-

Posts

333 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by VersaillesinNY

-

-

-

http://www.forbes.com/sites/phildemuth/2015/03/26/quote-of-the-year/

“This has basically never happened before in my whole life. I can remember 1½ percent rates. It certainly surprised all the economists. It surprised the people who created the life insurance industry in Japan, who basically all went broke because they guaranteed to pay a 3% interest rate. I think everybody’s been surprised by it, including all the people who are in the economics profession who kind of pretend they knew it all along. But I think practically everybody was flabbergasted. I was flabbergasted when they went low; when they went negative in Europe – I’m really flabbergasted. How many in this room would have predicted negative interest rates in Europe? Raise your hands. [No hands go up]. That’s exactly the way I feel. How can I be an expert in something I never even thought about that seems so unlikely. It’s new territory….

“I think something so strange and so important is likely to have consequences. I think it’s highly likely that the people who confidently think they know the consequences – none of whom predicted this – now they know what’s going to happen next? Again, the witch doctors. You ask me what’s going to happen? Hell, I don’t know what’s going to happen. I regard it all as very weird. If interest rates go to zero and all the governments in the world print money like crazy and prices go down – of course I’m confused. Anybody who is intelligent who is not confused doesn’t understand the situation very well. If you find it puzzling, your brain is working correctly.” Charles Munger

-

The Plot to Free North Korea With Smuggled Episodes of ‘Friends’

http://www.wired.com/2015/03/north-korea/

Recommended documentaries

Crossing the line - available on Netflix streaming & youtube

https://www.youtube.com/watch?v=LY0Wlk1BtXA

Money And Power in North Korea: Hidden Economy

https://www.youtube.com/watch?v=4Mmq3NW_FQg

For every USB drive I send across, there are perhaps 100 North Koreans who begin to question why they live this way. Why they’ve been put in a jar.Korean activist

Two things work beautifully to ruin an aggregation of people. All the best people leave; that's a sure source of huge failure. Then you have the remainder under a total crazy bunch of people -- like say the nutcase that runs North Korea -- and of course that will ruin anybody. Do you see all those pictures of North Korea at night? It's dark! They have starvation in the Year of Our Lord 2010! They have people starving in the dark! That's what communism will do for you if you work at it hard enough.

Charles T. Munger - University of Michigan

-

Another glimpse of the meeting while we wait for some serious notes.

-

Charlie Rose: Remembering Don Keough - March 19, 2015

http://www.charlierose.com/watch/60534467

My advice to a young person, especially a business school student, interested in Allen & Company is to be sure you become an interesting person. You should develop a full range of interests and not worry about a career. Instead, take courses that interest you-- statistics, philosophy and so on. Secondly, any young person who doesn't put the international world into perspective is a damn fool. Any education in today's world must incorporate some part of it outside the United States." Don Keough - Allen & Co. Former Chairman, to prospective Allen employees. -

-

Nice French-Canadian investors who have found their yardstick in the Graham-Buffett-Fischer-Lynch approach.

Francois Rochon was an “early” investor in Fairfax from 1996-1999 and again in 2002.

He is a friendly guy and a great networker who has met Prem Watsa, Francis Chou and more recently legendary investor Peter Lynch.

From its track record, we can appreciate talented skills in analyzing and picking the right companies in order to build a concentrated portfolio. AUM seems to be $80 M about three years ago, definitely higher now. The fund’s management fee is undisclosed.

Like many of us, Giverny seems to get ideas from Berkshire. Here are some companies (past & present) in both “partnerships” portfolios:

=> Wells Fargo, M&T Bank, Union Pacific, BNSF, Wal-Mart, P&G, BYD and American Express.

The second important idea generator for Giverny is Sequoia Fund. Here are some companies (past & present) in both equities portfolios:

=> Valeant, Precision Castparts, O’Reilly Automotive, Fastenal, Mohawk, Omnicom, Google and Wal-Mart.

I’m not taking away Rochon’s credit for cloning the right companies at the right time and outperforming the indexes over the long term. Rochon and his team are also innovators who have generated their own investment ideas:

=> Berkshire, Fairfax, Bank of the Ozarks, Disney, Buffalo Wild Wings, Resmed and many more.

As a fund trying to grow AUM, Giverny doesn’t publicly disclose:

- its current top 5-10 positions

- its returns net of fees

- its cash level

Therefore, it’s difficult to evaluate the percentage of Giverny’s portfolio originated from in house ideas versus cloning strategy.

In this business you have the innovators, the imitators, and the swarming incompetents.Bill Ruane

-

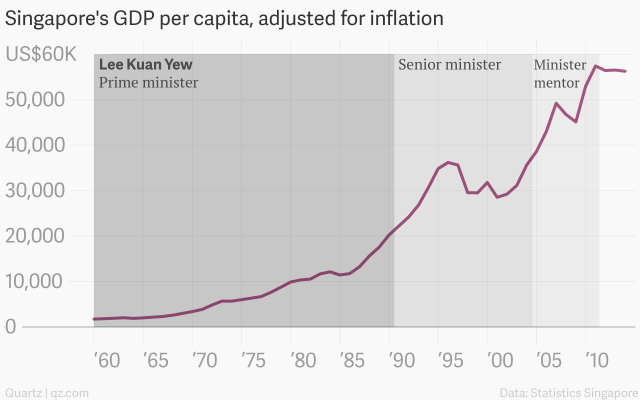

RIP Mr Lee Kuan Yew.

Creating Singapore: The life of Lee Kuan Yew

http://qz.com/365559/creating-singapore-the-life-of-lee-kuan-yew/

A Conversation with Lee Kuan Yew - Council of Foreign Relations

http://www.foreignaffairs.com/articles/49691/fareed-zakaria/a-conversation-with-lee-kuan-yew

Munger praises Singapore and Lee Kuan Yew

“I think Singapore is the single most successful governmental system that exists in the world.”“Study the life and work of Lee Kuan Yew, you’re going to be flabbergasted"

Charles Munger

“I have spent my life, so much of it, building up this country. There is nothing more that I need to do.

At the end of the day, what have I got? A successful Singapore. What have I given up? My life.’”

Lee Kwan Yew

-

Here goes another interview:

Mohnish Pabrai and Guy Spier in Conversation with Saurabh Madaan | Talks at Google | March 16th, 2015

-

Thanks globalfinancepartners.

-

This year, I have a hard time finding an electronic way to request the paper version of the annual report with the colored cover.

I can't do it via the proxyvote nor via the BRK minimalist website. Although, I can order BRK activewear online ::)!

-

Does anyone know where to find a proxy link for ordering a paper version of the "Annual report" :o?

-

It's not simple to receive a paper copy of the Annual Report this year.

BRK is probably trying to save some paper by discouraging shareholders to make the written request.

Annual Report

The Annual Report to the Shareholders for 2014 accompanies this proxy statement, but is not deemed a part of the proxy

soliciting material.

A copy of the 2014 Form 10-K report as filed with the Securities and Exchange Commission, excluding exhibits, will be

mailed to shareholders without charge upon written request to: Sharon L. Heck, Secretary, Berkshire Hathaway Inc., 3555

Farnam Street, Omaha, NE 68131. Such request must set forth a good-faith representation that the requesting party was

either a holder of record or a beneficial owner of Class A or Class B Stock of the Corporation on March 4, 2015. Exhibits to

the Form 10-K will be mailed upon similar request and payment of specified fees. The 2014 Form 10-K is also available

through the Securities and Exchange Commission’s Web site (www.sec.gov).

-

Liberty,

That's because Altice's IPO only took place 13 months ago ;).

-

Altice’s savvy ‘playbook’ fuels rapid growth at telecoms group

http://www.ft.com/intl/cms/s/0/5cf6cd60-bc18-11e4-b6ec-00144feab7de.html#axzz3TSsVJzp6

"Apart from a Nespresso machine, there are few frills at Altice’s office in Geneva. Jeans and open-necked shirts are the standard dress code and easyJet is the airline of choice for the 15 staff members of the Amsterdam-listed, Luxembourg-registered telecoms group.

“These guys don’t even have secretaries,” says one investment banker.

If Altice were a struggling start-up, this would seem perfectly normal. But in the past 12 months, the group has put up €28bn to transform itself from a relatively small-scale cable group into one of the continent’s leading telecoms operators that oversees 35,000 employees.

The pace of expansion has wowed investors: since its initial public offering just over a year ago, Altice’s share price has risen 197 per cent, giving it a stock market capitalisation of more than €20.5bn.

The company’s rapid growth — recent acquisitions include Portugal Telecom and a controlling stake in SFR, France’s second-largest mobile operator — has led some analysts to wonder how far the group can go.

In just over a decade, the business set up by Franco-Israeli billionaire Patrick Drahi has evolved from a project to roll up French cable assets into a burgeoning media empire. And Altice has no intention of stopping.

“It’s not that we sit down with a map every day, but we are very open to a lot of projects and we go very fast,” says Dennis Okhuijsen, chief financial officer.

Altice is a holding group that draws on the experience of Mr Drahi and his team in the cable sector. Many of them honed their skills either as an employee or a banker to Liberty Global, the world’s biggest cable company. Mr Drahi sold a regional French business to John Malone, founder of Liberty Global, in 1999.

Like Liberty Global, Altice relies on its savvy use of capital markets to fund its growth. Mr Okhuijsen, for example, used to be treasurer at Liberty Global. While there, he built a stable of relationships with leading banks and learnt how to use debt and equity issuance to minimise costs. [...] "

-

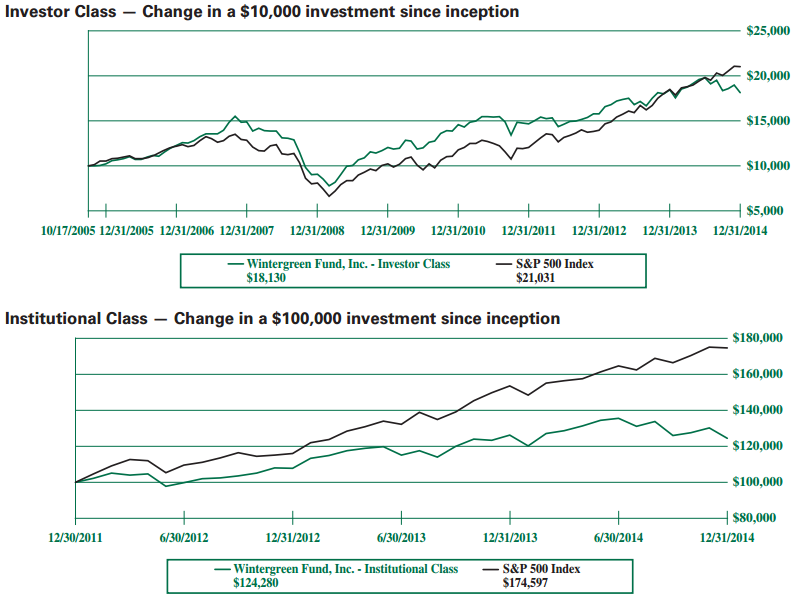

Well, talking about the wolf, the timing couldn't be better; let's take a look at his recently published annual letter.

http://www.wintergreenfund.com/downloads/wintergreen_fund_annual_report_20141231.pdf

-

David Winters had a good start, he was mentored by Max Heine and Michael Price.

One of the problem is that he opened his Wintergreen fund prior to the financial debacle.

From 2006-2008, you could spot him on Consuelo Mack wealthtrack and cnbc preaching his optimism on the stock market.

Winters was clearly raising funds and got burned like most of the value shops during the crash.

At Wesco’s annual meetings, he used to ask his lollapalooza questions and played the faithful Munger-Buffett fan.

He seems to be a nice guy although he also seems to have lost it during the Coke compensation drama.

David Winters took it to a personal level and openly criticized Buffett for abstaining during the Coke vote.

After that, his fund sold its entire BRK position. In retrospect, Wintergreen's shareholders got negatively impacted by the sale given BRK strong performance.

Even if Winters doesn’t advocate smoking; I couldn’t invest in his fund due to its permanent large exposure to tobacco companies (18.2% of the portfolio as of Jan 2015) and comfortable management fee.

I think he is making too much noise about Coke while only having 5% or $105 million of his fund invested in the company.

Buffett’s recent comments will adversely impact Wintergreen fund's ability to grow its shareholders base while under performing the market.

David Winters should focus on delivering performance to its remaining shareholders instead of being a pain in the neck (excuse my French).

-

Attached is Warren's recent interview with a German newspaper.

It seems that Buffett is starting a PR campaign in order to buy more businesses in Europe.

On balance the low euro is good for takeovers. But the euro exchange isn’t our primary motivator.Our motivation is to own more good businesses in Germany. WEB

Warren_Buffett’s_German_To-Do_List_·_Handelsblatt_Global_Edition.pdf

-

My mistake sleepydragon.

Journalists like alarmist tones in order to increase their audience.

As a BRK shareholder, I feel that management is transparent and the Newsweek article goes to the trash bin.

-

-

The Brazilian judge and Porsche driver has a curious definition of Batista's insider trading case:

"Eike had insider information that he used to obtain profits. He is like the woman who cheats, and the shareholders are like her husband: By the time they found out it was too late.”

-

Aswath Damodaran - "Valuation: Four Lessons to Take Away" - Talks at Google - Feb 17, 2015

This guy is just great!

-

LC,

Are you suggesting to set up the next Cobf meeting at a NY cigar club?

-

Mark Mobius on investing in Cuba - Feb 17, 2015:

60 Minutes lead story on Michael Lewis - Flash Boys

in General Discussion

Posted

How one trader made $2.4 million off a tweet

http://fortune.com/2015/04/01/2-4-million-off-a-tweet/

"Someone made a big bet on a company minutes before news came out about a possible acquisition. Was it insider trading or a well-programed computer that placed the bet? [...]"