Luke 532

Member-

Posts

2,931 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Luke 532

-

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Mel Watt to testify next week before Senate committee... https://www.wsj.com/articles/senate-panel-to-revive-mortgage-overhaul-efforts-with-first-hearing-next-week-1493836967 -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

I wouldn't be so quick to assume that. The shouting last night might be an indication that nothing bipartisan gets done, and perhaps that display last night is enough for Mnuchin to think he's given Congress a chance and now he needs to act. But I think he gives Congress until the 2nd half of the year to see what they come up with as he has stated he won't tackle GSE reform until then. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

http://video.foxbusiness.com/v/5420142826001/#sp=show-clips Doesn't sound like Mnuchin expects (nor needs) Congress to get this figured out. We already knew that he doesn't need Congress, but it almost seems like he doesn't expect Congress to do anything... although in the past he has said he is hopeful for bipartisan support. Heck, I'm hopeful the Red Sox would draft me and I could play SS for them, but I'm certainly not expecting it. Mnuchin is being thorough and meeting with a bunch of interested parties (as he should). The point is that he clearly realizes that he alone can make a recommendation to Trump on what to do and, more importantly, he seems to realize that might be the best option. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Wow, Zachary wasn't kidding on the shouting thing. Thanks for posting, Desert. Good stuff. This is from Capuano though not sure if it's from yesterday or not... -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Hmmm... Zachary Warmbrodt tweet... It’s 10 p.m., and members of the House Financial Services Committee are nearly yelling at each other about Fannie and Freddie -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Agreed. But keep in mind the Administration does have the documents that might connect the dots. If there is one from the last administration that says something to the effect of "we need to take this from Fannie to pay for Obamacare or it will die" then that would be enough, in the court of public opinion at least, to say Fannie paid directly for Obamacare. From an accounting standpoint, and I'm a former accountant, money is fungible of course. I know Corsi is a whack job, but he mentioned that the White House told him that Obamacare paid for with Fannie money. This was well after Trump had been in office and had access to the documents. Trump was also more direct yesterday in his tweet where he said "Obamacare is dead..." In the past he has said "It will die..." "it is going to die...", etc. He knew about what was to be discussed in this morning's interview before it aired. Too much dot-connecting can be detrimental at times, but it seems prudent in this case. And it's kind of fun. :-) I can't believe the market is offering prefs at roughly 30% of par value in this environment... pretty amazing deal if you ask me. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Bartiromo: "There's been a conversation on Twitter and has been for a long time that President Obama needed money for Obamacare and he would take from all the agencies and he took from Fannie and Freddie. Is that true?" Mnuchin: "It's true. They used the profits of Fannie and Freddie to pay for other parts of the government while they kept taxpayers at risk." Mnuchin has been very vocal that one of his main goals with housing reform is to make sure the taxpayers are not at risk. Here he makes a clear connection that using profits of GSE's to fund other programs keeps taxpayers at risk. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

"We still essentially have a government monopoly and we're repeating many of the same mistakes" Is that still the same old narrative that FnF are monopolies and they should have been replaced and the many big banks should launch competitive business lines? This statement could mean anything to anyone. Bob Corker would interpret it the above way I think. But people on this board would think it means releasing FnF. I agree that it could mean various things. I just find it useful to post quotes when Fannie Mae is discussed openly in the media by people of influence. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Maria Bartiromo using the Fanniegate hashtag tonight. Probably more of the same from Mnuchin tomorrow morning but wanted to mention it in case anybody wants to watch on the off chance he mentions something new. Maria BartiromoVerified account @MariaBartiromo Tomorrow bright & early @MorningsMaria @FoxBusiness @USTreasury secy @stevenmnuchin1 #taxreform #fanniegate 6-9am et -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

http://www.icba.org/news-events/press-releases/2017/05/01/president-trump-kicks-off-icba-capital-summit Washington, D.C. (April 30, 2017)—More than 100 community bankers representing the Independent Community Bankers of America® (ICBA) will meet with President Donald Trump and other top administration officials at the White House to kick off ICBA’s Capital Summit, which begins tomorrow. Mnuchin and Hensarling are speaking at this event. ICBA had a very shareholder-friendly (it seems) housing reform proposal a week ago. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

At the 6:20 mark of this video, Rep. Hensarling and Maria Bartiromo discuss Fannie/Freddie (this morning)... http://video.foxnews.com/v/5416917954001/?#sp=show-clips Bartiromo: "Real quick, sir. Fannie and Freddie privatized, is that on your agenda... over the near term?" Hensarling: "Absolutely. We have got to reform our housing finance system. We still essentially have a government monopoly and we're repeating many of the same mistakes, Maria, that led to the crisis in the first place. So I look forward to working with the Administration, Senator Mike Crapo, my counterpart in the Senate, and we're going to get this done." -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

FNMAS halted (regulatory, not volatility). Likely nothing as other prefs and common are still trading. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

My bad. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Plaintiff Outlines Plan for Potential Fannie/Freddie Settlement http://ctfn.news/plaintiff-outlines-plan-for-potential-fanniefreddie-settlement/# -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Joseph LawlerVerified account @josephlawler 6m6 minutes ago Hensarling says he shares Crapo's optimism that Fannie/Freddie reform can be done this year, says he is "very anxious" to return to it -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

H. Res. 280: H.R. 1694 - Fannie and Freddie Open Records Act of 2017 passes US House (Rule vote) by 226-192. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Mnuchin on Bloomberg Starts around 14:20 mark... https://www.pscp.tv/w/1mnGeEMpZpAGX I may have missed a few words here and there as I typed this while listening... Interviewer: "US needs to get Fannie Freddie out of gov't ownership. What is your plan to get the gov't out of housing and what would be the effect on mortgage rates." Mnuchin: "Many meetings. Housing reform is a priority of mine. Existing system of Treasury as gigantic line to Fannie/Freddie and operating these the way they are, we are determined to change that and not have that continue for the next 4 years. The fundamental principles is to have proper housing finance in this country. We've had liquidity for the 30-year mortgage, has been very important for the middle income in terms of being able to have home ownership and home ownership and building, as you know, is a very big part of the U.S. economy. The number one issue is we want to make sure we have proper liquidity in the housing markets. The other number one issue, and I wouldn't even call these one and two in any particular order, I'll just call them top two, is we can't put the taxpayers at risk. So we can't have a system where there's a bailout of housing finance. We are looking at housing reform. We've spoken to different people, I think there's a lot of different good ideas. This is something we'll be working on in the second half of the year once we get further down tax reform to focus on our housing policy." Interviewer: "Have you talked with Ben Carson on those plans?" Mnuchin: "Absolutely. We are going to work very closely with him. Although the major focus is on Fannie Freddie we are concerned with the growth of FHA loans. And we want to be very careful in fixing Fannie Freddie that we don't create a bigger problem at FHA. Whatever the solution we're not going to push down on this and pops up on the other side of FHA. So we're looking at this and working with HUD on comprehensive housing issues to make sure we have liquidity and we have safety." -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Mnuchin and Hensarling are the speakers at the ICBA May 1-3 event. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

nice proposal, thank you icba. confused on the warrants into sr preferred comment in your pasted attachment -- was it a typo? Yes, I believe it was. The warrants are for common stock. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

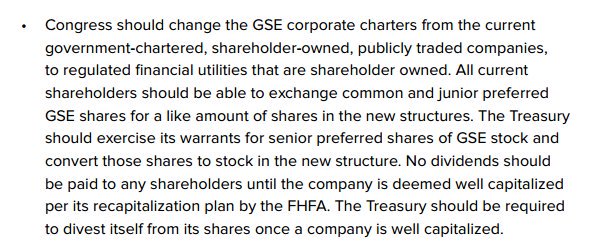

I'd be happy with the ICBA proposal: http://www.icba.org/news-events/press-releases/2017/04/25/icba-white-paper-lays-out-principles-for-housing-finance-reform The attached image is a highlight of the proposal. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

House Rules Committee meets on Tuesday regarding the Fannie/Freddie Open Records Act (attached). And here's the link to follow the billl: https://www.congress.gov/bill/115th-congress/house-bill/1694/cosponsors?q=%7B%22search%22%3A%5B%22hr+1694%22%5D%7D&r=1 -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Interesting that Senators might want to do GSE reform before Dodd-Frank... Q Mr. Secretary, in Congress it seems like in the Senate they want to do GSE reform before Dodd-Frank reform. Is that order you would support? And what do you think is the biggest holdup to getting a GSE deal? https://www.whitehouse.gov/the-press-office/2017/04/21/press-briefing-secretary-treasury-steve-mnuchin-financial-services -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Pulitzer Prize winning writer Gretchen Morgenson has written some good articles on the GSE's over the past couple years. This particular article was great when written and is still great today. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Thanks for the info. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Reuters PoliticsVerified account @ReutersPolitics 2m2 minutes ago MORE: Trump to sign memoranda Friday for treasury secretary on orderly liquidation authority, financial oversight council - spokesman CNBC NowVerified account @CNBCnow NEW: Trump to make first visit to Treasury Dept. tomorrow to sign two financial-related executive orders (via @kaylatausche & @EamonJavers) Orderly liquidation... of warrants? Perhaps.