-

Posts

3,679 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Everything posted by Dalal.Holdings

-

Lol. You mean spend more $$ for poorer outcomes strength and power? See Viking's post above mine. If you are hoping to be saved by U.S. healthcare system/pharma, prepare to be disappointed. Don't worry, the Republicans, led by Pence, are already using their greatest weapon: "thoughts and prayers". It works after every gun rampage, why not now? Science is useless and agencies like the EPA and CDC are socialist money pits that deserve to be starved of funding (but we'll sure miss them when we need them!).

-

-

If America finds a cure faster than other countries then perhaps the fattening of the pharmaceutical companies has been worthwhile. Do you think another country (socialized medicine or otherwise) has a better chance? Well during the last Ebola outbreak it was a lab in Winnipeg that developed the vaccine. And a lab in Saskatoon that was created to deal with exactly these types of viruses and has tons of experience with corona viruses (including developing vaccines for them) has a already been working on this for a while. So we'll see... Vaccines are cheap. Not that much money to be made bd a minefield for lawsuits. It’s one of the best return on investment for public health, but not for Pharma or biotech companies. It’s one field where public funding is needed. Not necessarily. GSK set to make $2B in sales on Shingrix, a vaccine for a very target demographic. Vaccines can be very lucrative, esp in a case like this where just about everyone will want one. Vaccines are also probably the most bang for your buck thing our healthcare system does -- a great man once said "an ounce of prevention is worth a pound of cure", so it's probably ok if they cost a bit (an individual only requires 1-2x shots with them unlike the recurring revenue treatments like humira earn on individual patients). Even the ebola vaccine took years for rollout (which would have been late without containment). Anyone who has ever looked at companies in drug development knows -- best to temper expectations with respect to drug approval and rollout. Developing new drugs is much easier said than done.

-

You could make a better argument that the CDC should spend less time advocating against guns, etc. and more time protecting us from infectious diseases. https://www.usatoday.com/story/opinion/2014/10/05/ebola-cdc-jobs-tasks-multitasking-thomas-duncan-column/16766801/ If you think bringing up how ebola was handled will make this cdc look good, then just lol. This is a clown show in comparison to how ebola was contained. Not enough tests out there by dismantled cdc means people have unknowingly been spreading it. High risk people were denied testing. Supposedly the province of British Columbia has tested more individuals than all of the U.S. (https://globalnews.ca/news/6610416/bc-covid-19-testing-more-than-united-states-premier/). When your boss calls it “Democrats’ hoax” I guess it must not be that important. Oh, how dare I bring politics into this—when POTUS makes a comment like that, it is totally apolitical and rational. But hey, it’s just like the EPA-an unnecessary arm of the govt to be dismantled. Serves no public purpose. Let’s put pseudoscientists in charge of it and see what happens.

-

Wonder what concoction of drano they'll be recommending to the public. Wow, supercomputers! This will surely help. This is what happens when Republican rubber stamp "scientists" are put in charge. This one in the famed Trump Dept of Energy, almost as skilled as Rick Perry--must be still looking for that "clean coal" recipe. Science is the pursuit of truth. With this crisis, these clowns have nowhere left to hide anymore and unfortunately for us, they're in charge. Elections have consequences it turns out. Well, on Tuesday, PatofthePig drafted a post for us providing a link to a newspaper article that suggested that chloroquine appears to reduce the length and severity of the coronavirus. I have not read anything else about it since, but it's interesting that a relatively old, off-the-shelf malaria treatment could end up having another use. Interestingly, it's been off-patent for 50-ish years now, so if it is actually found to be useful, it might be a treatment that is cheap enough for use by the world's poor. If the US government is trying to pick some low-hanging fruit by testing the efficacy of a broad range of existing medications, I'm all for it. SJ Malaria is a protozoan parasite. Very diff from a virus. I highly doubt an agent effective against malaria would have effect on this. Coronaviruses aren’t new. The chances that there is a common agent out there effective against them that we do not know about is slim. A lot of noise out there. Strange that Republicans who tout the private sector are relying on gov’t labs to find a cure.

-

https://www.bloomberg.com/news/articles/2020-02-29/trump-team-testing-off-the-shelf-drugs-to-cure-coronavirus Wonder what concoction of drano they'll be recommending to the public. Wow, supercomputers! This will surely help. This is what happens when Republican rubber stamp "scientists" are put in charge. This one in the famed Trump Dept of Energy, almost as skilled as Rick Perry--must be still looking for that "clean coal" recipe. Science is the pursuit of truth. With this crisis, these clowns have nowhere left to hide anymore and unfortunately for us, they're in charge. Elections have consequences it turns out.

-

Boeing, Lockheed and Northrop have remained domiciled in the U.S. though and sell planes/gear abroad and the discount to the gear they sell is not as steep as Pharma discount of U.S. drug prices vs even Canada. So defense co profits are brought back home and they pay U.S. taxes. Compare that to tax inverted pharma co now domiciled in Ireland that Medicare has no power to negotiate with. If the burden of world security is on America, tell that to the Pres who is asking for NATO members to chip in for their fair share. Fact is, the gap between America and ROW has narrowed over past 70 years, so the burden for pharma R&D and other stuff should not rest so disproportionately on Americans. Also, you think that all that excess $$ from ripping of Americans going to drug companies went to more lab benches and scientists? More was probably spent on patent attorneys than scientists (For Abbvie/Humira, it seems like $$ well spent--a great ROI! For patients & society, not so much). I could go on and on, but easier to just stick to Munger's brevity and call the U.S. system a "national disgrace". Like I said, as far as development of an effective treatment/vaccine rollout for Coronavirus is concerned, prepare to be disappointed.

-

If America finds a cure faster than other countries then perhaps the fattening of the pharmaceutical companies has been worthwhile. Do you think another country (socialized medicine or otherwise) has a better chance? Sure there are good actors out there who might deploy capital more favorably, but there are many more co's out there with behavior not too dissimilar to Valeant. They rip off American taxpayers (by overcharging Medicare) and relocate headquarters off shore to some low cost country so they cut down on U.S. tax bill--screwing American taxpayers both ways (Pfizer, et al). Congress (McConnell, et al) make it so Medicare has no power to negotiate drug prices. Mylan used political influence to convince schools to buy $600 epi pens Abbvie has somehow extended its humira patent in the U.S. (hey, maybe you can be a lucky patient and apply for a "rebate" from Abbvie, still doesn't spare our healthcare system tho)--Europeans didn't indulge them in that though. These co's fatten their bottom lines and then use that capital to do mega mergers (often with an overseas co so they can relocate their HQ to cut U.S. taxes: Pfizer was going to pay $160B for Allergan in 2016--that's money largely reaped from overcharging Americans that would not have gone to R&D but into Allergan equity/debt holder pockets for a tax inversion)--they don't plow it all into R&D. Waste. Waste. Waste. *If* America finds the cure--there is no evidence that American co's will (not to mention a lot of these are no longer American co's bc they moved out to dodge our taxes)--why is the burden for funding the world's pharma R&D being put on U.S. taxpayers???

-

We will learn the true cost of not having socialized healthcare with this crisis. As with a lot of things (e.g. climate change), we are not very good at anticipating and protecting against complex, nonlinear phenomena that pose 2nd and 3rd order effects. As Churchill said: "Americans will always do the right thing--only after they have tried everything else" Or Munger: We'll have single payer healthcare as soon as Dems take WH and Congress. Or "America's healthcare system is a disgrace". Let's see how fattening up the pharmaceutical company bottom lines over the years help us with this black swan. Let's see how much they put into R&D and how long it takes to get treatment/vaccine out. Prepare to be disappointed.

-

https://www.businessinsider.com/how-much-does-coronavirus-treatment-cost-cdc-health-insurance-2020-2 U.S. Healthcare System is a Joke though and that will become so much more apparent to everyone as this unfolds. Americans who don't (or can't) pay the healthcare bills will not get tested/treated and instead spread this in the community compared to just about every other developed country where the cost of healthcare visit is low. This, along with the revelation of what happens when a marketing guy conman President faces a true crisis, may very well lead to the United States electing its very first socialist president in 2020.

-

Despicable, but I imagine given the lax attitude shown on this forum to you, you will be allowed to post as usual. I wish no ill will to you or your family, but to each their own.

-

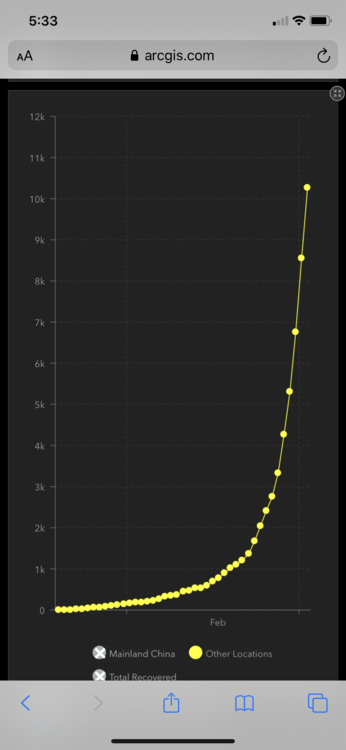

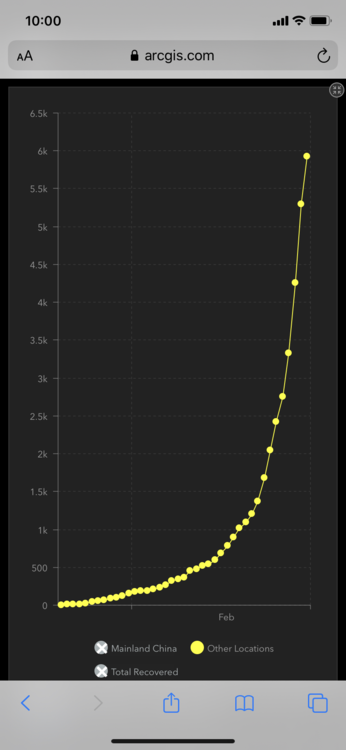

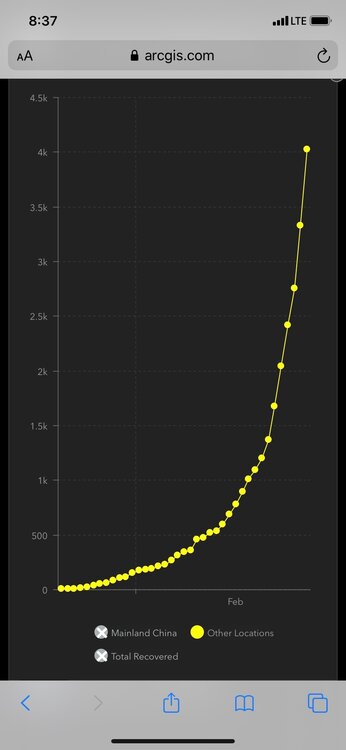

Exponential growth continues. As I asked a day ago--what happens to $4000 $6000 that compounds at 20% per day? That last dot represents 2/29 cases outside China (2/29 has not even begun in many places yet). Sauce: https://systems.jhu.edu/research/public-health/ncov/

-

The graph you should be looking at: cases outside China. Numbers you can actually trust. Note within China, there are some provinces where the case # has not budged for over a week (Zhejiang). It seems like there may be some obfuscation going on, esp outside Hubei. For those saying not to worry about the "2%" that will be affected, the economic implications of people staying indoors are massive enough, esp in a consumption oriented economy with anemic growth such as ours. Trump the reality TV star is finally being put to the test. As is his MO, he's setting up a fall guy (Pence) because the buck never stops with him, but with the people he hires (they're always "the best"--until they're not: See Tillerson, Flynn, Bolton, Kelly, etc etc). He's terrified of being honest to the American people because it will cause panic (crisis of confidence) and trigger a recession in an election yr as people will cut off travel/shopping/home buying/etc. And of course, God forbid stocks come down bc then he can't use his clever "how is your 401k doing" campaign line. And Powell won't be able to help him with a cutback in consumption that comes from virus induced fears, not only do we have rock bottom interest rates, but lowering them will not get people to go outside. Reality will likely catch up to his obfuscation anyway and he can't cover up a crisis like this one for long...this ain't no reality show or Trump University where it's all about the marketing. After all it is exponential growth in cases (about 20% a day--what happens to $4000 that grows 20% a day?). The truth will overwhelm his massaging of the message in due time with a crisis like this one and it will not be pretty.

-

Druckenmiller and Trump were right

Dalal.Holdings replied to Cardboard's topic in General Discussion

The original conversation referred to depth of recessions and magnitude of bubbles (peaks and valleys) being worsened by Fed. There was no discussion on stock returns or even GDP growth over long periods. My only argument is that the Fed made cycles less intense on the ups and downs, not more. If you want to argue about Fed and gdp or stock market impact, you’ll have to find someone else to discuss this with because I don’t have a strong opinion on that. -

Druckenmiller and Trump were right

Dalal.Holdings replied to Cardboard's topic in General Discussion

I actually realized that I made a mistake when I posted before. The US stock market did 7% from 1871 to 1913, including all of your panics that you are panicking about. There was actually price deflation this entire period. Investors did very well. From 1913 to today, the US stock market did about 6.6%. I will call that a rounding error and say it was about the same. I don't think anyone needs to prove the fed made things worse. Prove they made things better. If you can't why don't we just revert back to a more natural state. Why do we keep rolling the dice with central planning? Lol.. the U.S. “stock market” was in its infancy during that time. Stock return comparison not exactly apples to apples. What really matters and what real PANIC is: when you are lining up at your bank not sure if your checking/savings account money will be there when you get to the teller. You can thank the Fed that you don’t know what real panic is. The reason you think “Panic = 20% decline in stocks” is thanks to the Fed. -

Druckenmiller and Trump were right

Dalal.Holdings replied to Cardboard's topic in General Discussion

The chronic meme of "the economic (boom/recession) would have been much shallower if only the Fed had (raised/lowered) rates by x months by Monday morning quarterbacks (usually "macro" traders like Druck or CNBC commentators like Cramer) is amusing. Just sum it down to: "everything bad in the economic cycle is the Fed's fault". If you want "real data", look at the United States before the Fed existed on Wikipedia (they used to call them Panics for a reason): Panic of 1907 Panic of 1901 Panic of 1896 Panic of 1893 Panic of 1884 The list goes on (and on)... So if you want to argue that the Fed makes things worse, please provide data of similar caliber. Can't wait until historians write about the Fed induced great economic crash of 2018 where the S&P sold off (almost) 20% from all-time-highs and nearly everyone who wanted a job had one... -

Druckenmiller and Trump were right

Dalal.Holdings replied to Cardboard's topic in General Discussion

It’s obvious—the S&P500 (Mr. Market) as Druckenmiller states is the Best indicator. So what if algos drive a large number of movements. There must be hidden signals in there. And of course, as value investors who follow in the path of Berkshire here, we fear volatility and must lash out at the FED whenever we see volatility (as many have in these pages). Who was the great investor who said that “volatility is an investor’s worst enemy”? Certainly many on here fear volatility, that’s for sure. I guess we realize who was swimming naked now that the tide has gone out... -

Druckenmiller and Trump were right

Dalal.Holdings replied to Cardboard's topic in General Discussion

Somebody call the Wahmbulance! Omg Trump has more rate increases than Obama, the odds are totally stacked against him!! Obama had it so easy walking into the oval office in January 2009 at the depths of the largest recession since the Great Depression with double digit unemployment. Donald J Trump; however, is a beacon of a man who has gone through real hardships like 25bp Powell rate increases from record low rates during record low unemployment (low unemployment not at all due to Obama though). Since He was a child, He had to learn to lift his silver spoon by Himself. Let us not forget His crippling bone spurs which prevented His service in Vietnam but did not stop Him against a valiant fight against HIV in the 90s. This man knows honor, knows sacrifice. The FED (I capitalize it to show my tinfoil hat) is to blame for all market declines. Trade war? Crazy tweets? Unhinged speeches? The FED needs to learn to bring rates DOWN after Trump acts to accommodate him and his volatility. Everyone Trump has hired were the best people when he picked them (Powell included), but somehow always lose their way. These people are to blame for all of the Executive branch's mistakes. The mistakes do not emanate from the top--only the positive success stories do. Nothing on the downside is Trump’s fault. Everything on the upside is due to him though. Am I doing it right? This thread belongs in the politics section. -

Druckenmiller and Trump were right

Dalal.Holdings replied to Cardboard's topic in General Discussion

Amusing that everyone points to the Fed "screwing up" as cause for recessions. In 2000, when tech stocks were trading at absurdly high multiples and the Nasdaq was stratospheric, could the Fed have done anything really to stop a recession? Could the Fed have stopped the slowdown after an unpredictable event like Sept 11 2001 and get people to fly again??? Druck in his latest video claims that if Bernanke cut a little earlier, the 2008-09 crisis wouldn't have been that bad. Please. Would a little cut have prevented the failure of Lehman and AIG which had hundreds of billions in shady derivatives with counter-parties across the financial system bearing fallout? Would a little cut from the Fed really have prevented a crisis? AIG built up its hedge fund with terrible risk management over many years--it had nothing to do with the Fed, but the actions of bozos at the top of those firms. Go read "The Big Short" and tell me how Bernanke could have stopped that economic tsunami. The Fed is not the cause of recessions nor able to single-handedly prevent them. Cycles are normal. The bad businesses need to fail. Bank balance sheets were a mess and needed to be cleansed. That takes time. -

Druckenmiller and Trump were right

Dalal.Holdings replied to Cardboard's topic in General Discussion

Really? I guess it's subjective and hard to prove but I tend to think American prosperity had much to do with free market capitalism. Certainly the us economy grew strongly and the market made people rich before the fed was introduced. Maybe the US succeeded in spite of the fed. If you look at the massive amount of debt that was introduced over the last 30 years I have to blame that largely on the fed and their slow hand on interest rate increases. I don't think trump should be trying to influence the fed, I think he should be trying to abolish the fed. You blame the fed for debt levels? Does the Fed create the budget or enact massive tax cuts without reducing spending? Does the Fed control gov't spending at all? The Fed is "slow" with interest rate increases? I guess you then support Powell because you support high interest rates? Oh, and on the Fed being "slow", Paul Volcker's term contradicts you. Of course free markets played a role--the U.S. grew in the 19th century with free market capitalism. Since the Fed was created (1913) however, the U.S. has done much better (fewer panics, boom/bust magnitude reduced) and has become the world's largest economy. The U.S. economy of the 20th century >> 19th century U.S. economy. Oh, you're an "abolish the Fed" kind of person. No point in engaging further. -

Druckenmiller and Trump were right

Dalal.Holdings replied to Cardboard's topic in General Discussion

:D Funny that both Jim Cramer and Stanley Druckenmiller jumped in at the peak of the tech bubble in 99-2000 (Stan likes to exclude his results at Quantum when he quotes how he earned "30% over 30 years"). Guess they believe in those hidden signals the market whispers to them a little too much. I keep in my records a speech of Cramer's in 2000 to remind myself of who he is (must explain why his day job is now working for CNBC and not managing money): https://equitymates.com/lets-review-jim-cramers-2000-stock-picks/ https://www.fool.com/investing/general/2008/08/27/jim-cramers-regrettable-investment-advice.aspx I wonder how Berkshire Hathaway fared with its investments through the tech bubble and its bursting...Is that old crank Buffett still managing money or did he get a job at CNBC too? -

Druckenmiller and Trump were right

Dalal.Holdings replied to Cardboard's topic in General Discussion

The only thing one should be sure of is that Mr. Market is not to be trusted. It worked for Graham and it worked for Buffett (who is a lot more successful than Druck or Cramer for some reason). The other thing to be sure of is that it’s worth preserving something that helped create the greatest prosperity the world has seen over 100 years (Fed dual mandate and Fed independence). No one can be trusted to “maximize the S&P”, but managing inflation and employment with independence from politics has a great track record. -

Druckenmiller and Trump were right

Dalal.Holdings replied to Cardboard's topic in General Discussion

Guess we should give the Fed a third mandate like Druck seems to imply (because Druck seems to believe that Mr. Market is the world’s best economist—Ben Graham would disagree): the Fed should maximize the S&P 500. Surely that will lead to great long term economic prosperity. -

Druckenmiller and Trump were right

Dalal.Holdings replied to Cardboard's topic in General Discussion

Jim Cramer touted for wisdom on here? Please. What are we, a banana republic? The central bank head of India recently resigned because the Prime Minister wanted easing next year (an election year for him). Do we want to go down this path??? Whether a sitting President can fire anyone at the Fed is questionable (https://www.google.com/amp/s/www.forbes.com/sites/patrickwwatson/2018/09/06/how-trump-could-fire-powell-and-rebuild-the-fed/amp/). Why the change of heart in here? Anyone recall David Einhorn and his talk of “jelly doughnuts” by the fed many years ago? Suddenly now we want easing? But hey, I guess your portfolio is down a few points now and you can’t take it, so we should destroy the precedent of an Independent Fed that has made this country what it is... Guess we all (Trump included) just want it to be 2017 again with unnatural low volatility across the board and surging asset prices... If volatility like this scares you (after many years of rising asset prices) and you resort to lashing out at the Fed, you have no business actively investing, IMO. -

Druckenmiller and Trump were right

Dalal.Holdings replied to Cardboard's topic in General Discussion

Happy to see Powell tell Trump to gtfo. Independent Fed all the way. Druck sure mooching off publicity these days (loves commenting on macro macro macro).