-

Posts

564 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by ratiman

-

-

So Powell comes out and says what everybody is realizing, that current rates aren't very restrictive, and now Fedwatch has Fed staying flat through December at . . . ZERO. Not .1% but actually 0%. I'm clearly missing something. Isn't the first rate cut the hardest, because it commits the Fed in one direction? If the Fed stays flat it leaves open the option of hikes without flip flopping. There must be something else going on because cutting with everything at highs and oil perking up and so on strikes me as insane.

-

I bought a really crappy and tiny tech distributor that mostly distributed hard drives to system integrators near Atlanta that was run by the son in law of the dead founder. A real prize. I owned too many shares to get out very smoothly until one day half the world's hard drive capacity was knocked out of service by a typhoon and I realized that at least 20% of the inventory was hard drives. I called in to the next conference call (I might have been the only caller) and asked if hard drive prices had doubled. He said they had more than doubled. The next earnings report, earnings were about half the stock price. I sold the morning of the the earnings report when the PE was about 5x and I might have just gotten back to even. It went bust not much later. It was called SED International.

-

I like the new BG2 podcast, with VCs Bill Gurley and Brad Gerstner. What's fascinating is that Gurley is genuinely interesting and has a distinctive perspective and Gerstner just spits out some words that make noise as if he were jerome Powell testifying in front of congress. I'm not going to be investing in startups but it is interesting to hear what Gurley thinks about self driving cars, LLMs, etc. Just fast forward through all the Gerstner parts.

-

The housing market has been consistently undersupplied since GFC. Only borrowers with pristine credit scores could buy homes and NIMBYs in coastal cities have also impeded housing supply. There is a huge bulge of millenials buying homes and not an adequate supply so I don't see rent or housing prices slowing down. Once people start stripping components out of inflation it starts to sound like a rationalization. Inflation is like heating up a pan of pop corn, the pan is getting uniformly hot even if not every kernel is simultaneously popping.

-

I think there is a widespread expectation that we are going back to disinflation. Disinflation was underestimated in the 80s and 90s and today inflation is being underestimated. 4.2% seems like not nearly enough to compensate 10 year bondholders for the risk of inflation. If Donald Trump becomes president does anybody think he is going to put the gov't on a diet? Does he look like that kind of guy? The handful of deficit hawks are vastly outnumbered not just in congress but even among Republicans.

The Fed signaling they are about to cut will paradoxically make it much harder for them to cut.

-

According to the CME Fed tracker, there is a minuscule chance (.3%) that the Fed rate stays flat through December.

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

This doesn't make any sense to me. Right now nominal GDP is higher than the Fed rate (5.25%). If inflation is ~3%, economic growth is ~2-3%, then Fed rate is below NGDP. Trailing NGDP growth is at 6%. How can it be virtually GUARANTEED that the Fed will cut when Fed has not brought inflation to 2% and the rate is not restrictive? Plus we see oil and copper and trucking and gold are taking off. I don't get why the rates market and Fed are so dovish. The chance the Fed stays flat should be at least 5-10%.

-

Was EInhorn ever long GM and short TSLA at the same time? This is perfect midwit meme content because both the dumbest and smartest investors know that you don't want to be long the past and short the future.

-

Does anyone believe that GM is trading at 5x earnings? It came public at $25 in 2010 and is currently at $38.

-

A former Greenlight analyst basically refutes Einhorn point by point in this clip. It's not that the market has gotten too irrational, the market is too efficient.

https://www.youtube.com/watch?v=7ZpLMWpUQPM&t=1683s

-

Einhorn owned GM for years. Is he saying that GM was really trading at 5x when it was trading at 5x and he had to sell GM because the market wouldn't recognize the true value of GM? Because if that is his argument then he's just making excuses for owning a bad company with a low multiple.

-

Will natgas investors ever make money? It seems like the industry is stuck in a permanent glut. Another widowmaker trade. Natgas is below $2.5 which is where it was about 25 years ago.

-

On the day his father died his son Phil liked this tweet:

It’s amazing how fast you can go from “a robot is vacuuming my house” to “a robot is doing a bad job vacuuming my house, man fuck this boi” -

Why not just look at return on capital? It shouldn't matter how it's funded. I think somebody won a Nobel prize for proving that.

-

But can't the assets be transferred to another bank?

-

GS is running the sale process. Why wouldn't GS be the acquirer? It would be a chance to lock in tech firms as clients and GS is a bank. WFC might be another possible acquirer as it's in California but WFC already has a lot of problems of its own. JPM is always at the top of the list but after Bear Stearns I don't think Dimon wants to go through that again. Or will there be no takeover and it will just go into the typical FDIC process, which would be devastating for a lot of startups and VCs.

-

Thanks, that is helpful.

-

Thanks. I thought that was the answer but I've run into some companies with such slow turns that I thought it might be that the company was valuing inventory at retail price. Another quick question: if a company ships off the inventory to a retailer, does the inventory shift to the retailer or is it still considered in inventory until the retailer pays?

-

This is a dumb question but I couldn't find the answer. When a company lists inventory at $10mm, is that the cost of the inventory or the retail price? I would assume it's the cost but if so, many of the companies I follow don't turn over the inventory more than once a year. I know there are some accounting experts on here who might help with this basic question.

-

Here is his explanation of the non-expecatations approach:

https://operators.macro-ops.com/wp-content/uploads/2017/09/Expectations-Investing.pdf

"Having been on the sell side for many years and then on the buy side, I can say categorically that the single

greatest error I have observed among investment professionals is the failure to distinguish between

knowledge of a company’s fundamentals and the expectations implied by the company’s stock price. If

the fundamentals are good, investors want to buy the stock. If the fundamentals are bad, investors want to

sell the stock. They do not, however, fully consider the expectations built into the price of the stock.

Whenever I assert that stock prices are based on expectations, investment professionals shrug their

shoulders and say, “Well, of course. That’s obvious.” But as obvious as the assertion sounds, few investors

take the time to understand those expectations and determine whether they make sense.So the non-expectations approach is "Buy a good story, sell a bad story," which probably isn't the worst advice, but it's not a position that anybody would defend.

I think Mauboussin is actually trying to sneak in a slightly stronger claim under the heading of "expectations investing." The stronger claim is that there is information in the stock price and an investor is better off "updating priors" than dismissing it as irrational. That would be a more interesting argument but he probably doesn't spell it out because he doesn't want to be associated with momentum investing.

-

If you're on COBF you're probably familiar with Mauboussin's expectations investing. The idea is that you begin with the stock price, figure out what expectations are built in to the stock price, and then compare with your expectations & estimate of stock value. What I don't understand is how this is any different from calculating fair value, and then comparing with the stock price. It's the exact same thing. I've read the book, I've listened to MM's interviews, I've read reviews, and I can't figure out how his process differs from ordinary stock picking. He's rebranded the platitude "hear both sides of the argument" as "Expectations Investing." It really is a great trick.

-

8 hours ago, Cigarbutt said:

AFAIK, the real price for a Big Mac has remained stable (or the nominal price may have outpaced inflation slightly; have Big Macs become smaller or is it me growing up?) since the 60s (45 cents in the mid 60s). Of course, the value in MCD has been growth in sales (and scale), not necessarily growth in margins through pricing power.

The value in See's was potentially untapped pricing power.

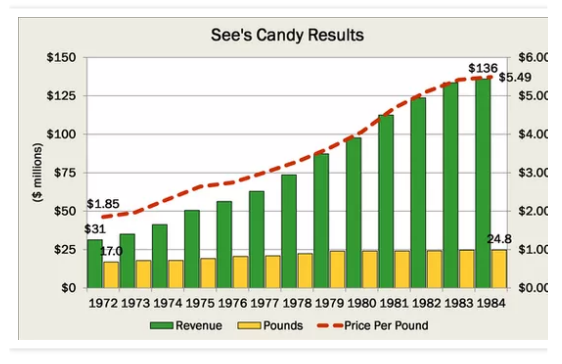

What was the origin of this pricing power? The usual ingredients and likely the perceived 'quality' and consistency of the product. Relative scarcity may have played a role in the wholesale decision. When looking at available numbers (more specific data was likely available around the 1972 purchase) the price of See's one pound of chocolate went from 0.50 cents around 1935 to 1.85$ in 1972, for a CAGR of 3.6% vs 3.1% for CPI. In 1972, one did not necessarily need to understand specifically the underlying moat and pricing power as it had been historically established. A difference of 0.5% doesn't sound like much but this excess pricing power leads to compounding benefits that flow directly to the bottom line (and return on capital numbers). From 1935 to 1972, this small difference in excess pricing resulted in an excess of 20% of extra nominal sales and extra nominal net profits.

From 1972 to 1984, room for more pricing power was explored (trial and error may be the only way to find out). The price per pound of chocolate grew (CAGR) at 9.5% versus 7.9% for CPI. Without this excess pricing being exercised, the price per pound would have ended up at 4.61 instead of 5.49 as reported. 5.49 being 20% higher than 4.61, from 1972-84, See's exploited its pricing power over 12 years instead of over 37 years after the great depression.*

For those interested (educated guesses from various reported sources):

CAGR See's price per pound of chocolate from 1984 to 2022: 4.3%

CPI from 1984 to 2022: 2.8%

Of course, this can't go on forever as eventually See's may occupy the full 5% share of disposable income for food away from home.

*Purists will signal that cocoa price behaved like a typical commodity in the 70s but cocoa input price had come down in 1984 to some degree and the cocoa's share of the price for the pound of chocolate is likely around 10% of total price so..

Interesting, thanks. I think a lot of investors would pass on that business because there's no unit growth and the price hikes are unsustainable. Every high-margin consumer brand attracts very persuasive critics who make some really good points about the margins. In this very thread there is somebody saying that Starbucks relies on the genius of Howard Schultz. It is very hard to get over that skepticism. Maybe the explanation is that the chocolate business is a really good business to be in when everybody in America is gaining an extra 20 pounds.

-

Every single reason Buffett proposed for the success of See's turns out to be wrong. Scarcity? Lindt is in every drug store. Geography? Every brand comes from somewhere. Freshness? Nothing fresh about Lindt or Godiva.

-

If a Sees Candy-like investment were to show up today, value investors would dismiss it as being an overpriced & faddish product with no sustainable moat, the same way that value investors dismissed Starbucks in the 90s as overpriced & faddish coffee, even though Starbucks was over 30 years old by then. When people say that Buffett understands the Sees moat, I don't think that's correct. He could read the financial statements, but buying the brand was still a leap of faith because the strength of the brand is mysterious. There is something inexplicable about genuinely successful premium brands. If Starbucks were named Il Giornale or Nike were Dimension 6, they would not be the same brands.

-

If Sees Candy were publicly traded, would any Berkshire investors own it?

"That company has no moat. This is the Harley Davidson of chocolate, it appeals to boomers but to nobody else. You're buying into an overpriced, overhyped brand with no moat that can't grow outside of California. Those margins are indefensible and over time they will be competed away."

Maybe the real genius of buying Sees was that ultimately Buffett didn't know what the moat was but he bought the company anyway.

How is the Fed going to cut rates with inflation over 3%?

in General Discussion

Posted

It's not the case that the recession crowd has stopped predicting a recession. The consensus has not shifted to "inflation is here to stay". A few people predicting higher inflation does not change the consensus. The consensus is vastly and overwhelmingly on the side of disinflation, a slowing economy (variable lags), and lower rates and lower inflation over the long term. If that is your position, you are with the crowd. The crowd is usually right but you are not bravely fighting the consensus.

For instance consider the consensus (from Nick Timiraios of WSJ):