-

Posts

46 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by keegomaster

-

-

35 minutes ago, Dynamic said:

Margin debt can be very risky especially if your dealer offers you more margin that Regulation T. In times of major decline they then tend to increase the margin requirements which is more likely to lead to forced sales at the worst time.

However, I could imagine that right now with Berkshire B shares over $400 and A shares over $600,000, you could withdraw on margin about 5% of the market value with very little risk, so $20 against each B Share or $30,000 against each A share. If it fell 75% it would still only be a 20% loan to market value and I don't think it's ever fallen to a quarter of a previous high.

If Berkshire compounds at say 8% or better in the long run your percentage loan would reduce over time making it even safer so long as the margin interest isn't too expensive. So there are ways it could be done pretty safely so long as you're strict about keeping your limits a very long way from a margin sale in the worst case scenario.

Berkshire has dropped 50% in a few instances. One of those during 2008

-

2 hours ago, gfp said:

Well Charlie also had this quote on Warren's investments in Japan, "It was like having God just opening a chest and just pouring money into it."

I'm not even sure I can calculate the return on investment because the equity sliver was so small, the carry was so positive and the debt used to float the purchases and hedge the currency was so profitable. If we pencil in that we used insurance float for the tiny "equity" sliver then I guess this is as close to warren giving a master class on free money as we will get.

h/t kingswell newsletter for the chart

The chart title is a bit of an understatement with positions up 120% to 260%

-

4 hours ago, Xerxes said:

Interesting, what book is this?

-

I just read the letter, and still have to go through the report, but I noticed two interesting non-financial things:

- the color of the report cover is black, which I interpret as mourning or grief for Charlie's passing- seeing Warren refer to Charlie as a father figure: "In a way his relationship with me was part older brother, part loving father"

I just found it interesting. Great year. The weakness in Energy and Utilities was more than compensated by the good Insurance and Investment results, which is a statement to the strength and diversity of the businesses it holds.

-

Very strong annual results. This is what caught my eye:

- The excess of fair value over carrying value of investments in non-insurance associates and market traded consolidated non-insurance subsidiaries increased significantly to $1,006.0 million at December 31, 2023 from $310.0 million at December 31, 2022, with $315.2 million of that increase related to publicly traded Eurobank.

-

Have you looked at Quartr?

-

9 minutes ago, TwoCitiesCapital said:

I do tend to focus on assets more than earnings - but I dunno if that alone is a "cigar butt" investor or just a traditional deep value approach.

I like to buy things @ clear discounts to assets.

Fairfax in 2020.

Fairfax India from 2019 - now

Exor from 2015 - now

Fixed income CEFs in Q4 of last year

GBTC in 2021-2023

Etc. etc. etc.

All demonstrated asset plays with easily verifiable discounts to NAV and typically some sort of reasonable track record in growing it.

I just feel far more comfortable holding those, and knowing when to buy/sell them, versus trying to project earnings/revenues into some distant future and then determining an appropriate discount rate back.

Would you be willing to share names of the Fixed Income Closed End Funds you own? Haven't looked at CEFs in a long time... wondering what discount to NAV is like these days... Thanks!

-

I started watching Dumb Money last night on Netflix, and it's looking good.

It's about Roaring Kitty the GameStop saga. Decided to stop early, in order to restart watching with the wife, who also find these kind of movies entertaining (eg Wolf of WS or The Big Short).

Has anyone watched it yet?

-

On 12/29/2023 at 7:29 AM, Eldad said:

I’ll take Mars and Koch anytime they want to sell. BRK needs to buy something big soon.

Maybe Greg will become the new Charlie and can get him to be a little more proactive than waiting for the phone to ring.WEB won't change one bit (let alone at his age). He will pull the trigger only when the big elephant is in sight.

-

On 12/20/2023 at 6:36 AM, throw123 said:

Starting position in HSY

I have also started looking at HSY recently, similarly with PFE. These are the companies that one wishes to own for the long term but are usually expensive. So when they start to trade around 52w lows I start to consider them... Especially when most positions in my current portfolio seem to be fairly valued and not attractive for the next marginal investment.

For HSY the narrative around the price decline seems to be Ozempic and other related weight loss drugs. To me those fears seem overblown, and I plan to continue reading and understanding HSY's financials and probable future performance.

Is there anything else to consider as potential threats or concerns to HSY?

Cheers!

-

34 minutes ago, UK said:

As per the 2022 Annual Report, Farmers Edge had a "carry value of $2.76 per share (versus market value of $0.20)". The current market value of FDGE is $0.13 before the privatization offer was announced today for $0.25. This was a ride to the bottom. Hopefully they can turn the ship around.

This is what they said about FDGE on the 2022 AR:

"Farmers Edge had a very challenging year in 2022. Unfortunately, the performance since the IPO in 2021 has been extremely disappointing. Vibhore Arora, former Country Leader of Amazon Canada, took over as CEO of Farmers Edge in June with the goal of growing new acres, improving execution, product delivery and the customer experience, building enterprise partnerships and a new management team and right sizing the cost structure. We are very excited about the initiatives taken already to move the business on a pathway towards positive cash flow generation. FarmCommand is a leading precision farming application and we are pleased to see that Vibhore has been successful at refining the business strategy, which is key for reducing the cash burn rate and bringing in new elements for future success."

-

Added more GOOGL, and started a position on AMZN. The return to positive Free Cash Flow (and the relative and absolute magnitude!) is a very good sign of the increasing Operating Income (through increased revenues and reduced costs), together with a more mindful Cap Ex spending. In addition the growth in AWS with relation to AI/ML forebodes good things to come.

-

GOOGL!

Revenues are growing, operating margin is growing. I think that the sell-off on the basis of lower-than-expected cloud revenue is an overreaction.

An overall concern with growth companies is the relative valuation vs. risk free rate (i.e., at a 22 PE and 4.5% earnings yield, equities seem frothy and I expect them to come down... not sure when)

-

@Morgan glad the site and files are useful! have fun analyzing the data... last night I spent a few hours analyzing Canadian provincial bonds and corporates... oh boy, time flies when you are having fun! Cheers!

-

Hi @Morgan

Prof. Damodaran has spreadsheets for each year since 1999 with different multiples, e.g., PE ratios, P/BV, EV/EBIT, EV/EBITDA, etc., in the 'data' section of his website:

https://pages.stern.nyu.edu/~adamodar/New_Home_Page/dataarchived.html

Hope it helps!

-

I use good ol' Google Finance: sort ascending by % price change and look closer at things at the top (i.e., those that are significantly negative for the day).

-

Started a position on DIS. Bob Iger's turn around is happening (improvement in FCF, ROIC), and the stock is trading at 5-yr lows. Happy to start here and build up if it keeps trailing lower.

-

3 hours ago, Eng12345 said:

Bought some more C today. Becoming a large position for me with a cost basis around $44.5 - which I’d like to lower a bit more

Your posts reporting on the C position build-up made me take a quick look at the fundamentals:P/B = 0.42 (ycharts)

P/E = 6.55 (google finance)

Div yield = 5.13% (google finance)

C almost meets the definition of Peter Cundil's magic sixes:

"They are companies trading at less than 0.6 times book value (less than 60% of book value), 6 times earnings or less, and with dividend yields of 6% or more." ("There's Always Something To Do" Christopher Risso-Gill)

I may add C to the watchilist!

Cheers!

-

Trimmed down some BRK.B.

At 1.45x BV it's getting a bit pricy. Planning to repurchase when PB goes back to around 1.3x -

Closed my ATVI positions. Exited at $91.92 (19.8% return in 15 months, or about 15.8% annualized).

I think there are better options than the residual 3% upon transaction close, and some risks still remain (albeit minor) with the UK's green-light.

-

11 hours ago, lessthaniv said:

Not sure I'm understanding the math on your comment? Can you elaborate on your calculation?

The following is from the Aug 2nd, 2023 newswire but the 5yr hasn't moved materially.

Oh, thanks for making me aware that the rate had already been reset. I missed that news release (and it is also on the Enbridge website, so I can't believe I missed it).

Yes, like @maplevalue mentioned, the 6.112% rate on $25 face value is $1.528 which represents 8.9% on the $17.11 I paid for the lot I bought. -

Bought some Enbridge Preferreds (Series H) on margin. The rate reset is happening on Aug 30th and I anticipate the upcoming rate will have a ~9% yield that should cover the ~6% margin cost.

EDIT: Like @lessthaniv pointed out, the rate was reset on Aug 2nd at 6.112%

-

Added (and plan to continue to add) to GOOGL on pullbacks

-

13 hours ago, Viking said:

Is the stock priced properly?

Efficient market hypothesis: “The efficient market hypothesis (EMH) is a hypothesis that states that share prices reflect all information and consistent alpha generation is impossible. According to the EMH, stocks always trade at their fair value on exchanges, making it impossible for investors to purchase undervalued stocks or sell stocks for inflated prices…” Investopedia

A lot has happened at Fairfax over the past 30 months. Let’s do a quick review and see what we can learn. Most importantly, is the stock priced correctly, as the EMH would suggest?

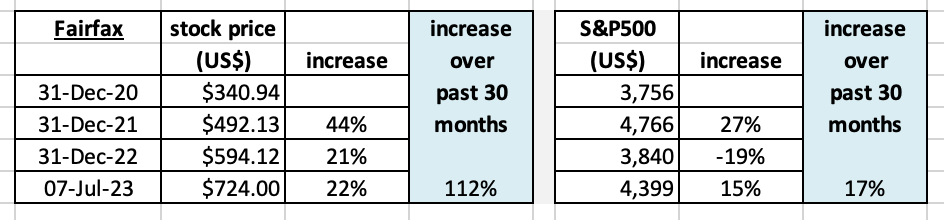

How has Fairfax’s stock performed over the past 30 months?

First, let’s get some context. Fairfax has been one of the best performing stocks over the past 30 months both in absolute and relative terms. The outperformance has been remarkably consistent each year.

Fairfax’s stock has outperformed the S&P500 by 95% over the past 30 months. That outperformance must make Fairfax one of the top performing large cap (in Canada) stocks over the past 30 months.

Does this mean the stock is now expensive? The proverbial ‘big fish that got away’ from investors? Let’s find out. Let’s try and keep an open mind. What do the numbers tell us? And what about management? And future prospects?

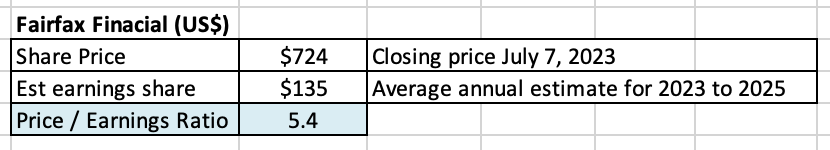

Let’s start by looking at the traditional valuation tools:

Price to earnings ratio (PE)

My current estimate has Fairfax earning about $145/share in 2023 and $135 in both 2024 and 2025. I view this as a mildly conservative estimate for the next three years. I’ll provide more details in my 3-year earnings forecast for Fairfax - coming in the next week or so.

Importantly, the quality of the earnings being delivered by Fairfax are the highest in the company’s history; it is primarily being delivered by record operating earnings (underwriting profit + interest and dividend income + share of profit of associates). All three individually are at record levels.

We learn in the chart above that Fairfax is trading today at a forward PE multiple of 5.4 times. That is crazy cheap, especially given the quality and durability of earnings.

What is the PE multiple of the overall market?

The forward PE multiple of the S&P500 is 20. Fairfax’s stock is trading at a SIGNIFICANT discount to the S&P500. Fairfax’s stock price could double from here and it would still be trading at a 50% discount to the S&P500 multiple.

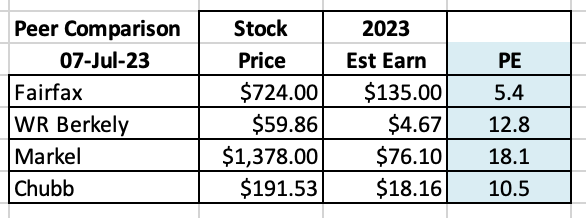

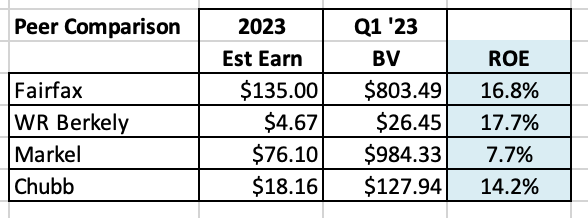

How about compared to some P&C insurance peers?

Looking at PE, Fairfax is trading at 48% (Chubb) to 70% (Markel) below peers. Fairfax’s stock looks dirt cheap. But let’s keep digging.

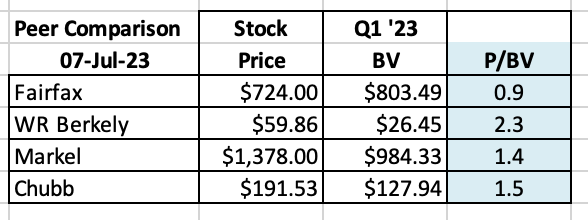

Price to book value multiple (P/BV) and return on equity (ROE)

Let’s now look at the price-to-book value (P/BV) and return-on-equity (ROE). These two are the preferred metrics used to value insurance companies. Let’s start with P/BV.

How does Fairfax stack up compared to peers?

Looking at P/BV, Fairfax is trading 36% (Markel) to 61% (WR Berkley) below peers. How about ROE?

Looking at ROE, Fairfax is poised to deliver an exceptional 16.8%, at the high end compared to peers.

What can we conclude after looking at the valuation metrics?

Looking at PE and P/BV, Fairfax’s stock is exceptionally cheap compared to the market and peers. At the same time Fairfax is delivering best-in-class ROE.

This makes no sense. Let’s keep digging.

What about management?

I recently did a long-form post where I reviewed capital allocation at Fairfax over the past 5 years. Bottom line, it can be argued that Fairfax currently has a best-in-class management team (compared to peers).

The mystery deepens.

What about the future prospects of Fairfax?

Fairfax has three engines driving its business:

- Insurance: Fairfax has grown net premiums written by 400% over the last 9 years. At a 95CR, underwriting profit is on track to be a record $1 billion in 2023.

- Investments - fixed income: Fairfax has navigated the spike in interest rates masterfully in their $40 billion fixed income portfolio, moving to 1.2 years average duration in Dec 2021 and then pivoting and moving to 2.5 years average duration in Q1 2023, locking in higher yields. As a result interest and dividend income is expected to be a record +$1.5 billion for each of 2023, 2024 and 2025.

- Investments - equities: Fairfax’s $16 billion equity holdings have been performing very well, lead by Eurobank and total return swaps on 1.96 million FFH shares.

Most importantly, all engines are performing very well at the same time, perhaps for the first time in the company’s history. Significant asset sales over the past 12 months have been icing on the cake: pet insurance ($1.4 billion), Resolute ($626 million+$183 million CVR), Ambridge Partners ($400 million).

In short, Fairfax’s prospects have never looked better.

What are external groups saying?

AM Best, the credit ratings agency who specializes in insurance companies, just upgraded Fairfax’s ratings (including those of its two largest subs - Odyssey and Allied) because of its much improved financial profile.

Most sell-side analysts have been warming to Fairfax over the past year, repeatedly increasing their estimates and target prices. Most have Fairfax as ‘outperform’ and a few have it as a ‘top pick’.

Conclusion

What did we learn about Fairfax?

- The stock price is unambiguously cheap in absolute terms and when compared to peers.

- The quality of the earnings are high and durable.

- The management team is best-in-class.

- Future prospects have never been better.

- Ratings agencies are drinking the Kool-Aid, with upgrades.

- Sell side analysts are drinking the Kool-Aid, with upgrades.

The cheap stock price stands out like a sore thumb.

How do we explain it?

The answer is simple: Mr. Market is wrong. Now I know, according to EMT, this is not supposed to happen. What we have today is a real life example of where the efficient market hypothesis is bullshit. At least in the short run.

We have situation where Mr. Market is grossly mis-pricing a stock. Now I do think the EMT is generally accurate over the medium to long term… the mis-pricing usually does not last for long.

The disconnect with Mr. Market is fundamentals. The fundamentals have been improving at Fairfax for the past couple of years but are just now showing up in earnings.

It’s like Mr. Market has been standing on the beach the last couple of years wondering why the water is running out to sea. The answer is we have a tsunami of earnings coming from Fairfax in the coming quarters and years. Mr. Market will figure it out. But in usual fashion, only when the wall of water comes crashing in (wiping out all the wrong-headed thinking on the company in the process). "What a shocker!" everyone will say. "Who could have known?" A similar thing happened to Fairfax in the 2006-2009 period.

The coming spike in earnings is not a surprise to those who follow the company closely. So we are in this surreal environment where the future is kind of knowable (a spike in earnings leading to a spike in the share price).

What to do? Trust the analysis (be right). Get the correct position size. Have patience (sit tight).

—————

“And right here let me say one thing: after spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: it never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets . I’ve known many men who were right at exactly the right time, and began buying and selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine - that is, they made no real money out of it. Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money. It is literally true that millions come easier to a trader after he knows how to trade than hundreds did in the days of his ignorance.” Reminiscences of a Stock Operator

After seeing the comparison of P/E and P/B of FFH against the other competitors...I wouldn't be surprised if at some point in the future Berkshire makes a bid for Fairfax (similar to what they did with Alleghany).

What did you learn this week at Fairfax Week?

in Fairfax Financial

Posted

How could one get access to Packer's letters?