-

Posts

247 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by MattR

-

-

7 hours ago, Spekulatius said:

Sold BTI in my IRA accounts.

Why do you feel like selling? It is still pretty undervalued compared to most of the market, and pays a nice dividend, especially if you bought in the 35 range.

-

12 hours ago, Spekulatius said:

It's not that great of a book. Greenblatt's books are much better, imo.

Greenblatt and Lynch have the best investment books IMO. They contain wisdoms, no matter how often you read them and they don't go out of date.

-

4 hours ago, Stuart D said:

Anyone know what's happened to 6541, Grace Technologies?

It was the cheapest company in my screener on every value-metric, but the stock is down 99.3% in the last 12-months. The most recent filing's I can see are from June 2021 and there was plenty of cash (4 billion yen), so I wouldn't have guessed this would be a donut. It's a little bit concerning to see these type of draw downs for seemingly well-capitalized Japanese stocks. There is limited news or analyst coverage and I haven't found any answers yet by bumbling through their IR Information section on their website. Looks as though there was a 2 for 1 share split and revenues waaaay down (50% decrease), but only 2.8b in total liabilities and it was still profitable, so there must be something else that's happened.

They had an investigation done regarding their accounting. I took the report from the Japanese Section of their Investors Relation and put it into google Translate.

Seems that they recorded sales in a lump sum and then recorded sales without any payments at all. Additionally they forged documents to fake the sale.

What they will do:

- It means that the company will be delisted: As announced separately in "Rase", it is scheduled to be delisted on February 28, 2022.

- They will have to change back the financial statements of the last years.

So it doesn't look to good for them.

-

11 hours ago, Stuart D said:

Has anyone listened to the audio version yet? I'm tossing up which version to buy.

I'd prefer to listen to it whilst driving to work, but I find some of the more quantitative/technical books e.g. Security Analysis, are easier to digest in a physical book format.

Yeah it has a lot of financials on it, I don't think it will be a great listen.

-

7 hours ago, cwericb said:

Are you perhaps confusing Alkaline batteries with standard carbon batteries? The biggest difference I have found between different brands of alkaline batteries is that Duracells are often considerably more expensive, but they don't seem to last any longer than other brands that cost a lot less.

I think Duracells are better, because they have a more even distribution curve. I see it in my active electric bass. On other brands, the sound gets weaker and weaker, with Duracell it is like a big cliff, sound is good and then instantly bad - Changing batteries takes less than 2 minutes so I prefer it.

-

7 hours ago, stockman500 said:

Has anybody when following WallStreetBets recently, I have to say their major stocks picks last winter were absolutely solid for momentum, trend, meme investing. There were a lot of posts on Palantir when it listed at $10 and was going up, a lot of posts on GameStop for all of fall and winter, leading into the late Jan squeeze.

This year, post Q1, seems to have been more of a miss. They were pushing hard for stocks like WISH, CLOV, SDC, BABA, and now it's mostly just memes about losing money and no actual stock picks. There were a lot of memes about losing money on WISH recently. Some people did have success buying short term puts on PTON and DOCU for Q3 earnings and making solid returns off that.

WSB used to be a fun place where you would find solid thesis more often than not - with the influx of members after the Gamestop Squeeze the quality went into the gutter. Used to be one of my favourite internet hangouts, not anymore.

-

17 hours ago, mcliu said:

Also signed up for premium today. Great app, hope you guys make it even better.

I was debating between TIKR and Koyfin, but chose TIKR because it loads faster and is better for fundamental investing. Koyfin has a nice UI though.

Btw, is an API on the roadmap (like simfin.com) so we can use it with other applications like Excel or Google Sheets?

Same, I also debated between Koyfin and Tikr. But the limited call transcripts and watchlist in koyfin for the cheaper subscription pushed me toward Tikr. Add the great overview for fundamentals from Tikr, Screener and Investor Tracker and it's a no brainer - especially at that price.

-

On 11/16/2021 at 8:51 PM, CapriciousCapital said:

Is there a 13-F equivalent in Asian markets?

Sadly not, the only way you can see it, is if they have 5% of a company.

-

20 hours ago, boilermaker75 said:

From the link, Chancellor Henry Yang has hailed it as “inspired and revolutionary.”

I was an Assistant Dean for Henry when he was Dean of Engineering at Purdue, about 30 years ago, until he left to become chancellor of UCSB. If Henry likes the idea it is probably worth doing. Henry is probably the longest running chancellor/president of any major university. It has been a while since I spoke to any faculty at UCSB, but when I did they loved him.

He can be a god, this design is ludacris. No windows are insane. The plans also doesn't have great common rooms for just relaxing. 1 toilet for 8 people? What happens when the air conditioning breaks (it's a student dorm, it will break). Crazy design...

-

6 hours ago, formthirteen said:

Interesting that LMT is down 11.80%, should be a good cash substitute. I owned TPB for a while, but had no conviction and sold. NTDOY is interesting, but I'm skeptical of "the next Disney" thesis, maybe I need to dig deeper. I have no conviction in the INTC turnaround, maybe we don't even need one to profit.

It's not the next disney, it's Nintendo. Loved Franchises (Super Mario, Pokemon, Zelda, Metroid....). I would say that their IP is even stronger than something like Mikey Mouse.

-

10 hours ago, Spekulatius said:

Remember the fallen….FinTwit favorites.

I also bought. Growth is still solid, sharebuybacks are increasing and with current share price would be 6,8% of the company. Including the dividend it's a 7,5% yield for a year. Seems decent.

-

10 hours ago, DooDiligence said:

1. Be grateful for what you have.

2. Be scrupulously honest with yourself & thread the needle between malicious deception and "no honey, you don't look fat in those jeans".

3. Set goals & be prepared to fail along the way, dust yourself off and constantly reevaluate your steps to the goal.

4. Avoid main stream television media and online social networks that resemble echo chambers.

5. Praise sparingly & publicly. Criticize directly & privately and avoid back biting.

6. Don't spend more than you make & don't commit yourself to debts for stupid shit. (See #1 for reinforcement of this concept.)

There, now I'm a self help guru. Please send your generous donations to...

If you now don't break each and every one of them, you are better than Peterson. Where can I wire the money ?

-

12 hours ago, Spekulatius said:

I believe the ascent of crypto competing with gold has more to do with it. The correlation with the stimulus package is coincidental.

In theory yes, but gold is such a low allocation and many people who buy gold want the opposite of the speculation of crypto. I think it is the other way around that the stimulus package is responsible and crypto competing with gold i coincidental.

-

-

6 hours ago, BRK7 said:

No worries DD, I initially thought the same thing.

Interesting data-point to share:

Today I got an SEC filing alert via docoh.com in my email inbox. It arrived 7 minutes EARLIER than the same alert arrived via my $20K/year Capital IQ account.

Of course, docoh is not a substitute for the breadth of what CapIQ offers. However, within the scope of what it offers, I am very impressed with docoh.

Docoh is awesome. So easy to just favourite your portfolio/watchlist and get every filing. No need to create complicated spreadsheets or bookmarks.

-

3 hours ago, Spekulatius said:

It is simple in theory - It is difficult emotionally. I tend to cut my loses quickly, but don't let my winners run enough others let their winners run more, but also hold onto losers. The most successful investors have both. They are quick to change their minds and adapt to new circumstances, yet let their winners run.

-

18 hours ago, Spekulatius said:

And the rest goes broke doing the same thing.

Yes, because they forget the other side of the coin to cut loses quickly.

-

11 hours ago, gfp said:

I get a trade magazine called "Builder." Today's issue ranks the largest Homebuilders by 2020 closings. Was happy to see Berkshire's Clayton Properties Group (site-built only, does not include Clayton's manufactured homes) rising to number 9 on the list with 9,475 closings in 2020. More than well known names like Toll Brothers, MDC, Hovnanian, Beazer, etc.

What does the green point mean? Is there an option to see homebuilders from last year,to see who is rising and who is falling?

-

Added Baba. Now more than 15% of my portfolio

-

3 minutes ago, ValueMaven said:

Here is a crazy but interesting idea. Berkshire issues $20B shares to acquire Markel. Get's huge float, profitable and unique underwriting business it can easily fold into the Primary Group. Gayner joins the board. Then buysback $20B worth of stock. Roll Markel Ventures into MSR unit.

Just an idea

That would be hilarious :D. Personally i think at current prices Markel is actually pretty cheap.

-

21 minutes ago, fareastwarriors said:

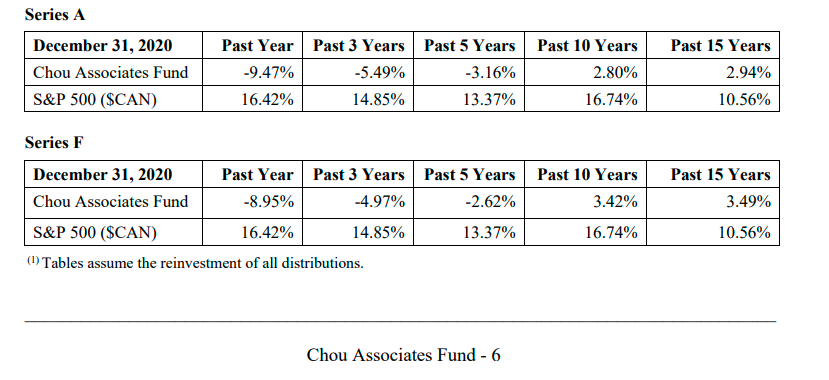

Wow. I am no Einstein when it comes to stock picking, but such an underperformance is actually impressive.

-

11 hours ago, Lollapalooza said:

I read lots of envy in this thread. I guess success does attract that a lot...

if you dont give him credit or you're genuinely not interested in what he says and "his latest gimmicks" why do you waste 1h of your time watching?

Unlike you and me, he steps out of anonymity and does not shy away from sharing his ideas and latest learnings with others.

I find it disrespectful specially when you know he used to come to this forum. Personally I appreciate his openness and I feel I've shortened much of my learning curve by listening to him and others that arent afraid to come out in public with some of their 'contrarian' philosophies.

I find him a bit gimmicky, but that doesnt detract from the value he provides with his talks. If I stopped learning from every person I find slighly gimmicky the learning opportunities would be severely limited. I am a big fan of his and a big fan of his picks (especially Shinoken, wouldn't have found that awesome business otherwise), and while it seems that he always finds new buckets to play with and touts them as the best bucket he ever found, I still learn more from him than from pretty much every other investor that aren't called Buffett, Munger or Li Lu.

-

3 hours ago, Cigarbutt said:

It looks like it was a decision based on a more basic level of (mis)understanding. Insurers are regulated at the state level but the risk-based formula used for the regulatory assessment of portfolio's (or float's) safety is standardized through NAIC's model (formula and levels of regulatory intervention). This is kind of basic knowledge before one would commit 150M for the purchase of a US-based insurer. i guess it would be similar to buying a regional bank and then being surprised that capital and liquidity ratios need to be met as a going concern when aiming to manage the asset side of the portfolio.

Yeah, before commiting so much money, one would assume to at least have a very basic understanding.

-

Increased my positions in Mo and BTI. Was cheap before even cheaper now.

What are you buying today?

in General Discussion

Posted

I think that it will be difficult to do in practice. Cigarettes were only heavily taxed after decades of research on health problems. With nicotine pouches it will take another decade at least to have proper health statistics.