oscarazocar

-

Posts

125 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by oscarazocar

-

-

The part on Musk's algorithm for operating companies is very good. The algorithm, plus his raw intelligence and intense focus, are the reasons for his unusual success.

https://medium.com/@alastairallen/the-musk-algorithm-c241d9d0ee3d

-

15 minutes ago, blakehampton said:

Buffett said at an annual meeting that most of his money came from a dozen good decisions or so. Does anybody have a good list of those 12? I can think of a few but I’m missing some:

- Apple

- Coca-cola

- Gillette

- Amex

- GEICO

- Cap Cities/ABC

- The Washington Post

- Wells Fargo

- See’s Candies

I also think it might be interesting to rank them by impact but it sounds like quite the challenge.

National Indemnity, See's, Buffalo Evening News, GEICO, Scott Fetzer, hiring Jain, KO, AXP, Mid-American, BNSF, AAPL.

Scott Fetzer is a very underrated acquisition. Berkshire paid $235m net in 1986, took out $244m (net income = FCF) in first 5 years, $309m in next 5 years, and in year 11 earned $82m net, with Scott Fetzer segment at $32m net income (peak), Kirby at $39m (peak) and World Book still earning $10m. The entire thing did about 24% IRR with minimal leverage. All that cash went into equities and other businesses at attractive prices between 1986-2000.

-

17 hours ago, ValueArb said:

Just came across Apogee Enterprises (APOG). A "leading provider of architectural products and services for enclosing buildings, and high-performance glass and acrylic products used in applications for preservation, protection and enhanced viewing". Last decade has grown revenues at a decent clip (7%), while growing profits at a higher rate (10% ish). Dividend yield close to 2% while it has retired about a quarter of its shares over the last 6 years.

This doesn't meet my purchase criteria (its not a net-net) so I stopped my research there, but mr market is offering it at a 10 PE for those who like this kind of thing.

APOG has a great niche business, the Large-Scale Optical segment, that makes coatings for picture frames and is very steady and highly profitable. It is different in character than the rest of the APOG businesses, less cyclical, and provides ballast if the main business has a big down cycle.

-

The SEB repurchase wasn't just from a "major shareholder group", but the Bresky family which still owns over 73% and has controlled and run the company for many decades.

It's a very odd transaction. Why would they sell a huge block at such a large discount to tangible book value when the stock has traded above that level for many years? Presumably they would get a decent premium to tangible book value if they sold the company outright.

-

I recently came across the Tsai Capital 2023 Q4 letter on Reddit, turns out that the manger, Chris Tsai, is the son of one of the 1960's Go-Go investing OG's, Gerry Tsai.

https://tsaicapital.com/files/Tsai-Capital-Annual-Investor-Letter-2023.pdf

https://www.nytimes.com/2008/12/28/magazine/28wwln-tsai-t.html

-

18 hours ago, Munger_Disciple said:

I don't know much about the location of these builds; could be in very underserved areas with little competition. In general, the "good' locations" for overbuilds get decent numbers initially, and incrementally returns get harder and harder after the initial uptake. This is especially the case with an incumbent.

Returns on fiber/broadband investments hugely depend on competition or lack thereof. As others have mentioned, if you are in an area with 3 or more providers, returns will be terrible. If you are the only option or there is one other mediocre compeitor, returns can be very good.

Allo focuses mainly on small towns where they think they can have a high market share. Click below and you and see the places they are. It's mostly small towns in Nebraska like Kearny, Crete, and Gering. This is not competition central. They went into Lincoln because Spectrum (Charter) had a terrible local reputation and, as mentioned, I believe they got a good deal with the city who wanted competition in the broadband market.

https://www.allocommunications.com/communities-that-want-allo/

-

49 minutes ago, Munger_Disciple said:

It takes a long time for a new entrant to get anywhere close to 50% penetration (if ever) and that time dramatically reduces IRRs. It took CHTR & CMCSA more than 25 years to get to 50% penetration in broadband when they were monopolies for high speed internet & already had a customer relationship thru' cable video & phone. The new entrant has to fight for every sub against an incumbent who is offering an equivalent broadband service plus cell phone bundles. It is a very tough fight & I think you will see most overbuilders go under or sell to the big boys.

I used to think overbuilders were the biggest threat to incumbent cable but it turned out the real threat came from FWA despite its far poorer service and that appears to be moderating. The reason for the initial uptake of FWA was the bundling with cell phones IMO & lack of mobile traffic on 5G bands (no longer the case).NNI has disclosed Allo metrics over time and the penetration has been reasonably impressive. In 2017 they had 71k passings and 20k households served for 29% penetration, then ramped up and by 2020 had 150k passings and 59k households served for 40% penetration. I spoke with them several years ago and they indicated they would hit their financial targets with 50% penetration and in the 2022 letter they indicated results are ahead of initial underwriting expectations. My guess is that their Lincoln deal was probably a pretty good one given their long-time presence and deep connections there.

-

4 hours ago, LearningMachine said:

I remember some of the cable investors have mentioned in the past how laying fiber doesn't make economic sense in today's high interest rate environment.

The core message I took away from that discussion was that fiber pays at best only about mid-single digit unleveraged yield, and that doesn't make sense when interest rates are higher than that. @Spekulatius, if memory serves right, I think you might have been one of the participants in that discussion.

I see people buying NNI and BOC where they are allocating capital towards fiber install.

Can we jointly figure out what is the unleveraged FCF yield range on laying out fiber?

NNI is not really allocating much capital towards fiber. They invested $450 million in capex and net losses in Allo (their fiber business) through 2020, then in late 2020 sold a majority stake in the business to a private equity firm (SDC) for $260 million and retained $130+ million in preferred stock and 45% equity interest (at the time valued at $129 million), so they took out most of their invested capital. They have contributed minor amounts since, including $8 million in 2023 Q1, but Allo raised debt to fund its growth going ahead and I think there will likely be minimal future capital conributions.

-

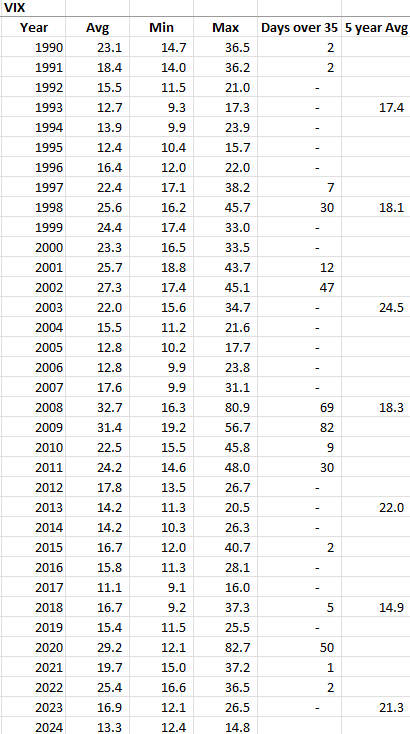

My understanding of the actual mechanics is crude, but I believe that the quoted VIX index is based off an expectation of forward 30 day market volatility derived from option prices, so it's not definitionally impossible for it to differ from market prices if you had odd and systematic behavior in the options market.

Practically, I think this only happens in single companies or other, more narrow indexes. If someone was systematically selling options or CDS in huge amounts, you might see a volatility number that is artifically low (and which in turn, might present a great buying opportunity). I recall that Berkshire CDS has seen some beavior like this at times in the past. In terms of the CBOE VIX, I think the market is too big to see an impact.

-

That's just looking at the history on a spreadsheet, not terribly complicated and available to anyone with Excel and Yahoo Finance.

I have no idea if someone is manipulating VIX. I am skeptical, it sounds like one of those stories that people like to tell themselves. If you look at the numbers, nothing is terribly out of line from history. I first started looking at this a few years ago after reading something about how low VIX was and how it was being supressed, and it turned out the 5 year avg was actually a tick above the long-term average.

Weird behavior in what are essentially volatility indexes is often a sign that a big player is doing something dumb and suppressing the market. More or less, Nick Leeson blew up Barings in 1995 and you had the London Whale losses at JPM in 2012 from players making big dumb bets, and in both cases smart operators caught wind and bet against it. In terms of the VIX market itself, my guess is that it's too big for that kind of manipulation, but probably does move over time based on systematic behavior by market players.

In terms of how I look at it, it's an effective and crude rule of thub. When VIX is over 35, it's not a surprise why, people are freaking out about something and markets are tanking. I picked 35 because it matches up almost perrfectly with my bottoms-up view of good buying opportunities over the last 20 years. GFC in 2008/2009, Europe panic in August 2011, briefly in late 2015, Christmas Eve 2018, Covid in spring 2020, Russian invasion in spring 2022. In that period, I have never seen markets tank without VIX reacting in the way you would expect.

-

14 minutes ago, blakehampton said:

The VIX has seemed to hug twelve forever now, besides that whole Silicon Bank fiasco last year.

That's an interesting way to think about it. Owning 10-20 1% positions just so you can soothe that drive to be active.

VIX hasn't closed below 12 since November 2019. It hit 26 in March 2023 and 21 in October 2023. For 2023, VIX averaged 17. It was over 35 for 1 day in 2021 (Jan 27) and 2 days in 2022 (March 7/8).

Fortunately, if you are a non-institutional investor, you can usually buy a full position in a day of most liquid stocks.

Anyway, setting a rule like this is one way to take the pressure off - it's an external signal that tells you, "Don't worry about buying anything today, better opportunities will likely come along". Sure, you can end up waiting 5 years like 1992-1996 or 3 years like 2012-2014, and of course there are sometimes great opportunities in parts of the market when VIX is low, but as simple rules, I've found it hard to beat.

-

17 minutes ago, backtothebeach said:

+1

Pretty much what I figured out about 5 years ago. Only two steps, with an optional third:

1. Buy Berkshire and/or other reliable compounders when they are relatively cheap.

2. (optional) when they are really really cheap add a little leverage, take off leverage when they seem slightly expensive

3. Do nothing

Questions to figure out: Which companies are compounders? Which are reliable? What yardstick to use for "cheap". Not too hard for Berkshire. Or even the S+P500 if you happen to catch it in a bear market.

Sadly that is boring AF, so I have not been able to stick to only these. Getting better at it though.

An approach that I have seen that seems to work pretty well for portfolios like this is to build up a group of larger positions in high quality companies over time (say 5-10% positions for 80-90% of portfolio) and then have 10-20 1% positions in other stuff. I heard Bill Miller mention this approach years ago, as he had the same problem of getting bored. The smaller stuff keeps you occupied and active and perhaps makes it easier to wait until a fat pitch comes along. Another rule would be not to take a bigger position unless the VIX is at some predetermined level, say above 30 or 35. It is remarkable when you look back how closely VIX above 30 correlates with stocks being cheap. You can see the daily price history of VIX on Yahoo Finance going back for decades. Pretty much anytime something like BRK was really cheap, the VIX was at those levels, with two notable great opportunities in BRK being in August 2011 and May 2020.

-

Haghani was one of the founders of Long Term Capital Management (LTCM) and one of the key players there. He is featured in Roger Lowenstein's excellent book.

https://www.amazon.com/When-Genius-Failed-Long-Term-Management/dp/0375758259

-

According to the 1986 prospectus, Gates owned 44.8% of MSFT after the offering. Paul Allen owned 24.9% and Ballmer owned 6.9%. Ballmer has sold a few chunks over time but has retained over 2/3rd of that original stake as per last report of his holdings in MSFT proxy in 2014.

https://www.begintoinvest.com/wp-content/uploads/2018/03/Microsoft_prospectus.pdf

-

18 hours ago, ValueArb said:

Nate's oddball stocks newsletter is only $600/year, which isn't too bad if you want to work this space full time. Its unclear to me if he's still publishing though, I didn't see any 2023 newsletters on his site.

I don't think Walker manuals has been published since 2006 that I can find, but the good news is otcmarkets.com is free and it does a pretty good job of linking to latest financials from dark companies if they are available.

Oddball newsletter came out in Jan/Mar/Jun/Aug/Nov of 2023, 5 issues.

-

17 minutes ago, gfp said:

Why do you folks think Ron Olson has a several billion dollar net worth? That would certainly be news to me.

Olson's publicly filed/known holdings are $88 million in Berkshire Hathaway stock.

-

37 minutes ago, Cigarbutt said:

-From the role of luck to present appreciation for civilization and to the need to soldier through (with a bit of "luck"?; my children call this blind optimism)

Mr. Munger recently commented on the % success rate to treat child leukemia (from 0% to 90%+) and associated this 'progress' with civilization.

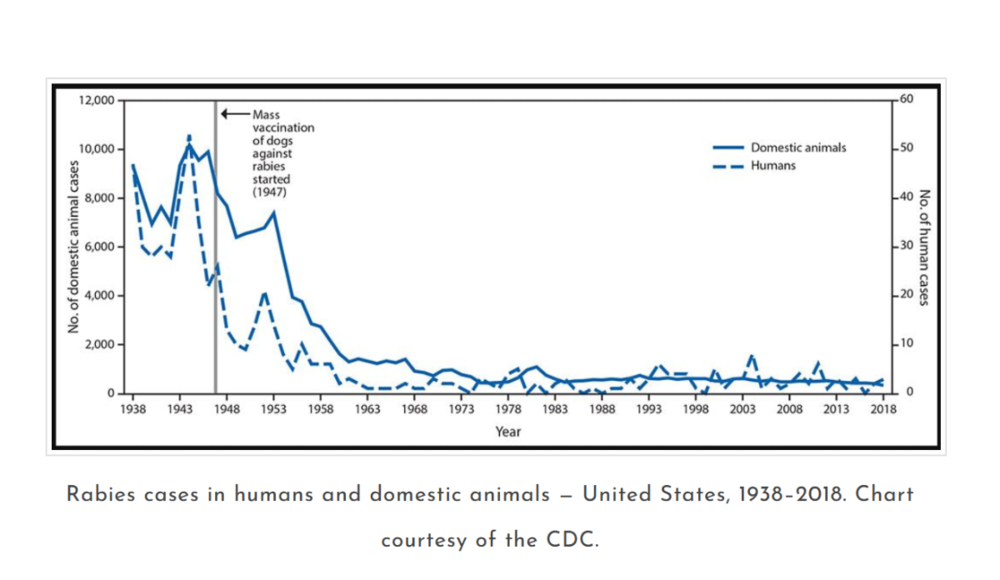

In 1931, being bit by a stray dog infected by rabies was essentially a death sentence.

The US eradication of the rabies canine variant has been a amazing success arising from civilization (collaborative effort; policies such as stray dog 'management', rational application of science etc).

All his life, he wondered.

If there is a Good Place, then Dr. Donald Pinkel has the penthouse suite. He passed away about two years ago. Dr. Pinkel more or less single-handedly revolutionized treatment for pediatric Acute Lymphoblastic Leukemia (ALL), pushing against many who told him it was pointless and that attempting to cure it would only give false hope to families. At the time he started, the survival rate for pediatric ALL was 0% and it is now 95%+. It wasn't some magic bullet, just assiduous tinkering over many years. I believe that Teddy Munger died of ALL.

Here is an excellent obituary from 2022.

https://www.nytimes.com/2022/03/12/health/donald-pinkel-dead.html

-

8 minutes ago, CorpRaider said:

What happened to them ETFs?

What happened to that other long thread on Pabrai cataloging his various shenanigans over the years? Was it taken down for some reason?

-

He posted on Silicon Investor extensively back in 2000.

-

9 hours ago, Xerxes said:

There you go:

The back end of the episode on GE, starting mark 42 minute, where he talks about Zaslov and Brian Roberts. Something to do Reverse Morris Trust requirement that ends in April 2024.

The World According To Boyar Podcast - Value Investing Podcast (boyarvaluegroup.com)

Warner Brothers and Discovery merged in a Reverse Morris Trust transaction in April 2022 and there is basically a two year period until they can do another tax-free merger. As I recall, a Reverse Morris Trust transaction is one in which a public company spins off a division and merges it with another company, with the spun-off piece owning greater than 50% of the new entity. Liberty has used these type of transaction a few times over the years.

-

-

1 hour ago, Spekulatius said:

I am not sure where BHE is held, but suspect it’s at the insurance level as well. However, if it is were possible to spin BHE it would make the least sense because BHE has so much depreciation that they have a negative income tax rate, meaning they reduce taxes for the rest of Berkshire as long as they belong to the conglomerate and would lose those tax credits if they were stand-alone. I think BHE is actually the least likely part to be spun off.

I think the easiest so spin off would be the large minors stakes that also present some deadwood like KFC or maybe even KO. They are not controlled by Berkshire, so Berkshire could sell them off, as ai think they are more or less sentimental holdings in WEB coffee can portfolio and unlikely to outperform in the future,

It would be very hard to dispose of those equity stakes with paying taxes, which is a big part of the reason they aren't sold. Berkshire was able to dispose of its Washington Post and Proctor & Gamble stakes through cash-rich splitoffs a little while back, but those are tricky to do and the stars have to line up.

-

23 hours ago, CorpRaider said:

Oh I was just joking, it's an old talk on youtube to DU students and he talks about levering up $T stock on margin. He doesn't really talk about anything substantive w/r/t $T.

I think this is it:

Edit: Whelp, I got filled. I think I'm going to puke.

There is a good book form 2005 called The End of the Line on AT&T's big move into cable with the purchase of TCI and MediaOne in 1998. There is lots on John Malone in it.

https://www.amazon.com/End-Line-Leslie-Cauley/dp/1439123098

-

23 hours ago, CorpRaider said:

Thanks for pulling that history together. Would love to hear them answer a question about that.

GHC starts handing out options to the son in law who begins rolling up sub-scale tech businesses. MKL starts publishing goals for insurance premiums written. BOC launches a new fund raising initiative/SPAC ~monthly.

My list of potential berk-alikes is currently at or around zero.

NNI is pretty impressive and walks the walk. Management owns a lot of stock and has a long track record. The education technology business (Nelnet Business Services) is outstanding and worth a lot. It takes a little bit of effort to sort through the various pieces but it's worth the effort.

https://www.nelnetinvestors.com/home/default.aspx

Interview with David Einhorn

in General Discussion

Posted

What are some examples of the big discounts in smaller stocks that you are seeing? Thanks.