one-foot-hurdles

Member-

Posts

61 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by one-foot-hurdles

-

Which probably means he will seize the Russian assets of companies domiciled in Western countries not that he will seize the shares of American shareholders of Russian companies. To me it would be a pretty stupid move if he did. All it means is that Russian companies would no longer have access to international capital markets which hurts Russian companies and it won't really have any effect on Western countries, governments or powerful stakeholders. I actually vastly prefer Russia to countries like India which trade at much higher multiples. India is extremely corrupt but on top of this its a democracy and I think this is really bad. Most Indian voters are poor and uneducated and all they care about is that politicians hand out goodies. I actually think a Russian dictatorship is much better protector of property rights than Indian democracy. Putin and his cronies aren't stupid. He may beat the goose and kick it but he won't kill it. Indian voters on the other hand are quite happy to beat it close to death, not eat it and then leave it out on the street where it can be half eaten by feral dogs. Gee thanks for the vivid imagery!

-

"PATIENCE is the ultimate skill you can bring to investing" - I have this quote up on my wall - Spend more time building on your investment process than building your investment portfolio. - Read, read and study from the investment greats, understand their investment philosophy, their process and valuation techniques. Make notes and keep a journal! - Get you feet wet (when you're ready) and make an investment. Learn by doing! But keep a journal on your research and decisions - this is key to fine tuning your process. - Level 3 curriculum gives you a great introduction to the various biases in investment decision-making (keep those books as reference, don't burn them!). Use that to further your understanding about your own emotional/cognitive biases, strengths/weaknesses - figuring this out(an ongoing process) will be most of the heavy-lifting done.

-

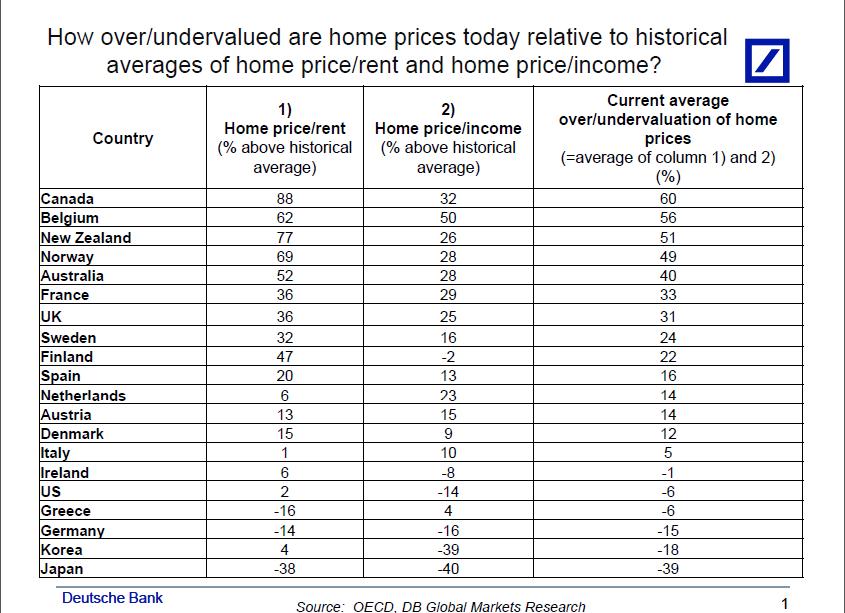

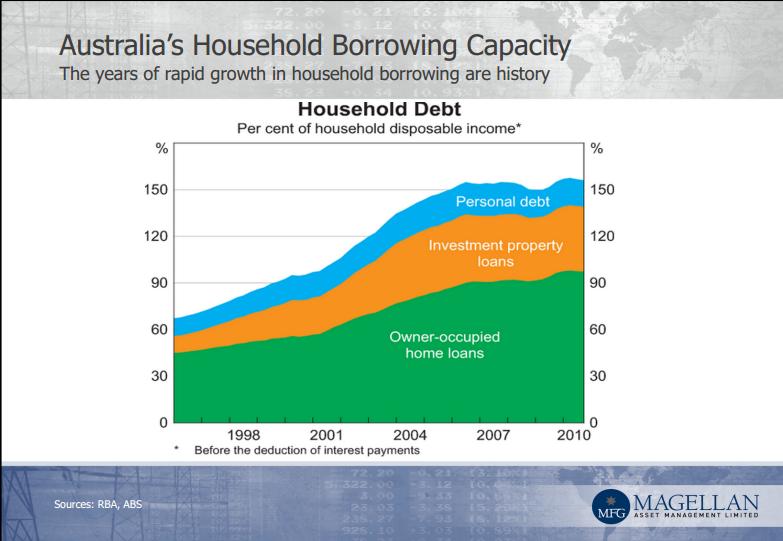

Not disagree with your major points, but you also have to consider the implicit rent that the householder is paying to the landlorder. Plus there are significant non-pecuniary benefits to owning your home, and customizing it just so, and finding a niche in a community. Of course it goes without saying that any asset you own will provide you with unique benefits. The question one needs to ask is at what price are you paying to enjoy those benefits? And more importantly are its cashflows compensating for the costs of ownership. In Australia, buying a property today is a loosing investment proposition, if you're buying to live in then you must consider it as a sunk cost and ensure u're gearing is prudent and optimal from a tax perspective, thats it. And as an investment property, well you're basically taking a leveraged position on an overpriced asset with negative cashflows (low yield-managing costs-interest) and you dont get to enjoy any of the benefits you mentioned.

-

Maybe just to add some color... My worry with "fixing" this site is the better looking and more usable it becomes, the more it will start to become like the Yahoo Finance message boards, which if you haven't seen them, are honestly barely a step up from youtube comments. The quality of the conversation and the people in this community is incredible, and I'd hate to pollute it with lower quality people, which I suspect would happen if it were "fixed". This is my greatest concern

-

New car Old car Leasing or Cash what do you do?

one-foot-hurdles replied to ASTA's topic in General Discussion

-

New to investing and looking for some direction

one-foot-hurdles replied to WolfOfMainStreet's topic in General Discussion

Try and get your hands on the Behavioral Finance materials from the CFA Level 3 cirriculum(2013 onwards) - gives you a good understanding on investor bias. Books on psychology: Kahneman - Thinking fast and slow, Taleb - Fooled by Randomness, Mackay - Popular delusions and madness of crowds -

New to investing and looking for some direction

one-foot-hurdles replied to WolfOfMainStreet's topic in General Discussion

Welcome to the board Wolf, Security Analysis is the 'Bible' of value investing, but it might be a hard read someone starting out. Here are some books I would read first: Starting out - One up on Wall Street - Peter Lynch Very popular and inspiring introductory book. Introduces basic analytical concepts without getting too tedious - The Intelligent Investor - Benjamin Graham great book for intermediate fundamental analysis - Buffett: The Making of an American Capitalist - Roger Lowenstein easy-reading book on the 'Maestro' and a gentle intro into principles of value investing, told in a way that speaks more on reason and commonsense rather than mathematical formulae and ratios The next phase.. - The Investment Checklist - Michael Shearn - Common Stocks and Uncommon Profits - Phil Fisher - Security Analysis - Graham & Dodd -

Taken from Greg Speicher's ebook 10 ways to improve your investment process: ...Guy Spier talks about how checklists counter what he calls “cocaine brain” which is the feeling of euphoria that can cloud your judgment when you get excited about a stock. A checklist brings you back to earth and prevents stupid mistakes... They are not a substitute for judgment, but they do aid our memory and help us to manage complexity. They help us to manage our emotions and misjudgments. They also help reduce the effects of complacency. Instead of thinking – “Why bother reading the proxy and footnotes? Most of the time there’s not much in them.” – you go through them because it’s on your list and part of your discipline.

-

Industry Background of People on This Forum

one-foot-hurdles replied to BG2008's topic in General Discussion

Trading operations for a systematic CTA fund, prior to that was a trader (FX and commodities) in both investment and retail banks. -

Best Resource for ASX Listed Companies

one-foot-hurdles replied to Myth465's topic in General Discussion

I've been a member for several years. I find that they are very thorough with the subset of stocks that they do cover. Its a good way to learn about various quality Aussie businesses like Woolworths, Cochlear, CSL. They also manage 2 model portfolios, Growth and Income, good place to get some ideas. There is also a subsidiary free site http://www.incomeinvestor.com.au/. -

Best Resource for ASX Listed Companies

one-foot-hurdles replied to Myth465's topic in General Discussion

Intelligent Investor Share Advisor provides data (ASX 200) but I think this is only for paying members and its fairly limited. They also have a free app http://stocklight.intelligentinvestor.com.au/ which is a quick n dirty stock filter No website that Im aware of that lists 5-10 yr data like Gurufocus.com. Maybe brokers like Commsec and Etrade.com.au but again not as reliable as going straight to the source (Annual reports). -

Thanks for the charts one-foot-hurdles! I'm from Belgium and try to persuade friends and family on a weekly basis that real estate is expensive here. Somehow there rationality goes out the window when it comes to owning a home or even buying it as an investment. Any chance you can link the complete presentations? Its a similar situation with me, though I’m starting to win over some of my family members.. I keep saying ‘Why put all this money in one house to earn 1-1.5% yield at best when you can be a part owner of Australia’s best supermarkets, shopping centers and airports at 4-6% yield easily?’. I think the fundamental flaw with most folks is 1)they are blind to downside risks (the cliched false-truth - “Buy property, cos it’ll always go up”) 2)They have a predisposition to shun equities because its ‘too risky’ 3)They fail to understand the nature of the 2 major risks they are exposed to - market risk (property value) and financial risk (mortgage)... but most importantly.. 4)They don’t appreciate what is opportunity cost. home_prices.pdf

-

-

-

Value Investing In India And South-East Asia

one-foot-hurdles replied to a topic in General Discussion

Thanks ajc