wachtwoord

Member-

Posts

1,639 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Everything posted by wachtwoord

-

LOL Reacting NOW because this actually IS an interesting discussion point different from what's been discussed before (and you have point). Yes, in the current situation Bitcoin from any address can be taken when a quantum computer with sufficient qbits is developed Not with zero effort mind you! But then it becomes doable in polonial time to brute force private keys. The first one's to fall would be the old P2PK addresses (as these make the public key destination of the tx public) and addresses that do use P2PKH (or newer) but have at least one outgoing transaction are also easier to attack. Note that these addresses being beatable in polynomial time is highly unlikely without a quantum computer (and hence why I only consider quantum attacks). Compare the situation to the question whether P=NP. It's almost certain not the case but proving it is very very difficult. Highly unlikely in this field should be interpreted as "impossible" in this field for practical applications. Anyway before the time quantum computers have enough qbits to be a real threats people will see it coming because of the sublinear progress in this field. The code to make Bitcoin quantum resistant has already been written (but would require a hard fork). By the way, even if you have access to a quantum computer today with sufficient qbits it's harder than you think to get money out of it by taking Bitcoins at will. If this is noticed by the market price would race to zero and how do you explain the origin of funds at whatever off ramp you're using? Only a limited amount of money can be extracted with this. Finally while I do believe it's an effective canary for a sudden breakthrough in quantum computing power it's highly unlikely the CIA or anyone else planned this. Much more likely to be an emergent characteristic.

-

If people are trying to understand. Eg you wrote "This just isnt true. " about a 100% objective truth. I don't feel any progress is being made here. Further you start again with "So there is no insurance against loss of BTC" which is neither inherently true NOR relevant wrt the discussion with Bitcoin which I just spend effort trying to explain. It just seems you don't get it: RE has certain risk outside of your agency that you must insure or take on yourself while Bitcoin does not have that specific risk. This is an argument for Bitcoin not against. Not losing your Bitcoin lies within your own agency, and would be a different risk. Perhaps go read SharperDingaan's post above as he formulates things very differently from me. Maybe you have more success getting him cause I can't explain this much easier (so I don't think complexiteit is why you're not getting it). Regarding Parsad: "Bluegold did a great job replying to the first two." , two points of which I already explained while they are wrong, after Bluegold's post and before Parsad's. Then he continues with saying he can sell something to move it GL doing it when you actually need this feature (gov imposed capital controls or seizing of your property) and finishes with a myrad of non-intrinsic benefits of RE that could easily be true for Bitcoin too and starts on volatility again which we spend forever on explaining why that's not a relevant argument here ... At this point I feel we could talk daily for a year and we wouldn't make any progress. If I'm succeeding in anything here it's pissing people off: no point in that. And the present discourse doesn't have any value for me personally either. I'll probably revisit this thread some time in the future again and see whether there's progress as I've done multiple times in the past. If you want to ask specific questions to me feel free to PM me. Further I have no doubt the interaction will continue without me. Hopefully on a more amicale tone too (better for everyone ). No hard feeling from my side by the way guys. If you sense anything of that sort that's simply frustration for making zero progress Wish you all the best!

-

I'm going to stop responding because progress seems to be none and I'm kind of done. The above reactions all just prove that all my points are not understood or ignore and that your base knowledge here is too low to have a meaningful discussion. I mean the guy not knowing that literally anyone with a below average computer can encrypt data in a way that no entity on Earth can decrypt it and subsequently not believing me because some news article "said so" is Good luck with that is all I can say (And this is not meant sarcastically I really wish the discourse here, this topic specifically, wasn't at the level it's at).

-

By the way I should probably stop posting again as it may now appear as if I'm trying to convince people to invest (this being an investment forum/topic and all). I'm not. I'm not saying this is a good investment for anyone as I have no idea how long it will take until price moves value and whether there'll be (long) periods of extreme illiquidity. While that's true for any investment that's true even more for Bitcoin. (Partially) Effective bans, special taxation, subsidized "alternatives" etc etc are all sort of ways it can be artificially made to take longer as well. Combined with increased globalization (and therefore ease of passing authoritarian laws) means it could take a very long time. Any progress (adoption, price) thus far has been much faster than I ever imagined and could very easily not be indicative of future adoption/growth rate. Please treat the discussion here as purely academic in nature.

-

I tried to reply to all your questions and statements. Let me know if I missed anything. 1. Insurance is a way to cope with a problem at a cost. The problem is lower with Bitcoin. Whether a third party way to change the nature of a downside (insurance changes a high variance, low probability cost to a low variance high probability cost) says nothing about the nature of the thing we are discussing. Insurance is theoretically possibly wrt every financial risk that is independent of the state. 2. Two reasons: 1. Real estate is one of the easiest to seize for all governments because they more often have an excuse. Eg if they want to build a new building or highway on the land they declare it for the common good and force you to sell. If someone can force you to sell, especially at a price determined by them, you don't really own it. 2. They can seize Real estate without your cooperation and Bitcoin only with your cooperation. This gives options eg waiting out the wannabe thieves or relocating to elsewhere. You can even theoretically promise some of these assets to people that would help you with dealing with w/e state is holding you hostage. None of hhese options exist at all with your assets already seized. You mention hacking. You can literally not get hacked if your keys never touch the internet and are properly encrypted. No amount of solid police work can change that. All the recovered keys by law enforcement were badly secured or given "voluntary". I mean theoretically they can torture it out of you but in reality they probably promised lower sentences or threathened with other things the owners considered worse than losing their property. It's in no way perfect but vastly superior to real estate. So your examples: computer under the floor board? obviously poorly encrypted (or voluntarily decrypted by suspect). Binance? Nothing to do with Bitcoin (smart contract) but even so user error (error in smart contract). Regarding replacing fiat: the vast majority that own it? Perhaps. If you weigh it by holding size? No way in hell. It's not a surprise mom and pop investors have no idea what's going on (they are also unlikely to store it diligently). And regardless does it matter what people believe? It's the factual truth that matters in the long run.

-

Real estate is, when compared to Bitcoin: * Easier to unintentionally destroy outside of fault of your own * Easier to take by government (eg disown for "common" good) * Non fungable (vs more fungable Bitcoin) * Harder to split * Harder to move * Easier to create more of (impossible to make more Bitcoin) So much less hard than Bitcoin.

-

Incompetence by users. Few of these are hacks btw. Most are plain old theft by insiders. But even in the case of hacks plain old computer systems are hacked. Bitcoin has never been hacked and neither has main stream wallet software. Again: one needs to protect the keys to one's safe. How is this news to anyone?

-

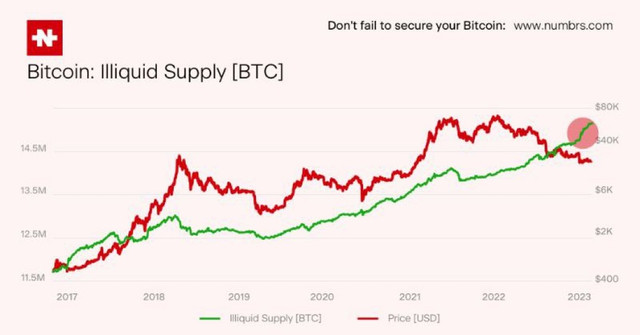

Real estate can be taken by governments at any point in time. How's that I'm not talking quite as short term as you. This is why you present a shorter timeliness as me and zoom on. Illiquid generally supply rises as the price increases. Regardless how do you explain the general increase in illiquid supply in the period since the cut off of your time period even with your short term focus? The main point I was countering with the graph however was your point that most holdings in Bitcoin are short term in nature. It shows a rise in illiquid supply over the 2017-2023. Is that short term? Btw this relation also exists before this period but this is the one I could find most quickly and I didnt want to waste too much time in a discussion that seems to go nowhere (and seeing you come with an even shorter graph seems to imply you don't care for data prior to 2017 anyway).

-

Name something, anything, that's harder.

-

Steal the keys? How? That's physically impossible if you keep your keys of internet connected devices as you should. Anything is incredibly reckless behavior.

-

You're wrong in your assessment that most use is short term in nature. 78% of the supply is illiquid right now: And of course you can exclude exchanges. There's zero need to keep Bitcoin there. That's same as including the fact that you can burn bills in the stove as a threat to the security of fiat.

-

This. Parsad is saying: if you give someone the keys to your car he can drive of with it! No shit Sherlock (Hope it's clear this is meant in jest).

-

RKA did not say Bitcoin will replace fiat. It won't as it's something else. Rubber will also not replace helium gas: that's non-sensical Bitcoin IS a hard asset. The harvest asset in existence that we're aware of. I won't repeat here again of why it is. You can scroll back if you are interested in learning why.

-

With Bitcoin you store value for the long term, not the short, so volatility holds little relevance. If you require short term liquidity it's wise to briefly store it in a bad long term store if value with low volatility (eg USD). Cant get at their wallet? That's just amateuristic. These companies should go bankrupt as they are incompetente. The market is a weighing machine. Bitcoin is more efficiënt that the traditional fiat network. How many people di you recon work in the finance industry? How much do they cost and how many resources do they use on an anual basis? Bitcoin is negligable by comparison. Bitcoin has had no security hacks (there was once an underflow error in, I believe 2010, but that wasnt exploited before it was patched). You confuse lack of security by human actors with security errors in Bitcoin. Bitcoin us completely secure if you act responsibly.

-

Rkabang also doesn't call Bitcoin a fiat replacement and yet your entire reply centers around that. Do you understand why we say you have not understood? You don't respond to the points made.

-

You write most people are making a different point. Those are not the proponents. Also to give an example to counter your last sentence (there are many),you wrote "There has to be price stability...liquidity...portability...security...etc. The BTC on-chain network was not capable of that." That's all completely wrong and you simply state it without even arguing why you think they are true. That shows you have no clue what's going on in this specific topic. I respect you but you are very very wrong here and convinced of your wrong view so I'm telling you: out of respect. Thinking that Blockchain, which in isolation is simply and extremely inefficient database, is the innovation and not the combination of mining and blockchain to solve the Byzantine generals problem shows you should go back to where the discussion was in 2009, 2010 and 2011 (and even earlier by diving into the crypto punk mailluists!) If you wish to understand what's important and what's not.

-

Why are you talking about cryptocurrencies? I was talking about Bitcoin: the only valuable one. Crypto isn't just a payment system. Quite the opposite: an elementary payment system is slapped on top for convenience but has nothing to do with crypto. Bitcoin isn't intended to replace fiat currencies (and if people habe that intention they'll be disappointed). It will significantly reduce their importance though.

-

And what makes you think that makes you the earliest of the in this thread?

-

It think it is ironic yes but in the long run irrelevant. Perhaps the inventor (I prefer that over creator as many people contributed to its creation) was incorrect on one metric and perhaps he used this as a clever trick to increase early adoption (easier to understand for people and more attractive to "greed") which was the most vital time in it's existence, bit does it really matter? I'm not a Satoshi worshipper, just like I don't worship any other inventor. I do highly respect the innovation he did create though.

-

Hard asset has utility value directly in and of itself (intrinsic value). Fiat currency does not have this and cannot have this by definition. Bitcoin does have it as there's not another good in the world that you have as much (permissionless) control over and which is as hard to seize (factually not legally). Gold has it too but much less good than Bitcoin: it's easier to seize, harder to authenticate, easier to block, harder to store, slower and harder to move and harder to divide. Plus it's supply is much less sure.

-

Everyone, pro or contra Bitcoin, who believes Bitcoin is primarily a currency, are wrong yes. There is no currency centric innovation there. Therefore if you analyse it as a currency of course you're not impressed. Also: Bitcoin's implicit payment system is purposefully simplistic in nature and will remain so. Again not the innovation. Other solutions can be used for payments, be it on another layer (lightning) or just an old fashioned payment method denoted in another nominal unit where you first swap your a Bitcoin into. Efficient payment is only a relevant feature for the liquid part of your wealth.

-

Lol what? Only people that don't understand Bitcoin even think it is a currency. Ofcourse it won't replace fiat currencies. It's primarily a store of value (the greatest one by miles and miles). Again: I'm surprised and disappointed an otherwise highly intelligent man speaks in such confidence about something which his statements show he hasn't understood much of. "It Ain’t What You Don’t Know That Gets You Into Trouble. It’s What You Know for Sure That Just Ain’t So" - Mark Twain I hope when I check here in a few years more have understood what it is this topic is about.

-

What makes you say this? I'd wager a lot this isn't true.

-

Completely this. I let it rest for a few years, checked up here and frankly it didn't improve. There's one person who doesn't understand what the generic meaning of intrinsic value is and gets stuck in a context specific one based on specific assumptions. Meanwhile Parsad comes in, someone with outside of this topic usually well argued points of view, and he says Bitcoin has no utilitarian value. NONE. He doesn't say he doesn't know but instead he makes a completely nonsensical statement that he seems awfully certain of. There's just no point discussing it here. Maybe in a northern 5 years? 10? We'll see I guess.

-

Never mind