giofranchi

Member-

Posts

5,510 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by giofranchi

-

Eric, Of course I have already said it many times, and you know very well my thought on the subject… But I repeat it once again: the reason to hold FFH today is not that the price of its stock will do fine in a market panic… Sincerely, I have no idea how it will behave… And I don’t see how anyone can predict such a thing… What I do know, instead, is that no other company I am aware of is so well positioned to take advantage of a market panic. This is the only reason I hold such a large investment in FFH today. Because it is a business led by opportunistic people, who are doing something I understand and like. Period. And because I think it is cheap. No idea what the stock price shall do. And don’t care. You might say: well, I don’t like what they are doing… That’s perfectly fine! It is a business judgment. It is different from mine, but I understand and respect other points of view. And also find them useful. I think that’s what Packer is saying: he thinks this bull market will go on for years, therefore he feels no need to be invested in a business positioned to take advantage of a market panic. Very well! I can accept eventually to be wrong. (And don’t forget my firm’s equity is up 22% this year, the FFH investment notwithstanding! ;)) What I cannot relate to is the following thought: in a market panic FFH will go down with everything else, therefore I will buy it later at more advantageous prices… This is something I really don’t understand, because business is not done that way. Gio

-

Not much to say about that experience… In 2008 I was mainly invested in high quality, high free cash generating companies: PG, JNJ, ABT, and KO. Then I also had a stake in BRK and WMT. Of course, they declined somewhat, but the free cash my businesses generated was very high compared to the net worth of my company. Therefore, I was able to average down aggressively, and just a few months later I was already in the black… Today, things look much different: if next year my businesses generate a free cash that is 10% of my firm’s net worth, I will be very satisfied. Therefore, to take advantage of any market correction (-20 / -30%), or panic (-40 / -50%), that might come to pass, my strategy simply cannot be the one that worked so well in 2008/2009. Gio

-

Does the CAPE still work? Gio does-the-cape-still-work-december2013.pdf

-

Maybe, the economy will do just fine… I don’t know. What keeps me worrying is a CAPE that doesn’t stop getting higher and higher… Now, like rijk has just pointed out, it breached above 26. If it doesn’t stop increasing, it means that my fear Keynesian policies stimulate prices more than the underlying economy is not yet proven unfounded… Because it simply means that prices keep increasing faster than earnings. If we get to Mr. Shiller’s bubble threshold, a CAPE of 28-29, no matter what the economy does, only two outcomes will be plausible: 1) prices stay flat for a long time, 2) a crash. Of course, I have never seen 1) happen before. Gio

-

--Russell Sage Gio

-

Merry Christmas & Happy Holidays Everyone!

giofranchi replied to Parsad's topic in General Discussion

Merry Christmas & Happy Holidays from Milan, Italy. A cheer to many more years of continuous learning and improvement together! :) Gio -

Just back from a 4 days trip to Paris!

giofranchi replied to giofranchi's topic in General Discussion

Thank you, Liberty! ;) Gio -

Just back from a 4 days trip to Paris!

giofranchi replied to giofranchi's topic in General Discussion

Your guess is just right!! ;D ;D ;D Well… It has really been a “tour de force”…!! I am exhausted!! Probably, what I liked the best is “Notre Dame”: to think that they started building it 850 years ago, and still is a majestic building… is truly impressive! The civil engineer that still lurks inside me cannot but cherish such an extraordinary accomplishment! ;) Nice to hear you are visiting Thailand! Unfortunately, I have never been there, but it must be great! Enjoy your staying very much! Cheers, Gio -

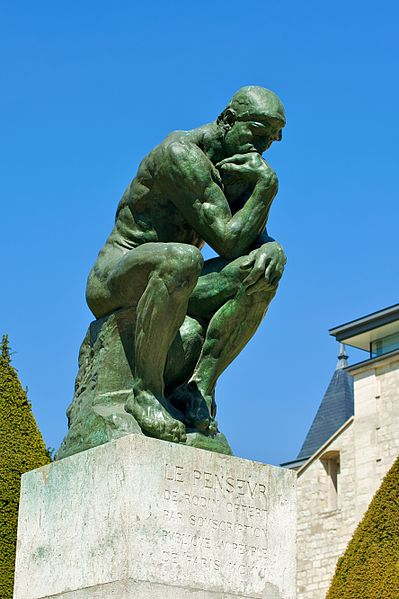

Among all the fine pieces of art I was able to look at closely, “Le Penseur” (The Thinker) by Auguste Rodin is by far the one the best fits the “mood” of this board! :) --WikipediA Cheers! Gio

-

No no! If they meet my “hurdle rate”, I always invest! It is just not so easy to meet it!! ;) Well, the fact is my portfolio many times is very concentrated… It might just happen that even in a market that keeps going up 2 or 3 positions are down at the same time… Just look at FFH and LRE today, which are by far my largest investments! :( Gio

-

Joel, I am not talking about downturns… great opportunities might arise for very different reasons… And a general market downturn is only one of them! A BP’s offshore plant blows up, and XOM sells off abruptly… Johnson&Johnson recalls some flawed products in its portfolio of OTC drugs, and Abbott sells off abruptly… They are only two of the examples that come to my mind right now, and that I was able to take advantage of in the recent past. How could you predict when and why those kind of opportunities might present themselves? Imo, it simply is not possible. Gio

-

;D ;D ;D Very funny story! Don't mess with successful small business owners! ;) Gio

-

No one of the great financial minds of the past viewed cash only for liquidity reasons. Not even Mr. Buffett (otherwise, how could he have deployed so many billions in 2008 and 2009?!). If you hold cash only for liquidity reasons, by definition the amount of cash you have will never change, no matter which opportunities arise! (It will change only if your liquidity requirements change) Rebalancing is easy to say, but very difficult to do… You must be sure that your other investments are performing well at the exact time the opportunity you want to grab becomes available. And, of course, you can never be sure! If, instead, they are underperforming at the same time that opportunity becomes available, your purchasing power might be greatly diminished. You can rebalance anyway, but you won’t be able to purchase as much of that opportunity as if you were holding some cash! How much cash as a strategic asset to hold? I don’t know. That is the hard part, and the part those great financial minds of the past managed so shrewdly… it is up to each one to decide! Gio

-

Al, as far as I am concerned, it goes something like this: you have to know some businesses very well, not many businesses, just a few, but make sure in those few businesses you have developed great conviction. Then, you will be able to deploy into them your “cash reserve” at the right time, provided, of course, that you have a cash reserve! Now, when will you see me use my cash reserve? 1) If FFH trades near today’s BVPS, that makes no sense at all, 2) If LRE trades around 1.15 – 1.2 x BVPS. When will 1) and 2) happen? I cannot know. What I know is that I won’t be able to take advantage of 1) and 2) without some cash reserve. Gio

-

I would say Fairfax and Lancashire. Gio

-

What do I want for Christmas? Well guys, you know I am in love! You will meet her next April in Toronto, and you will realize why I cannot really ask for anything more! I am blessed with something I don’t deserve. :) Cheers! Gio

-

David, while I agree with the Farnam Street’s part of your post, the second part is clearly too kind…!!!! We all know what an extremely experienced investor and very successful professional you are, and this wonderful board would be much poorer without you. We are all very lucky to have made your acquaintance through this great community of like-minded people! :) Cheers, Gio

-

+1 Good post! Gio

-

Joel, I think anyone should read and study Mr. Russell Sage’s methods and how he made use of his “cash reserve”. Don’t forget that we are always talking about the future while investing… And the future is never certain! 1) The fact an investment meets “your hurdle rate” is and will always be a supposition you make about a business you don’t manage… And even if the fate of that business were in your own hands, you may never be sure about its future… I am absolutely not sure about what will become of the businesses I manage personally! 2) I think events that create great opportunities are inherently unpredictable. Other people are not able to predict them, otherwise they simply wouldn’t occur, would they? Why are we supposed to best other people in predicting them? I don’t need to predict. Because I know I will always have the cash to take advantage of them. 3) Besides Mr. Sage, I know of no other great financial mind of the past, who didn’t always have ample cash reserves, Mr. Buffett included: AL2012 If we are not to learn from those great and very successful minds of the past, how are we supposed to navigate the perilous waters of investing? This being said, I admit it is much easier to raise cash, when you cannot find any investment that matches or exceeds “your hurdle rate”! ;) Gio

-

+1 ;) Gio

-

"A New Widow Maker?" by Mr. Charles Gave Gio Daily+12.10.13.pdf