oddballstocks

Member-

Posts

2,266 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by oddballstocks

-

My wife owns the fund in an IRA so we've been getting the letters for a few years now and I've seen these names a few times before. I have looked at other TAV holdings but never the HK stuff. I ran a screen of net-net stocks trading in HK about a year ago, I was inspired by the TAV holdings. I attached the xls file to this post. If you do look here is a link to HK's version of EDGAR: http://www.hkexnews.hk/ Companies in HK have similar reporting requirements to companies in the US, filings are in english, transparency pretty decent. Hong_Kong_NCAV.xlsx

-

The Five Rules for Successful Stock Investing: Morningstar's Guide

oddballstocks replied to racemize's topic in Books

Seem to remember discussing this book a few months back so there's probably already a thread... I remember the first half was DCF stuff, not extremely useful. I wish he would have spent a little more time with different valuation techniques. Dorsey and DCF reminds me of the phrase "when all you have is a hammer everything looks like nail". The second half is the most valuable portion of the book, Dorsey goes through different industries and talks about the key metrics and key drivers for each industry. Each of those chapters is probably ten pages long or so and can be read pretty quickly. -

Walker's Manual of Unlisted Stocks - Harry Eisenberg

oddballstocks replied to oddballstocks's topic in Books

Tim, I've considered the same thing as you, build out a database of unlisted stocks and put it online. When I think about this it isn't as easy as just updating the Walkers. I've been going through it and probably 40% or more of the companies in the 03 edition aren't traded anymore. So some newer unlisted companies would need to be found to fill these spots. The second issue is as you mention there would be a substantial upfront cost to buying all of those shares. I've run across a few stocks that are technically traded but shares haven't had a trade since 2009 or early 2010. I wonder how much actual paying interest exists for a thing like this. As I've been going through the Walkers Manual I've been trying to blog about these companies. In a few cases I've mentioned that I have financials for unlisted companies and I'd give them out to anyone who emails me, to date I've had one request. I think this is a niche market within value investing. I've also considered putting together a few reports for minimal costs on some of these companies, but I keep running into the same issue as above, lack of demand. -

Seems to be the party line, RIMM builds for business and iPhone/Android is for 14yr old kids playing Angry Birds. I was at a company meeting last night, 100 employees, I saw 0 Blackberrys, everyone had an iPhone or Android with one Palm Pre (that person making fun of themself in a presentation). Three years ago 75% of this crowd had Blackberries, those same people all ditched them for the fun phones. I've asked a few of these people and everyone of them said ditching the Blackberry was worth it and they wished they did it earlier. When you lose a customer like that it's hard to go back. I can't imagine any of these people jumping from the fun phone back to a Blackberry, the mindshare has been lost. None of this stuff is fluff business either, people doing spreadsheets, one guy did a presentation off his iPhone. One more anecdote, our company is moving into the mobile space in a large way due to customer demand. What do customers want? They only want iOS and Android applications, they've communicated clearly that Blackberry/Palm/Windows isn't worth the effort. This is all anecdotal but from my vantage point it's significant. I don't hold any RIMM shares nor do I want to, I'm not sure how you regain all those lost customers. Will be fascinating to watch.

-

Watsa no stranger to betting on perceived value

oddballstocks replied to CanadianMunger's topic in Fairfax Financial

So that means that in eight years every man woman and child on the planet will have 6.6 devices that require streaming for that stat to hold true. I'm calling BS on that. Let's revise this and consider that in eight years it's unlikely that the entire world population will be out of poverty and will be able to afford 6 $100+ devices with their associated data contracts. So let's say that 50% of the world will be able to afford them, so that means 12 devices per person. This stat shows how meaningless linear projections are. Twelve devices...give me a break, I'd need a murse to carry all that crap... -

Book/Manual/Guide for the London AIM?

oddballstocks replied to oddballstocks's topic in General Discussion

Here is the Japan Company Manual: http://www.toyokeizai.net/shop/magazine/jch/ (mentioned in this thread: http://www.cornerofberkshireandfairfax.ca/forum/index.php?topic=4325.0) Here is the S&P one: http://www.amazon.com/Standard-Poors-500-Guide-2012/dp/0071775323/ref=sr_1_1?ie=UTF8&qid=1326996463&sr=8-1 -

Book/Manual/Guide for the London AIM?

oddballstocks replied to oddballstocks's topic in General Discussion

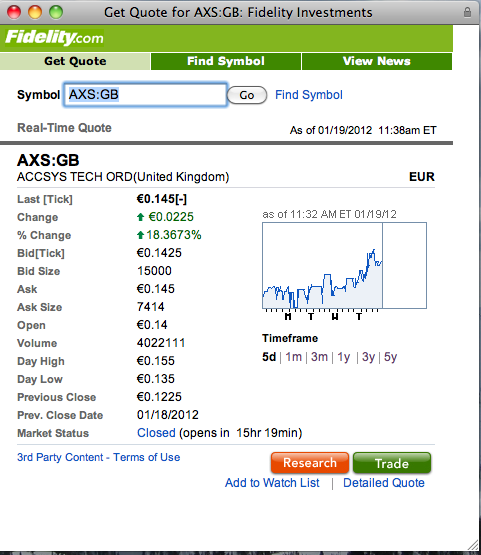

Fidelity has AIM investing, they allow it online as well. As a test I just pulled up two quotes from the AIM website the top risers for the day and got back quotes on both. I attached the screenshot of my quote. The one caveat is that Fidelity doesn't allow orders that extend past one day and some AIM stocks are very illiquid so a GTC order is impossible you have to place the order each day until you get a fill. The price to trade is £8.95 plus stamp tax. Just another note if you want to trade a $50k or larger order Fidelity can trade any market in the world directly with a broker. The fee is $132 which is pretty reasonable all things considered. -

I'm looking for something like the S&P Manual for the London AIM. Basically a physical book that has a short summary and some summary financials for the shares that trade on the AIM. I know S&P makes these for the US, someone had posted one for the Japanese market a few months back so I have to assume something similar exists for the AIM. There are a few publications on their own website but most are focused on growth companies and information for companies that want to list. My intent is to page through and then do further research on anything that looks interesting. I realize I could use a screener but often I've found stocks that are really interesting don't screen that well, or won't turn up on any specific screens I've run. The best way (unfortunately) to find stocks is just brute force, as Warren Buffett says start with the A's.

-

Rumors floating that they're going private

-

Thanks for the comments NormR - I've had similar experiences in my own portfolio, but what surprised me is the extremeness of the data. I've always heard the rule of five, for any five given stocks one will do terrible, one really well, and the other three average. Median is -20.5 which is below the FTSE Small Cap ex-US benchmark (-19), I should have included that. Racemize - I don't have any hard numbers but probably 25-30% of my portfolio at any given time, the size fluctuates as opportunities come and go. For net-net's I'm not a buy and holder I buy below NCAV and sell once NCAV is reached. In a few rare circumstances the business improves so much, or something fundamental changes and I'll continue to hold the company. I only have one stock like this, the rest I sell on the way past NCAV. Just a note that momentum is usually strong with these stocks, it's no uncommon for them to start to rise and continue for a while, I try to ride the wave if possible. SharperDingaan - I would agree with you, the 1yr was arbitrary and to satisfy my curiosity. I know an astute investor could have taken advantage of selling early in a few cases. For example Dainichi was a company I purchased, at the end of the year it was up 22%, but it could have been sold for 40% more a few months back. I sold about 15% off the high. Obviously my return is higher due to the better timing and shorter holding period, I know there were other stocks that were similar.

-

There are often posts on here asking about net-net's or mentioning net-net's, I also write about them often on my blog so I was curious as too see how they actually performed over the past year. This is looking at all of the net-net's on my screen not just companies I had purchased or researched. I screened about a year ago for companies that were debt free and trading below ncav. I then took that data this year and found the 1yr returns for those stocks. I have a more complete writeup on the blog, but I've attached the spreadsheet with the summary results and data to this post. Here is the summary info: Companies starting 2011 214 Companies ending 2011 176 Equal weight return -0.26 Australia -3.354 Belgium -15.25 Canada 27.74 France -15.5 Germany 11.1 Hong Kong -40 Italy -4 Japan -8.19 Netherlands -1.5 UK -6.63 FCF Positive firms -10.33 Dividend Payers -15.77 Mcap > 1m -13.44 Mcap < 1m 58.92 Number of companies with Positive returns 30 Return > 10% 21 The original blog post (I have some other observations, methodology):http://www.oddballstocks.com/2012/01/international-net-nets-one-year-later.html I'm interested in comments or your observations. I think what surprised me the post was how much of the performance was related to a few stocks that went up a lot, taking those out and the results beat the benchmark but are a bit more mediocre. Nate NCAV_performance.xlsx

-

Buffett Offers GOP Donation Challenge

oddballstocks replied to dcollon's topic in Berkshire Hathaway

This thread reminded me of a quote I read that seems appropriate "Democrats spend your money while raising taxes, Republicans spend your money while raising deficits" I wish there was a candidate who didn't just believe the party line, I realize this is what's required to get elected, but I still wish it. The problem I see is that the country's problems aren't solved by a Republican or Democrat idea, you really need some out of the box thinking. Ron Paul at least is willing to be out of the box which is more than anyone else. But either way I'm not very hopefully that anything will change. While we're on politics I am always fascinated that people get so involved in watching national politics yet those are the ones that will probably have the least impact. At the same time the local stuff, school districts, townships all of that is ignored yet that could have the biggest day to day impact on a person's life. It just seems switched, if the local school board destroys the school system I could have trouble selling my house vs some bill that decreases military spending in 2017. -

I have had some stock certificates through the years, my parents used to hold all of theirs in certificate form. It's a pain, total pain. My parents kept all their shares in a safe deposit box at a bank. So to sell shares they'd have to drive to the bank, get the shares out, make copies, mail them to the broker, wait a few days and then sell. There might be three or four days between the decision to sell and the broker executing the trade. If you overnight mail it I guess you can achieve execution in about a day, although this is costly again because of the premium postage. I know with my broker (Fidelity) I can request anything in certificate form, I think there's a $35 or $45 fee per stock certificate requested. I only did this once when I donated some shares to a charity and it was easier to take the certificate and sign it over in person. I guess in short I don't see the point. For each purchase you're going to be paying $35-45 plus commission, you now have the risk of something happening to the shares in transit or in storage and you have a large delay in selling. Not worth it to protect against a MF Global, you're probably better off opening a few different brokerage accounts. I guess the corollary is do you keep all of your cash at home instead of at a bank? You're basically asking the same thing, brokerage houses have SPIC for stocks, commodities have no such protection. SPIC protects against fraud by the brokerage up to $500k per account. If you have more than $500k just spread your assets between institutions.

-

Here's the thread with the Argo comments:

-

I've written up COR and ARGO on my blog, I also had a great conversation about ARGO on this board squished in some other thread. In short: COR - Owns the cork market, nice niche, innovative, balance sheet improving, results improving, sell worldwide but associated with Portugal, only about 20% of sales are local. Family majority ownership. ARGO - selling for less than net cash, management has incentive based on history to regain the company. Options issued at double market price, could be bought out based on asset manager purchases for probably 3x current price. Good downside, great upside. They are an emerging market hedge fund manager. GAV - Family owned company similar to COR in that it's a niche market, great ROE/ROIC ex-cash. Sell worldwide have taken a hit recently due to a decline in solar subsidies and franc. They sell sensor systems and components, specialized products. All three of these are fairly illiquid, I've been able to buy within a day or two of placing my order. I'm not sure how well you'd be able to accumulate millions of dollars worth, but then again I think the mcap for each is less than €150m. I'll post the links to where you can find out more tomorrow when I get a chance.

-

Agree with you, I've been on a tour of the European markets myself and have done a decent amount of posting on my blog. I've been looking at two different types of companies, quality net-net's and hidden champion companies selling at cheaper prices. I've found a few net-net's but nothing great. With regards to hidden champions there are bargains in the countries no one wants to touch, Portugal, Italy etc. Of the German companies I've looked at nothing has stood out as really cheap fire sale prices. What I've seen in Germany seems to be the highest quality, but the market recognizes that. Looks like your picks are a bunch of ADR large caps. I'm much more of a small cap direct investor myself, do you limit yourself to ADRs? I think a lot of the reason that this is a North American board is that most North American investors have trouble accessing world markets. A second reason is that between the US and Canada a lot of investors have the view that there is more than a lifetime to research (a perfectly valid view). Anyways as far as picks I'll throw out a few: COR.Portugal, GAV.Swiss, ARGO.UK

-

It seems that part of the thesis is that Sears can sell off their real estate holdings to Target, Costco, Best Buy etc and realize the value of the underlying land. The problem I see with this is outside of a one light town everywhere there is a Kmart or Sears that I've seen there is also a Target/Costco/Best Buy/Lowes in a much better more prime location within a mile or so. It seems that we've hit the point of retail saturation. I'd actually be interested in seeing a list of Sears/Kmart locations with distances to the nearest locations of potential tenants. I think the best possible outcome is if Sears dumped their retail and licensed their brands. I know their brands don't hold much or any mindshare with us, but they hold more than the namesake locations. I believe craftsman still has some loyal followers, same with Lands End. This will be interesting to see how it plays out. I personally won't touch this with a 50ft pole, the reason? SHLD has all of the looks of another investment that turned into my biggest loss. I invested in Seahawk Drilling under the premise that the rigs were worth almost 2x the market cap just for scrap alone. Even in a dire situation I figured I could realize at least my investment back under a liquidation. The business eventually put themselves in such a bind that management sold to a competitor for less than scrap. My thesis was dead on, the buyer touted their amazing buy in the acquisition slide. The buyer actually scrapped the rigs and realized the liquidation value I was betting on. I believed I had a margin of safety in buying assets for cheap, my mistake was that I had no control of the asset conversion, and that in the process of trying to save the business and turn things around management put themselves into a position which destroyed the margin. I fear that SHLD is doing something similar.

-

A few Kmart's that I know of are in shopping centers that are half empty so in factoring in the real estate value I'd maybe chop off 30% or so for bad locations and the length of time to sell. I was actually in a Kmart this past weekend, it's one of the only places you can buy ginormous clothes (3x and up for a relative) and the store is quite sad. A lot of inventory that looks like it hasn't moved in years, the place just has this mishmash feel. One minute you're next to washing machines, then suddenly you're in the middle of a toy section, and a few steps later you're looking at $1000 TVs which are next to piles of cheap Christmas candy.

-

Wow, flashbacks of the CFA exam in reading those questions Duration, this is the percentage change in the bond/s/fund for a 1% change in interest rates. So if you have a bond with a duration of 2.2 a 1% increase in rates will mean a 2.2% drop in the value of the bond. Nissan and Renault, just spent some time on this recently. You can hedge with futures or synthetic options. So for example if Renault wanted to hedge their position they could do this call option + treasury - underlying = synthetic put (I think, bit rusty on the formula). As for Renault guaranteeing Nissan's debt I'd look at it two ways. The first is consider a liquidation, can Nissan's assets support the debt? Probably not, that's why they need the guarantee, so look at under what condition an impairment would occur for Nissan such as % drop in sales or % rise in costs, then examine the impact on Renault. Secondly I'd consider this a full debt for Renault less any expected recovery from a liquidation. Maybe Nissan can support 60% of the debt so 40% is Renault's. Change in depreciation doesn't affect cash flows, but increases earnings if it's lengthened. AR means nothing for earnings, but cash flow will drop. Pension is a real liability, look at GM, pension owns part of the company along with the Gov, where are equity holders? They're writing off their losses, some bond holders were trumpted as well. As for the minority stake it depends on how much the company owns. Different thresholds mean different things in breaking out the consolidation. So that's my best shot.

-

Anyone ever measure their R-squared?

oddballstocks replied to oddballstocks's topic in General Discussion

Twacowfca, yes Coefficient of Correlation. I'm not surprised yours is low, that was my suspicion for most here as well. I agree with you on the under performance for the most part, although it seems some of the funds we have that are going to be removed are just bad funds, frequent manager changes and managers who just aren't that good. One of the reasons I want to show R-squared is to drive home the point that we need a few more index funds in the 401k. If I'm going to basically match the market with my funds I'd rather pay .2% to do it instead of 1.3% -

I looked at IB for their international platform as well and was put off by the monthly fee. I don't trade enough to offset it each month and it would be slowly digging away at my account. I realize it's not much but it's enough. I think where IB is great is if the portfolio size is large enough at that point the costs maybe don't matter as much. I can imagine someone with seven figures not caring about paying $360 a year for data. This is especially true for some RIA's and partnerships, a few hundred or even thousand a year is nothing for them. The little guy on the other hand...well I'd rather keep the $360 personally.

-

I'm helping my company switch out some mutual funds for the 401k and one metric I always like considering is the R-squared. It's not all that surprising but many of these funds are close index-huggers. So this got me thinking has anyone ever calculated the R-squared for their own portfolio? Just based on discussions from this board I'm guessing people are going to be low. If anyone has done this in the past I'd be interested in hearing about the experience, and if you're comfortable the R-squared valued. It doesn't even have to be current.

-

I thought only Indian citizens could buy Indian stocks, is there some sort of loophole? I remember looking into this recently as well as seeing someone post about it on the board. Here's an article I found: http://jayesh.profitfromprices.com/invest_in_india.htm I classify as a foreign non-Indian, so it seems I'm out of luck.

-