Phoenix01

Member-

Posts

251 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Phoenix01

-

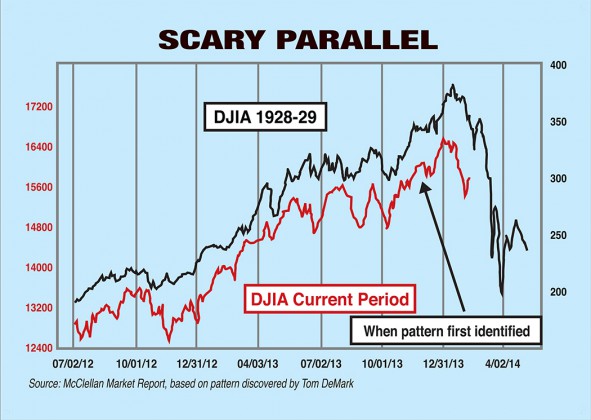

Here is an interesting graph. If history repeats itself, we will have some really interesting discussions at the FFH AGM.

-

That would have been epic!

-

Packer, ValueLine shows their median stock estimated P/E ratio is 17.8 (it varies between 10.3 & 17.5). The median stock estimated Div Yield is 2.0% (it varies between 4.0% & 2.0%). The median stock estimated 3-5 yrs appreciation potential is 35% (it varies between 40% & 185%). All the needles are pointing to red. It does not mean that anyone knows when it is going to blow up, but I will be keeping my distance. It will take a really sweet deal to draw me back in, and I do not see any.

-

It all comes down to margin of safety. Are you reaching for yield or shooting fish in a barrel? In an overpriced and fragile economy, what sort of returns are you going to demand? Are those returns available today? My perception is that there is a lot of of reaching for yields, so I am stocking up on dry powder and waiting patiently.

-

Exposure to a single commodity and customers that are concentrated in one sector. High debt & capital requirements. In light of a possible economic downturn, I have been buying puts against some of the most vulnerable players.

-

Here is a link to an article by Soros that does a nice job of highlighting the major financial risk that exist today. http://www.project-syndicate.org/commentary/george-soros-maps-the-terrain-of-a-global-economy-that-is-increasingly-shaped-by-china There is a lot of fragility in the world. It will not take much to trigger a crisis.

-

Txlaw -- anything else you can share about what Brian said? Thanks. I can't really recall the specifics. For some reason, I feel like it was quite similar to Kyle Bass' view of the world at that time. My major takeaway was that HWIC had positioned the portfolio in a way that was anticipating some sort of global macroeconomic disaster -- an echo of the financial crisis due to money printing and governments taking on more and more debt. And that because they really believed in this view of the world, they would not be taking the hedges off anytime soon. Since I totally disagree with the hedging strategy, it was a very worthwhile thing to hear from someone other than PW because it solidified my decision to stay away from FFH until they actually take off the hedges. I recall that it was all about the uncharted territory and unintended consequences. FFH spends a lot of time trying to figure it out, and they did not know what would happen next. The risks of something bad happening (especially in Japan with Abenomics) was very real and even probable. I look forward to the AGM to see what has changed.

-

Rogermunibond, Thank you for the link. I will need to re-read it a few times to full understand all the ideas that are discussed. Regards

-

Kyle Bass seems to have done his homework and has a high conviction that Japan is with 2 yrs of a debt default. I know that FFH is also really concerned about Japan (informal discussions during the 2013 FFH AGM). Do you have any other sources that can provide further clarification on the current Japanese situation?

-

Zachmansell, The whining over the hedges is really annoying. Thank you for the thought you into your post. Phoenix01 (Patient investor since 2000)

-

I have been following this thread and there is a basic fact that seem to be missing. 1) The realized losses on the hedges are caused by the fact that FFH is selling the lower strike price hedges and rolling them into higher strike price hedges (they are also lengthening the duration). Why is this being done? Well...Taxes! As FFH sells off the equities and locks in the profits from the overvalued market, they offset the gains by improving the hedges. The hedges of today are not the same as 3 years ago. This is a tax free way of rolling their equity gains into the hedges. I am fully invested in FFH, as I have been for the last decade. I have not found a compelling reason to sell. If there is a drop, I will go all in, but at this point I think that they will be presenting some really interesting numbers for the start of 2014 and there may not be a sell off.

-

BlackBerry says Fairfax to buy $250 million more debentures

Phoenix01 replied to ourkid8's topic in Fairfax Financial

Today BB has 3B in cash & 1B in convertible debt. For simplicity sake let's assume the rest nets out to 0, for a tangible value of $2B. The company is still generating 1B of free cashflow annually despite all of the crap it has been through. If you believe in Chen & his team, then this is a bargain. I am with Prem on this one. He has often said that you can't over pay for a an excellent leader. I'm hoping to meet with Chen during the Shareholder meeting to confirm my suspicions that he is the right person to turn BB around. -

Here is another good video of Ray Dalio http://video.cnbc.com/gallery/?video=3000008442

-

The company sells to fractional policies to a pool of investors. In general everyone makes money. The policy holder gets more than the insurance company is willing to pay out and the investors get some positive return. In the earlier years, the returns for the entire industry were not so good, but lately the returns have been better. LPHI is buying a lot of the policies for themselves. I think the company is the victim of short sellers and that the issues are overblown. The integrity is still a problem. They compete with their own customers and use the company assets for their own benefit. There are much better places to be invested. I was going to sell out at the peak, but I did not want to pay taxes on the gains. This has happened to me several times before. I need to discipline myself to ignore the tax implications and make decisions purely on the trade. Paying taxes is better than losing money!!!

-

Ivey School - Presentation by Irwin Michael

Phoenix01 replied to JEast's topic in General Discussion

James, Thank you for posting. That was a great presentation. -

How do you optimally allocate your portfolio concentration?

Phoenix01 replied to yudeng2004's topic in General Discussion

There is a tremendous need for the products that both are producing and this need will go on for decades. NE has the best margins in the industry and can be differentiated by its safety record and cautious management and the relationships they have in place. Post GOM spill, there will be a premium for this. You are definitely correct that oil dropping to $40 is a huge problem. I personally think that all indications are that the price will continue to rise because of the lower $US and the increase in demand with more and more people rising out of poverty. You can also protect the position with an oil hedge if you are not comfortable with the risk exposure. Education is going to be the battle ground of the future. The US has dropped the ball on this front and will have to invest heavily in order to remain competitive. ESI appears to be one of the better run for-profit schools, but I have not investigated many of them. They seem to have the management aligned with the interest of the students and the shareholders. -

How do you optimally allocate your portfolio concentration?

Phoenix01 replied to yudeng2004's topic in General Discussion

As mentioned earlier, ESI & NE are really cheap right now. Both of their industries have been battered, but they are both still solid and will be able to take advantage of the fallout. ESI is discussed under a separate thread titled "Education Stocks Once Again Get Slammed on Apollo Report". Noble is a deep sea driller with an impeccable safety record and management team. Peak oil and the huge Brazilian off shore initiative will give this company all of the opportunities to grow into the future. In the short term, I think the Q3 will disappoint and may offer an even better entry point, however, it may already have been priced in. -

How do you optimally allocate your portfolio concentration?

Phoenix01 replied to yudeng2004's topic in General Discussion

I agree that these types of "Plan A" stocks are hard to find. Right now there are several of these available. I would not consider this a plan B type of market. -

How do you optimally allocate your portfolio concentration?

Phoenix01 replied to yudeng2004's topic in General Discussion

<<But I suppose this entire exercise is a reflection of my doubt that "buy undervalued security, hold it, and sell it at 80-90% intrinsic value" is really the best one can do. And I have always had trouble dealing with these things just by reacting to them - there has to be a plan.>> If your company is a good one, the full intrinsic value should keep increasing over time. You are therefore chasing a moving target. If you can project the earnings growth into the future (which you should based on your analysis) and the company is tracking to those expectations, then the there is no real need to sell. Each new company brings with it new risks and opportunities. The opportunity for the new company needs to be much greater to account for the new risks that are not as familiar. -

Education Stocks Once Again Get Slammed on Apollo Report

Phoenix01 replied to Josh4580's topic in General Discussion

Blum Capital Partners currently hold over 10% of the outstanding shares and is adding more on the weakness. Is anyone familiar with Blum? Do they have a good track record? -

Education Stocks Once Again Get Slammed on Apollo Report

Phoenix01 replied to Josh4580's topic in General Discussion

From the ESI annual reports If an institution’s FFEL/FDL official cohort default rate is 25% or greater in any of the three most recent federal fiscal years, the ED may place that institution on provisional certification status. The ED may more closely review an institution that is provisionally certified, if it applies for approval to open a new location or offer a new program of study that requires approval, or makes some other significant change affecting its eligibility. Provisional certification does not otherwise limit an institution’s participation in Title IV Programs. Below is a list of the ESI cohort default rate. Federal Fiscal Year FFEL/FDL Cohort Default Rate Range 2008 (a) 3.6% to 15.5% 2007 (b) 2.7% to 15.2% 2006 1.7% to 12.9% 2005 1.3% to 12.6% 2004 5.8% to 12.7% 2003 4.5% to 10.2% 2002 2.1% to 12.1% 2001 4.9% to 12.7% 2000 4.5% to 17.5% (a) The most recent year for which the ED has issued FFEL/FDL preliminary cohort default rates. (b) The most recent year for which the ED has published FFEL/FDL official cohort default rates. 6. Financial Aid Programs We participate in various Title IV Programs of the HEA. In 2009, approximately 70% of our revenue determined on a cash accounting basis under the calculation of the provision of the HEA commonly referred to as the “90/10 Rule” was from funds distributed under these programs. We administer the Title IV Programs in separate accounts as required by government regulation. We are required to administer the funds in accordance with the requirements of the HEA and the ED’s regulations and must use due diligence in approving and disbursing funds and servicing loans. In the event we do not comply with federal requirements, or if student loan default rates rise to a level considered excessive by the federal government, we could lose our eligibility to participate in Title IV Programs or could be required to repay funds determined to have been improperly disbursed. Our management believes that we are in substantial compliance with the federal requirements. -

Business Insider interview with Jim Grant

Phoenix01 replied to biaggio's topic in General Discussion

Thank you Biaggio, I was impressed by Jim Grant. -

twacowfca, I hope you are right about the hurricane season, but Paula is still hanging around. Like TariqAli mentioned, there are some special situations that provide some nice fat pitches. The oil spill in the GOM took down Noble (NE) disproportionally. They are an outstandingly well run company with a solid balance sheet and they have profited from this situation by the acquisition of a smaller competitor that has solidified their relationship with Shell and provided them with some cover during this dark period. In 5 years this will look like such a no brainer. There is also ESI in the for-profit education industry. The industry has been beaten down, but the great companies find a way to turn it around. There is a separate thread about ESI.

-

Education Stocks Once Again Get Slammed on Apollo Report

Phoenix01 replied to Josh4580's topic in General Discussion

The impact of the regulation seems to be over blown. Secretary Arne Duncan from the U.S Department of Education gave the following telephone interview. http://www.ibj.com/proposal-links-subsidies-for-itt-educational-peers-with-performance/PARAMS/article/21290 While most education companies provide valuable training and skills, high-cost education programs that lead to low-wage jobs are harming students, leaving them with hard-to-pay debts, Duncan said. “We want to hit the ones at the bottom, those that simply aren’t working for students,” Duncan said in the press briefing. “The 5 percent would frankly be the bottom of the barrel.” ESI is not that 5%. -

Education Stocks Once Again Get Slammed on Apollo Report

Phoenix01 replied to Josh4580's topic in General Discussion

Thank you TariqAli, The article has an interesting approach to analyzing the situation. It is mechanical and misses some of the finer points that set ESI apart from its competitors. The base assumption is that the enrolment will shrink because a portion of the students will no longer be able to get access to the loans if the costs are too high. However, ESI enrolment has continued to increase enrolment in Q1 & Q2 and the management has addressed this issue in the past by providing alternative financing and also bursaries and other fiscal incentive for student with good grades. The alternative financing is through a joint venture with other investors to create a trust that provides the loans. ESI is on the hook for the defaults above a specified level. This is shown in the balance sheet as restricted cash and is a negligible sum. A quick look at Apollo shows that they have significant restricted cash that keeps increasing. I am assuming that a similar financial set-up was put in place for Apollo but with different results. The bursaries and incentives costs are rolled into the SG&A and shown in the Income Statement as student services and administrative expenses. ESI management seems very aware of their responsibility towards providing the students with gainful employment and have stayed well below the mandated levels. I do not foresee any significant impact of the new rules on their long term performance. If anything, the cleaning of the industry bad apples may provide further opportunities. If I have missed something, please let me know ASAP!!!!