thomcapital

-

Posts

78 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by thomcapital

-

-

Both Norman Asbjornson with AAON and Valentin Gapontsev with IPGP have doubled my money and continue to outperform their respective industries, though both are currently quite expensive.

Hey nice to find someone else who appreciates good 'ol Norm!

-

I would read McKinsey's book on valuation to help understand the value drivers, and recognize that a model is only as good as the assumptions that go into it.

I think McKinsey's book (Valuation: Measuring and Managing the Value of Companies) is the most in-depth book on the subject. You should be able to get by with an older version as well if you want to save a few bucks. There weren't many changes between the 2nd and 4th editions, for instance.

-

Nothing earth shattering here, but I thought the last piece was interesting

"Is there a particular threat you’ve identified that’s most likely to blow up next?

The answer is yes, but I can’t talk about it yet, because I’m in the middle of a book about it. It’ll come out next March.

And will that be before or after it erupts?

I can’t actually tell."

He knows Burry...and Burry recently opened up a new hedge fund. I wonder if there's a connection here.

http://www.businessweek.com/articles/2013-09-12/michael-lewis-on-the-next-crisis

I had the pleasure of seeing Michael Lewis give a talk at an industry conference a week ago. He confirmed his next book will be about HFT (I think he said the title is "Flash Boys", calling it a wall street story set in the world of HFT). He called the wall street crisis the gift that keeps on giving. :)

And "Flash Boys" it is...

-

Nothing earth shattering here, but I thought the last piece was interesting

"Is there a particular threat you’ve identified that’s most likely to blow up next?

The answer is yes, but I can’t talk about it yet, because I’m in the middle of a book about it. It’ll come out next March.

And will that be before or after it erupts?

I can’t actually tell."

He knows Burry...and Burry recently opened up a new hedge fund. I wonder if there's a connection here.

http://www.businessweek.com/articles/2013-09-12/michael-lewis-on-the-next-crisis

I had the pleasure of seeing Michael Lewis give a talk at an industry conference a week ago. He confirmed his next book will be about HFT (I think he said the title is "Flash Boys", calling it a wall street story set in the world of HFT). He called the wall street crisis the gift that keeps on giving. :)

-

As a consultant, Mr. Long is sought after by asset management firms, hedge funds, principal trading organizations, index providers, ETP sponsors, and private equity firms to help them develop and deploy benchmark crushing systematic investment strategies.

I work for a large buy-side firm that, regrettably, likes to spend money on consultants. I'd love to bring him in, videotape his presentation (and Q&A) and share it with you all. :)

-

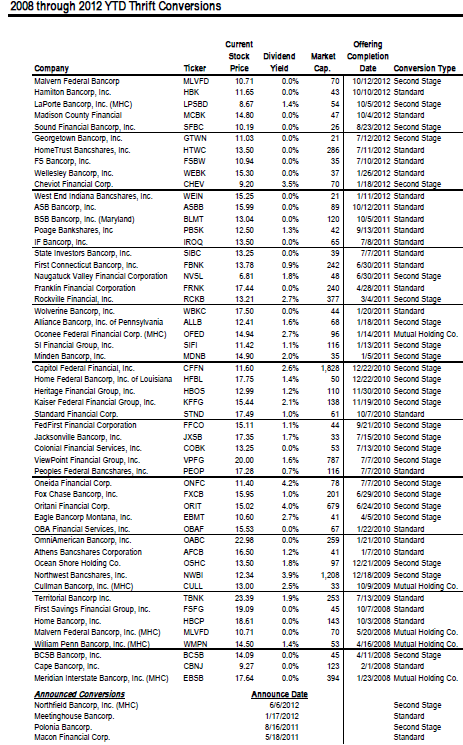

Demutualized banks are common targets, although that is such conventional wisdom now that it's probably not very useful.

Not as common as demutual investors think. The demutuals have been on an absolute tear recently.

Is there a way to screen for demutualizations? I think plenty of investors (like Klarman and Einhorn) made a bundle on demutualizations in the 1990s. The way they explained it, it seems like free money.

I've attached a list from '08 - '12, from late last year. I read on VIC (on the mssg board) that Peter Lynch derived a nice chunk of his outperformance from these as well.

-

I know you can do this with word, but would you use this service if it was available? Would you pay to use it? If so, how much?

I wouldn't pay for it considering Word is available. Also Bloomberg and Factset offer a similar feature for those with access.

-

I was thinking there was something else out there besides just using Word. I guess not? Thanks guys!

-

I believe there is a (free) online tool that can be used to see annual revisions/additions made to documents, such as 10-ks. Has anyone heard of such a thing?

Thanks in advance.

-

Visteon is another, though I haven't kept up with their progress:

http://www.cornerofberkshireandfairfax.ca/forum/investment-ideas/vc-visteon-corp/

-

What are people's favorite ways to play the housing recovery? I feel like I missed the boat on this one and most things I look at are getting close to fairly priced.

Here's an "all-in-one" solution:

"It is not inconceivable to imagine a home buyer spotting a home for sale in a Berkshire owned paper, contacting a Home Services of America real estate agent and taking out a Wells Fargo Mortgage on a new home. The new home might include Shaw Carpet, Ben Moore Paint, MiTek fastners, USG drywall, a Trane heating/cooling system, and Johns Manville insulation, all surrounded by an exterior of Acme Brick (and some components may even have been shipped by BNSF). The closing transaction in some areas could be through one of American Home Services firms.

The family would then drive to the new home, turn the Schlage door knob and may decide to fill the space with new furniture from one of Berkshire's regional furniture stores. A John Deere riding lawn mower may be handy for the new yard. And in some parts of the country, the home could use MidAmerican Energy utilities. And DirectTV may be a desirable entertainment option."

http://seekingalpha.com/article/1089381-broadly-framing-housing-with-berkshire-hathaway-in-2013

Some competitors against the BRK lines include MHK (Shaw), SSD (MiTek), EXP (USG), OC (Johns Manville). Not all are pure plays. It seems most names have run quite nicely, with the new home levered, or non/less discretionary-type companies selling up near normalized earnings levels. Others that are more repair/remodel oriented are still being discounted somewhat. For LUK fans, MLI may be worth a look (compete's w/ Cerro Group, owned by The Marmon Group and now Berkshire). Berkshire owned ~10% of MLI back in '04-05 I believe. The one analyst covering the stock thinks $5.50 in EPS at 1.1M starts is doable.

-

Is it inconceivable that somebody buys WDC or STX. I recall from at least WDC management's incentives that they will be very well compensated for a takeover.

From an interview with Steve Luczo earlier this year:

Q: Could we get new players?

A: The technology is too hard, on all of it. No.

Q: What does that mean for investors in drive stocks?

A: If you were a really big, smart technology company that saw all the trends in cloud and mobility; all that says is storage, storage, storage – you’d probably see a reason why owning these critical technologies is important. But you’d run into so much flack from someone saying, oh, you should do software and services only.

Q: So are you saying something could try to buy you or WD?

A: I think if someone were thinking about it from a pure technology perspective, they’d be all over it.

Q: But who would it be?

A: Any big technology company, you can fill in the blank. IBM, EMC, HP. Anyone that’s big. But they won’t, because that’s not what the market wants them to do. The market does not want them to be in the hardware business. Although Todd Bradley [who runs the PC business at HP] just wrote a great article on why hardware is important. And the end of the day, all this stuff has to be delivered on hardware. If I’m in the business of selling in the cloud, and all the cloud is is a disk drive with some bandwidth, I need access to drive technology. At the end of the day, all I’m doing is taking disk-drives and integrating them. It depends how big is my cloud business going to be.

-

Let's throw some darts in the dark:

Fiat.

* Marchionne is one of the best CEOs I've seen.

* priced at just 0.05x sales.

* Good balance sheet.

* Chrysler is killing it in the US and provides a margin of safety in case Italy goes bust.

* Fiat is earnings positive despite horrible utilization in Italy, and if it ever rebounds …

* convoluted way of claiming Ferrari and Maserati (don't tell Bigliari).

Now, 40x in 10 years… probably not. Double digit x, I would say yes.

Ah Plan Fiat came to me on my drive home tonight and you beat me to it. What triggered it for me was Guy's tweet/comments on Fiat from last week. Agreed, if it's not the warrants I vote Fiat.

-

He's talked about the warrants before, and has mentioned the banks, AIG and GM as examples of those companies who have issued warrants. To get to those kinds of returns, using a warrant would certainly help eh?

Edit: except for the whole "hold for ten years" thing.

-

They were mentioned in his 3Q12 letter. Part of which is quoted here:

http://csinvesting.org/2012/10/15/fraud-gms-tarp-warrants/

Oh, and to make sense of my earlier comment: later in the letter he goes on to mention how he needs partner approval to buy warrant securities in his funds.

-

Gm would be my next guess. Definitely has strong tailwinds. Or maybe byd?

If not BAC, then I agree on GM, too, especially considering his recent comments on the warrants...

-

Look at Greenblatt's Magic Formula. Wes Gray, a professor who has a website that escapes me (but is working on a book with the Greenbackd guy), tried to prove the reported returns that Greenblatt provides and was unable to do so. If memory serves, they were no where close, although still very good.

Not trying to derail your conversation here, but I was pretty concerned about Greenblatt's magic formula reported results and that study as well. I still don't understand why Greenblatt didn't post specifics on the formula--I was worried he cherry picked the best day/month specific date combo with the highest results.

Through http://csinvesting.org/ and the blogger's uploaded "library" I read class notes from someone who audited Greenblatt's class over multiple years. There are some nice tidbits of information in there from Greenblatt on how he ran that backtest and some of the minutia involved that I haven't seen elsewhere. That helped me (partially) reconcile his results vs. the turnkey analyst author's work, but I'm still not fully convinced however.

-

These are posted on Dr. Burry's website at: http://www.scioncapital.com (scroll to the bottom of the page). I wonder what spurred him on to post that new statement and to finally upload these two letters? I have emailed him, more or less begging him to release more of his fund letters to no avail.

-

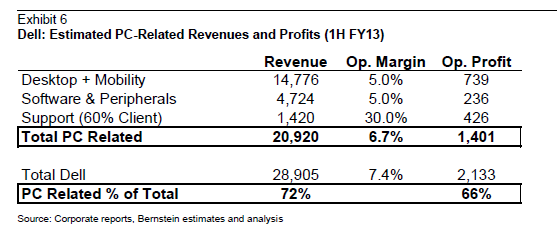

Ah, but what percentage of the product revenues are PC/mobility revenues? And what percentage of income comes from PC/mobility revenues?

That is the million dollar question. I've seen estimates all over the place, with the most PC-weighted coming from Bernstein at ~72% of revenues and ~66% of EBIT. I'll attach the table from the note when I get home.

-

I'm not too familar with rights offerings. Does anyone know how Sears Holdings arrived at the $15/shr. ($346M) that will be raised by selling SHOS?

What I do remember about rights offerings is what Greenblatt says in his "Stock Market Genius" book: "Buy all rights" (pg. 109). The subtitle on that page says it all. :)

-

I have nothing against Jacob, but I stopped visiting his site several months ago after he added a premium pay-for-access section. Once upon a time, Jacob was the sole author of valuewalk, and he had some great connections and could get hedge fund investor letters, interviews, etc that no one else had. After using a free trial of his premium service (which I will not bash here, but was incredibly disappointed in) I'm not at all surprised with the path he has chosen for himself.

-

I'd say it depends on the company and location. Obvious (or not) the further from a big city the less dressed up a place is going to be. So if you're in a small town in Kansas for a small company a suit is overkill. Here is a random guide I made up but I think is appropriate:

Just curious, have you attended a small town analyst meeting in Kansas? Seems like a long way from home for you...

Great guide!

-

Wisconsin.

-

why bother? it's chicken feed for them and probably more trouble than it's worth. Buffett's advice was to go out a buy a single family home "for yourself" and put a 30 year mortgage on it. If he said someone could do well buying up a lot of homes and renting them, I believe he meant you would do well; but probably not as well as he can do investing in securities. And he can do that from his bedroom or office. He was making a comment that it's safe for j6p, who is always afraid to buy something unless it's "rising," to wade back in and start buying real estate again. btw, if the guy who goes out and buys 100 homes and rents them out does well over the next five years, how well do you think a bac shareholder is going to do?

Saw this in today's WSJ (Wall Street Explores Landlord Business, A1-2): Buffett... said in an interview on CNBC last month that he would buy up "a couple hundred thousand" single-family homes if he could do so easily, given the high yields on rental investments.

I've really enjoyed this discussion.

Residential Housing Companies

in General Discussion

Posted

Several companies were mentioned in this thread from 2013:

http://www.cornerofberkshireandfairfax.ca/forum/general-discussion/from-power-tools-to-carpets-housing-recovery-signs-mount/