giofranchi

Member-

Posts

5,510 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by giofranchi

-

Hi oddballstocks, please, let me know as soon as you take your new company public: it is going to be the very first IPO I will gladly buy into! ;) Usually, I look for stable businesses, which change very slowly or better not at all, led by the shrewdest and most opportunistic strategic minds out there. But, if I could find a company with the “best tools”, that provides a “superior product”, which is "best in class" and "high margin", and which is also led by a very good capital allocator... then, oh well!, I am sure I will not only make a killing… it is going to be a true slaughter!! ;D ;D Cheers! giofranchi

-

Cardboard, let me ask you a question: have you ever managed a business of your own? If you have, you know at least as well as me that most technical aspects are beyond the man at the helm (furthermore, Mr. Watsa hasn’t ever been at the helm of BBRY!). I manage my businesses finding good and reliable technicians, whose work I can barely evaluate and judge... It has always been this way, it has worked pretty well, and it will always be so. Believe me: Mr. Watsa doesn’t know anything about new phones… And has never pretended otherwise… He might have made a mistake judging BBRY’s management, but I am not sure... Imo, the error here is much easier and plainer to see: he was tempted to invest in technology, when technology is so hard to predict. Period. Why did he stay on the board for so long and said nothing? Simply because he didn’t know what to say! I wouldn’t have known what to say, you wouldn’t have known either… giofranchi

-

Given the fact I AM THE BUBBLE GUY!!, I guess you are talking to me… ;D ;D So, let’s examine what you are saying: First of all, you write both about strategy and about decisions made by a Manager. They are two different things: I am critical about strategy, instead I almost never question single decisions made by a Manager (I only question them when they evidently seem to go against the general strategy). (Btw, also the term “Manager” is somewhat misleading: I look for great entrepreneurs, and their first duty is to shift capital from poor performing assets to high yielding ones. Everything else follows. At least, this is my experience managing the two businesses I personally control. So, I guess the term “Entrepreneur” might be a much better choice! :) ) Second, not only the strategy of the company I decide to invest in is important, but it is important in relation to my own strategy (or the strategy I decide to follow for my firm). For instance, my firm’s equity is up 15% this year, yet I have basically three large stock market investments: FFH, LRE, and BH. FFH has gone nowhere, LRE has actually declined, BH is much smaller than the other two. Then, I hold a lot of cash. For the next 3-4 years I can see my firm’s equity increasing 15% annual, practically without running any stock market risk. And why should I accept market risk? To grow 20%? In a deleveraging with stock market prices high? No, thank you! That’s why FFH’s strategy fits perfectly with mine. The same thing can be said for LRE: I want a cash generating machine in an industry that works well during a deleveraging. Engineering services surely are not such a business, for profit higher education might be and is working just fine, insurance might do very well. So, Lancashire as well fits perfectly with my own strategy. Then, what is Mr. Brindle’s strategy? Well… basically to look for the best bargains he can find… and what should I question about that? This being said, I am well aware FFH and LRE might not fit well with someone else’s strategy… But, of course, I can only speak for myself. giofranchi

-

"The Unwatched Variable" by Charles Gave giofranchi Daily+9.24.13.pdf

-

I take the time to read all of your posts and I presumed your belief (based on the general tone of your posts) was that they hadn't slipped up -- merely been early. I think that true of a lot of the shareholders who are buying today. Thus, it's not the kind of "slippage" that's going to create a buying opportunity as some people are seeing it as favorable slippage. No Eric! Please, don't waste you precious time!! :) Fwiw, I don't think Mr. Watsa was early... I think he was and is successfully following a strategy... Ok, another bubble talking, I know... In a deleveraging I think you must have a strategy. Surely you must have one, if you are at the helm of a large company. And a strategy like this: "don't worry, everything is going to be fine!" is not what I have in mind... Mr. Buffett has the following strategy: "every month $1.2 billion in cash are delivered at my door". Ok, that's a good strategy. Can Mr. Watsa use Mr. Buffett's strategy? Unfortunately no! So, Mr. Watsa devised this alternative strategy: "I will grow capital when general stock market prices are low, and I will PROTECT capital when general stock market prices are high". This is what I think and this is what I have seen him doing since 2006. But the market doesn't care what I think! The market only sees a business that hasn't been meaningfully profitable for 3 years now! To get more bearish on FFH, the market must see something worse than the lack of profitability, which is the loss of capital. But, wait, if FFH loses capital, its management would have failed exactly to do what it is striving to achieve since 2010... To protect capital! So, the question would become: do you prefer to invest at BV with a management who is successful at what it wants to do, or to invest at 0.8 x BV with a management that has proven to be a failure? giofranchi

-

But what exactly do you mean by “slipping”?! If FFH hasn’t slipped during the last three years… It has posted almost no earnings!! LRE is another matter: the importance of LRE is to possess a "cash machine". I suggest to anyone who is interested to read every conference call by Mr. Pearson of Valeant. You will clearly understand how a business with not so much upside, but that keeps generating substantial amount of cash, might be a great asset to own. :) giofranchi

-

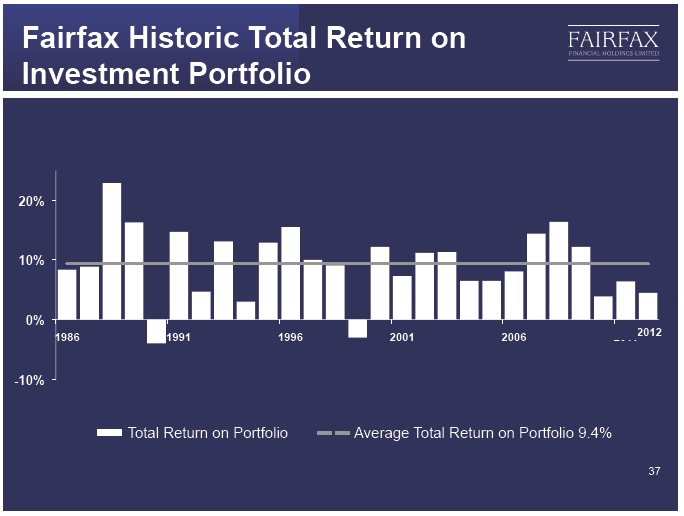

Well, keep in mind they now enjoy a leverage they have never enjoyed before… because it takes time to put insurance float together, and to make it grow. So, you don’t want to necessarily compare past results with present results. Because past and present find Fairfax in two very different situations… Instead, the average return on its portfolio of investments is imo a much more reliable figure, to judge their investment acumen… And investment acumen hopefully doesn’t deteriorate over time… For those very few great practitioners it actually increases year after year! :) giofranchi

-

+1 7.5% or even 15% arent garenteed just because you have a business model, or are happy with lumpy returns. I think Al's message missed the mark.... Well, historically they have achieved a 9.4% annual return on their investment portfolio… I thought 7.5% was somewhat conservative… But it seems I live in a bubble!! ;D ;D PS Actually, I don’t even need a 15% compounded increase in BVPS… My firm will probably continue to post operating profits for many years into the future… (of course, this might be another bubble of mine!! ;D ;D) Therefore, a 10% compounded annual return from its stock market investments will probably be satisfactory! To achieve such a result Fairfax must get a 4.5-5% annual return on its investment portfolio… practically half its historical result. That’s I think a good margin of safety… Of course, a good margin of safety, if you find yourself in bubble territory, might still not be enough!! ;D ;D giofranchi

-

I don’t agree. What matters is the business model. And, if there is one thing Mr. Buffett showed the world, is that Fairfax’s business model is one of the very best. To achieve a 7.5% yearly return on your investment portfolio is not all that difficult! Remember Mr. Graham who said that to achieve satisfactory results in investing is easier than you think? Well, exactly! The business model will do the rest, and Fairfax’s BVPS will compound at 15% annual for many years into the future. And, of course, it doesn’t matter if that 7.5% return is achieved in a manner you don’t like or you don’t approve. Of course, many members of the board are not satisfied with a 15% compounded return… Because, like Al has said, they can achieve much better results… That’s a good reason to sell your Fairfax shares! But not because you think they won’t achieve a 7.5% annual return on their portfolio! That is a bet you are most probably going to lose. giofranchi

-

Another word starting with "f" springs to mind. At least Prem is holding to his word and won't sink more cash into the deal. Thanks for posting as this was my biggest worry cheers nwoodman Yes! This is very important! And let me breathe a sigh of relief! ;) giofranchi

-

Hi Al, here I must (ruefully) admit I agree with you… The exact opposite to the majority of people on the board, I invested in Fairfax not “in spite of”, but “because of” all its cash and hedges… Now, this BBRY deal threatens to put in jeopardy its until now rock solid balance sheet… Of course, I will wait for more disclosure on the subject, in order to be able to evaluate the matter with as much objectivity as possible. Then, if I don’t like what I see, I will act accordingly. giofranchi

-

-

--Charles Gave giofranchi Daily+9.19.13.pdf

-

Keynes: Economic Possibilities for our Grandchildren

giofranchi replied to dcollon's topic in General Discussion

--William Butler Yeats Therefore, we should read Keynes time and time again! :) giofranchi -

"A New Greek Test for Europe" giofranchi A_New_Greek_Test_for_Europe_by_Ashoka_Mody_-_Project_Syndicate.pdf

-

"Why We Didn't Learn Enough From the Financial Crisis" by Justin Fox giofranchi Why_We_Didn’t_Learn_Enough_From_the_Financial_Crisis_-_Justin_Fox_-_Harvard_Business_Review.pdf

-

I have started reading [amazonsearch]Russell Sage: The Money King[/amazonsearch] --Ralph Waldo Emerson --Russell Sage Highly recommended! :) giofranchi

-

"Why Europe Is Still Broken" by Charles Gave giofranchi Daily+9.12.13.pdf

-

"Advantage America" by Gary Shilling giofranchi Advantage_America.pdf

-

Find the presentation in attachment. :) giofranchi Howard_Marks_Barclays_Global_Financial_Services_Conference1.pdf