thomcapital

Member-

Posts

78 -

Joined

-

Last visited

thomcapital's Achievements

Newbie (1/14)

0

Reputation

-

Several companies were mentioned in this thread from 2013: http://www.cornerofberkshireandfairfax.ca/forum/general-discussion/from-power-tools-to-carpets-housing-recovery-signs-mount/

-

Hey nice to find someone else who appreciates good 'ol Norm!

-

I think McKinsey's book (Valuation: Measuring and Managing the Value of Companies) is the most in-depth book on the subject. You should be able to get by with an older version as well if you want to save a few bucks. There weren't many changes between the 2nd and 4th editions, for instance.

-

Michael Lewis on the Next Crisis (Businessweek article)

thomcapital replied to a topic in General Discussion

I had the pleasure of seeing Michael Lewis give a talk at an industry conference a week ago. He confirmed his next book will be about HFT (I think he said the title is "Flash Boys", calling it a wall street story set in the world of HFT). He called the wall street crisis the gift that keeps on giving. :) And "Flash Boys" it is... http://mobile.nytimes.com/2014/01/15/business/media/new-michael-lewis-book-on-financial-world-will-be-published-in-march.html?_r=1&referrer= -

Michael Lewis on the Next Crisis (Businessweek article)

thomcapital replied to a topic in General Discussion

I had the pleasure of seeing Michael Lewis give a talk at an industry conference a week ago. He confirmed his next book will be about HFT (I think he said the title is "Flash Boys", calling it a wall street story set in the world of HFT). He called the wall street crisis the gift that keeps on giving. :) -

I work for a large buy-side firm that, regrettably, likes to spend money on consultants. I'd love to bring him in, videotape his presentation (and Q&A) and share it with you all. :)

-

"Bullish on Community Bank Stock" - Barron's

thomcapital replied to jay21's topic in General Discussion

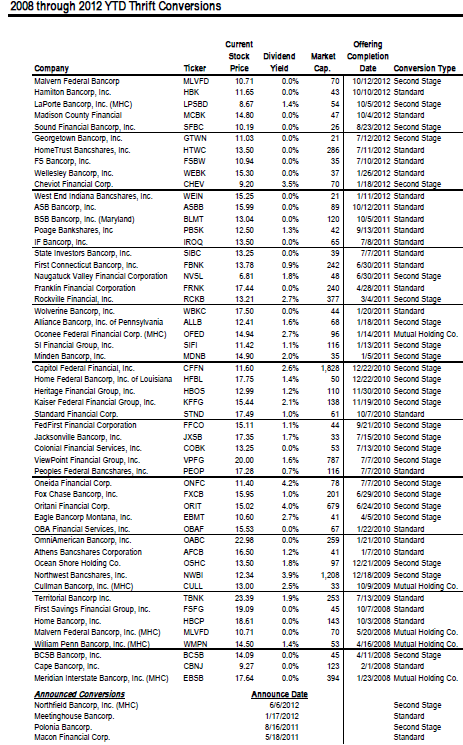

Not as common as demutual investors think. The demutuals have been on an absolute tear recently. Is there a way to screen for demutualizations? I think plenty of investors (like Klarman and Einhorn) made a bundle on demutualizations in the 1990s. The way they explained it, it seems like free money. I've attached a list from '08 - '12, from late last year. I read on VIC (on the mssg board) that Peter Lynch derived a nice chunk of his outperformance from these as well. -

website to track document revisions (for 10-k's)

thomcapital replied to thomcapital's topic in General Discussion

I wouldn't pay for it considering Word is available. Also Bloomberg and Factset offer a similar feature for those with access. -

website to track document revisions (for 10-k's)

thomcapital replied to thomcapital's topic in General Discussion

I was thinking there was something else out there besides just using Word. I guess not? Thanks guys! -

I believe there is a (free) online tool that can be used to see annual revisions/additions made to documents, such as 10-ks. Has anyone heard of such a thing? Thanks in advance.

-

From Power Tools to Carpets, Housing Recovery Signs Mount

thomcapital replied to PlanMaestro's topic in General Discussion

Here's an "all-in-one" solution: "It is not inconceivable to imagine a home buyer spotting a home for sale in a Berkshire owned paper, contacting a Home Services of America real estate agent and taking out a Wells Fargo Mortgage on a new home. The new home might include Shaw Carpet, Ben Moore Paint, MiTek fastners, USG drywall, a Trane heating/cooling system, and Johns Manville insulation, all surrounded by an exterior of Acme Brick (and some components may even have been shipped by BNSF). The closing transaction in some areas could be through one of American Home Services firms. The family would then drive to the new home, turn the Schlage door knob and may decide to fill the space with new furniture from one of Berkshire's regional furniture stores. A John Deere riding lawn mower may be handy for the new yard. And in some parts of the country, the home could use MidAmerican Energy utilities. And DirectTV may be a desirable entertainment option." http://seekingalpha.com/article/1089381-broadly-framing-housing-with-berkshire-hathaway-in-2013 Some competitors against the BRK lines include MHK (Shaw), SSD (MiTek), EXP (USG), OC (Johns Manville). Not all are pure plays. It seems most names have run quite nicely, with the new home levered, or non/less discretionary-type companies selling up near normalized earnings levels. Others that are more repair/remodel oriented are still being discounted somewhat. For LUK fans, MLI may be worth a look (compete's w/ Cerro Group, owned by The Marmon Group and now Berkshire). Berkshire owned ~10% of MLI back in '04-05 I believe. The one analyst covering the stock thinks $5.50 in EPS at 1.1M starts is doable. -

From an interview with Steve Luczo earlier this year: Q: Could we get new players? A: The technology is too hard, on all of it. No. Q: What does that mean for investors in drive stocks? A: If you were a really big, smart technology company that saw all the trends in cloud and mobility; all that says is storage, storage, storage – you’d probably see a reason why owning these critical technologies is important. But you’d run into so much flack from someone saying, oh, you should do software and services only. Q: So are you saying something could try to buy you or WD? A: I think if someone were thinking about it from a pure technology perspective, they’d be all over it. Q: But who would it be? A: Any big technology company, you can fill in the blank. IBM, EMC, HP. Anyone that’s big. But they won’t, because that’s not what the market wants them to do. The market does not want them to be in the hardware business. Although Todd Bradley [who runs the PC business at HP] just wrote a great article on why hardware is important. And the end of the day, all this stuff has to be delivered on hardware. If I’m in the business of selling in the cloud, and all the cloud is is a disk drive with some bandwidth, I need access to drive technology. At the end of the day, all I’m doing is taking disk-drives and integrating them. It depends how big is my cloud business going to be. http://www.forbes.com/sites/ericsavitz/2012/04/12/seagate-ceo-luczo-on-drives-zettabytes-flash-and-his-tattoo/