-

Posts

6,553 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Posts posted by LC

-

-

21 hours ago, Gregmal said:

The whole “value investing is dead” rhetoric is total loser bullshit. If a company proves its ability to generate value for its owners, it will be noticed, and assuming no onerous capital structure, somebody will eventually get greedy and try to acquire it.

Agreed- what do you think old guys with liver warts do on park avenue? Spend time with their family? I don’t think so! -

41 minutes ago, This2ShallPass said:5 hours ago, LC said:

What you have unintentionally done LC (and other regulars) is give some fuel to the troll fire.

Fair enough, and I can understand the sentiment.

But I absolutely hate an echo chamber- even when the majority are correct. I'll entertain any nay-sayers as long as they have a good point to make.

Same to the point Greg was making about cowardly short sellers who don't have the sack to claim outright fraud. To me - I don't care, say whatever you want. We're all big boys who make our own buy/sell decisions. If you have a good point why a stock is overvalued, I'll hear it.

If the best short thesis is immaterial accounting treatment and articles by Brett "CFA" Horn...well, I don't find the short points compelling, and I was a buyer yesterday and today.

-

2 hours ago, Gregmal said:

I kinda have a theory too that with the spread of inequality and wealth concentration there’s a FUBU element that’s much more prevalent in what I’d call tier 1 assets. Real estate, stocks, private businesses. These are things for rich people, run by rich people, and increasingly becoming scarce. There is a finite number of places to put money. Debt is largely for suckers. Think pension funds and entities that need a return but aren’t practical about maximizing it. So real assets and things of value just continue to get sucked up. Think Hamptons parcels that were owned by normal folks, then sold for cash to middle class folks, who then got cashed out by developers, that then sold to families who put it in a trust and use it one month a year….

So my loosely held belief is that over time this adds to the bid under quality stocks. More “cash/money/currency” less “place to put it”.

Jpow is gonna give us 10% rates for 3-5 years. Crush the FUBU element you describe and reallocate some wealth to the "suckers".

-

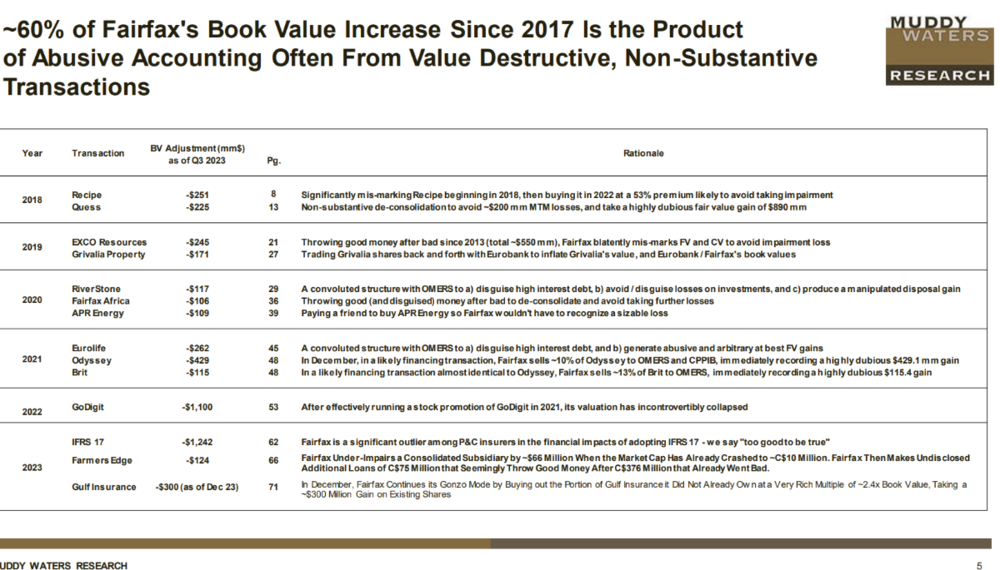

Ok so the argument is: if there's 1 cockroach, there's probably 100 more.

Fair enough of an argument. But I think there's a few factors that run contrary:

-Earnings: they exist and they are of high quality: interest & underwriting profits

-Interest income is hard to fake.

-Underwriting profits, sure you can under-reserve. But this info is public, and it is well known the industry is in a hard market. So it's hard to disprove that these are real profits.

-On the asset side: if you think they are delaying taking markdowns of certain assets, then you also have to credit them for delaying unrealized markups of other assets. It has to cut both ways.

QuoteIf your partner is a crook even in small matters - it doesn’t matter how much your business “earn” or “can earn”.

Question: Warren Buffett/Berkshire marked down its Kraft-Heinz position well after a large and sustained drop in the share price. This is the same behavior MW is accusing Prem of. Do you think Buffett is a crook?

-

19 minutes ago, SongDonkey.AI said:

If even 10% of Muddy’s allegations are true you are in trouble, guys. It is not popular on this board to be contrarian but this is what it is.

Help me understand here:

So if MW argues that Fairfax's book value needs an 18% downwards adjustment, and you're saying if 10% of that is true....then I need to be worried about a 1.8% BV contraction?

Sorry but the magnitude is not screaming "trouble" to me....what am I missing?

And if you'd care to elaborate - what parts of MW's allegations do you think are most accurate and most impactful? I'm just having trouble seeing it.

-

15 minutes ago, gfp said:

I already posted about this, but all off-the-run treasury securities are classified as Level 2. Also any bond that requires a dealer quote to mark to market is also a Level 2 security. So that leaves basically on-the-run treasuries, bills, cash equivalents, as the only level 1 bonds.

Thank you, I must have missed your post - so I'm guessing mostly the off-the-run treasuries, so no big deal at all.

Some accounting reading for anyone interested: https://viewpoint.pwc.com/dt/us/en/pwc/accounting_guides/fair_value_measureme/fair_value_measureme__9_US/chapter_4_concepts_u_US/45_inputs_to_fair_va_US.html#pwc-topic.dita_1533084709184712

Carson Block in shambles.

-

The only outstanding question I have is on the Level 2 classification for FFH's bond portfolio. My guess is there are covenants/options linked to these bonds which cause the L2 classification. Even with that question mark outstanding, the interest income generated from these bonds is observable so it is really more of a curiosity vs. a concern.

-

3 hours ago, KFS said:

Another video interview of Carson Block discussing the MW short.....

Fairfax Financial: The Oracle of Nothing - Zer0esTV: Video channel for short sellers

Someone has to tell Carson Block to get a new suit. Guy looks like he's wearing a pillowcase.

I was bemoaning selling ~3% of my position at 1310 or so. Well, thanks Carson as I bought that back and more.

-

Agree with pupil on the overall market structure.

Do not agree with Brett Horn who couldn't hit a tee ball, rather insisting that the ball is actually 2 ft lower.

-

Yeah the main point of MW is overinflating book (carrying) value of assets. There appears to be a case for that. Market values are lower than carrying value for many of FFH's smaller investments.

Two points: One, this is one of the reasons I don't really like using BV as a means of valuation. Earnings matter.

Second, as Dinar said there is a flip side. Other assets in FFH are performing very well. And, let's assume there was no nefarious reason for FFH's dealings - well, they would have to be booked the way that Fairfax has done so. i.e. If I decide to buyout the remainder of a partial investment, I have to write-up the whole investment on my books. Now, testing impairment should also happen regularly. But take a look even at Berkshire - how long it took them to impair their Kraft Heinz position despite the market price already having reflected.

Carrying value will always trail market value. As long as both move in the right direction I think it is reasonable. I would like the company (Prem) to make this point...and perhaps some board members who are closer to the company can share their views.

23 minutes ago, Ghost said: -

2 hours ago, cubsfan said:

^^^ 100,000 Americans a year, mostly young, die from Fentynal poisoning. Most of these illegal immigrants are victims of rape and child traffickers (cartels). So let's keep enriching the cartels - shall we? Keep the open border, all your Fentanyl comes from China via Mexican Cartel labs, and keep the child traffickers coming. That's a great solution.

So, what is the solution?

War on drugs? Build a wall? Efforts to constrain the supply side are 0-for-2.

It may be time to look at trying to reduce demand for the product.

What drives people to drug use, what can we do to limit that?

I'd argue the stuff I see posted around: "Late stage capitalism" "The American Dream is Dead" The massive wealth gap, homelessness everywhere...

The chances of upward mobility for a teenager/20-year-old grow smaller and smaller. This leads to hopelessness, depression, and drug use. This is what we should focus on.

-

Everything in Denver priced under 2022 peaks is getting snatched up. The only stuff sitting is the stuff listed as if we're still @ 2.5% rates.

-

It's essentially riskless, but yes theoretically it could be. You agree to lend your shares out, there is a chance the ultimately counterparty(s) may fail to deliver to the central clearing house (DTCC/NSCC).

For anyone who cares about the plumbing:

-

Reminds me of the original hedge funds: the idea of being 100% invested in the index, then hedging out (either long or short) individual stocks the manager found under/over valued.

-

One further question - when you do sell individual stocks, do you immediately reposition into the index?

-

So interestingly enough the below article hit my inbox this morning:

https://specialsituationinvesting.substack.com/p/focus-and-investing?publication_id=903552&utm_campaign=email-post-title&r=1kl6gsThe author looked at some

of WB’s early partnership trading/investing behavior. His conclusion is not all too different than what you describe above, Viking. What really stood out to me was WB’s aggressiveness in minimizing opportunity cost:

Buffett focused completely on finding the next great opportunity and moving into it in as big a way as possible without regard for systems. He identified opportunities by spending the limited time he had studying what was knowable and important while largely ignoring the rest. He formulated a clear idea of intrinsic value in his mind and then refused to overpay. He then used opportunity cost as a framework to constantly move capital from his worst ideas into his best such that he could maximize his returns.

A lot of people (myself included) think concentration is 5 equally weighted positions. To Buffet I’d imagine that is 20% your best idea, and 80% worse ideas. So yes you are concentrated- but in sub-optimal ideas!

Anyways I think between the article and your post it provides a good spectrum of how WB achieved massive wealth and some points take away. -

This being an election year may be an influence as well.

-

When using leverage you want lots of ways to win and only a few, hopefully known, ways to lose.

JPY is where I could see using leverage

-low interest rate, so the carry cost isn't going to kill you

-purchasing stable, undervalued assets, hopefully even with a dividend that covers the carry

-has a macro theme in your favor (Japan, Buffett, etc.)

Even Fairfax (maybe a year ago) would be another one.

-Industry tailwinds (hard market)

-Stable, known earnings

-Stable FX

-Tempered macro environment (Powell could be content raising, holding, or lowering rates - but nothing drastic)

Size it so there needs to be a really large macro swing to really hurt you, i.e. great recession/COVID style thing. Sell, take your capital loss, and buy options to the upside.

-

4 minutes ago, Viking said:

I would love to hear other board members thoughts: how do you handle position sizing? Especially when the winning/oversized position is likely just getting started?

I trimmed <3.3% of my FFH a week ago thinking:

OK this is getting a big chunk of the portfolio now,

So let's take some eenie-meenie little profits,

And given FFH's volatility maybe I can buy it back in a few days/week.

That was $60 dollars per share ago. I can't help but get in my own way sometimes. That said the position is still close to 40% weighted.

QuoteEverything else is expensive now...

Luca, haven't I seen you posting in the "What are you buying" thread on a very regular basis?

-

John oliver has done some decent episodes on relevant business/investing topics.

I won't say I always agree with his conclusion or even how he presents the evidence, but I will give him credit for at least giving airtime to topics that nobody else would.

-

I usually don't but will go up to 20% or so.

-

Well, he could do another tax free swap similar to what happened with Berkshire and Graham holdings.

I wonder - could Berkshire fund a credit line to Apple, allowing Apple to buy some asset(s) Berkshire desires (perhaps including Berkshire's own stock). And then they can affect a tax free swap?

-

Try some backwards engineering.

Look at a small cap growth stock which has done really well, and look at the first few years of financials. See what metrics stick out to you and try and replicate that.

-

20 hours ago, value_hunter said:

Why are you concerned about KW deal? Just because of the recent price drop? Or you think the KW deal is fundamentally flawed?

No I don't think it's fundamentally flawed, they mention a strong LTV for the properties supporting the deal - at its core it looks to me like Fairfax is helping out a partner who is in a poor market right now. And throwing in for some equity as well. OK fine. But it just seems like a reach, similar to continuing to fund Blackberry. At small amounts and with long-term partners, OK I am willing to extend benefit of the doubt. But this kind of cheeky stuff is how they went about putting on billions of deflation hedges.

FFH as an investment continues to work if they just stick to (around) their knitting and not trying to outsmart everyone in every market.

Fairfax 2024

in Fairfax Financial

Posted

Replace GIG with Fairfax stock and you just described many investors on this board. People with cost basis at 50% of today's price