-

Posts

1,725 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by ValueArb

-

So What Exactly Is The "Short Homebuilders" Thesis At This Point

ValueArb replied to Gregmal's topic in General Discussion

Nope, still not shortin them. -

So What Exactly Is The "Short Homebuilders" Thesis At This Point

ValueArb replied to Gregmal's topic in General Discussion

I'm not shorting homebuilders. -

I have a friend who is a professional developer who is using ChatGPT to help him generate code and swears by it. I'm setting up a lunch to get the full scoop.

-

I agree with all of this.

-

Or because "valuations" based on "expected" adoption curves is circular reasoning? If BTC goes up, more people will buy it to speculate. But the opposite is true as well. And estimates based on observed growth during stimulus and the lowest interest rates in history aren't likely to match performance during high inflation and higher interest rates without direct government stimulus. Value is based on generating cash flows. Crypto does not and cannot generate any cash flows, so it can't fit within the classic investment definition of possessing intrinsic value. Its no different than gold or commodities in that respect.

-

Dividends vs Buybacks, why not more Buybacks?

ValueArb replied to Luke's topic in General Discussion

I'd argue buybacks benefit the selling shareholders, even at large discounts to intrinsic value, since they would be selling at even lower prices without the buybacks. And sometimes selling below IV can be directly beneficial to a shareholder, if they are using the proceeds to buy shares in something even farther below IV, or something of great value that makes them far happier, such as a divorce. I tell myself this a lot because I'm heavily invested in SRG where Eddie Lampert is selling every single day, and it helps me sleep (a little) at night. -

Dividends vs Buybacks, why not more Buybacks?

ValueArb replied to Luke's topic in General Discussion

Neither Buffett or Apple know when the market is going to re-evaluate the PE, if ever. Buybacks have enabled Apple to grow EPS 16% annualized for the last decade. If you think it's going to be able to do 12-15% EPS growth the next decade, buybacks at a 20 PE are likely very accretive to earnings. The break-even mark is probably 25-30 times earnings. So no reason to wait for cheaper years that might not come any time soon if you can return capital tax free at 25x earnings. At 30x+ PE, yea they should wait or switch to dividends. -

According to this guy, lots of snakes in the bed at Signature Bank Signs of Trouble at Signature Bank Edit: To be clear this is Signature Bank, not Silvergate Bank. They are both crypto on-ramps, but Signature doesn't have the direct FTX exposure and class action lawsuits. The article is about a private blockchain they provide "vetted customers" which apparently isn't strongly vetted and used by a number of potential scammers? It's also a sign of how hard it is to be a crypto bank nowadays.

-

Are both Binance and Huobi in the midst of bank runs that are challenging their solvency? https://www.forbes.com/sites/javierpaz/2023/01/09/binance-is-bleeding-assets-12-billion-gone-in-less-than-60-days/?sh=c727d5515cfb

-

Inflation better be plummeting soon or institutions are going to stop buying paper that pays less than the inflation rate.

-

If you can't rebut the facts of the article, by all means vent if it makes you feel better. There is no reason the crypto thread can't carry a balance of views.

-

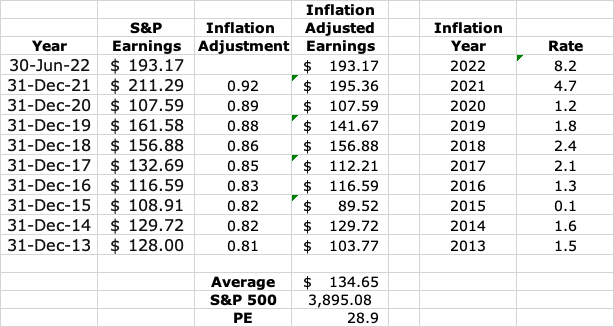

How often was the S&P up on years when the market price was significantly higher than its intrinsic value?

-

I think being out of the market for any extended period is bad for any skilled investor. I would never use a metric like this to tell me whether to buy or sell stocks. If i can't find good businesses trading at a significant discount to intrinsic value I'll naturally build up cash until I can find one. But for passive investors sitting out equities from start of 1999 to start of 2009 to sit in safe fixed income investments would have doubled their portfolio size over staying in the S&P 500. It does make logical sense because the Shiller is telling you the equity risk premium is near all time lows.

-

Another adjustment we should make is tax rates. The corporate income tax rate cut in 2017 increased after tax earnings roughly 10% for every year thereafter.

-

Yes those were just two of the errors in my calculations, but it doesn't matter since @shdl showed me all my work was fruitless.

-

I'm actually getting a slightly higher PE when I do it by hand, so unless I'm doing it totally wrong they seem correct.

-

Depends on how you use it. Theoretically if you got out of equities entirely every time it broke a 30 PE and waited till it got back to 15 before getting back in, you would crush the market. I'm always 100% invested whatever the Shiller PE because I'm mostly doing special situations. But anyone thinking that this year the S&P 500 has a greater than 50% likelihood of an up year isn't just ignoring Shiller, they are ignoring the Fed's stated intentions to keep raising rates.

-

not sure I understand. It says it’s inflation adjusted already. Are you saying its not, or done incorrectly?

-

An alternative viewpoint. https://www.multpl.com/shiller-pe When the market PE is over 25 the odds of another upswing start to get significantly lower, and the odds of a bad year get significantly higher..

-

It's an interesting article from a leading science site. We should focus on facts and arguments, not personal attacks. Otherwise I would have thrown out the article entirely had I known he was pro-monarchy;)

-

Just a reminder to protect your keys.

-

I can’t answer that, as I didn’t write the story or headline.

-

"Key bitcoin developer calls on FBI to recover $3.6M in digital coin So much for enthusiasts championing the decentralization of cryptocurrencies." https://arstechnica.com/information-technology/2023/01/key-bitcoin-developer-calls-on-fbi-to-recover-3-6m-in-digital-coin/

-

without comment. "ARK Fintech Innovation exchange-traded fund unloaded roughly 404,000 shares of Silvergate on Thursday, cutting the ETF’s holdings by more than 99%, according to data compiled by Bloomberg. " https://finance.yahoo.com/news/ark-fund-unloads-silvergate-stake-131252888.html

-

Are Large Players Keeping Crypto Prices Up?

ValueArb replied to Parsad's topic in General Discussion

I posted this on the other crypto thread but in case you didn't see it it's worth a read. The scam in exchanges is apparently to mint your own coins, run up its price by trading it against yourself, and then use that to cover the growing hole in your balance sheet. FTX did it, Binance lis doing it, and more than a few smaller exchanges doing it. https://dirtybubblemedia.substack.com/p/the-binance-scam-chain