perulv

Member-

Posts

101 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by perulv

-

LRCX is down 25% since this. If I click the buy(more)-button it will probably go down another 25%, but I just cant help salivating over the long term metrics. Great business on sale, or mean reversion of too-good-to-be-true ROA and growth?

-

Is the valuation that high now? EV/Ebit aroundt 15, P/E under 20, for a company with two digit ROA that is market leading in (some of?) their segments. At least in sports/outdoors, it seems Garmin is the dominant brand in my circles. I guess we could turn that on its head and ask how can they grow. I am tempted to buy, but agree that it is not necessarily much margin of safety.

-

Small position in Ørsted (ORSTED.CO). Not cheap, but less pricy now that everything "green", both crappy and good businesses, have come down in price. Decent fundamentals in an obviously increasing market.

-

The general idea is that if everyone has put in huge orders to these suppliers (that seem to all be dropping in price now), and at some point all these orders are filled, everyone suddenly has all the <whatever the suppliers produce>, and the demand drops? Are you staying away from (buying in) this space altogether atm. @Spekulatius?

-

A personal anecdote: A few years ago, I started working in a small company together with former colleagues (who started it). We all bought shares, and after a while the company went public and the share-price increased. At one point our shares was up 4x, and since this was my biggest single "investment" (not much value investing thinking there) ever, the amount felt quite substantial. "I can almost cash out my mortgage"-big, not "I can retire"-big. Around this time, both me and two colleagues bought a cabin/vacation-house. It is not unusual for people in Norway to do this, and the purchases were not directly "funded" by the price of the shares. I could have bought the cabin without having the shares, and I did not sell any shares to finance the purchase. Nor did the bank we loaned part of the purchase-sum from take the shares into consideration. But, and to the point of this thread, I felt "richer", and this probably influenced the decision. (Fast forward to today, the share-price fell well bellow the initial price we bought them for. We enjoy the cabin, which ironically has increased its valuation. I retrospect it looks quite silly that I call myself a value investor, and did not sell any shares at that high valuation. For all practical purposes I was an insider, and if anything this has made me more sceptical to insider buying as a strong positive signal. People close to the company might know more than outsiders, but drinking all that kool-aid does something to judgement)

-

That is a sobering thought SIMO and LRCX does not mention this directly in their forecasts as far as I can tell. But then again, not sure how much weight I should put in what is not in these guidances. SIMO on 2022 outlook: "“After delivering record operating results in 2021, we are optimistic that 2022 could be another banner year,” said Wallace Kou, President and CEO of Silicon Motion. ", revenue +20% to 30% Y/Y LRCX: " “While supply chain conditions worsened in late December and are causing near-term impacts to our results, we expect wafer fabrication equipment investments to again increase in calendar year 2022, leading to another strong growth year for Lam.” Q1 guidance: Net income per diluted share $7.36 (down from 8.44 in Q4) In the short term, it feels like that saying "a rising tide lifts all boats" works in reverse too. SIMO with EV/EBIT at 12 falls 8%, TSLA with EV/EBIT at 200 falls 10%.

-

Lam research (LRCX). Maybe buying these semiconductor stocks right now is catching a falling knife, but great businesses decent price etc. "All" the q4 results in my portfolio looked the same yesterday, "higher earnings, but supply chain", and they are all down 5-10% today.

-

It seems like we are at the tipping point where the cheapest energy is renewable, and the best cars are electric (and most economically sensible, depending on the subsidies and taxes. But we are getting there, at least in Europe). But given that premise, what should we invest in? One thing is avoiding companies that have no earnings and nothing more going for them than "being a green/ESG stock". I bought shares in First Solar and Solar Edge in 2015/2016. Both (had) made money , had little debt, and seemed to me to qualify as a value investment. And marked leaders in a growing segment. They have had a very different development, both in earnings and in stock-price. Solar Edge has been growing their earnings steadily, and the stock-price went from 15 to 300. Which probably makes it highly over-priced now, but even just looking at the earnings these companies took a different path. My theory is that First Solar is suffering from what is shown in the graphs in the first post here, making less and less money per solar panel. But Solar Edge seems to have avoided this somehow, being more in a "selling shovels in a gold rush" situation, selling a small (?) but essential component in the solar-setup. Is it possible to identify companies with the "Solar-Edge characteristic", companies that participate in a growing market/megatrend with some ability to keep their profit-margin? Or is it just luck, and will be evened out by competition, and I should know this if I had studied economics?

-

COBF 2020 Returns (pre-tax, after fees, etc)

perulv replied to Broeb22's topic in General Discussion

up 79% (in my local currency, NOK). The biggest positive contributors were SEDG (up over 300%, trimmed it multiple times) FSLR (77%) SQM (83%) WAF (81% since I bought in april), biggest negative Aggreko (down 24%). Right now, it looks like my effort to find renewable-related companies that also fit the quality-company metrics (actually making money, not too much debt, good ROA, decent EV/EBITDA) have paid off. But then again, everything remotely "green" have gone way up, quality or not. While I still believe that decarbonization and all that comes with it (EV, power production, power grid management, storage etc) is "the future", I have not bought any stocks in companies related to that lately because of the crazy pricing. And I must probably realize that a fair part of this years gains are luck, or at least not very reproducible. The gains are mostly due to multiple expansion, not increased earnings. edit: my strategy for 2021 is pretty much sit on my hands for now. I bought several stocks in the last few months that are not in the "renewable-field", including CIEN, SIMO, INTC (which I have very mixed feelings about). I will buy if (I think) opportunities arise, but some of my worst decisions seems to be immature selling. -

Looks interesting with revenue growth, stable margins, and high ROIC. This thing deserves a thread of its own, IMO. Maybe this is similar to MU, cyclical, long-term trend is upwards, buy when others are looking the other way? SIMO’s memory controller business is a much better business than MU, imo, because there is less pricing fluctuation and it is fabless. Gross margins are fairly stable around 50%, so it’s not as good as a CPU or analog business, but much better than totally commoditized segments like memory. I can start a thread and write a few lines, but my thesis isn’t deep: it’s just an OK to good and somewhat lumpy business that is cheep. Every time I look at SIMO, I think "why is't this priced higher?". I first bought some shares of it in 2017, at $42. My "analysis" back then was (I wrote it down) : "Looks like a solid company. Makes money, has no debt, is in a market that has a future. Is the market leader?". Today I still agree with my thesis, and now it is priced at $39 ??? In a crazy market where "everything" is priced to perfection, I just don't get why this has been more or less flat for five years. My main reason for not buying some more SIMO is that often when I think Mr. Market is wrong, it turns out there is some valid reason for the price being what it is...

-

Just like the dot com bubble, the underlying trend is imho "not wrong". Just like you were right if you thought "software is eating the world" in 1999, energy is going to be gradually decarbonised. And there are renewable-companies that make real money, and tick my quality-company-boxes (ROA, debt-levels etc). That said, I totally agree that most/all of these now seem to be very high priced. I have sold parts of my SolarEdge-position at several occasions over the last couple of years, and each time seen the price rise higher. While earnings have risen 4x ish since 2017, the price has risen 20x, bringing EV/ebit to around 70 or something. I keep looking for companies that will benefit from the increase in renewables (ideally in a sell-shovels-in-the-goldrush way) and are still reasonably priced, but that search has not returned much lately.

-

I've been buying Intel in the last days. The low price, high ROA and long term steadily-ish growing earnings was just too tempting. I have no idea if and/or how quickly AMD will continue to steal market share. But then again, that marked will probably continue to grow.

-

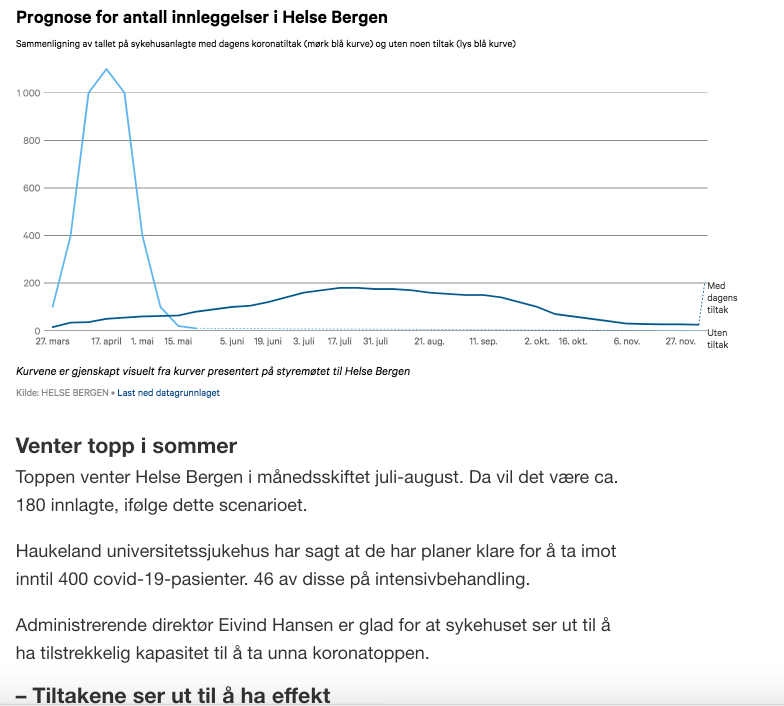

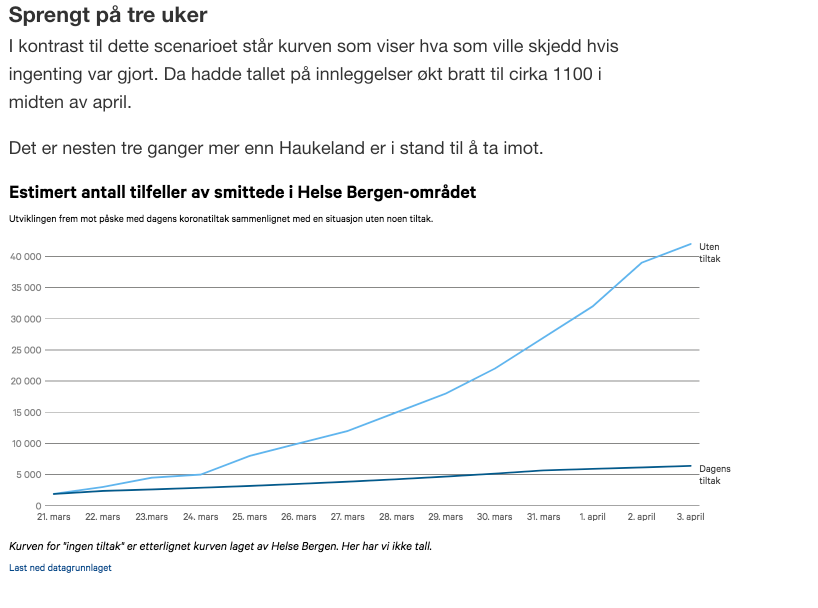

I know this is pointing out the obvious, but it would be interesting to see the same graph for a parallel-universe Europe where we did not put in place the most severe restrictions on movement etc since WW2. Attached is a graph of hospitalizations due to covid-19 in Norway. The shut-down went into effect 13th march. (edit: smaller picture-size)

-

Paste and share a screenshot of a favourite quote

perulv replied to drzola's topic in General Discussion

“Perfection is achieved, not when there is nothing more to add, but when there is nothing left to take away.” - Antoine de Saint-Exupery -

Companies with a Fortress Balance Sheet and Liquidity At the Moment

perulv replied to BG2008's topic in General Discussion

Maybe not "a ton of cash" but Solar Edge (SEDG) and Silicon Motion (SIMO) are both companies with little to no debt, good ROA and in areas of business that are probably not less important in the future. SEDG is probably not considered cheap yet, but I am thinking of buying (more of) both if they continue down. -

Actually, it was an interesting article in our regional paper today, where the local hospital (Helse Vest, Norways second largest) had made some prognosis based on the current social-distancing measures. It is in Norwegian, which I know you kan read John, but it is also behind a pay wall :/ (https://www.bt.no/nyheter/lokalt/i/50qVoK/haukeland-venter-under-200-koronapasienter-paa-topp) I've attached a couple of screenshots. The main idea is that "the curve is actually flattening" (Edit: "our prognosis indicate that this will actually flatten the curve enough" is probably a more correct description) , and never reaching the limit of intensive-care beds. This should probably taken with several grains of salt, but promising nevertheless.

-

Why wouldn't it be practical? IB offers accounts to Norwegian citizens according their website: https://www1.interactivebrokers.com/en/index.php?f=7021 I went into the application process and Norway was one of the choices for your country of residence. If they have a brokerage license there it seems pretty likely you'd be able to transfer your existing accounts to them, or at least wire the money. I suspect any fees charged for a wire would be outweighed by the savings in margin very, very quickly. You are right. Thanks for pointing this out to me, I'll check it out.

-

I live in Norway and am a Norwegian citizen, so I dont think IB is an (practical) option. I ended up selling some USD at the (for now) crazy rate of 11.5 NOK pr USD, hedging about half the value of my USD portfolio. I tend to mess up these attempts at hedging, time will show how it turns out.

-

My local currency is NOK (Norway), and it is totally crushed lately (https://www.xe.com/currencycharts/?from=USD&to=NOK&view=1M). If I buy stocks in USD now and things become somewhat normalized, I might lose 20-30% in currency-fluxuations. I know that this is always the risk of buying in a foreign currency, but this situation seems extreme. I can buy by loaning in USD in my online brokerage account, but the interest is high (7%). This would cancel out the currency-risk, at a fixed price. Would you do this today? There are companies that are starting to look attractively priced, and my thinking is that some reversion to the mean is more likely than not. Or at least that a known 7% loss is the lesser of two evils right now. Last time I looked into it, I did not find better means of currency-hedging (for the small positions I take). (Edit: the flip-side is of course that my USD positions have been worth 30% more for the same reason.)

-

https://www.amazon.com/Pantsdrunk-Kalsarikanni-Finnish-Path-Relaxation/dp/0062855891 "Danes have hygge. Swedes have lagom. But the Finns have the best - "kalsariokanni" or pantsdrunk – drinking at home, alone, in your underwear." I am not from Finland, but as a person from another nordic country, I can say that we have all been practicing social distancing our whole lives.

-

My personal opinion: I really have no idea / strong opinion right now if the measures taken in Norway are too weak or too strong, too early (probably not) or too late. But given that the only measures that exists are variations of separation of people and hand-washing, there is probably not a second chance if you are too late. To _flatten the curve_ that is. Which makes obvious sense, not overwhelming the hospitals like is happening in Italy. It also seems pretty obvious that this (combined with the oil-price-war) will have great economical consequences, imho not discounted in the market yet. My personal actions have been to move some of my portfolio/savings to cash last week, Tell my kids and myself to hands and use hand-sanitizer, and drop a planned company-trip abroad (for socializing) next week. No, the trip would not kill us, but with the pace of change that is happening now, I weigh the potential downside (stuck/isolated at airport/hotel/country/at-home-when-back, generally contributing to more movement of people and viruses) higher than the potential upside.

-

Some facts and observations (hopefully presented without much opinion) from Norway (population 5mill), might be of interest to someone, at least a data-point. The national institute for health will now put out daily reports, here is the one for today, trough Google Translate: https://translate.google.com/translate?hl=&sl=auto&tl=en&u=https%3A%2F%2Fwww.fhi.no%2Fcontentassets%2Fca5914bd0aa14e15a17f8a7d48fa306a%2Fvedlegg%2Fdagsrapporter%2F2020-03-10_dagsrapport-covid19.pdf (seems Google Translate is missing the graphs, see original versjon here https://www.fhi.no/contentassets/ca5914bd0aa14e15a17f8a7d48fa306a/vedlegg/dagsrapporter/2020-03-10_dagsrapport-covid19.pdf) Summary (from https://www.fhi.no/en/news/2020/status-koronavirus-tirsdag-10.-mars-2020/): (The PDF adds that 4461 persons are tested so far) No deaths yet, some seriously ill and hospitalized in the last days. We have mostly been importing our cases from Italy, but the health officials say we are now probably moving into the "next phase" with cases that cannot be traced is starting to pop up. New rules from today is banning gatherings with more than 500 people (the actual rules are a bit more detailed, exceptions exist etc), typically impacting concerts, sports-events conferences etc. The main idea is "flattening the curve".

-

A data-point from Norway (might be interesting for some, presented without opinion): Out of the (as of yesterday) 86 confirmed infected, no one is severely ill, or even hospitalized. And as you say, (many?) more are probably infected, as just those with symptoms are tested. But then again, most of the infected are people coming home from ski-trips, not elderly people with reduced immune-system.

-

The panic of reduced earnings and increased bankruptcies, or the panic of dying? The first concern seems pretty real, with conferences, flights, marathons, all kinds of gatherings cancelled all over (Europe at least), and more and more people "working" from home. I agree with the latter being irrational for most people.

-

This Google Translated article probably does a better job than I explaining it: https://translate.google.com/translate?hl=&sl=no&tl=en&u=https%3A%2F%2Fwww.aftenposten.no%2Fnorge%2Fi%2FjdAaGA%2Ffryktet-at-1400-nordmenn-kunne-vaere-korona-smittet-men-de-fleste-var-bare-forkjoelet