ScottHall

-

Posts

774 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by ScottHall

-

-

You need to build some character and I don't mean that in the usual way. Stories run the world and you can make money rain from the heavens with them. The best hedge fund managers know how to market themselves as characters to stand out from the crowd. Vanilla Value Version V doesn't do anything to get people excited. Even returns matter only so much in a way; there's seemingly hundreds of minor league hedge fund managers out there with great track records, with way less AUM than they "should have."

Way I see it there's two kinds of fund managers. The ones who try to make a buck through portfolio returns and the ones who try to make a buck from attracting more assets. I think too many of the smaller hedge funds don't understand enough about storytelling. Copying Buffett's letter only means something to the in-group, and there is a market there. But for the wider world you might need something that is more of a spectacle. Bill Ackman has been great at that. A lot of little league fund managers think he is a laughingstock now because his AUM is shrinking.

But even with the bad returns, he's still collecting fees on HOW MANY BILLIONS? Oh.

-

"They were good for their day but they are both hopelessly outclassed by modern investors."

Part of these Scott?

Why don't you post that link to that video where you are sitting down on your couch with your cat so that people here could learn what a true winner looks like?

Cardboard

There's no need to be modest, Cardboard. Everybody knows you are one of the greats I was talking about. Your track record of calling out FRAUDULENT companies early in their hype cycles is truly unparalleled and ensures nobody will ever forget your contributions to our field. You've been a big inspiration to me as an investor, and are one of my most valuable resources on this entire website.

Thank you for being you, Cardboard. And please keep posting the ideas.

<3

-

Good point!

I would wager a large sum that there are very very few people on this site that are not in that 120 IQ and above.

I just don't think the "average" person is interested enough or capable enough to research and pursue these ideas, so they probably aren't even on here.

Your 100 IQ guy isn't considering these things, he/she probably isn't even investing.

So smart to spend three pages arguing which geezer is smarter and why. They were good for their day but they are both hopelessly outclassed by modern investors.

-

You guys are missing the point as usual. Sometimes founders have to create grand stories to raise the money to finance the work to get to the point that they aren't stories anymore. So many great companies have been built this way that it's very typical of a value investor to jump all over the leaders who fail to make the transition. Reflexivity is real and Holmes did not prove as skilled at mastering this art as Musk, Trump or Bezos.

Classic case of value investors missing the point, again.

So Musk, Trump and Bezos were all frauds who eventually turned the corner?

Musk and Trump are not out of the woods yet but Bezos has reached escape velocity and has for a long time.

Musk needs to continue to tap capital markets to finance his operating losses until he can get where he needs to be. Tesla consistently and wildly overestimates its unit production and has been getting investor financing while doing so. People need to believe in Musk for him to overcome the obstacles ahead of him, because he will require their money to do so. So long as people believe in Musk enough to continue to finance him, Tesla can afford to lose as much money as it wants. When belief in Musk is no longer high enough for people to finance him, that is when current year economics would matter.

Tesla's biggest asset is Musk's ability to raise capital. If he can raise enough of it, he may be able to "cross the rubicon" into the world he wants to see. That's a world where his companies could be worth a lot. But it's reflexive... if people don't believe in him, he won't get there.

So is it fraud to use your marketing skills to highlight the amazing stuff you've been able to accomplish, so that people will want to continue to finance you despite ongoing operating losses? A lot of people are jumping ship at Tesla. That's usually not a great sign. Maybe Google will buy Tesla if public perception falters and finance Musk. It'd be more sensible than any other project.

Or maybe the public will continue to finance him so long as he continues performing technological marvels, operating performance issues be damned, and one day the infrastructure will really come together. Who knows?

Trump is Trump and we'll leave it at that, so this doesn't become a political thread.

-

You guys are missing the point as usual. Sometimes founders have to create grand stories to raise the money to finance the work to get to the point that they aren't stories anymore. So many great companies have been built this way that it's very typical of a value investor to jump all over the leaders who fail to make the transition. Reflexivity is real and Holmes did not prove as skilled at mastering this art as Musk, Trump or Bezos.

Classic case of value investors missing the point, again.

-

The current price doesn't seem to be much of a premium if they can keep up results like this for a while.

-

The most important thing to remember about investing is that very few of the symbols we create have any intrinsic meaning and are valuable and useful because of human psychology.

-

Salesmanship is life. The value investing community is a babe in the woods in regards to what actually moves the needle in this world.

-

Not directing this at the OP, but the short thesis that Tesla is comprised of a bunch of crappy engineers who will never figure out how to produce a decent car seems beyond self-delusional. There's this weird personal thing from finance folks towards Musk that makes little sense to me.

I agree with people that bringing a production vehicle to market is exceptionally challenging and this uphill battle probably isn't correctly factored into the current share price.

Beyond that I don't see much intellectual honesty in the short argument.

Anyways, that's my rant for the day.

I agree, and think the value of Musk's understanding of human psychology to the viability of his businesses might be underappreciated. The stock looks at least superficially expensive to me but that's a different question entirely.

-

I wrote some far OTM puts at a $60 strike. $1 per contract for 60 days of exposure. Defined loss acceptable. Annualized return acceptable.

-

I get deals based on my social network from time to time.

-

Morgan is a great writer and even better guy.

-

If the debt is what matters, 100%. Otherwise, close to zero.

-

Re. Buffett, didn't he advertise in newspapers that he was looking to buy businesses?

That is sales and marketing and he was doing it in a time when it wasn't normal to buy an ad like that. He also wrote articles for fortune, etc.

He's a sales machine and like you said ALL business is about sales. You're selling when you look for investors, you're selling when you talk to a broker about real estate, etc.

And Buffett was selling when he presented to local Omaha investors. He's selling when he's at his annual meeting, on tv.....as you noted.

You need a little bit of track record or something to sell though. That's a given.

It's not as much of a given as you might think... :/

-

SPIN Selling is good

The Ultimate Sales Machine

Pricing with Confidence

Marketing High Technology

Tested Advertising Methods

The Ultimate Book of Phone Scripts - Title is misleading, guy walks you through exactly how to move a sale from prospect to close all on the phone

Ogilvy on Advertising

How To Sell Anything

The Boron Letters - classic, possibly true, possibly fake, don't matter

Ca$hvertising

Just finished: Just F*ing Demo and Product Demos that Sell

Upcoming:

Pitch Anything

Demonstrating to Win

I like several of these (haven't read all), but wanted to underline Tested Advertising Methods. That book took me from zero to winning a copywriting tournament, and the knowledge continues to pay some very pretty dividends even now...

In a very literal sense. :)

-

I think Nate is so right. I've made a ton of money on stocks others hated because I knew their marketing was working wonders. As I am beginning with some angel investments now, it's pretty much how I evaluate the outlook for each potential investment.

I had an investment recently in software start-up. I know very little about software. But it has access to a unique method of customer acquisition that, although software is the product, turns it into a direct response marketing company. Something I know very well.

It'll probably fail but I think by understanding marketing, you can rig the deck more in your favor than you'd expect, in some circumstances.

-

1) Sure

2) Teach me marketing - All of these guys became wealthy from raising money and being asset managers. They aren't wealthy from working a 9-5 and investing their savings. They are all out there talking their book, raising money and earning fees. Performance is secondary, they make fees in all markets.

The 'gurus' are gurus because they market themselves like crazy, not because they're better. There are unknown investors with great track records who are wondering when they'll be discovered. The gurus have let the world know about themselves. This is why they're gurus, they understand the power of a brand and marketing.

This is such a great point and something SO MANY minor league hedge fund managers simply don't understand! Which is quite amusing, when you consider that they analyze opportunity cost for a living.

It's not that people don't understand it. It's that people don't want to do it. It's likely a lost opportunity, but you can't force people to do it. To pick on oddball ;), he doesn't do it either... where is his $10B fund? 8) ;D

He is running a software co. and has more knowledge about marketing than most on the board. From what little understanding I have of his software business, it seems like he utilizes his marketing skills regularly while trying to sell his product.

A little different than a MINOR LEAGUER sitting in a dusty library hoping that their returns will bring the big bucks in.

-

1) Sure

2) Teach me marketing - All of these guys became wealthy from raising money and being asset managers. They aren't wealthy from working a 9-5 and investing their savings. They are all out there talking their book, raising money and earning fees. Performance is secondary, they make fees in all markets.

The 'gurus' are gurus because they market themselves like crazy, not because they're better. There are unknown investors with great track records who are wondering when they'll be discovered. The gurus have let the world know about themselves. This is why they're gurus, they understand the power of a brand and marketing.

This is such a great point and something SO MANY minor league hedge fund managers simply don't understand! Which is quite amusing, when you consider that they analyze opportunity cost for a living.

-

Anyone think the 30 bucks selloff is a overreaction to Amazon buying Wholefoods?

I'm not saying COST is cheap at this level (although it almost never seems to be cheap) but it looks like an overreaction.

My guess is it will be closer to 3-5 years to see Amazon start taking share from COST.

Stock market is forward looking, supposedly.

-

Seems like a smart buy.

-

I've thought of buying some Fairfax at around current prices. Already own Markel.

-

F.A.N.M.A.I.L.

Well guys, now that I'm back in action it's time to share some fan mail I received on sabbatical.

I have the best fans, but this time the mail came from none other than The Chairman, Jeff Moore of Sitestar.

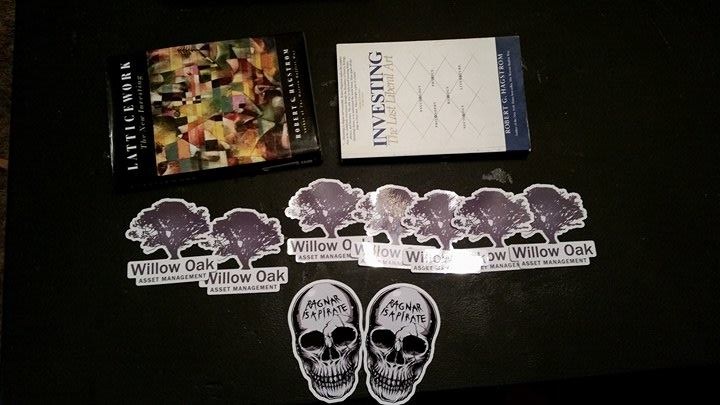

On top of getting two cool looking investing book, there were also hidden goodies packed away inside...

Stickers!

Two Ragnar stickers and a heaping helping of Willow Oak Asset Management stickers. What great Sitestar swag.

So a huge shout out to Ragnar for the shareholder swag, considering I was forced to miss the Sitestar shareholder meeting this year.

Will these stickers become a lucrative opportunity down the line? As Steve and team grow the business, these could become collector's items someday. I'm not selling a single sticker.

If YOU want to do your duty of sending me fan mail and appearing on this thread, please PM me here or on Twitter to see how you can get involved in the Scotty community.

-

Scott, what is your lifetime IRR?

This is publicly available on my Twitter stream. I've publicly disclosed my returns so far this year (now dated), last year, the year before that, and XIRR since 2008 (when I turned 18 and opened an account in my own name). I can give you an update of this year's returns, because what I posted on my Twitter is now dated. I'm too lazy to dig the rest up ATM but you can find it easily enough.

My return YTD is: 21.52% on a total of 31 positions.

I learned about copy writing a few different ways. I had various products I was selling through Direct mail marketing and then rented my own buyer list. I would look to see who rented my list, because they rented my list I had access to their mail piece. I would then order there cheap introductory product or service thereby getting on their customer list, then I would read through the 50 or so mail pieces I received each month for anything from sex toys to business opportunities.

During the depth's of the recession, with my response rates down from 3% to 1.25% and my dollar per lead down from 200 - 90 I learned to innovate. Dollar per lead is the amount of revenue derived from each lead generated. There really is nothing like a great recessions to teach you about business. Especially when your on the front line. From 2007-2010 profits were down 85%. Which was effectively going from hero to mediocre.

One, everyone's credit sucked so I signed up with a billing company and designed a financing program where I basically covered my hard costs, of COGS, and the rest was received over 18-36 month contracts, I had no idea how many people would pay and for how long, but my costs were covered. No downside, high upside. As it turned out, about 70% of total contracted monies were received, much better than I expected. This is turn changed my business from a cash machine with huge up's and downs to a stable grower. Basically, for the first three years of this program, sales and profits had to go up because the finance portfolio was always growing. After three years I knew it would continue to improve, having to do with the maturity of the portfolio. If sales are constant, and the portfolio reaches maximum capacity at the 3 year mark of from when the financing started due to a maximum of 36 month contracts. I didn't realize at the time how much maturity would matter. Basically, in a portfolio with an average duration of 22 months and a maximum of 36 months, what happens is the 30% who don't pay become a smaller and smaller % of the total portfolio over time. Reminds me of cacc in some ways.

Another thing I did that relates to copy writing, against my copy writers advice was I changed my promotional offer from a 100% money back guarantee to a 200% money back guarantee. Of course this was a test and I only did it with 100k mail pieces. My copy writer said that he had never seen it done before and he thought that people would order it to simply send it back at a profit. He also said that the DPL or dollar per lead average (up sell sales) would decline because the quality of the lead would decline caused by the profit seekers.

My contrarian point of view at the time of initiation was the following:

-I thought people were too lazy to send it back

-I thought people would forget they could make a profit

-I thought more people would order item(s) and some of them would be up sold

-I thought because it was an uncommon practice it would build credibility in the products

-I thought it would shock people into ordering who normally wouldn't have

-I knew that I didn't know and should always be testing something

The result was that my response rate immediately went from 1.25% to 2% and the DPL went from 90 to 120. There was increased returns of the products, they went from 3% to 7%. The cost of the increased returns were about 1% of the additional profits.

Anyways not to derail thread but all this drm stuff brought back memories.

Scott, I know some great copy writers if you're interested.

These are some great stories, Flesh. I like how your out of the box thinking helped create better economics for your business.

I've worked in various roles in different marketing organizations. I've done copywriting, helped determine returns on various promotions and in aggregate, aimed at justifying more resources for growth. The biggest companies in my industry are not small, though some seem to think that's the case from my discussions with others here.

Most of that sort of IRR analysis is only useful if you're not the agent in charge of the wallet, so to speak. If you know a piece of copy is good and have agency you don't have to justify the expense to anyone... I've sort of been gradually shifting myself in that direction. More towards owner-operator, less of a cog in the machine.

I've been focusing on honing my skills for that. I recently wrote a piece of copy on royalty that ended up being the biggest of the year so far for that particular client. My cut for 20 days of writing ended up approximating my salary from my old gig.

Persuasion is an incredibly useful skill. I'd love to chat with you about your war stories in the future, if you're game. I don't really need a copywriter, but I love to talk with others about their experiences in the industry. I could tell you some interesting refund ideas I've used in the past... I bet we could compare a lot of notes on that!

I can't really discuss all of this publicly... but feel free to e-mail or PM me.

-

Fun to listen to. I did skim but a lot of it was quite interesting.

How did you learn Valuation?

in General Discussion

Posted

I wouldn't read any of these books. This sort of thinking is toxic and distracts you from how the world really presents opportunities.