hobbit

-

Posts

147 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by hobbit

-

-

This will help discover true value of BIAL. First airport business to be listed in India with 64% stake in Delhi airport. I believe the demerger date is Jan 11

https://investor.gmrgroup.in/pdf/GMR Demerger_Investor Presentation.pdf

Could be a catalyst for FIH

-

HWIC which owned 7%approx of IIFL finance sold the entire stake in the past few days. Wonder what this means for FIH's stake...signs of underlying issues at IIFL finance maybe? optically it looks cheap but there might be hidden stress in their book

-

Excellent article . Fairfax India's airport valuation is most likely conservatively marked.

-

-

good results from Chemplast...for me the most exciting business in portfolio right now

-

Fairfax India has NSE shares valued at INR 1400 approximately

NSE update

"

Unlisted shares of NSE are currently trading at Rs 3,300-3,500 per share, valuing the exchange at nearly Rs 1.75 lakh crore. The shares traded at Rs 1,750 apiece in March as against Rs 900-1,000 in September last year.

" -

23 hours ago, Viking said:

Hobbit, thanks for posting. I saw the 10% move in Chemplast Sanmar shares overnight and was wondering what was up. The stock is now up more than 25% since its recent IPO. After BIAL this is Fairfax India’s largest holding so the move in the stock price is material. chug, chug, chug…https://archives.nseindia.com/corporate/CHEMPLASTS_05102021193005_Business_Update_05102021.pdf

Chemplast shared this update today

-

On 9/28/2021 at 4:38 PM, petec said:

I don’t know it well. Can you walk me through the summary valuation to get to 2x? Thanks!i will try to do a detailed post later but essentially this

and

mark up in egypt business

-

https://thedeepdive.ca/pvc-prices-soar-to-record-high-as-homebuilding-becomes-even-more-expensive/

http://www.sunsirs.com/uk/prodetail-368.html

Chemplast is marked at 440M on books. It could easily be worth 2x

-

Sanmar

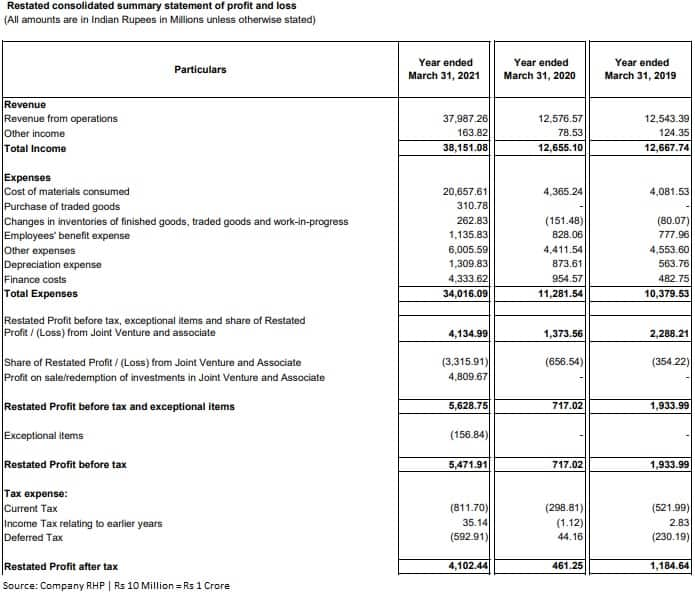

Look at the finance costs for 2021 . This should drop drastically post IPO. Essentially there ipo price is at almost half the P/e of their peers.

https://twitter.com/nbalajiv/status/1424426082002882561?s=20

-

On 6/18/2021 at 1:52 PM, Viking said:

Hobbit, that is a very good summary. Thank you for taking the time to post it. So you are confident that the valuation of BIAL is roughly accurate at $1.4 billion? If so, Fairfax India is dirt cheap.

The question then becomes when will sentiment change and drive the share price closer to BV?

What are your thoughts on the share buyback/dutch auction? Is it a marketing exercise by Fairfax India to get the story out (how undervalued the company is)? Or is it to buy out the weak hands (shareholders who are frustrated with multi-year underperformance)? Or the first step to increase Fairfax’s ownership stake - leading to Fairfax buying Fairfax India back down the road?

I especially liked your very candid explanation of why the share price is trading so far below BV. I agree with everything you said. I am not sure if time alone will fix this. I hope Fairfax India keeps aggressively buying back stock (and does another big buyback if share continue to trade so far below BV when the dutch auction is completed). Large stock buybacks appear to me the best way to reward current shareholders.

Airport Valuation -

If Anchorage was public PreCovid , there is little doubt that its share price would have corrected anywhere between 30-50% post Covid crash in mar 2020. I was/am of the opinion that FIH should have marked down their investment even if it was a temporary markdown. FIH not marking down its investment in BIAL reflects the tremendous confidence they have that BIAL is optimally/conservatively marked .This confidence stems mainly from 2 things - the second terminal coming online next year and ability to claw back revenue in the next control period. FIH's enthusiasm from BIAL is not shared by the market including their partner OMERS who added a ratchet clause to protect themselves from any downward revision in valuation.This is again a classic case of whether you trust the mgmt or not. I for one do not think that mgmt will deliberately mark up the investment just to earn fees. Fairfax mgmt might be completely out of sync with market dynamics but I do not think that they are blatantly dishonest. 5 years down the line as the second terminal has fully ramped up , we are hitting 70M in annual passengers and Indians have more money to spend , BIAL will be conservatively worth 5B+Shanghai airport has been one of Li Lu's best investments and the similarities here are striking. I believe munger also owns the stock or has owned it in the past.One of the things we got into [in China] was the Shanghai airport, the main airport in China, with no debt net,” Munger said. “How can you lose owning the main airport in China?”Dutch Auction -I think it's the best way to reward existing shareholders and also an important indicator of mgmt's conviction in the portfolio companies. Returning cash at this point in time also implies none of the companies are under significant financial stress and have no need for external cash for the foreseeable future. The only drawback that comes to mind is that this might shift the timeline for the IPOs until August as the mgmt would want to buy the shares at the lowest price possible. ( unless investors tender shares right away ). It could also be that OMERS or some other big shareholder wanted to liquidate their holding and approached FIH.Modi-I think Modi has done a decent job given what he inherited when he became PM. India is still deeply socialist due to the close ties India had with Soviet for more than 40 years post independence. It is not easy to reform the country and give it a capitalistic structure. It will take time. The fact that India has not had a big corruption scandal at the federal level since modi took over is a huge plus. I definitely feel the country is headed in the right direction. Polarization in the society along religious lines is the biggest disappointment so far in imo and hopefully things get better on that front. Regarding re-election there is very little chance that he does not serve at least another 2 terms. -

36 minutes ago, ICUMD said:

Hobbit, thanks for this excellent analysis. I agree as I think many do that FIH is undervalued. Seeing how it is a large position for you (and for me), you must be optimistic that's it will achieve parity with it's book value. What will it take for this to happen and when? Obviously despite the institutional holders, there are a lot of weak hands selling. I personally know some previously staunch holders who sold at $8.

It all depends on the time line for the IPOs. I think Seven islands and Sanmar happen this year . Anchorage and NSE next year.

-

On 6/17/2021 at 12:17 AM, obtuse_investor said:

Agreed. I put the back of the napkin aside and did some real math on the BVPS annual return since very first filing. The return has been 11.3%. Note that this return is after fees to FFH.

For comparison, stock has returned about 3% over that same period. Buyer from 2015 IPO (with cost of $11) lost about 8% each year on multiple compression.

Full disclosure, I am not planning to tender my shares. And no, I fortunately didn't buy at IPO.

My 2 cents on this

1.Public investments -

(a) IIFL ( finance(327M) + wealth Mgmt.(202) + Securities(54) +5paisa(23) ) + CSB (230M ) = 834M ( 31 mar 2021). Conservative Fair Value in 2 years = 1.3*834 = 1.1 B

India's NBFC sector has gone through a tumultuous time in the past 3 years. First with ILFS crisis and then with two waves of COVID. This is possibly the harshest stress test any NBFC can go through and the fact that IIFL finance has come out of it unscathed tells you a lot about strength of their loan book. The loan book is heavily focused on retail and gold loans and a very small part is corporate . A well run NBFC in India should easily give you a 20%+ CAGR in earnings and coupled with a growing economy could be one of the best ways to play India story. IIFL finance is trading at an earnings multiple of 10 and I do not see it staying there as Indian economy starts opening up.

Only 3.7% of Indians invest in stocks vs 50%+ in US. India will mint new millionaires every year. These two factors alone are significant tailwinds for IIFL securities and IIFL wealth mgmt business . IIFL securities was trading at 4*earnings( net of 100M property that it owns in Mumbai) at the end of last quarter and is up by 80% since.

CSB is already a phenomenal turnaround story which is reflected in its financials and share performance. Its not too hard to imagine what a good CEO can do with a bank in a growing economy like India. It is extremely hard for a foreign operator to get a banking license in India .

5 Paisa recently raised equity worth 33M at a 70% premium to the share price and the stock has doubled since then .

(b) Fairchem + Privi = 64 + 163 = 227M. Conservative Fair value in 2 years = 163M + 64*2 = 291M

Privi has been liquidated for 163M already. The day the announcement was made FIH stake in privi was worth 233M. This deal puts Fairfax mgmt in rarified circles of investing community since its extremely rare(never) to sell your stake for a 30% discount to a promoter . Especially when there is no pressing need for cash. A self goal by the Fairfax team.

Fairchem is doing well and has a huge room for growth. The share price has doubled since the last quarter .

(c) Other public Equities = 160M .Conservative Fair value in 2 years = 160*1.2 = 192M

With the recent run up in India market . I imagine they are doing okay here.

2. Private investments -

Anchorage/Bangalore Airport - ( 1.4B ). Base case Fair value = 1.4B

PreCovid

A new runway at the current terminal has been operationalized which will help BIAL to overtake Mumbai in terms of domestic traffic. Second terminal on track for mid 2022. (It looks amazing btw.) A cybercity under construction on 400acres around the airport. A clear path to 70M+ passengers from the current 35M in 5 years.

Adani trying to list their airport assets for 4B+ .The other public airports around the world trading at 1.5-2 times the multiple of Bangalore airport.

BIAL has a claw back provision for Aero revenue which guarantees them a fixed 15% return on equity in any given control period. This should help them recover a significant amount of lost revenue over the next 2-3 years.

PostCovid -

I think based on the factors above FIH should not find it hard to list BIAL( via anchorage ) for 2.8B+ . Without COVID, the valuation could have easily been 4B+. Mgmt indicated in the annual report that despite covid, 2.8B valuation for BIAL is fairly low and they expect better pricing in public markets given the marketability of an asset like BIAL.

Sanmar - ( 338M ) . Base case Fair value in 2 years = 700M

This is a hidden gem in the portfolio which could be worth 3-4x from current prices ( 80%) or go to zero ( 20%) . PVC pricing is at all time high but sanmar is facing a liquidity crunch which has forced their hand to go for an IPO an year sooner than what they would have liked. If you read the IPO circular , it becomes clear how undervalued Sanmar is at 1B valuation. FIH is flush with cash even post tender offer and will not let their equity get affected and might provide a short term loan if needed. Sanmar merged their India businesses earlier this year and is going to aim for a combined valuation of 2B+ for their India business when they ipo this year. Then you have the Egypt business which could be worth another 500M easily. all this is dependent on whether they can tide over their current liquidity situation ( I think they will ). Post the equity raise there is a clear path to 200M in EBITDA within 2- 3 years for just their India business, which as per the valuation of their peers ( 20X multiple to earnings) should put just india business at 3-4B valuation. Sanmar is paying interest rates as high as 18% on their debt and will significantly bolster their cash flow if the IPO is successful since most of the IPO proceeds will be used to pare down debt.

Seven Islands - (104M ), Base case Fair Value post IPO = 200M

This business has been growing EBITDA at a 30% CAGR for the past 10 years. Past year revenue and earnings grew by 57% and 87% respectively . Promoter owned and operated . Should easily list at 20x earnings giving it a valuation of 400M+. FIH is marking it at 105M

NSE - ( 72M ) , Base case Fair Value in 2 years = 150M

Based on the transactions in pvt market earlier this year , FIH stake is easily worth north of 100M today and will be worth 200M+ when NSE IPO happens. FIH will keep marking it conservatively until the IPO. Covid volatility has given a tremendous boost to another already growing and monopolistic business. Here are the numbers

NCML - ( 86M ), Fair Value in 2 years = 86M

the only bad investment FIH has made so far. It has a decent chance of turning out okay given the strong tailwinds on the back of agriculture reforms initiated by the govt last year. Since there is no clear timeline of when the turnaround might happen lets keep it at where FIH is marking it.

Saurashtra(33M) - Fair Value in 2 years = 33M

too small to move the needle right now. Has been an okay investment so far.

Cash = 100M after tender offer

FIH Fair value in 2 years = 4.2 B. Current value = 1.9B

Debt = 550M

Have to account for fees , taxes .

Now the question arises why is the share price languishing at 0.7*BV instead of trading at a premium if the outlook is so rosy -

1. Mgmt Credibility -

In the past 2 years I have spoken to 20+ fund managers and individual investors regarding Fairfax Financial as well as Fairfax India and almost none of them want to touch anything that has Prem Watsa et al incharge. No one cares about their long term track record given their horrendous performance over the past decade . Prem's ramblings on tech valuations and value investing in his annual letters has reenforced the view that he is living in denial and is incapable of admitting and learning from his mistakes. The Mgmt gets a solid C from the market right now. Imo Prem et al have earned it and deserve it .This is reflected in the valuations of Fairfax Financial , India and Africa. The sentiment is so heavily tilted against the current mgmt that it almost makes a case for being a good contrarian indicator. Fairfax India has borne the brunt of this negative sentiment despite having invested in some quite decent businesses.

A a couple of examples on why mgmt gets a C from me ( for now ) -

(a) Fairfax financial gets paid in shares of FIH based on the appreciation in BV regardless of whether the shareholders of FIH make money or not. This BV is dominated by private investments which FIH mgmt is marking . A better way of doing this should have been to take the minimum of ( BV, share price ) and charge fees based on that so that fees only get paid when shareholders are making money too.

(b) Transaction with Privi at 30% below market price with zero explanation to minority share holders

2. Lack of price discovery -

There is a lack of clarity whether FIH is a PFIC or not for US investors. This rules out most of investment from US. India is an emerging market which is a negative for a lot of Canadian Investors. Coupled with a small float and almost zero smart money looking at this, price discovery has been significantly hampered. If you look at the ownership structure of Fairfax India ; OMERS, FFH and host of mutual funds are biggest share holders. FIH is the biggest buyer at 25% of daily volume almost every day.

3. COVID - there is still a lot of uncertainty whether India will experience a third wave or not.

I have been invested for the past 3 years+ and post the crash in share price during COVID made it by far the biggest position in my portfolio.

-

Unless something goes horribly wrong with COVID in India in terms of a third wave which lasts for a few months. This is a 25+ stock in 1-2 years.

-

I am surprised how optimistic this board is regarding mgmt given that they have very little skin in the game and their history of screwing over minority share holders . Privi being the most recent example.

-

3 hours ago, TwoCitiesCapital said:

Very interesting that the buyer got a control 'discount' instead of a paying the typical control 'premium'

31% off fair market value just seems steep without explaining the why behind it?

Doing this deal without any explanation tells you everything you need to know about the quality of people at Fairfax and what they think of minority shareholders.

Is there any example of a large stake sale happening at such a steep discount ...ever? Typically the worst ones are at 5-10% premium over the share price. This is a terrible look on the mgmt in a market which is already skeptical and gives them a 30-50% discount to BV. Maybe rightfully so.

-

-

Thanks Jfan and Xerxes. Do you happen to know if it was recorded, I cant seem to find the link.

-

Anyone attended the Virtual AGM? any notes would be appreciated . thanks

-

The more I think about this, the more I realize it's a complicated structure that's a bit difficult to understand. Essentially through Anchorage, Fairfax is selling off the airport via public listing. Presumably, they are monetizing parts of it at current Mark to market prices, but will necessarily need to keep some equity for future cash flows and growth. (Otherwise what's the point of having bought it in the first place). As the airport generates a regulated rates of return, those cash flows will likely go to Anchorage shareholders. Some management fees would go back to Fairfax India for their work on development/management. Really, for this arrangement to make sense, Fairfax India needs to deploy the capital they raise via the Anchorage ipo in a way better than the airport investment is in and of itself. Maybe it's a way to diversify their investments? If the airport was fully valued this would make sense, but I'm not sure this is the case presently. I'm open to corrections in my interpretation. Thoughts?

Anchorage is more like a platform to do future infra investments and due to that might even trade at a premium to BIAL valuation. They might sell more equity in anchorage separately through OMERS etc to do more investments

-

-

https://finance.yahoo.com/news/fairfax-india-announces-filing-prospectus-124500982.html

IPO of Seven Islands Shipping. Fairfax India owns 48.5%

Has anybody done the arithmetic to figure out what value this might place on FFH India's 48.5% ownership?

SJ

This is the prospectus Seven islands shipping filed with SEBI. Numbers are on pg 58. Fairfax india invested at valuation ~170m. SIS should have annual PAT of 18mil growing at 30%+ which can conservatively translate to a multiple of 25+ , valuing the entire company at - 450m+ .

-

they are up 150mil + on just their IIFL holdings in the past 1 month

-

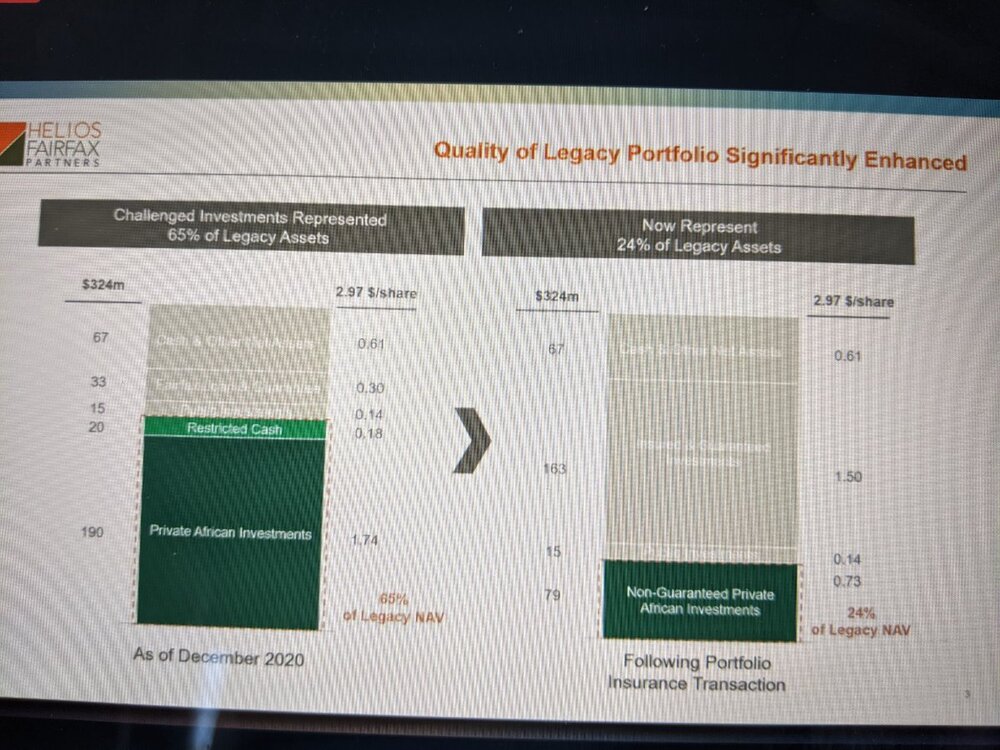

Why is Fairfax bothered with Helios' second best ideas (the first will go to the helios' fund I presume).

What makes you think this?

they had a section in circular describing the conflicts policy --

The interests of Helios may conflict with the interests of the Corporation.

The Corporation will rely on the expertise of Helios (including the Partnership and the Manager, in its role

as sub advisor), in identifying and advising on investment opportunities, transaction execution and asset

management capabilities. Helios also provides similar services to other subsidiaries of funds it manages.

The advisory services to be provided by the Partnership under the IMA are to be provided on a nonexclusive basis to the Corporation and its subsidiaries, and accordingly, there are no restrictions on Helios

from providing similar services to other entities, including certain funds managed by Helios, or from

engaging in other activities in the future (whether or not their investment objectives, strategies and policies

are similar to those of the Corporation). The Corporation acknowledges that Helios will allocate investment

opportunities among the Corporation and its subsidiaries and the other portfolio clients of Helios in

accordance with Helios’ Conflicts Policy. As a result of this Conflicts Policy, the Corporation may, from time

to time, be precluded from participating in an investment opportunity available to the Partnership and the

Manager, in its role as sub advisor, that would otherwise be compatible with the Corporation’s investment

objectives and restrictions.

Fairfax India new issue

in Fairfax Financial

Posted

https://www.thehindubusinessline.com/markets/stock-markets/demerged-gmr-infra-starts-trading-in-bourses/article38241204.ece