Peregrine

-

Posts

555 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Peregrine

-

-

And just like that, FT deleted their original story. Pretty slimy if they put false speculation out there to benefit some shorts.

-

12 minutes ago, KJP said:

Wow. I wonder how much of this is being manipulated by the short and distort artists.

-

2 hours ago, Dalal.Holdings said:

Re Juiciness: explain why Dimon is taking a victory lap on this if it’s really “$10B more than they should have” on positive tangible book and earnings impact on JPM…

Here’s the problem: a quick receivership and sale via giving JPM a good deal increases the probability of future bank failures. So, while quick receivership may have lowered the cost of FRC’s failure to the FDIC, it may have increased the number of upcoming failures that the FDIC will have to deal with.

If banking sector consolidation is to occur, now it’s best for the acquirer to let the FDIC take it under and take on losses on their behalf.

The FDIC has set risky precedents here: that a bank in receivership is more attractive to a buyer than a bank that’s alive. And also that all depositors will be saved. They may have also caused a discounting of bank common/preferred equity and corporate bonds given the increased risk of these getting zeroed out (which hampers the ability of banks that are still around to raise capital). These are precedents that may prove very expensive to the depository insurance fund overall, more expensive than a slow wind down of FRC and SVB.

Re: juiciness

Because FRC is worth more to JPM than simply the market value of its loans.

Re: quick receivership

I don't see how this was at all rushed. FRC lost nearly all its deposits within a few weeks' time and was given nearly a whole month to find a private solution. And when it couldn't, this bank tried brinksmanship tactics by threatening its suitors that if they didn't save it the costs would be worse.

You really think the FDIC should let this bank operate with no deposits of its own and negative NIM and generate losses for the foreseeable future?

-

1 hour ago, Dalal.Holdings said:

The key question—did the “sale” occur on similar “juicy” terms as SVB and FRC? No, because Sheila Bair actually had a spine and worked to minimize losses to the deposit insurance fund. With the current admin, there is no such effort.https://www.ft.com/content/b860ebb6-f202-4ec6-a80c-8b1527c949f4

"Juicy" terms? Based on FRC's own FV marks, JP Morgan paid $10 billion more than they should've to the FDIC! The longer it goes on, the worse the bid the FDIC gets. And the longer it goes on, the more desperate FRC gets.

Back during the S&L crisis when probably more than a half of S&Ls were zombies and operating with negative equity, S&Ls kept upping the ante in raising deposit rates and driving further down the credit spectrum in a desperate bid to become viable. Needless to say, this is not good for the financial system.

-

Rapid receivership and sale happened all the time during the S&L and GFC crises, especially when a bank lost deposits at the rate that Signature, SVB and FRC did. Without rapid receivership and sale, the cost to the FDIC would've been a lot greater in all likelihood. The longer it goes on, the worse for the FDIC and the worse for the financial system.

-

It's kinda funny how posters in this thread somehow forgot that FRC was mark-to-market insolvent and based on their own FV marks, no less. They couldn't hold on to their deposits, which forced them to get high cost financing, which turned their bank upside down. The regulators didn't do that to them - if anything, they helped them.

If there were no visible hand, this bank would've gone down a lot sooner and everyone owning the capital stack gets zero'd a lot quicker.

-

15 minutes ago, mcliu said:

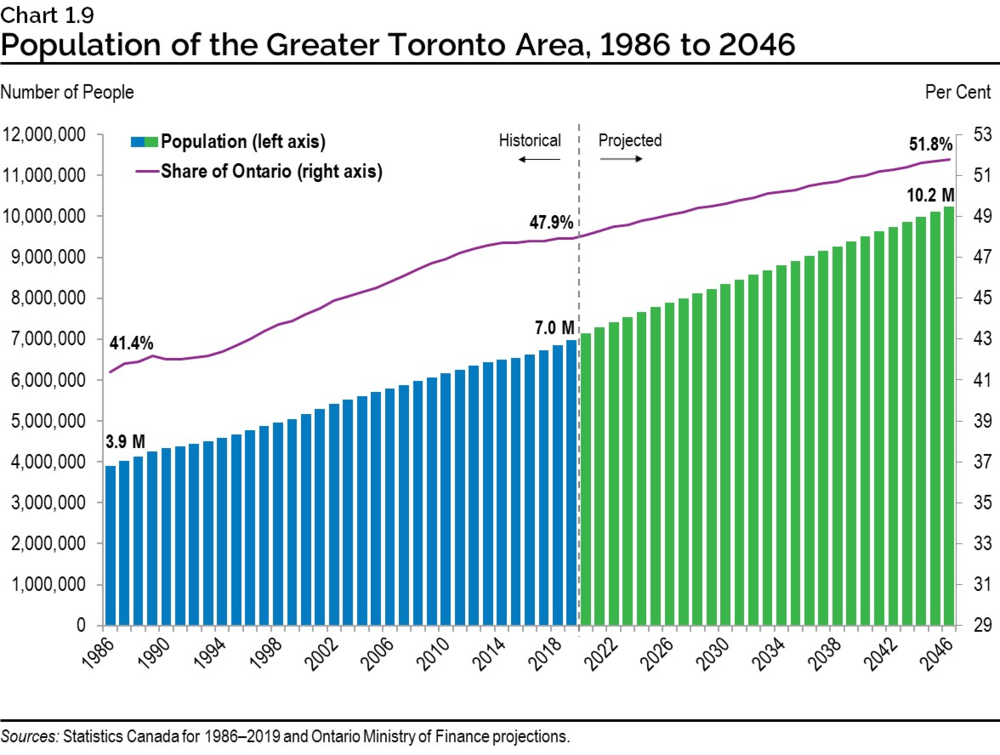

That number's from 2019. The 2021 census had the GTA at 7.3 million. With over 1 million new immigrants in Canada last year alone I have to imagine that the 2023 census is close to 8 million or above that. Not to mention that with urban sprawl what qualifies as GTA should be broader encompassing than the official definition.

-

The GTA probably has a population that's around 8 million now, on par with New York City. I remember 20 years ago when they had less than 5 million. I think it's surely the fastest growing developed city in the world. Combine this with housing NIMBYism and a public transport system that hasn't budged and it's really unsurprising why housing prices are what they are.

The Tier 1 cities in China have the same problem with housing prices and they don't have the NIMBY problem because the state owns all the underlying land.

-

2 hours ago, maplevalue said:

Just Ontario that has this https://toronto.citynews.ca/2022/06/29/ford-government-caps-rent-increases-2023/. Honestly I doubt there is much pushback since Ontario govt just won a majority and 2.5% is peanuts compared to what it 'should' have been (5.3%).

What I meant was that landlords will push back.

-

On 6/25/2022 at 7:14 PM, SharperDingaan said:

Rents are dirt cheap, and the annual rent raise is capped in most places. As most include property tax, mortgage, and condo fees; inflation cost > rent raise is eaten by the landlord. A non issue a long as the landlord has turnover, if not - the landlord needs to sell. Rates of your floating rate mortgage rise > 150bp over 3-6 months, and you're f*****.

However, rents are rising rapidly. If the place you live in is sold, your rental deal is off if the buyer is a family that actually wants to live in the place. Not unusual for the displaced to find that the rent on their new place is 2-3x higher than it was on the old. Sticker shock, mostly because the old rent was artificially low.

SD

Well, the feds just pushed the annual rental increase to 2.5% and I suspect that there will be a lot of political pushback against that number given where inflation is.

-

One more thing that deserves mention:

The speed of the housing decline. The 20% decline from peak to trough in Canada in 90s took place over the course of 7 years. In the US GFC, a 20% housing price decline from the peak took barely 2 years. I think this clearly was the effect of a huge amount of foreclosures or homes from distressed sellers that flooded the market with housing supply. And why were there so many foreclosures? It came from insanely lax mortgage rules that fueled a massive homebuilding boom that took the US a decade to recover from.

As mentioned before, Canada's big housing problem is a lack of supply. I doubt that a huge number of homes suddenly come on market even if arrears rates kick up substantially.

-

Some more interesting data:

Canada prime rate:

1972: 6%

1981: 21%

Canada housing prices indexed to 2010 at 100:

1972: 39

1981: 52

So during the time frame when the prime rate more than tripled, housing prices went up 33%.

The real downturn was from 1989 to 1996 when prices fell 20%. And this was during a period when prime rates fell from 12% to 5%. Seems like housing prices are more correlated with unemployment than anything else.

-

22 hours ago, alpha said:

I don't think you can compare the 2 markets without factoring in a bunch of issues like: immigration rates, vacancy rates, building codes, property taxes, landlord/tenant laws, financial regulation/ money laundering laws, environmental laws, government lending programs, etc... pretty much all of these factors favor higher housing prices in Canada. I can't comment whether the valuation should be 2 times higher but currently there is definitely a supply/demand imbalance for housing in Canada.

Yeah. I'm not sure there's as much meaning in this as there is in "US healthcare is 2x as a % of GDP as Canadian healthcare".

-

1 hour ago, Viking said:

We really do not have very good information in Canada on what is really going on with housing. I think it is pretty clear that lots of first time buyers are getting the down payment from parents/family members. Where are these people getting the $ from? Perhaps a home equity line of credit? Is this kind of borrowing increasing? How do rising interest rates affect those borrowers? Would this debt show up in mortgage numbers?There's $200 bn in HELOCs in Canada, compared to $1.6 trillion in mortgages outstanding. I think that average balance might include HELOCs, though I'm not sure.

-

16 minutes ago, Spekulatius said:

As for the GFC, my comparison is just alluding to the fact that the average homeowner during the GFC didn't really have a problem with their mortgage.

Canada situation is different than the US during the GFC, but that does not mean that homeowners buying now in Canada are not stretched. Its the reset in interest rates that could become a problem in addition to the high prices. I would love to see an analysis that states how homeowners that bought the last few years in Canada will do if their mortgage payment doubles, which is possible if he trend in interest rates persists.

If you're saying that most mortgagors didn't default in the GFC then you're correct. Of course, if over 50% of mortgagors default, the world would be over. Non-performing rates on US mortgages peaked at 10% and that was enough to bring about the worst recession since the Great Depression. Same metric in Canada never peaked above 0.7% or something.

-

4 minutes ago, Spekulatius said:

There were ~2.8M foreclosures in 2009 and there are 120M households in the US. The average homeowner did just fine during the GFC. What percentage of homeowners did default during the GFC from 2008-2010? Maybe 6%? The average is almost always fine, it's those on the margins that are the problem.

Not all 120 mm households in the US are homeowners. And a very small percentage of homeowners are actually looking to sell in any given year. There were >4 million foreclosures from 2007-2011. It absolutely flooded the housing market (in some areas more than others) with supply that no one wanted and had a huge effect on housing wealth for years that was felt by pretty much everyone. Even prosperous areas like San Francisco saw prices down 25% from peak to trough in pretty short order.

Canada's housing problem is not an excess of supply but a dearth of it.

-

35 minutes ago, Spekulatius said:

So, that means the average homeowner will be fine. The average homeowner in the US was fine too in 2009. The problem is what is the mortgage for those homeowners in Canada that bought in the last 5 years and can they pay their mortgage if it resets to current interest rates or let's say 6% or 7%.

Average homeowner in the US was not fine in 2009. Poor underwriting started off as pretty marginal and very quickly became table stakes. Even conforming mortgages at F&F became awful. Mass foreclosures ensued because so many borrowers didn't even put on a down-payment, resulting in a glut of homes that suppressed home prices and killed home building for more than a decade.

Mortgage underwriting has only gotten more stringent in Canada. Borrowers need to qualify at a 2% higher rate than the contracted rate so some level of rate sensitivity is already baked in. But agreed that first-time homebuyers are most at risk.

-

It may surprise you, but:

Average mortgage balance in the US: $US 230k

Average mortgage balance in Canada: $CAD 200k

Canadians are just sitting on a lot more equity in their homes.

-

50 minutes ago, mcliu said:

Russian demands:

1) Neutrality

2) Crimea

3) Donetsk & Luhansk

Will Ukraine take the deal?

Certainly a positive that they're no longer seeking the ouster of their leadership.

-

9 hours ago, changegonnacome said:

+1

as above Ukraine though will be wrecked first by aerial bombardment such that its hobbled for a generation.....the price has already been paid by Putin...... sanctions, international condemnation.......logic dictates that Russia's full objectives now need to be completed & Putin will swiftly move to aerial bombardment, decide on a level of destruction he deems appropriate......& then come to the negotiating table to participate in diplomacy theatre where each sanction lifted is traded for some Russian de-escalation (that they would have done anyway cause they have no intention of staying). Macron/Biden will eat up every hollow diplomatic 'victory' as a sign of their 'strength' and 'statesmanship', cause they need it for their own domestic audiences but in reality they'll realize Putin is throwing them bones. He did what he wanted to do and nobody stood up to him.

If Putin is still rational, then he won't continue with this war any longer than he has to. Time is of the essence and he risks destroying the Russian economy if he prolongs this further. The West also has reasons to seek a negotiated peace ASAP.

-

1 hour ago, Spekulatius said:

I would seriously doubt that Lehman and a bear sterns failed because of short sellers. Lehman ran at a ~30x leveraged ratio going into the GFC with a lot of impaired assets. There was no way they could remain solvent. They were already dead, they just didn’t know it yet in 2008. Short selling has nothing to do with this.

It's liquidity that does companies in, not solvency. You can have the most well-capitalized bank possible, but they won't be able to withstand even 5% of their deposits leaving at a time.

Same for companies that require financing for working capital. There's a surprising number of non-financial companies that require short-term financing for the basic functioning of operations.

-

1 hour ago, changegonnacome said:

NATO membership, even the idea, is completely over for Ukraine……..this is the fundamental purpose of the Russian invasion………the West taught Russia was fucking around when it said Ukrainian membership of NATO was red line issue………well this is what red line issues look like……Russia backed up its talk and invaded the whole goddam country.

The same way the Cuban missle crisis was a red line issue for USA in the 1960’s……it wasn’t talk, they backed up with destroyers & the blockade in the Atlantic & nuclear missles pointed at Moscow

Russia has basically explicitly said that they're willing to go to thermonuclear war to prevent Ukraine from joining NATO. Do Western leaders really want to call to see if he's bluffing? That Ukraine joining NATO is not even remotely important enough to the West to even test that makes me optimistic that a successful negotiation can happen soon.

-

The most balanced take I've seen on this yet. From MSNBC no less.

This quote was on point: "It may sound cruel to suggest that Ukraine could be barred, either temporarily or permanently, from entering a military alliance it wants to be in. But what’s more cruel is that Ukrainians might be paying with their lives for the United States’ reckless flirtation with Ukraine as a future NATO member without ever committing to its defense."

-

22 minutes ago, changegonnacome said:

Ok lets take a step back here - two of those on your list of three (Russia, Iran).....are not on any expansionist trail, they dont have capacity to be truly expansionist in any real sense of the word even if they wanted to be.....China YES but not yet.........Russia/iran maybe bits of land or here there but come on.....quite the opposite everything they do is in regard to basic survival of the regime and their borders as currently constructed.....the Ukraine invasion at a base level is about a petro-dollar economy, in the age of decarbonization, that is strategically weak already but for sure to be weaker still in decades.......... re-asserting a buffer zone (Ukraine & Belarus) that was laid down after the fall of the USSR, implicitly blessed by the USA and the West as being strategically important for Russian security in the age of the EU/NATO.......I say these things not to condone what Putin is doing, he's a monster and pig........but he is currently acting rationally for someone who's alternative to be being in the office, is being dead......and was watching over the years the EU/NATO/USA moving further & further West into the agreed "NATO/Russia buffer zone" of Ukraine with overtures around them joining NATO etc. etc.

Nobody likes to say it - but Ukraine's role in life & in European peace and security (& indeed global peace & security) is/was to straddle the East & West while making the strategically weaker partner feel safe that they had some kind of buffer zone...Ukraine is/was a pawn in the balance of powers equilibrium game (ala Kissinger) that has kept Europe peaceful now for 75+ years until now.... The mistake was to encourage Ukraine to divert itself so completely towards pleasing or 'joining' the West & giving them some false sense that we would ACTUALLY support them in a conflict against Russia.....which in turn hardened their political stance in regard to Ukranian-Russian relations & negotitions in regards to Western Ukraine....this pivot to the West encouraged by the EU/USA was wrong IMO.

The end game for Vladmir IMO is to completely WRECK Ukraine over the next few weeks and months and then leave......such that whatever is left wont be joining ANYTHING anytime soon that might threaten Russian security........and Putin in 20 years time will die in the Kremlin Palace surrounded by friends, families and ass kissers with Russia's border exactly as they were when he took office. Its all a tyrant dictator in a strategically weak and weakening position could wish for and he's going to see to it that it happens and this is play.

Agreed with much of what you say here. Putin is dealing from a position of weakness and was perhaps desperate.

Not sure if Putin is doing this from a standpoint of self-preservation - I think the chances of a coup has gone up a lot since this act. And I wonder if he's no longer rational thinking. Did he need to resort to a frickin' invasion to ensure that Ukraine doesn't side with the West?

US Regional bank stocks - PNC Financial, TFS - Truist, USB- USB Bank, MTB - M&T Bank etc

in General Discussion

Posted

Looks like regulators finally waking up: https://www.reuters.com/markets/us/us-officials-assessing-possible-manipulation-banking-shares-source-2023-05-04/