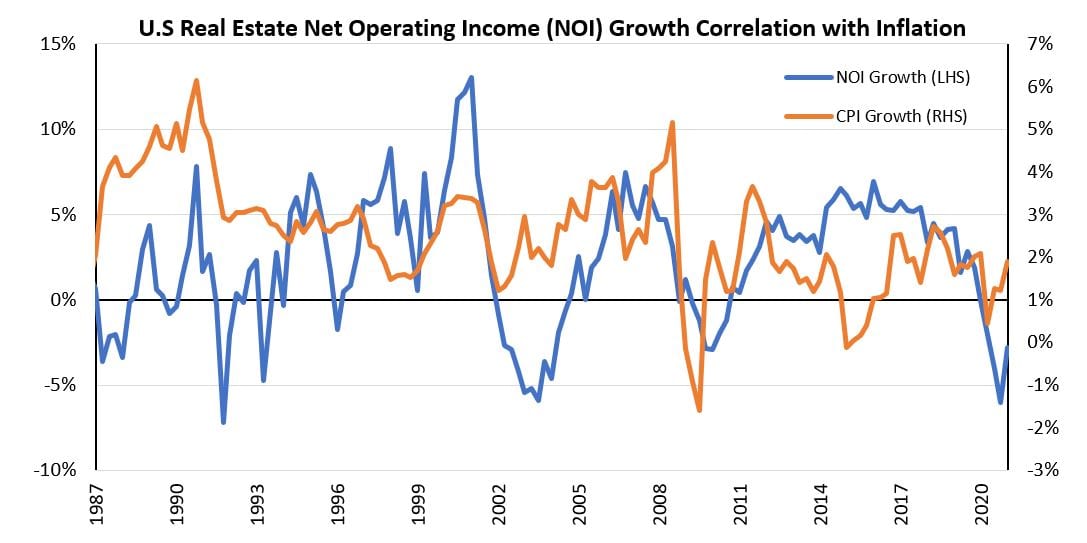

Janus Henderson recently wrote about REITs and inflation (https://www.janushenderson.com/en-us/advisor/article/inflation-property-equities-time-to-get-real/). In short they argue if inflation expectations go up, REITs stand to benefit.

-

Quote

https://www.bnnbloomberg.ca/population-growth-ticks-back-up-in-canada-despite-closed-border-1.1618294

The nation’s population rose by 0.2 per cent, or 82,366 people, in the first three months of this year to 38.1 million, according to quarterly estimates released Thursday by Statistics Canada. That’s the fastest quarterly population growth since the pandemic hit, and reflects a rebound in international migration. Quarterly growth averaged just under 0.3 per cent in the decade before the pandemic.

Population growth continues, and should pickup in the fall as many Canadian universities are committing to in person learning. If you thought the market was tight now, just wait until September! -

5 hours ago, Parsad said:

Rosenberg comments on prices in North Bay, ON. Cheers!

Terrific sarcastic comment on this tweet

QuoteDisagree.

1. North Bay is a world class city now. NYC, London, HK, North Bay, LA, etc it’s right in that list without skipping a beat.

2. They aren’t making any more land and it’s pretty scarce up there.

3. Immigration. I heard at least a dozen people moved there this year.

Kuppy on Inflation

in General Discussion

Posted

Cathie Wood: Next Big Risk Is Deflation