Aurelius

Member-

Posts

131 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Aurelius

-

Pabrai knows how to make money! Great marketer! I like his lectures. Seems to me he is living life on his own terms. Good for him. More people should do that. I remember a few years back being very surprised his returns weren't better than they actually are. Does anyone have his 5-10-15-20 year returns?

-

@Dinar @Gregmal Thanks! Wow - those are some very juicy premiums! I feel like the club is def getting sold. Present owners are hated/disliked by virtually all the fans at this point. Can't see them backtracking now and staying as owners... What are your thoughts as to why the premiums are this high? Most be the point @Spekulatius has made regarding minority shareholders, no? Edit: I sold a few puts as well. Kind of bummed I've totally slept on this ... ManU is my team!!!

-

@dinar Do you know at what price are Manu expected to be sold for? Ie how are you thinking about this?

-

AMZN is a steal! They obviously have a variety of different businesses. And as they are still investing heavily in growth you are not seeing the results on the bottomline. You'd need to value each component to get to a valuation. As a shortcut I've always thought it made sense to look at EV/gross profit as they do a lot of their investing through their PNL below the gross profit line. I believe Bill Miller has mentioned this as well. AMZN hasn't been this cheap (on EV/gross profit) since early 2015 before they broke out AWS in their financials. They are a powerhouse today compared to 2015. And do a lot more high margin business (AWS, Ads, 3rd party, subscription) today. There was a period in 2014-2015 when it traded at these levels we are seeing now. Then you have to get all the way back to 2009.

-

Unfortunately, the same where I live. It's really rather unfortunate for the investor. And I don't see the benefit for the society either. How is it better that I invest in company B rather than company A? I have to assume it's because of less developed "investment culture". Oh well...

-

Interesting! So you can sell a specific lot? Makes a lot of sense that you should be allowed to do that. Otherwise it seems like a pretty bad deal to add to a position when you're up a lot. I don't think that is possible where I live. @John Hjorth can you help here?

-

Here’s a dynamic I hadn’t thought of before. Please correct if I am wrong. Example Buy 100 shares at $100. Total investment $10.000. Price goes up a lot over time. Valuation gets cheap and I invest another $10.000 and get 10 shares. New price per share is $1000. Previous average price per share: $100 New average price per share: $181.8 Total investment: $20.000 Total shares: 110 Times passes and the price does another double to $2000 per share. I go to sell the 10 shares I added. Sell amount: 10*2000= $20.000 Amount invested: 10*181.8 = $1818 (shares sold*average price per share) Profit: $18.182 (20.000-1.818) Taxes at 40%: $7273 Money I can spend: 20.000-7.273 = $12.727 (So you invest 10K. It doubles. After tax you are left with 2.7K) VS investing in a new company Invest 10k Doubles to 20k I sell and pay 4k in taxes Money I can spend 16k Other cons of adding to my position: If I for whatever reason want to sell I can only do so while incurring tax payments. Example: I sell the amount I added to the position for the same price, i.e. $10.000. But now I owe $3.273 in taxes. A disaster outcome really. Even worse if I sell at a loss on my added-on position. I still owe taxes as oppose to a tax credit had it been a new position. I hadn’t given this much thought before. Seems important when you have big winners in your portfolio. Just writing it down and wanted to share my observations. Am I thinking about this the right way?

-

Thanks all! Lots of good perspectives. I'm leaning towards just letting it go... Hi John, thanks! Person is in his 60s. Wont need the money for another 4-5 years - perhaps longer. He might be interested if I presented him with a deal. He'd just never go ahead himself. But I also think it's a bias for people who invest to not be able to see cash laying around like that! haha But seriously, I think it could be a good deal. But probably just gonna let it go.

-

So to be clear: The objective is as Gregmal mentioned: to get them started and help with the “stock market fears”. And of course to make money as opposed to paying negative interest rates and inflation doing its thing. It’s not to start a business or any such thing. Also with regards to risk: The amount invested would be somewhere in the region of 1-2% of my current portfolio. Having said that I am not looking to offer a freeroll here. I would personally never accept such a deal and don’t intend to offer it. So I understand the resistance in this regard. The point is to offer a proposal that is fair to both parties. (if it ever happens…) Obviously the willingness to accept risk will be different for different individuals. On my part I don’t think I am risking much: -I will only lose money if the portfolio is down after lets say 4-5 years. Seems unlikely. -if it’s down 50% I’ll lose 0,5-1% of my current portfolio. I wont like it, but I can deal with that. Upside: perhaps a nice watch or vacation! Gregmal mentioned: 5% guareentee + 50/50 on profit over that. Another example is 25% of profit…? Obviously the offer would be contingent on him staying the course over lets 4-5 years. For the people who still feel this a bad deal for me: What would be a fair deal in your opinion?

-

I have a close family member who’s got some money saved up. He is uncomfortable investing it - keeps it in cash. Pays a negative interest on it now. He’ll basically never get around to invest it. He doesn’t need the money now. Might need it in 3-5 years time. (As in might want to spend it/portion of it) I was playing with the idea of making him an offer: -I’ll invest it for you. -If the portfolio loses money I will pay the loss 100%. -Provided you stay invested for lets say 4 years (fair?) -He would obviously be able to exit anytime he want. Why even do this? -I want him to make some money vs paying negative interest to the bank plus inflation devaluing his money. -I feel confident he’ll make money over lets say 4-5 years. -If not I’ll be able to take the losses easily. (Seems low risk) What’s a fair compensation/structure? Pros/cons?

-

thanks for the heads up -- love these Kindle deals!

-

-

Surely there isn't another country in the world that has tested more rigorously than the Faroe Islands. Population 52.000 Samples 156.223 !!! Confirmed cases 495 Recovered 490 (5 active cases) It has to be said, that only 27 people over the age of 60 have had the virus. www.corona.fo

-

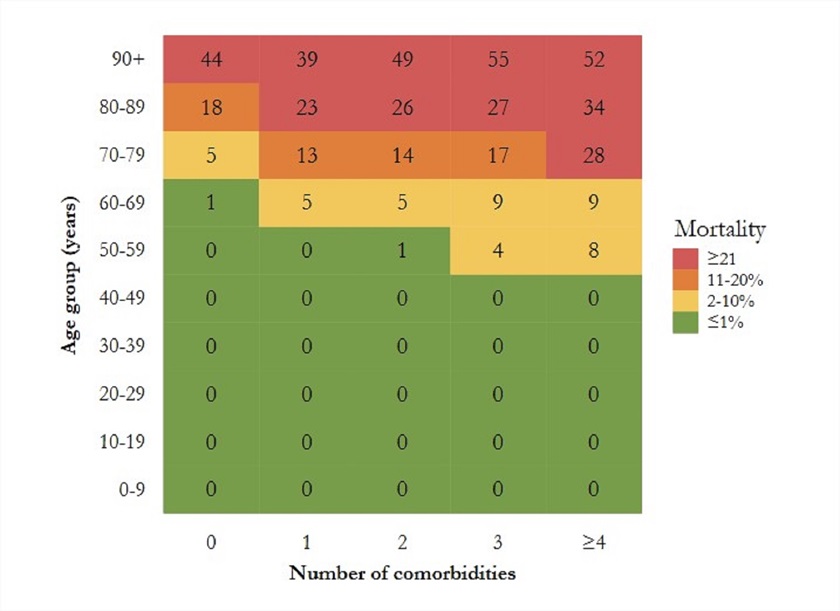

Danish info: VISION OF THE CASE: Virtually all chronic diseases significantly increase the risk of a serious COVID-19 course. The same goes for high age, severe mental illness and abuse of any kind. This is the conclusion after the first major systematic mapping of the risk profile of the Danes who have been hospitalized or died of coronavirus.

-

Update: Faroe Islands: Faroe Islands had the last case of Covid19 the 8. April. Since then it has been Corona free. A total of 187 got infected. None were admitted to intensive care. None died. Iceland: Iceland is really interesting because they have tested the general healthy public for antibodies as well as the regular testing. If we assume 0,9% of Icelanders got infected (seems conservative) that is 3276 cases. Covid19 deaths = 10 Mortality rate = 0,3 *Iceland had 1806 confirmed cases. 1794 have recovered. Last infection was on 12. april. Denmark: Denmark just released some Covid19 related numbers. None under 50 years of age has died. None under 60 years without comorbidity has died. 3/4 of mortalities were over 75 years. Average mortality age is 82 years. (Danish life expectancy is 81 years) In contrast 195 people between the age of 15-64 died of the regular influenza last year. 9 children under the age of 15 died as well from the regular flu last year.

-

Isn't that more or less true of any of his stock picks? SK can do whatever he wants obviously --- it has no bearing on what I invest in. Having said that -- I don't mind seeing well respected investors buying into companies I own. It might be (further) evidence that my ownership has some merit! Agree --- GOOG and FB were a lot cheaper a few weeks back.

-

Press conference with the Danish Prime Minister Some of the highlights: -Social distancing is working. Normal flu is more or less non existing. -Number of infected people has risen slower than expected/feared. -Expecting to gradually open up in about 2 weeks. Though emphasizing that the problem hasn’t gone away and social distancing is still needed over the next 2 weeks. -The virus still hasn’t topped - worse is yet to come. -Virus not going away. Expectation/strategy: more and more people will get the virus and become immune. -A LOT more testing. Two kinds of tests: 1)Are you infected with Covid19, 2) have you had Covid19 already.

-

Better (the best in the world?) data on Iceland --- and its results: https://www.youtube.com/watch?v=d6MZy-2fcBw&feature=youtu.be&t=736 Article on the randomized testing in Iceland: https://www.lesswrong.com/posts/68ZG5SYcRQ5q8F7QR/iceland-s-covid-19-random-sampling-results-c19-similar-to The official stats (not the randomized test): https://www.covid.is/data

-

John Hjorth, I am not making any judgements. Just reporting. It's going to be very interesting seeing how things progress in Sweden and Denmark... If in 2-4 weeks there is no mortality difference between the countries - what then?

-

If you are ramping up testing and especially focus on people with symptoms and people who might be infected, you are going to see exponential growth, no?

-

https://www.kinsahealth.co/social-distancing-and-its-effect-on-reducing-the-spread-of-illness/

-

Low or mild levels of influenza-like illness all over USA (trending down) https://healthweather.us/

-

Denmark vs Sweden: lockdown vs open In Sweden, the number of deaths per million stands at 11, while it is 12 in Denmark. But there are relatively more Swedish patients in intensive care, so these numbers could change over the next coming days…

-

Norway: 1,59% of population tested - 85.136 Infected: 4.265 Died: 26 - case fatality rate: 0,6% Average age of victims: 84 % of infected 80 years and older: 4,9% --> locking down countries vs protecting the elderly/vulnerable? Life expectancy in Norway: 82,5 years.