tylerdurden

Member-

Posts

242 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by tylerdurden

-

Look.. zero hedge is in the house! No, there isn't a third mandate for the Fed. Algos and quants don't matter. You don't get a helping hand. What is with all this bullshit? You get guys who spend all their days pontificating about the free market but once they start booking some losses they start crying like little girls and begging for a quasi-governmental agency for help. Grow a set. Ok, rant over. Now over to serious analysis. I'm not picking on you but I'll use your post as a spring board. By reading these boards I think there is some serious misunderstanding about what is meant by inflation when the Fed and pundits are using it. They don't mean actual inflation, they mean inflationary pressures. The fed's job is to look and combat inflationary pressure in order to keep inflation at 2%. It is not to fight inflation - i.e. if inflation gets up to 3%, then try to bring it back down to 2%. So you don't have to actually see inflation tick up for the fed to act. What you actually saw from the fed this week is really, really standard central bank stuff. If you have a strong economy around full employment that's expanding at a faster pace than potential you tighten. Btw, I am in the camp that the fed shouldn't tighten. The reason for that, which is the right argument for tightening, is the headline numbers are painting a wrong narrative. If the economy is doing so great then the labour market is banjo tight. At this level we should see wage inflation, but we don't see that. So maybe the economy is not doing so great. One of the worst mistakes in the history of the fed was the recession of 1937. Maybe we should avoid that this time around. Of course this is also political bullshit. They want the cake and eat it too. A booming economy and low rates. It doesn't work that way. If you have a booming economy rates will go up. If you want lower rates, it's because your economy ain't that good. They also fired Janet Yellen who was a looser money type with Jay Powell who was a tighter money type which conservatives liked. So why are they bitching now? They got exactly what they asked for! Hey rb I’ll have to include you as another tone deaf person like Powell. Tell me which recession we went into because of high inflation other than volcker fighting high inflation back in 70s. The real threat is bubbles (financial stability) and everybody including powell admits this except you. Anyways you just reminded how this board is full of people who have very closed minds and false sense of overconfidence in their views so no need to waste time posting probably. Good luck to all

-

Really good conversation here. I enjoyed reading your posts. One thing I have not seen mentioned is the hidden third mandate (kinda) for Fed. They always talk about the financial stability alongside unemployment and inflation objectives. I think it totally makes sense to normalize the cost of money etc. especially if you are not sure where the bodies are buried. However I have to agree with Druckenmiller about timing. This market is really weird with all the algos and quants etc. We can easily find ourselves in a self fullfilling prophecy if the market keeps on tanking fast and this spreads into real economy and/or other weak countries etc. I think there is gotta be some concern here for overall confidence and sentiment. I like Powell but come on man he seems so tone deaf. They don't even know the exact impact of all these interest increases on real economy because of the lagged impact (18 months some say). No inflation. no real urgency and you decide to increase amid this lack of confidence in markets. why? I don't get it. why not waiting for Jan or March and make everybody happy including Trump for a while? I fully support normalizing rates but not like this. At the end of the day, no one knows about future so they have to be more careful/gradual...

-

I respect Chou and follow him on a regular basis as much as possible. Having said that, I think he could be a little bit more honest with himself and his investors. Let's look at his Sears investment for example: I think at this point, most observes would say a bankruptcy is in the cards and it is a matter of time only however he has been writing all the same thoughts about this investments for the last I don't know how many letters. "We bought it at an expensive price but the idea still holds etc etc." Come on man, I saw this with Berkowitz, Pabrai and probably others. It is hard to manage other peoples' money I guess as some of you guys know better. It is really hard to admit mistakes straight it seems. Warren Buffett does it pretty well but not all managers have the same type of reputation which gives him the luxury to be more honest... Anyways, I like him and we all know that not all of your ideas will work even in 10 years timeframe, especially last ten years but he can and should be more honest I think overall.

-

No offense but you are totally missing the point. At least the point that I was trying to make... Demanding absolute consistency??? Who is demanding that? If you are making speeches here and there all the time, shouldn't we expect some type of consistency between your speeches and what you are actually doing in real life? No one is forcing him to make those speeches at the end of the day. After you tell your audience something you would have a moral obligation to either follow that in real life or let people know about any changes. Of course anyone has a right to change his mind but the problem is making public statements and the responsibility of letting people know about any changes that might follow afterward in my view. I totally agree with the previous comment regarding cloning too. He is always talking about how he is cloning easily etc etc. Is it that easy? come on man, you are supposed to give either full picture or shut up in my view.

-

There are many hedge funds which publish their letters publicly on their websites. I am not really interested with his letters or performance etc etc. I don't really care. Obviously he has great contributions to the society. My only objection about his methods is his inconsistencies between his speeches and his actions. So many occasions I have observed so far that he sets up rules, promotes ideas etc etc. and then he does something else. Perhaps he can't help talking too much, perhaps he is trying to maintain a good brand out there. I don't really know but it certainly becomes a credibility issue after a while. Anyways it is what it is...

-

His funds are all closed to new investors. That doesn't mean he won't open them in the future. The funds are frequently opened and closed. Again, it is a marketing ploy. Guess who also played hard to get. You create an atmosphere that feels exclusive, above hoi-polloi, ignoring the crowd, you feel special. You feel like part of a rarified group. Also when you say we are closed, you are sending a subtle message to existing ones. If you exit, you may not come back. Last year it was a different tune. There were frequent mentions about how our assets are trading at a fraction of what they are worth (you wont find any fund manager who'll say our portfolio will triple in value in few years). If you exit, you will miss the ride... There are lots of psychological mind games. Bottom line is, buyer beware. A mouse having (paying to have) lunch with a lion doesn't become a lion. +1 I have to agree with this. I also wonder how much of a cash holdings he has. To me any value investor should have some significant cash holdings since you can't predict the time of market crashes. I have a feeling that next crises he will go through the same experience that he had in 2008, like many other to be fair to him...

-

His funds are all closed to new investors. That doesn't mean he won't open them in the future.

-

There will be winners and losers for any investor for sure and I am not really interested about his returns at all. My only objection about the guy is he doesn't have any consistency at all in terms of what he preaches and what he does in real life. One day auto stocks are invincible, a couple of month later GM warrants are held as a cash replacement only. (How smart is holding a warrant position as cash, i'll leave that to his investors!). He says he will wait 3 years at least to understand whether his idea worked or not and goes in and out positions all the time. Anyways for some people this might be considered as being insincere, deceitful etc etc. He should perhaps sit on his ass and focus on his investments rather than talk as much as he does or wait he needs more funds so he can make more moneyyyy right....

-

I just watched his latest Google talk last week. It seems he now admits he might not be able to get the desired returns from GM investment. A couple of months ago he was the biggest promoter of auto stocks on Barron's. Of course anyone can change his mind but if you are constantly in "marketing" mode when you change views suddenly, it looks a little bit insincere to me. Also investing in warrants is not an easy path. What if China slows significantly next year because of this deleveraging thing going on there? What happens to GM warrants? Well, he was promoting investing into warrants big time in that article too :-) I am not a big fan of Guy Spier either but at the least he seems to have more consistency. He sticks with investments much longer like SRG and banks etc. Mohnish had one strike with ZINC recently so of course he will go nuts about another strike because of a potential Sears bankruptcy... Being a fund manager and a salesman at the same time is tough business...

-

Mr. Francis Chou's 2016 annual report is out

tylerdurden replied to Cigarbutt's topic in General Discussion

His banks stocks are working obviously. Who knows whether others will work at some point too perhaps. I guess if you are a value investor you should always look into the intrinsic value vs. the market value. Not market value as an absolute indicator... -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

tylerdurden replied to twacowfca's topic in General Discussion

Even if Mnuchin wants the solution that shareholders want, how much power will this guy have anyways? I mean he is the Treasury Secretary right not President. Sometimes even being the President is not enough in DC. With all the other priorities they have ahead (tax reform, infrastructure spending, some stupid trade war? etc) I am not sure how much this guy can accomplish even if he is on our side. I'd appreciate if everyone keep updating the board with respective buy/sell decisions. I'll totally admit that I have no clue where this investment going now:-) -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

tylerdurden replied to twacowfca's topic in General Discussion

This as always been "coin toss type of investment". You made some kind of estimate of probability of court win and/or administration settling/etc., you calculated market-assigned probability and you compared the two for investing or not investing. Yeah I agree. That's why I speculated with a very small position, which also allows me to monitor where this is going. Having said that, before it was depending on the probability of the court outcomes and obviously some legal expertise could help to assign particular probabilities on different outcomes. Now based on what I just heard on this board, at least some believe this is now dependent on what mnuchin wants to do and who knows what he wants to do. I don't think you can even assign probabilities on that with any degree of confidence. To me it is totally gambling now, if we are only following mnuchin going forward... -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

tylerdurden replied to twacowfca's topic in General Discussion

I have a very small FNMAS position. Isn't this now a coin toss type of "investment" then? If what mnuchin thinks is anyone's guess and the outcome of the investment is totally dependent on it, this is like going to roulette table playing black or red I guess. No investment at all, pure speculation...? -

I think a social democrat put it nicely: "Donald Trump is a pathological liar". That's pretty much it about him...

-

Oil, wow, WTF happened to all of the oil bugs on this site?

tylerdurden replied to opihiman2's topic in General Discussion

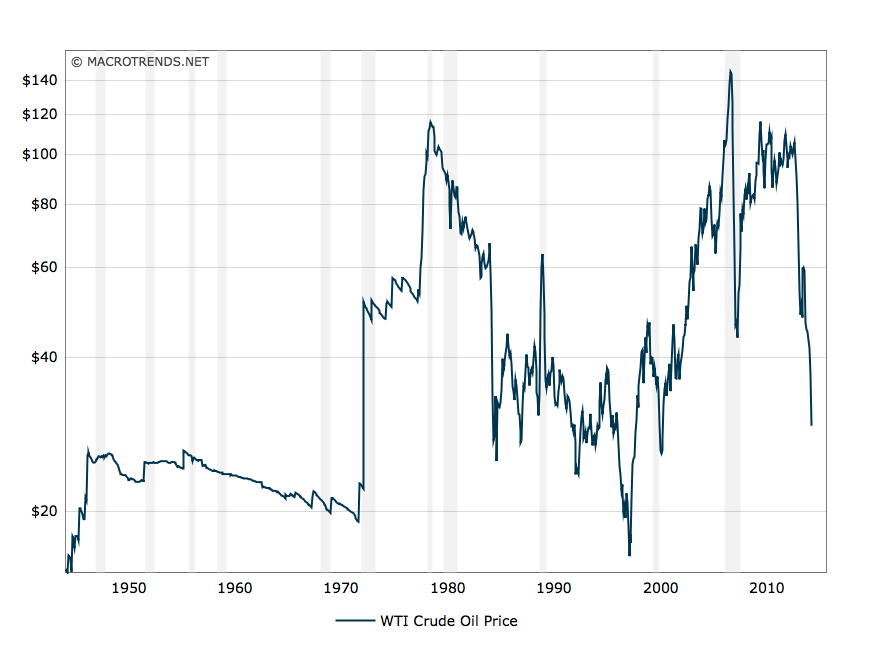

Oil should come back, I agree. Many producers cannot profit at these prices, underinvestment will cause imbalances in the future, Saudis cannot ignore social programs forever and cannot afford these budget deficits. We can certainly see OPEC finally coming together under Saudi leadership like in end of 90s I believe. Having all these said, when I look into the attached graph that scares me. From 1986 to 2003, like 17-18 years inflation adjusted oil price was below $40. Perhaps, we had lots of ample capacity back then. I am not sure but the graph makes me think all sorts of possibilities... -

What is the extent of the 'opportunity' in the oil market?

tylerdurden replied to bmichaud's topic in General Discussion

I don't know about the drumbeat but perhaps Saudis will keep on pumping like crazy even if they see a slowdown in US, in order to protect market share against their friends, Iran. Anyways, I am not trying to make a oil price prediction here by any means. I don't believe in those predictions at all but just wanted to remind that since we have States as big players in this market, we might not get economically justified answers all the time. Who knows what the price would be but you can still make arguments for $20 or $60 in 2016... -

Wow. Who is he cloning on the FCAU and ZINC positions? He has mentioned that ZINC is his first original idea, and FCAU was from a Columbia student's presentation. So you are saying he is cloning Columbia students? So I also heard on this thread he goes into positions where he expects 2x 3x gains; so how does Brk BAC fit? he seriously expected Brk to triple? Pabrai is so full of contradictions I wonder how anyone can follow what he says..... I don't know his results last year or this year... but it can't be good, GM has gone nowhere and Horeshead....well that's a disaster..... He paid $5-6 for BAC, so looks like a 3X. Most of his GM common was below $20 before he switched to the warrants, so nothing wrong with 50% gain in 3 years. He still may get his 2-3X. Pabrai held very little Berkshire just to park some cash rather than expecting 2x-3x from those shares. He thinks he can do better so I wouldn't think he'd invest any significant amount in Berkshire. I also think he performed well with BAC and relatively with GM. (GM is nothing near its earnings potential yet.) Fiat and Google so far are some of the winners obviously but he will have to wait patiently with names ZINC and Posco at this point of course. Not sure whether all of his investors have the same mindset for being patient enough. I assume they are. Berkowitz's investors were not when he was going through a rough patch with AIG and BAC several years ago. Anyways, he'd do well in the long run probably but I honestly think he and Guy Spier are getting bored just waiting patiently for their shares to show their real potential so they started doing all these talks, books etc. etc. It is a real good thing for us to hear what they have to say of course but If you talk more frequently there is more room for errors, inconsistencies etc. That's why we see them acting a little bit inconsistent sometimes I guess. It's human nature probably...

-

Easy to say, hard to do I would think... Last I looked he was invested in insurance, newspapers, utilities, railroads, a million kinds of manufacturing, another million kinds of junk food, and another 40 or 50 assorted service and retail businesses. Don't you think that's because of the size problem they have at this point? I believe there were times in his career that Charlie Munger was pretty concentrated. At some point, for an arbitrage opportunity, he invested all his money into one name only even...

-

Do you guys know how to buy this book? Amazon doesn't carry it for now and barnes & noble website does not even showing the book.

-

Nothing nefarious in their motives, so the "red-flags" issue is irrelevant. They've taken a teaching approach in their presentations...to share the knowledge they've garnered from their experiences...and it just means a lot of exposure to a lot of students. Cheers! I have not watched this one yet but have seen many of Mohnish's presentations. It's good that they are spreading the message but I am not sure whether they do a complete job. For example in terms of following 13-Fs, which is a main idea that Mohnish has been recommending for a long time, he needs to do more explanation in terms of the challenges for this approach. He makes it sound like it is piece of cake sometimes but in fact it is more complicated than that. If they choose to have more public attention, unlike some other value investors, that means they have more responsibility in terms of providing the full picture all the time... Also their views/approaches evolve from time to time as well like the level of concentration he had several years a go vs. now. That also is another challenge in terms of the teaching approach I think.

-

I think you are reading it as a hard rule. My opinion is that one should buy a company as if it is going to held for at least 2yrs. If the thesis plays out or your analysis is wrong or you find a cheaper stock, sell as soon as possible. Absolutely, i totally agree again. In this case though, it seems he replaced like 2/3 of Posco with Google. Now, google is a company that I like as well but nothing is really different in terms of the thesis for both of these companies for the last several quarters and google is like real household name that everybody is aware of in terms of the story so why would a highly reputable value investor buy a thesis just to replace it with another well-known one in a couple of quarters although there are not much of a difference in terms of the stories (at least as far as I can see of course). There are no crazy price moves during this time frame either for a value investor. I think this is more about investing in a better idea (google) rather than switching into the Korean shares since he still owned 1/3 of the posco shares as of dec 31. If there was a significant advantage of having korean shares, he could have switched all shares. Anyways, I learnt a lot from Mohnish's book and speeches etc. and I am thankful for that but i am somewhat confused if i have to be honest. I also remembered his speech at Google and he was also explaining why Google is a great company but it might not be a good investment because it's in the fast changing IT area etc. Go figure...

-

I totally agree with you about this being real life and he is managing real money. My question is more about what he is talking about and doing in practice. He does not have to talk about it or write a book etc. and then when he sees a better investment, sell something in a couple of quarters. I am more questioning his consistency. Guy Spier was also talking about this in his book. (Not selling 2 years at least I guess as a rule) I don't know of course Guy's standing with the posco shares now. since Mohnish does not seem to be as excited about those shares there is a chance Guy also downsized significantly... Again, it's more about the difference between principles presented in public and the practice, I am curious about. Of course anyone has the right to change his mind based on changing circumstances.

-

In his book and many of other speeches etc. he recommends holding to an investment 2-3 years no matter of what. While he is publicly promoting this idea (and cloning obviously), he sold big chunk of his Posco investment after only several quarters. Isn't this inconsistent with what he has been preaching about? (I don't think there is any fundamental change in terms of the prospects of the investment since his initial purchase)