influx

-

Posts

240 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by influx

-

-

On 9/21/2023 at 4:04 AM, Spekulatius said:

I have not listened to Chitchat AZO podcast, but you likely get better info here (Acquired Podcast):

@Spekulatius how about BHF?

-

On 10/28/2023 at 1:51 AM, Monsieur_dee said:

Yes, @Monsieur_dee

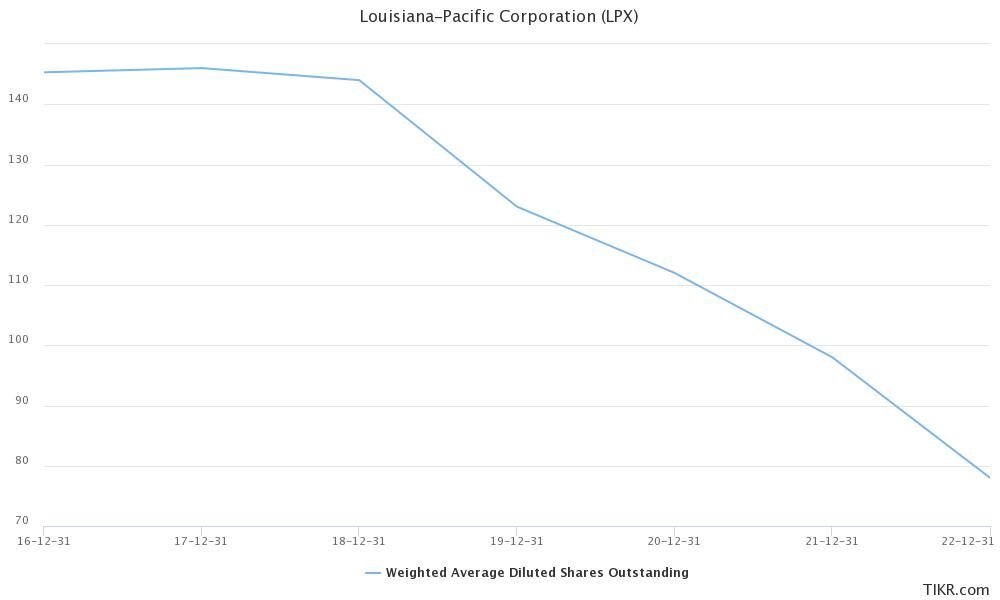

Bob Robotti was talking about LPX. I watched a fireside chat a month or two ago.

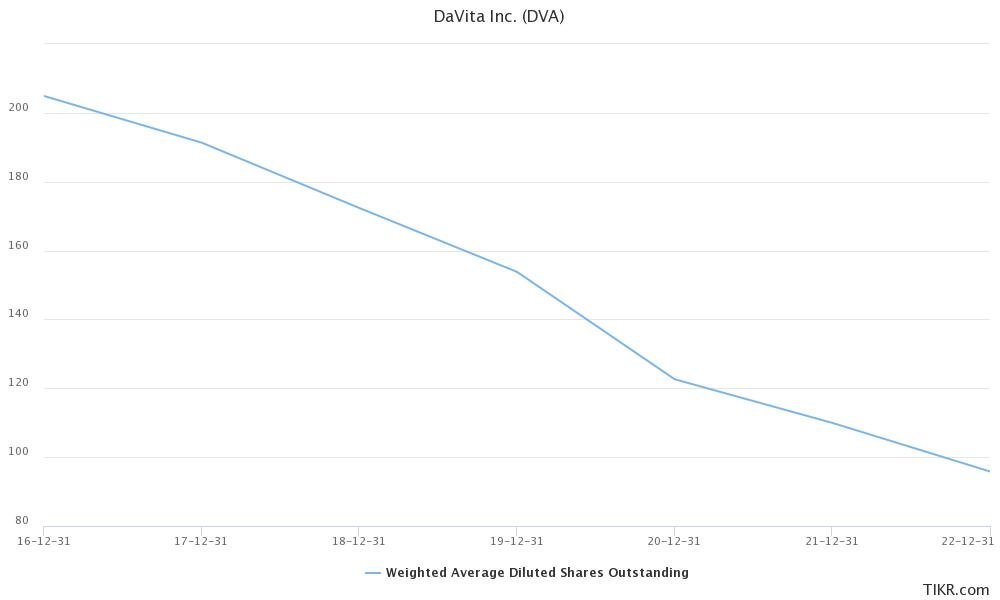

Is there a screen or a way to track these cannibals on quarterly or annual basis? It maybe manual or using ycharts and similar platforms?

-

Sounds like this is the vehicle, 5y warrants are his thing.

https://www.stockgumshoe.com/reviews/katusas-resource-opportunities/katusas-global-race-to-net-zero-and-the-global-war-on-carbon-emissions/

https://www.carbonstreaming.com/media/news-releases/carbon-streaming-completes-us1049-million-private-placement-of-special-warrants -

I've listened to some of his videos as well:

https://www.youtube.com/c/KatusaResearch/videos

But I am not sure which investments he refers to.

Somewhat similar is Pierre Andurand and his RV interview, he is nto the carbon credits futures

https://www.realvision.com/pierre-andurand-the-oil-master-looks-to-the-future

-

How do you track podcast guests by their full name? How do you setup an alert? Can you please share and tell what do you use?

-

Hi Guys and Ladies.

I hope you are well.

Is there a free screener/filter that I can use and setup.

I'd like to use the default 52 week filter but modify the start and end date. Can you please help?

Thanks

-

My trade platform is showing quotes on options for gold futures out thru 2026, so yes 5 year options there are possible. GLD only goes out thru 2022 so less than two years.

I can't imagine getting those prices quoted in the article even scaling up for current market prices. That would be like buying $2500 calls for $10, and the quote I am seeing is more like $300 for that option. The longest duration option you could actually buy for a premium of 1/2% and a strike price 35% out of the money is the December 2020 call, so only a bit more than five months of runway.

Yeah so it is the futures right? That's how I get 5 year leaps?

Yeah, sorry, it is an old Grants article, 10 or more years, don't remember.

-

Hi All.

I hope you are well. This might be better for Strategies but was unsure.

I have an old Grants article, quote: "(An investor friend relates that he recently bough 250,000 gold calls struck at $500 for five years at a cost of $2 each. Given that that the forward gold price is approximately $370, he observed, the calls are essentially free."

So, can you help me understand how one might be able to do this as a non-institutional investor?

Are they talking about long-term calls on futures contracts or?

Thanks

-

I'll gladly share this info but you'll have to endure the following personal anecdote.

One of my daughters was born with a heart anomaly resulting in occasional significant but non-life threatening episodes of arrhythmia, most of which would stop on their own but some of which required an emergency room visit for an intravenous dose of a medication. Eventually, she was scheduled for a procedure involving inserting a specialized catheter in her groin, reaching the relevant heart chamber and selective burning of anomalous electrical channels. From the economic side (my appraisal based on relevant inputs), I estimated the total cost to be about 5000$ CDN but the direct cost to me is difficult to assess because I live in area where medical care is 'free'. When my daughter got scheduled for the procedure, I met a member of the extended family who 'recommended' that I go to the US in order to get this done as he knew somebody who had done so. Why would I do that? He said the treatment must be awesome because it had cost the person 25000$ USD. From a balanced point of view, there are reasons for a premium. But what is reasonable? I don't think Mr. Pearson answered that question appropriately.

The relevant part of the video starts at around 1h15min and you can download the prepared testimonies.

Thanks sir. Yeah, understood. I hope all has gone well

-

Hi Folks.

I hope you are well.

I've tried to find this online. Do you guys know if there is a full video of the hearing?

I've seen the Dirty Lies short snippets though. Would love to watch the whole thing.. :)

Thanks

-

Hello Team.

I hope all are well :)

Just been thinking that I don't really know of a good source for the Canadian marks, e.g. Toronto markets.

I've done some search

https://tradingeconomics.com/cco:cn:common-shares-outstanding - works well. maybe it is using US stock exchange as a source in the background?

https://tradingeconomics.com/aim:cn:common-shares-outstanding - works well

https://tradingeconomics.com/pg:cn:common-shares-outstanding - doesn't work

And found few more but none of them seem to be working well with all the Toronto shares including the above. I'd really like to overlay this chart with the price per share chart.

I'd choose the past 5 or 10 years, choose the number of outstanding shares, the price per share and just get that on the chart?

Is any of this possible? If yes, can you please advise how? If not, do you happen to know of Toronto / Canadian markets service that provide this?

Thanks

-

Thanks.

I also found "The Geography of Time" by Robert Levine

-

Hiya folks.

Been thinking these 2-3 weeks and kind of getting to the concept of Time as an interdisciplinary concept. The pattern of its importance across different domains as well. I am almost done with Mark Spitznagel's book which emphasizes this long-term approach and time. Now, also reading mindfulness and meditation stuff and Time comes and jumps at me as a central concept. Sometimes I find this weird. It is like a topic has matured well enough in my head and then it gets a life of its own.

I am yet to read Time Paradox, by Philip G Zimbardo.

My question is do you know some other books that explore this concept, in practical terms?

I've read all of Taleb's books.

Thanks

-

I don't know one but did you try email the CSE to ask?

True and tried...but seems tedious process to find a bank/brokerage which deals internationally

-

Hello folks

I hope you're well

Do you know which brokerage services support http://thecse.com ?

It must be a brokerage service either:

1. In Australia, or

2. An International one, which works online and accepts international investors

Ideally I'd like a full online platform

If you know one, please suggest. I checked with IB, they do not work with CSE. I checked some other too and for some I am waiting for a response. No success so far. So, I thought to check with you if any of you know one that supports CSE

Thanks

-

I also did not anticipate that a president would be so hell bent on signing a deal with nothing in return from Iran except their word that they would stop nuclear weapon development for 10 years.

Cardboard

I read somewhere, Iran is supposed to be a potential US ally so that ME US allies can bypass Syria to Europe..or as an alternative to Syria

-

influx, Thanks for the Wesco collection!

Sure, seems what I looked for starts on page 52-65, more specifically page 54

-

Are you looking for the Wesco annual report?

I dont know - is that the case? Is the Wesco 1988 report to which Munger refers to in this 1989 resignation letter? Because Mutual Savings was part of Wesco?

If yes, then I think I have them and one can easily find them e.g.

https://rememberingtheobvious.wordpress.com/2012/08/03/charlie-mungers-wesco-letters-1983-2009/

Please let me know

-

Hello folks

Do you know where I can find 1988 annual report? "While the mess has many causes, which we tried to summarize fairly in our last annual report to stockholders, " --> it comes from http://mungerisms.blogspot.mk/2009/08/rormal-resignation-of-mutual-savings.html

I would like to read it.

Thanks

P.S. since it is Munger related material, I thought to post this in BH section

-

sedi.ca tells me they are 10% holder, and "Date the insider ceased being an insider of this issuer" is empty

Date the insider became an insider of this issuer 2006-11-07

-

Is fairfax still in?

neither in 2014 MIC

I dont see it here:

http://www.fairfax.ca/files/doc_news/2015/Revised-2014-Annual-Report_v001_n818c7.PDF

I see some recent (2015) references to fairfax

http://www.stockhouse.com/companies/bullboard/t.ts.b/torstar-corporation

Where can I check class b shares holdings, >10% or so?

Thank you

Public Company Share Repurchase-Cannibals

in General Discussion

Posted

Yeah, okay. Thank you.