giofranchi

Member-

Posts

5,510 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by giofranchi

-

Joel, How do you know this? Do you have their results on a 5 and 10 years basis without equity hedges? If so, could you please post them and tell us where you have found them? If they weren’t better than the indices, a long/short strategy (while waiting for some great opportunities to present themselves) would be sheer folly… Why do you think Mr. Watsa would have done that, if not convinced their stocks selection could beat the indices?! ::) Gio

-

Well, I wouldn’t like to see some move that is inconsistent with their way of doing things. Listen, I don’t think there is only one way to achieve great results. What matters is that you get to be the best at what you are doing and what you are doing is sensible, and you have the temperament and strength to follow your strategy till completion. If, on the other hand you are too much affected by temporary failure, and therefore you change course without a true reason, that would worry me… For instance, I decidedly wouldn’t like them taking the equity hedges off right now! ;) On the contrary, one of the reasons I try to answer all your doubts about FFH (and other investments of mine) is that this forces me to constantly revisit potential weaknesses of the businesses I own, and to write down the reasons why I think they still might do fine in the future. It is a continuous monitoring that I like a lot! :) Gio

-

Your whole argument about “the long-term” is very misleading. If Mr. Watsa’s defensiveness today is proven right, those numbers will change dramatically in a matter of just a few years… It is exactly like keeping cash for a very long time, and then investing in a truly outstanding opportunity: until that opportunity materializes, your track record seems very poor, than all of a sudden it becomes wonderful! Mr. Watsa at the AM has said the investment business is primarily characterized by how quickly things change. He simply has been waiting for three years now… Gio

-

The graph about debt: It is total debt that matters. Probably you are looking at gov. debt, which is only a part of total debt. Total debt bottomed at the end of the ‘40s, exactly when stocks bottomed. ;) Gio

-

CPI Contracts + Blackberry They have been discussed ad nauseam… I wouldn’t really like to hear anything more about them, anyway… CPI Contracts: What matters is only the asymmetrical bet. Nothing else. Macro, micro, bla, bla, bla… If you find a coin and you get the chance to gain 10 if heads comes out or lose 1 if tails comes out, will you flip it? Nothing else to say. Blackberry: As I have always said, much ado about nothing: they have always made mistakes investing in equities, they will go on making mistakes. Their track record has always being stellar, it will continue to be very good. Nothing else to say. Gio

-

Don’t confuse the short-term with the long-term: in the long-term FFH equity portfolio has always outperformed the indices. In the long-term they will make money, not lose it! Even if nothing truly significant happens to make them change strategy. ;) Gio

-

The whole part “Cash Burden” is very difficult to understand… Even more so because Mr. Watsa’s actions are crystal clear. They go like this: If you don’t see great opportunities, be patient, stay in cash (at the dinner a member of the FFH team said: I would have liked to invest this way: to stay in cash almost always and to swing only when truly outstanding opportunities come my way… But I was never able to do that!). An alternative to this approach is something Mr. Templeton practiced with success: buy the stock you like the best, sell the one you like the worst. The advantage of this approach over cash is that you should be able to earn an alpha. The disadvantage is that it is much more volatile. So, it depends on what you prefer at a given moment: to earn some alpha, or stability. If Mr. Watsa is selling, it is probably because he wants to be sure about its buying power, should some opportunities arise. He simply prefers right now the stability of cash to the profitability (and great volatility in the short run) of a long/short strategy. That’s all! ;) Gio

-

AZ_Value, Now to the equity hedges… But we have already talked about them for ages!! With the benefit of hindsight they have been a mistake! And their timing has been terrible! But a past mistake doesn’t mean they will prove to be a mistake at the present time too! As an ex-shareholder you have been lucky enough not to suffer from the bad timing decision to put on the equity hedges… good for you! Now what? Do you still believe they are a mistake also at today’s prices? This is the only question a shareholder should be concerned now. The past is past, the future is the only thing that matters. But, you might argue, if they have made such a mistake in the past, I don’t trust them for the future either… That’s your choice! And one I strongly disagree with. This is the reason: Each company, like each individual investor, has different situations and needs. And each one must devise the best strategy for him/herself, in order to always be solvent, to always continue business undisturbed, and to always have cash when opportunities arise. Lots of people show the arrogance to presume they know FFH’s situation and needs better than Mr. Watsa… They usually say: “I am in Buffett’s camp… look at how Buffett do things… etc.”. Not realizing each company and each individual investor are stories of their own, and that to generalize is the most dangerous thing they could do… You are in Buffett’s camp? No! You are absolutely not! And neither you know better than Mr. Watsa what’s good for FFH. Gio

-

AZ_Value, I also find your comment on underwriting results a bit misleading. You make it sound like 2013 has been nothing but good luck… Instead, like they have very often shown, it is now more than 10 years the average accident year combined ratios is below 100%, and reserves are redundant. ;) Gio

-

Packer, First of all let me tell you it was great to meet you in person! ;) Now I have “promised” to answer AZ_Value’s points, therefore I won’t have time to comment much else. But let me tell you I completely disagree with your suggestion. FFH is becoming a powerful force in insurance worldwide, and is buying insurance companies all over the globe in a very opportunistic way. It is what they truly know and what they do best. I asked Mr. Watsa at the AM about regulatory constraints, and he answered they will be able to raise their investments in equities, they will be able to invest in high-yield bonds, they will be able to invest in private businesses, etc. I have no reason to believe he was not sincere. :) Gio

-

AZ_Value, I have barely got to the disclaimer on page 1 and I have already found something I don’t understand… You say you own a few shares “just so I can get the annual report sent to me and attend the annual meeting if I want to.” Well, I have attended the annual meeting twice (in 2010 and this year), and I have never been asked a certificate to show I own FFH shares (an identity card is all I have been asked)… On the other hand, the AR is perfectly downloadable in pdf file… Therefore, I don’t see any true reason to own only “a few shares”. Now I will go on reading. ;) Gio

-

Hi guys! I am just back from two wonderful days in Toronto. :) AZ_Value, I will certainly read your blog. And I will answer to each point you bring up. Let me just say that I am more convinced than ever that FFH is a great company and will go on compounding capital at high rates of return. ;) Cheers, Gio

-

Corner of Berkshire & Fairfax Fund - Poll Q2'14

giofranchi replied to Ross812's topic in General Discussion

;D ;D ;D Sounds like I will go broke! ;) Gio -

Corner of Berkshire & Fairfax Fund - Poll Q2'14

giofranchi replied to Ross812's topic in General Discussion

Ah! Ok! Now I get it! Thank you, Gio -

Corner of Berkshire & Fairfax Fund - Poll Q2'14

giofranchi replied to Ross812's topic in General Discussion

Ross, I am not sure I understand how this actually works: is the poll done on a quarterly basis? I am probably going to vote for the same 5 companies years in a row… What’s the meaning of expressing my vote each quarter? ??? Gio -

I always like the point of view of a (very successful) business owner! :) +1 Gio

-

Very good paper by Mr. Hay. Gio EVA+4.4.2014_NA.pdf

-

Gio

-

--George F. Baker Gio

-

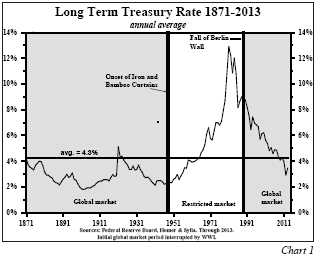

Sincerely, I have yet to find an attempt to justify present market valuations with some merit… If you look at the chart about Average Investor Equity Allocation, the author compares nowadays with the early 1980s, saying that situation couldn’t be repeated because interest rates were much higher back then. Yet, that same chart shows something very similar in the early 1950s… and during that time interest rates were as low as they are today (see the attached chart)… Then, the author goes on saying that, even if a 50% market crash were to come, it wouldn’t last years or decades… ??? ??? Who cares?!? What anyone should worry about is to have cash when good quality assets are marked down, exactly because the time frame at your disposal to take advantage of that situation will always be very limited!! Listen, say whatever you want, I agree with Mr. Klarman: We are swimming against the tide… So better choose among 2 strategies: 1) To be an incredibly smart stock picker, a la Packer; 2) To invest in something whose future results won’t depend at all on what the stock market does, a la Lancashire. Strategy n.2 is what Mr. Buffett is concentrating on since the late 1990s, preferring the purchase of whole operating businesses to the stock market, unless the stock market were hit hard (2003, 2009). Original mungerville, I am buying more Lancashire today too. ;) Gio

-

2014 FFH Shareholder's Dinner - Less Than 25 Tickets Left!

giofranchi replied to Parsad's topic in Fairfax Financial

Though it is a pity we won’t have the chance to meet in person this year, don’t worry Liberty! I plan to make the trip every year from now on! :) I spend so much time discussing ideas with all of you, and it is time I cherish so much, that, if possible, I truly want to meet you at least once a year! Therefore, Liberty, I sincerely hope next year will be the right time… Until then, keep up the good work! ;) Cheers, Gio -

2014 FFH Shareholder's Dinner - Less Than 25 Tickets Left!

giofranchi replied to Parsad's topic in Fairfax Financial

Great!!! ;D ;D ;D Thank you! Gio -

2014 FFH Shareholder's Dinner - Less Than 25 Tickets Left!

giofranchi replied to Parsad's topic in Fairfax Financial

Hi guys! I know a lot of you will attend the FFH dinner next week, and the AGM the next day. I will be there too. Therefore, I asked myself: how shall I recognize you? After all, we constantly exchange our views on business and other matters, but we have never seen each other… My solution: I will be recognized instead! I attach a recent picture of mine, so that you might recognize Gio at once! ;) I look forward to having a great time with you all in Toronto! :) Cheers, Gio PS Sanjeev, tell me that I can take a picture with you, Mr. Watsa, and Mr. Pabrai next week… three great value investors and a fan!! ;D ;D -

Of course, I hope so, though I don’t know and I cannot say… What I do know is that, after two "valuation peaks" gone extremely bad (2000 and 2007), if we ever learn something, people shouldn’t feel comfortable about being at the peak again! I have written “valuation peaks”, because this has very little to do with macro (I am pretty agnostic about what Mr. Putin in going to do!). Instead, it is a case of prices being out of whack with values once again… And, if we ever learn something, its outcome imo is quite predictable. ;) Cheers, Gio

-

Page 7: The Russell 2000 is as much overvalued as it was in 2000 and in 2007. Gio 3.28.2014_NApdf.pdf