klipbaai

-

Posts

15 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by klipbaai

-

-

@SharperDingaan do you have a view on Spartan Delta? SDE today announced a "Strategic Positioning Process" which, amongst other possibilities discussed in their release, could include a sale.

-

2 hours ago, glider3834 said:

good insights SJ - expect the insured losses to be less than the actual losses - in Calgary 2013 insured losses appear to be around about 33% of the actual losses/damages https://www.theglobeandmail.com/business/article-bc-floods-will-be-canadas-most-expensive-natural-disaster-this-year/

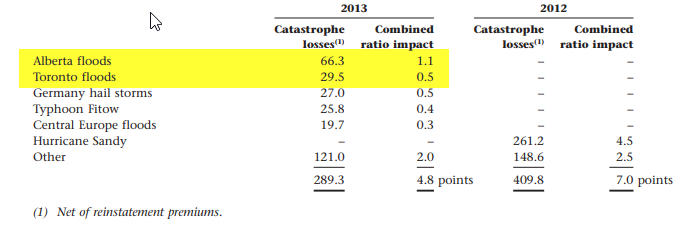

I am going back to 2013, floods in Alberta & Toronto.

In 2013, Northbridge Insurance had 2.52% market share & looks like Fairfax incurred around 3.6% of the insured losses.

Alberta C$1.7 bil (Fairfax loss 66.3 mil or 4%)

Toronto C$0.94 bil (Fairfax loss 29.56 mil or 3%)

In 2020, Northbridge had approx 3.2% market share

so maybe we could expect 4-5% of the insured loss based on their market share? Of course just purely an estimate & their underwriting exposures would have likely changed, but I think their market share in terms of premium does provide some help in terms of measuring potential exposure.

I haven't been able to find an insured losses estimate yet but anyone feel free to post if you have.

Cheers

Thanks for all the info, Glider.

-

Thanks, StubbleJumper

i did not mean to imply any doubt about the SIB.

I was thinking more about whether or not the announcement of a significant loss might present an opportunity and when that opportunity might arise … whether before or after the SiB.

-

Thanks for your thoughtful response.

Here's a link to an article in the Globe & Mail.

B.C. floods will be Canada’s most expensive natural disaster this year - The Globe and Mail

Other articles also mention that flood insurance is often not obtainable, suggesting that much of the cost may/will be borne by the Government/taxpayers and/or the unfortunate property owners.

Fairfax is, of course, in the business of insurance ... their expertise is in pricing risks appropriately and holding sufficient reserves to deal with the consequences. In that context, one should expect the losses to be manageable.

My interest is partly motivated by the timing with respect to the SIB. If Fairfax makes an announcement prior to completion of the SIB, might that change the possible dynamics of the outcome? For example, a drop in the current price might make tendering more attractive; provide an opportunity to add to positions; etc. The timing of an announcement might be quite significant. If Fairfax has developed an estimate and the number is material, must they disclose immediately? Or could they deliberately put off making an announcement until after completion of the SIB?

While none of this is knowable in advance, I am curious what this well informed forum thinks.

And, yes, it would be good to hear from Parsad given both his expertise and his long-time close experience with FFH which might perhaps give him better insight into how FFH will think about the timing of an announcement.

-

I expect Fairfax will have some exposure to the flood damage in BC. Based on similar weather related natural disasters to which it has been exposed in the past, any sense of whether or not and when they might provide announce an estimate? Will this wait until the next quarterly earnings announcement or might they release an estimate before then? Any early guesses?

-

Thanks!

-

Hi Sanjeev ... thanks for all this!

Does the new site have a summary of "Posts since your last review"? I found this a useful feature on the old site ... it summarized new posts by topic, identifying what was new since one's last visit and making it easier to pick out the threads one wanted to follow ...

If there is a similar feature in the new site I have been unable to locate it ...

Cheers

Mark

-

Wintaai Holdings Ltd (not listed)

in General Discussion

Posted

You can get some exposure to Wintaai by investing in Tim McElvaine's Fund, McElvaine Value Fund.