Cigarbutt

-

Posts

3,332 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Cigarbutt

-

-

11 hours ago, ValueArb said:

What is this measuring? Because its not correct for the US, as federal debt alone was 130% of GDP in 2022, and I don't believe that is counting state and local debt.

It's measuring global debt which is the US and the rest of the world (about 190 countries and total).

-

On 11/11/2023 at 3:27 PM, Jaygo said:

I agree that life is much better today but when the improvements slow down it feels like reverse. From 1900 - 1930 we went from shit ridden city streets rife with pestilence to inexpensive cars, penicillin, aircraft, electricity and a whole host of incredible things.

...

That's f....cked? why?...My kids hockey team is not allowed to change in the change room. why does he go home in sweaty clothing? Just because of a one in 100,000 pervert? ... pervert?

On 11/12/2023 at 8:59 PM, vinod1 said:...

The story of human progress can be summed up in one word: conquest of risks.

So not sure what is going on is bad.

Vinod

The penicillin example is interesting. Penicillin was 'discovered' in 1928 but availability came effectively to 'market' only in the 1940s, mostly as a result of imperfect but still impressive collaboration between countries and a reasonably effective combination of public and private participants. So it took a while for a revolutionary change (like electrification etc) to take effect.

Now we have the internet, artificial intelligence and related and, so far, productivity growth numbers have remained quite anemic. So it may take a while for the evolutionary (so far) technology to make it to market in a way to improve productivity (and, as a corollary, our standards of living)?

-

2 hours ago, changegonnacome said:

...

Very long way of saying that a standard recession playbook for stocks that worked from 1981 to 2021 might not be the right answer for prospective equity returns at the next downturn.

Yes since the early 80s, we (the global we) have gradually learned, in a Pavlonian way, to expect the fiscal-monetary playbook to play out, as expected.

But is this sustainable? Is there a risk of a non-linear change in trend? Won't the US retain relative refuge value?

-

On 11/9/2023 at 8:25 PM, UK said:

The bid-to-cover ratio was 2.24.

In a context of a very high 'supply' of such securities. This requires to be interpreted into a wider context?

-

2 hours ago, Dave86ch said:

It will absorb the excess liquidity and deflationary forces, reintroducing a healthy market for investing, in contrast to the current state where speculation has become the only means to preserve wealth due to the Cantillon effect, which is undermining price discovery

Interesting. Please help if the thesis is not beyond criticism.

Having limited cognition, i don't along first principles and tend to cling to analogies, links, comparisons etc

-i read this recently

https://www.linkedin.com/pulse/can-crypto-flip-script-cantillon-effect-ckc-fund

From the article:

"Several cryptocurrencies and digital assets seek to separate new money creation from politics and the state."

i work under the assumptions that:

-money creation will remain tied to politics and the state

-'we' will learn and won't repeat the Cantillon effect mistake that has shown up in financial and main street inflation numbers since 2020.

Where am i wrong?

-

On 11/9/2023 at 1:44 PM, changegonnacome said:

...

This period of government borrowing relative to the set of cards for the US economy that drove that borrowing (full employment/debt to GDP ratio+ inflationary backdrop) is by far away the most reckless its ever undertaken.

"Reckless" is a strong word and can be debated (here?) but the burden to meet the meaning of unusual is met.

"Large and ongoing deficits have fed (sic) expectations..."?

What's the point apart from 'interesting' discussions?

-

6 hours ago, Munger_Disciple said:

A couple of question for Fairfax experts:

- I was going through the cashflow statement in Q3 report. At first glance, it seemed odd that the cashflow from operations for the first nine months was negative $1B. Then I realized it was due to the line item called "Net purchases of investments classified at FVTPL". I would think purchases of investments would belong in investing activities, not operating activities? Is it related to adoption of IFRS?

- Why do they classify share buybacks into two separate line items, i.e., purchases for treasury and purchases for cancellation?

Thanks in advance.

Rapid answers (possibly wrong and not expert-like).

1. This seems like a reporting requirement and the 2022 annual report had the following to help adjust if need be:

"Cash provided by operating activities (excluding operating cash flow activity related to investments recorded at FVTPL) increased to $1,469.6 in 2022 from $1,352.0 in 2021 primarily reflecting increased net premium collections, partially offset by increased net claims paid at Crum & Forster and increased net taxes paid at Northbridge."

2. This seems related to a historical decision to purchase for treasury in order (not to cancel them) to use the shares so purchased for share-based compensation.

-

^Here's a humble take from a noob.

Short version: Treasury yields have recently risen as a result of fundamental supply-demand factors and only a small part of this increase is from the technical issues mentioned in the WSJ article.

-----

During the 1907 liquidity crisis, people wondered if the size of the money (and moral authority) of JP Morgan et al was enough and if there were more efficient (and more widely mutualized) ways to deal with such liquidity crisis. Then the Federal Reserve was created. Now, the size of the potential commitments seems to be endless but there are developing technical issues that are liquidity related. The size of the US Treasury market is HUGE and it seems like the intermediation process through primary dealers is no longer adequate for liquidity purposes.

-----

As the supply of Treasury debt has soared in an inverted environment, primary dealers' balance sheet constraints have resulted in large and growing arbitrage opportunities which private market participants (hedge funds) have tried to exploit using very high leverage. When volatility hits, because of the value-at-risk framework, hedge funds tend to unwind their positions and, reflexively (and in counter-intuitive way?), this actually tends to increase volatility. This issue continues to be relevant and there is a macro-prudential discomfort for systemic risk. If and when volatility hits, the Fed has an almost limited set of "tools" to deal with this temporary noise but it's still an interesting issue (for private market participants).

The following 2 graphs are from a recent publication, data stops end 2022.

The following graph is from a report just released by government officials who can produce unusually euphemistic titles with more recent data, showing the same growing pains in primary dealers' balance sheet constraints.

The 'easy' way out, as mentioned in the WSJ article, would be to re-establish some kind of relaxation on the SLR rule in order to allow commercial banks (and consolidated primary dealers) to expand their balance sheet and absorb Treasuries but there are problems:

1-This would mean continuing to allow private banks' balance sheet expansion ahead of underlying economic activity (just postponing the correction of imbalances)

2-This would mean to continue to allow banks to earn a significant (and growing) part of their return on assets from holding securities and not from making profitable loans to private market participants (the fundamental purpose of banks). Japan's banks have been on this trajectory for more than 20 years now and...

3-This would mean to re-ignite the fundamental factor behind the inflation with a lag that happened after Covid heroic monetary-fiscal measures

What's the point?

"I feel like he's trying to say something else that isn't such a mainstream take on it. He makes the very rare (for journalists anyway) admission that "Yet the end-buyers of the debt are unlikely to disappear since government deficits automatically create the very savings that are then channeled into financial assets."

As a noob, i would submit that the above quoted statement only applies in selected circumstances, especially the automatic part.

-

3 hours ago, Munger_Disciple said:

@Cigarbutt Thanks for your response. If I understand you correctly, wildfire risk is an evolving issue for regulators, and ultimately all the capex required to implement better shut-off systems will be borne by the public that receives the service. In the meantime, utilities that have not so hot balance sheets to handle current legal payments may go bankrupt so that creates an opportunity for a financially strong entity like BHE to pick up their equity for nothing. So it is painful in the short-term for BHE (a hit to current earnings) but a great opportunity to acquire other utilities long term.

Yes.

And whatever temporarily depress valuations or cause the sector to be in temporary disfavor may represent an opportunity to grow in these capital intensive businesses.

Added link for reference, if needed:

-

20 hours ago, Munger_Disciple said:

...

It is crazy that regulated utilities (where all the capex needs to be approved by regulators) have to pay for wildfire costs.

19 hours ago, Munger_Disciple said:More on wildfire looses at PacifiCorp. from 10-Q (underlined emphasis mine):

...

It is reasonably possible PacifiCorp will incur significant additional Wildfire losses beyond the amounts currently accrued; however, we are currently unable to reasonably estimate the range of possible additional losses that could be incurred due to the number of properties and parties involved, including claimants in the class to the James case, the variation in those types of properties and lack of available details and the ultimate outcome of legal actions.

Ok, a follow-up here in order to:

-promote some kind of uneducated wishful thinking?

-see this noise as a potential building comparative advantage?

At the very least, it's likely reasonable to look at both sides of the story?

-----

The following is based also on a relatively involved assessment of what happened to PG&E. Short version, fire costs (and poor management) tipped PG&E into bankruptcy (phoenix entity coming out with residual pre-BK equity value), costs were mostly borne by PG&E owners (at least it seemed at the time) but now (over time) appear to be effectively passed to the end of the line ie customers.

PG&E is based in California and there was an added consideration for inverse condemnation but even in that legal climate, the point is that costs will eventually be paid by customers and utilities will eventually earn their 'fair' return on capital.

-----

i did not follow the PacifiCorp legal travails as closely but, during procedures, potential liability of 7B and even 11B was mentioned although eventually, if history is any guide, the final liability will likely be much lower. In this specific case (during appeals, we'll see), a jury found PacifiCorp guilty of recklessness/negligence. A common aspect of this verdict with a recent Colorado case, which came to a similar conclusion (and with the recent Maui fires it seems) was the failure of PacifiCorp to proceed with temporary shut downs of electricity distribution in key areas. How to deal with wildfire costs for utilities is work in progress and regulators are slowly taking notice (what works, what does not work). One of the developing ways to prevent wildfire costs is to optimize the use of temporary shut downs. In other words, 'we' will eventually get better at it and utilities should (eventually) be treated proportionally.

-----

In August of 2020, on this Board (what are you selling pages), there was a participant who suggested the possibility to short Eversource Energy (poor management?, poor handling of an unexpected natural event etc) and i had suggested that this may not have been a good idea, at the time. Share price went from 90 to 80 and went back up rapidly. However, with interest rates rising, wildfire costs and others, share price is down 30%, imo getting to levels where BRK could pull the trigger (versus general price levels for utilities).

-----

The point being that the issue of wildfire costs is significant but temporary and may offer an opportunity for BRK utilities to become leaders in developing working models with regulators. There are many ways to discount this but, in a reasonably working free market economy, the customer should eventually bear the price of those costs.

Apologies for the long post but people often wonder about the impact of size on BRK for future growth and profitability etc. Expansion into utilities is potentially massive and offers long periods of adequate return on capital. But there will be noise and one has to assume that the US will continue to work reasonably well when dealing with such issues (public good vs private interests).

-

^Ok ok, you guys (@gfp and @JohnHjorth) are technically correct.

But my humble (and naive?) interpretation then is that the aimed objective (for BRK) is to pay less for the remaining minority interest ie to effectively transfer less value from the acquiree to the acquired.

The issue (conceptual) is that, if the above (as described) is technically correct, BRK then is trying to oppress minority shareholders. Somehow, this elicits some kind of gut reaction looking for a rational explanation and, on some occasions, economic substance is more important than the accounting language?

At the very least, a key piece is missing (opinion), if previously held fundamental assumptions about the BRK culture continue to apply.

-

-

22 minutes ago, gfp said:

...there is more to the story...

Clearly.

This open confrontation is unusual.

From a recent CPAJ piece:

"If an acquiree does not adopt pushdown accounting in a change-in-control event, it can elect to apply it in a subsequent period, subject to the requirements for a change in accounting principle. An entity may make a change in accounting principle only if it justifies that the alternative accounting principle is preferable. GAAP requires that companies apply the change in accounting principle retrospectively to the change-in-control event date (ASC 250-10-45-2)."

It looks like BRK 'found' evidence that some kind of material impairment was present AND had been present at least since the time of change of control.

It looks like this goes further than simply an intent to question an 'accounting' principle.

-

22 hours ago, Dave86ch said:

He doesn't understand the Proof of Work mechanism and its implications.

14 hours ago, TwoCitiesCapital said:...rather here to replace the payment processors like Visa (which I still believe).

If a store of value is all BTC ever becomes, it'll still be incredibly valuable.

...

If it masters that and then masters being a transactional currency via layer 2 systems, then we can discuss it being a unit of account and a reserve/stable currency.

...

I have mixed feelings on whether or not increased/transaction throughput will stabilize it's price or if it'll always display the characteristics of something perfectly inelastic (and therefore volatile AF). Time will tell - but it has many characteristics of a stable currency that the USD has lacked since severing ties with gold.

Need some help here.

A few years ago, after reading this:

i had looked into proof of work moving to proof of stake or else (referred to in page 9 of the link).

The link has common (with Mr. Munger) references to Adam Smith.

Any progress there in throughput?

-

8 hours ago, bizaro86 said:

While it's very high, 90% is verifiably more than live within 160km of the US border.

Alberta is more than 10% of the 40MM Canadians, and basically everyone here lives further than that from the border. Metros Calgary and Edmonton alone get you over 3MM, and the smaller centres and rural areas get you to 4MM outside that band. It's really only Lethbridge and some farms within that distance of the border in AB.

Add Saskatoon (~300k), Newfoundland (~500k) and Northern BC/Ontario and you've got at least another million.

We're having pretty significant in-migration of people who can't afford to live in Vancouver/Toronto any more...

Despite the above map and other 'sources', you are correct (i was wrong) and the percentage is closer to 80-85%. Thanks for the guidance.

Because of your post, i spent a few seconds on this topic (inter-provincial migration) and the net positive migration to higher latitude (and slightly colder) regions of Alberta is for real and growing. Interesting.

Real estate prices are clearly a factor. One also has to consider the relative commodity boom that is happening but there may be more (along the lines of what's going on in the US with NY/CA to FL/TX positive migration).

----) Back to what SharperDingaan is trying to do with this thread..

-

3 hours ago, SharperDingaan said:

...Assume maybe 60% financial illiteracy for the vast bulk of Canada’s population living within 200 miles of the US border.

So what?

...

Takeaways?

...

SD

A not widely recognized but verifiable fact is that 90% of Canadians live within 160 kilometers of the US border.

Number 3 reason for this fact is the attraction to Americans for what they represent, number 2 reason is economic ties but...number 1 reason is... simply climatic (not climactic).

For literacy purposes, 1.6 km = 1 mile

-----

i'm involved in the process of helping young adults in my tribe to get the government tools available to them (tax-deferred accounts for first house, for 'saving' and for 'retirement') to do the work for them and the result on their effective tax rate is really significant. And it's not that complicated.

-----

You mention a coming period for the next 5 years where there is a risk of being 'burned'. From my unusual perspective, things are slowly shaping up for some kind of blossom, what am i missing?

-

16 hours ago, Spekulatius said:

You are probably correct. What I do is just a quick measure to compare insurance cos quickly for the length of their tail. I think generally speaking, management should have the right answer using proper discounting.

The quick measure is fine to filter and obtain a rapid comparison.

-----

---) Back to FFH Q3 results

-----

-Mostly unrelated and irrelevant additions

-If you look at Mercury General (MCY; you've commented on this company before, good consumer deal, good agent but poor stock to own), they don't even try to match assets with liabilities and have relied for decades on positive cash flows from operations to pay developing claims (mostly car claims in California) and their Spekulatius quick ratio is 1.05. They have this nice table in their annual report:

So the quick measure works quite well and is related to the float leverage that long-tail lines entail. The other relevance between MCY and FFH is the temporary noise we're going through related to older years negative reserve development that are mitigated by reserve releases from more recent Covid-related years. It's interesting to watch versus the sustainability/durability of the hard market.

-If you look at the latest Personal Finance thread on worldwide wealth, you see that they report Belgium occupying the top spot and an inverse relevance to FFH numbers is that one needs to dig a little to figure out that Belgium numbers do not compare to other countries as the referenced link (likely) reported median wealth numbers without including private debt. Also related to a convergent relevance to FFH, one has yo dig a little to guess unreported assets. For the comparison of median wealth in different countries, using Germany as an example, it can be established that Germany has a relatively high level of 'public' ownership which, in theory, if spun out to citizens would result in a much better relative standing for median 'private' wealth. Of course, in that category, the champion is Norway with their publicly owned sovereign wealth fund which is not reported in the reference used in the thread. To adjust, you would need to add 250k USD to very citizen and then Norway dethrones Belgium in the top spot (once appropriate balance sheet adjustments are made).

-

24 minutes ago, gfp said:

...The Fed buys treasury securities and the seller of treasury securities gets reserves...

In a world where semantics can be so important, i would submit that the above statement is a factual misrepresentation or at least a partial representation of facts.

Since GFC, QE was effectively carried out with non-bank private participants (about 95% of open-market operations). These transactions do end up with a commercial bank balance sheet entry of a new reserve account held at the Fed. But, because of the non-bank participation. there are new balance sheet entries at the commercial bank level, a new asset of the bank ie money as an asset and a new liability ie deposit of the non-bank participant as a liability. This feature explains a lot the rise of the uninsured deposits that occurred especially after Covid.

All that to say that 'we' ended up with private participants becoming owners of zero-earning deposits looking to chase yields in related and other investing asset classes, contributing to lowering yields elsewhere and contributing to asset inflation (and also although hard to quantify to main street inflation through the wealth effect).

Just something to consider if sustainability becomes an issue or if tightening becomes part of the picture?

-

8 hours ago, SafetyinNumbers said:

Is it fair to assume claims in the quarter has a significant impact on their assessment of reserve adequacy? Based on IFRS17, the reserves seemed to be designated to a time period and then discounted back. Based on the triangles, ~25% of reserves are paid out in the next year so there is a lot of turnover expected (this is probably higher under IFRS17).i think you're right, the 'assessment' at this time of year happens because of a catastrophe-prone quarter, as part of end of year traditional evaluation of trends and also fits within some kind of cycle in itself:

-

2 hours ago, SafetyinNumbers said:

I assume reserves also follow a similar chart pattern as above so would it be reasonable to expect that Fairfax always has a lot of reserves they can and do release in Q3 of every year given the normally high CAT activity?

Historically, like most, they tend to look at reserve adequacy typically and especially in Q3 and Q4 and adjust accordingly (by releasing/decreasing reserves set aside if favorable or by increasing reserves if unfavorable).

Makes sense?

-

5 hours ago, Spekulatius said:

I use insurance liabilites / Premiums as a quick measure. I get $57B (2022 insurance liabilites) /22.6B (2022 net premiums) = 2.6 years roughly. It's probably not totally correct but in the correct ballpark.

Putting discounting of insurance contract liabilities aside for a second (2023 results will be IFRS17ed).

In your quick measure, why do you include the reinsurance part in the numerator but not in the denominator (otherwise the measure becomes about 2.1-2.2)?

Retention can vary from year to year and over time.

Any way to improve upon that measure?

Just take a look at reserve triangles:

About 50% milestone of the ultimately paid payments versus adjusted reserves happens in the third year (sometimes in fourth year).

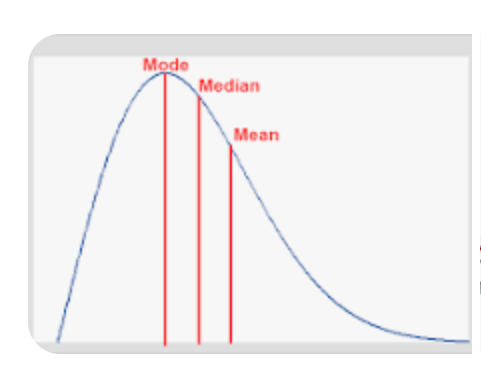

A picture about statistics and graphic reserve triangles and interpreted from an undiscounted perspective:

Reserve triangles typically look like the above (amounts paid over time) and tend to be somewhat skewed to the right (skewness even more pronounced with longer tail lines). Conceptually (undiscounted), the way duration is meant to mean in the insurance reserves world (opinion), the 50% milestone then underestimates to some degree the duration as recognized in insurers' parlance.

-----

Short version, P+C insurers' duration of insurance contract liabilities is reported to be between 2 and 4 years (more towards 4 years with long tail business). So with FFH, you'd expect the duration to be around 4 years because of their very significant exposure to long tail lines.

-----

So, i would suggest, as a quick measure, to use your measure, to call it the Spekulatius quick measure, to correct for the harmony between the numerator and denominator and to multiply by 2 and then i think you'd be in the right ballpark.

-

1 hour ago, RedLion said:

...homeless...

It's disgraceful, but I don't know what the solution is.

Every time i go to California (larger cities), this 'issue' is always kind of baffling.

This is not the area to 'argue' about this 'issue' but, recently, local journalism in my area, looking for models, produced balanced reviews of some kind of a 'model', made in Houston. Kind of interesting. Can we learn from each other?

https://www.governing.com/housing/how-houston-cut-its-homeless-population-by-nearly-two-thirds

It looks like some communities can achieve improvements but at what cost?

-----) Back to: have we hit the top discussions

-

37 minutes ago, dartmonkey said:

...

Virulent attacks against supposed short 'attacks' usually come from CEOs that have something to hide.

...

Do you think Fairfax used legal abuse when they described and moved against "abusive" short sellers?

Don't be offended by my question because it was a relatively grey area but, at the time, on a net basis, it really seemed like the appropriate thing to do.

-

4 minutes ago, RedLion said:

...(like we did after wwii).

not quite the way that is implied (based on numbers from that period).

Is the US economy set for another Roaring ‘20s?

in General Discussion

Posted

^Adapting quicker?, AI certainly deflationary?, inevitable but will it rhyme?

In the 1920s, productivity growth was for real, similar to what happened after the dot-com bu**le but the secular trend in the last 50 years is...

i believe productivity growth will make a comeback but it may take a while? and a bit of creative destruction (or destructive creation)?