doughishere

-

Posts

1,190 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by doughishere

-

-

Great game, Scott. Thanks!

Excerpt from the players guide:

(4) TAX STRATEGIES. In Wall $treet Raider, as in the real world, income taxes can take nearly half, or in some cases even more than half, of a company's profits. Thus, if you can reduce the taxes you or your companies pay, that can greatly increase your after-tax profits and your personal net worth.For corporations, note that a company that has a large amount of tax loss carryovers (from losses it incurred in prior years) can be an excellent company to use to make profitable investments, either in business assets or in stocks of other companies. For example, if you own Company A, which has large tax loss carryovers, you might have it merge with profitable company B, or buy up at least 80% of the stock of Company B, which will become a subsidiary that can report its taxes on a "consolidated" basis with A.

For example, assume Company A has tax loss carryovers of $1 billion ($1000 million), and the tax rate is 50%. If Company A earns zero on its assets other than its holdings of Company B, and Company B earns $300 million in the next quarter, Company B would "pay" Company A $150 million (its share of any taxes Company A might owe), but Company A would pay no taxes on its consolidated tax return, because of its large loss carryover. So Company A's loss carryovers would entirely shelter the earnings of its 80% or greater subsidiary, Company B.

Link to the online tutorial: http://www.roninsoft.com/tutorial.htm

Demo/Download Page: http://www.roninsoft.com/download.htm

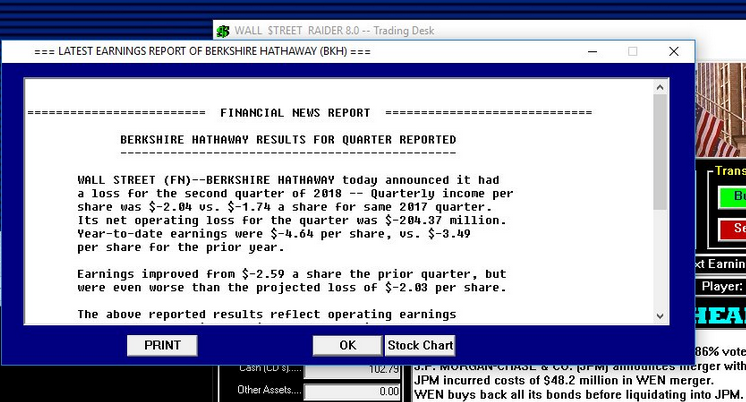

Attached is a screenshot. Warren and I are going to need to have a little discussion later.

Edit: Video list of some gameplay.

-

sears :(

Masochist?

Aspiring bagholder. Couldn't think of a faster way. :-[

You could always lever up with margin :-\

The analyst from Cowen called it a "highly levered play on SYW." If you buy on margin does that make it a 2x ETF on Eddie Lampert?

-

sears :(

Masochist?

Aspiring bagholder. Couldn't think of a faster way. :-[

-

sears :(

-

Joshua 10:25

hallelujah! Praise the one they call mnuchin!

-

investorG, here have a cup of coffee and a cookie and why dont you share with us your gse related feelings first? /s

-

maybe y'all should all start a fannie and freddie therapy support group? You know for the emotional suffering. /s

-

Great article, good for Adam!

-

So we have Mnuchin mentioning that he expects tax reform to be passed by Congress in August (bill introduced prior to then, so 4 months tops). We know that corporate tax reform will be a part of that. And we know the hit on DTA's for Fannie/Freddie would cause a draw. Trump recently signed an executive order stating no more bailouts so avoiding a draw is important to Trump. We also know the gov't. has a shade under 80% warrants and would make a ton of money on GSE reform that also benefits shareholders.

Carson said housing is involved in the infrastructure bill that they are currently working on. We know housing accounts for 20%+ of the American economy and any reform to housing, for any realistic person, has to deal with the Fannie and Freddie issue. It is also going to cost about $1 trillion for the infrastructure plan (partially offset by the gain in warrants that Treasury sells once they appreciate).

We also have Calabria saying that a framework is coming "within months." (could be 2 months, could be 11 months, or anywhere in between)

Now we're hearing that both infrastructure and tax reform bills might be advanced simultaneously. Introducing both bills simultaneously has deal and compromise written all over it... good 'ol politics. It also seems this will happen within 4 months given Mnuchin's quoted timeframe on tax reform, infrastructure being advanced simultaneously with tax reform, and Calabria's stated timeframe. Couple that with so many people in Trump's camp leaning in a GSE-friendly direction. I know the market disagrees with me, but man this seems like a very attractive investment at current levels (at least the prefs).

Report: Trump wants to move tax reform, infrastructure together

What does trump do.....say hes going to do something. Fail at it. Then set even loftier goals?

-

What was the last favorable outcome for plaintiffs? I lost count at how many there were for them.

-

So after judges Millet and Ginsburg have convinced us that our company is not undergoing "liquidation", like a good corporate finance student I am trying to calculate the net present value of my equity FNMAT as promised in the prospectus (8.25% dividends unless called back at par, valuing it as a perpetuity). If dividends are turned on in future it will just be a delayed perpetuity and discounted further. I'm trying to do this to compare the best case scenario to alternative investment decisions, or to know what it is worth in case of a question of "just compensation".

NPV = Dividend/(r-g) where r is the discount rate and g is the growth rate (assuming zero growth rate, and beta =1 for a low risk utility)

Using Professor Aswath Damodaran's discount rate teachings, Discount rate = Risk free rate + Equity risk premium*Beta = 2.39%+ 5.39% = 7.78%

NPV = 2.06/0.0778%

= 26.51

Thoughts?

EDIT: based on this valuation and revaluing it as an option, markets are giving 27.7% chance of this working out. That is a mispricing with the changing narrative

Best valuation I've seen tbh

-

Is there a specific thread that focuses on just the company...either in here or Investment Ideas?

-

-

Cooper: "We are continuing to evaluate the implications of yesterday’s decision, but at a minimum, it certainly strengthens our conviction that the Net Worth Sweep amounted to a taking of property in violation of the Fifth Amendment."

Sounds like Custer's Last Stand.

Sounds great but they could also be talking their book. Do you really expect them to come out and say the opposite? haha

True

Sounds like Custer's Last Stand.

-

We bought Exxon as a cash substitute.... because we thought Exxon was better than cash over the short term.

-

something is up. if you recall during mnuchin's hearing, he said at one point "i havent looked into it" in answer to a detailed question on GSEs. now, cohn says mnuchin has done alot of work on it. this is an administration that is all about action

Let's remember, Mnuchin said he hadn't looked into the legal issues. He could easily look at NWS and think "I don't like it, I'm going to end it" without technically looking into the legality of it.

Mnuchin: "I have divested my interest in the fund as well already. My job is to look out for best interest for taxpayer, maintain housing liquidity, whatever the legal issues are I haven't studied that at all."

http://www.reactiongifs.com/wp-content/uploads/2013/06/iceman.gif

-

"We are going to do things that I said we were going to do, and we are going to take care of a lot of people that were mistreated by government for many, many years." Trump, 1/26/2016

Im sure he had Fannie and Freddie shareholders first on his mind. /s

-

Pagliara vs Freddie Mac voluntary Motion to Dismiss

-

mnuchin will divest paulson advantage interest w/in 90 days of confirmation: http://online.wsj.com/public/resources/documents/Mnuchinletter01112017.pdf

Maybe this will be done in 90 days then. Not holding my breath.

-

-

Link to 2016s: http://www.cornerofberkshireandfairfax.ca/forum/general-discussion/your-2016-best-ideas/

I'll start.

I think Cash might be my best. Fannie and Freddie Prefs have some room to run also.

-

NFP that I use to mentor for. They take inner city kids in Chicago and put them in private schools. 100% of the kids go to college.

December 30 is Eve of Eve at Union Station Merchandise Mart. Great time!! Ive gone the past 5 years but wont make it this year.

http://www.highsight.org/site/epage/106996_961.htm

-

I would ask, What stock have you held for the last 15 years?

-

Who's ready

https://www.archives.gov/federal-register/electoral-college/key-dates.html

December 19, 2016

The Electors meet in their state and vote for President and Vice President on separate ballots. The electors record their votes on six “Certificates of Vote,” which are paired with the six remaining Certificates of Ascertainment.

The electors sign, seal, and certify six sets of electoral votes. A set of electoral votes consists of one Certificate of Ascertainment and one Certificate of Vote. These are distributed immediately as follows:

one set to the President of the Senate (the Vice President) for the official count of the electoral votes in January;

two packages to the Secretary of State in the state where the electors met—one is an archival set that becomes part of the public record of the Secretary of State's office and the other is a reserve set that is subject to the call of the President of the Senate to replace missing or incomplete electoral votes;

two packages to the Archivist—one is an archival set that becomes part of the permanent collection at the National Archives and Records Administration and the other is a reserve set that is subject to the call of the President of the Senate to replace missing or incomplete electoral votes; and

one set to the presiding judge in the district where the Electors met—this is also a reserve set that is subject to the call of the President of the Senate to replace missing or incomplete electoral votes.

December 28, 2016

Electoral votes (the Certificates of Vote) must be received by the President of the Senate and the Archivist no later than nine days after the meeting of the electors. States face no legal penalty for failure to comply.

If votes are lost or delayed, the Archivist may take extraordinary measures to retrieve duplicate originals.

Wall Street Raider

in General Discussion

Posted

Market crashed 20%. Black January (2017). Berkshire Stock fell to 1/3 its high price (about 70% bv). High was way more than book value. I wanted to short the stock (using options) but the Feds disallowed shorting to "Stabilize Markets." So in Feb. I bought a 4% stake (at about 70% bv).

Year later, stock doubled and Berkshire got bought out. I voted against, the business was turning(stock portfolio of Geico, Coke, Gillette and BNI held up well) plus it was not accretive the other company was levered up, and some how it passed. :(

Took the proceeds(sold the 4% which became about a 2% stake and paid taxes of about $15m) started my own holding company. 100% owned by me. Put the minimum in to incorporate, they took 10% of the top then contributed capital to the biz for the remainder of my net worth. Named it Weyland Industries (Ticker: WI).

One attachment is the main screen and a visualization of the company I just created. The other is a screenshot of Berkshire Hathaway's Stock and Bond Portfolio screen from the game.

Edit: Ohh one thing i wanted to clarify...the Berkshire Hathaway(A) in "this" post had a much different "profile" than the Berkshire Hathaway(B) in the above post. The game upon restart "loads" different metrics(portfolio values, earnings metric, ....yaddda). So I was lucky that this game had a stock market with super high valuations and that it crashed right soon after i started. Being in January 2017 was just the month the game started.

Each new game is essentially "unique" upon startup. But borrows heavily from the "real world"(ie...Berkshire Hathaway owns KO stock).