Luke 532

-

Posts

2,931 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Luke 532

-

-

@Luke

I think no one in administration is thinking about GSEs right now other than calabria, and no one is taking his calls right now. first things first. this corona madness needs to be attended to, say, over next 4 months, then everyone is going to raise their heads and say, phew, what now, and then they will say a number of things, but GSEs will be one of those. during this time the legal situation will mature and we will see where we are. one big variable will be delinquency rates on mortgages. right now, very low. in 4 months, how much higher?

Understood, but I would think the re-proposal of capital rule can come out even with this crisis. Latest word on the street is first week of April. And finalizing that rule is a rubber stamp a few months down the line if FHFA really believes in the figure they put out in April. With that said, I could see the PSPA being delayed.

-

Playing out a worst-case scenario here where we enter into a deep recession that renders an external capital raise in 2021 inconceivable ("I don't think that word means what you think it means," -Princess Bride. But I digress...). Not that I think that is going to happen, but stay with me here. So, in that scenario, would Admin still take the steps in 2020 to re-propose and finalize capital rule, as well as amend PSPA, and settle lawsuits? Or would they just say forget it and do nothing. I have my own thoughts as to the answer, but don't want to spoil the well before you guys answer.

In other words, are we setting up for an insane perfect storm where prefs are made whole (or close to it) while the entire stock market is on sale? Thanks.

-

remember, there PSPA is an agreement between treasury and fhfa as conservator, on behalf of GSEs. in connection with a release from conservatorship into consent order phase, a 4th amendment would be the last amendment, since fhfa would no longer have power under HERA to amend agreement, since no longer a conservator.

so while ACG is right that a settlement stipulation terminating litigation would be final, so would be an amendment by fhfa/treasury upon termination of conservatorship. so as per usual, ACG is half right

Great, thank you!

-

https://www.realvision.com/shows/trade-ideas/videos/fannie-mae-the-road-to-recapitalization

At 8:15 in the video linked above, ACG's Heffesse says "If you stop the sweep and amend the PSPA in a settlement in the judicial branch it's not reversible in the same way. If you put a fourth amendment in the PSPA who knows if you have another administration and they just add amendments to change it back. I mean there are some permanent things but if it's done by a court in a settlement you can't really go back."

Coupling this with the Goldman meeting two weeks ago where Admin is going to implement irreversible actions in calendar year 2020, wouldn't it be a more concrete move to do the PSPA amendment via settlement rather than as a stand alone action?

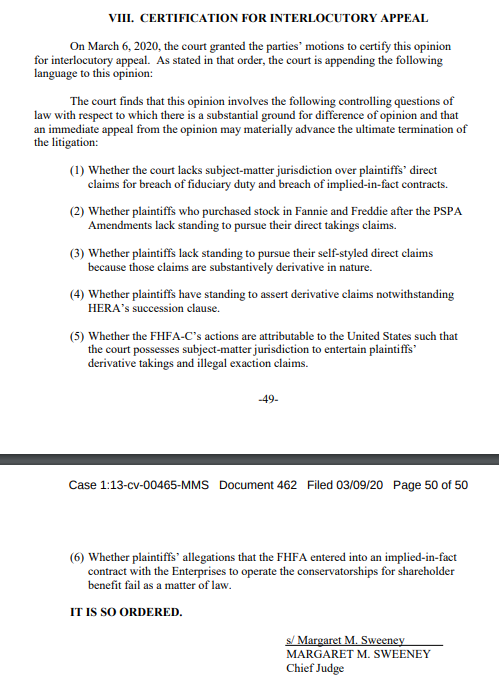

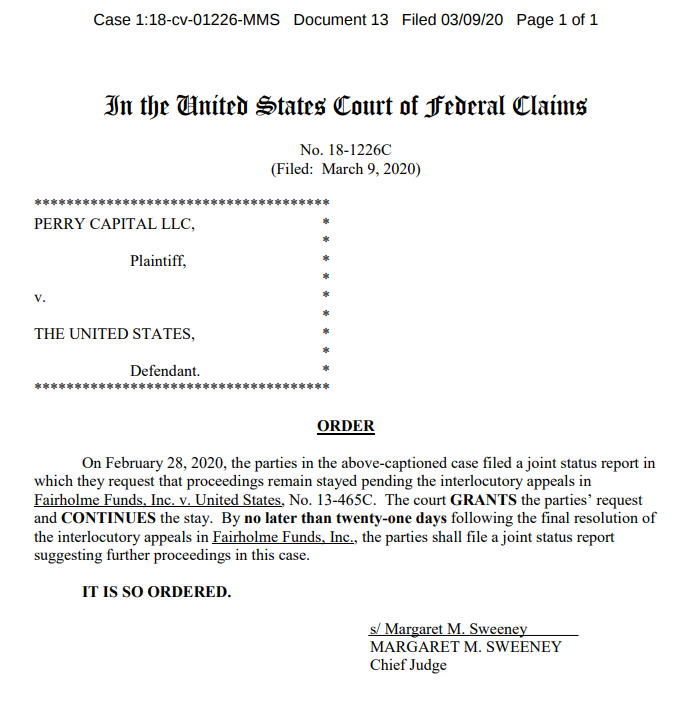

The Goldman meeting jives with ACG's timeline (attached) from a month ago where it is estimated the PSPA and settlement would be completed calendar year 2020.

In other words, we're looking at a settlement this calendar year, not just a capital rule and some variation of a PSPA amendment. Although a PSPA amendment may very well render the lawsuits moot, doing it via a settlement would be more permanent.

Thoughts? Am I way off base here?

-

PHH attorney gives Seila Law predictions - https://t.co/1bNNB6Sbeq - As the lead attorney for PHH Corp., Mitch Kider led the team of lawyers who first argued that the bureau’s single-director, for-cause only removal structure was unconstitutional.

PHH appealed a $109 million jud

-

Questions for everyone. Let's assume the data will prove that there is/will be a recession this year:

(1) In your opinion, how many months will that delay the capital rule being reproposed?

(2) In your opinion, how many months will that delay the capital rule being finalized?

(3) In your opinion, how many months will that delay the consent decree from being executed?

(4) In your opinion, how many months will that delay the amendment to the PSPA?

Note: I am not asking about raising capital via a "re-IPO"/SPO. I'm specifically asking about delays to the steps before they raise external capital.

Thanks.

-

You're asking if FHFA, which to date has been "legally" allowed to take all of the capital out of the enterprises they are claiming to conserve, is required to "legally" release a capital rule? Until courts definitively step in they are "legally" allowed to do whatever they want and answer to no one.

Does anybody know if FHFA is *legally* bound to re-propose the capital rule because they have publicly stated they will do so? If I'm Houlihan Lokey, I'm getting nervous about the markets and want to get the capital rule in place as quickly as possible.

Good point :)

-

Does anybody know if FHFA is *legally* bound to re-propose the capital rule because they have publicly stated they will do so? If I'm Houlihan Lokey, I'm getting nervous about the markets and want to get the capital rule in place as quickly as possible.

-

And if the GSEs exit c-ship, does Lamberth go away b/c the jr prefs are live again? That would make make the Lamberth case moot since new investors wouldn't have to worry about it by definition of the GSEs exiting c-ship. Maybe that's what Calabria intimated when he says the issues go away? Just musing out loud - I've got my thinking cap on, Cherzeca!

there will be a global litigation settlement. no way GSEs can raise serious funds in capital market without releases to the GSEs, fhfa and treasury

We're getting par* +/- a few percentage points any way you slice it, it's just a matter of when and how much volatility and uncertainty we get between now and then.

*or the equivalent of par, like a conversion to common.

-

Anyone taking advantage of these lower prices?

I sold everything at the top tick a few months back, and I re-bought it all today at the bottom tick. Unless there's more downside, then I'm just joking and will re-buy later.

-

Nothing new, but this was said about Layton's talk last week:

https://www.valuewalk.com/2020/03/fannie-mae-offering/

In the same vein, questions also remain about what will happen to the Junior Preferred shares. If nothing is done with then and the Senior Preferred shares are eliminated, then the Junior Preferred shares will return to par. That would mean they would more than double in price. However, Layton also said some kind of settlement could be negotiated, or there could be a deal to trade the Junior Preferred shares for common shares.

Additionally, several lawsuits over the Senior and Junior Preferred shares and the net worth sweep are still pending in the courts. Before Fannie Mae and Freddie Mac can hold offerings, these lawsuits will have to be settled.

-

Well done!

-

Q4 2019 earnings for Fannie and Freddie accelerate #GSE reform timeline. #ACGAResearch

Timeline attached...

FWIW, I asked today and David Metzner (ACG) says recent market developments (coronavirus, oil, Treasury yield, etc.) have zero impact on the timing in the graph attached to the post I quoted above.

-

-

thanks Luke. just fyi, nothing will be done with fhfa general counsel or treasury general counsel. each will need to hire deal firms that can handle this negotiation. while it is good to see fhfa look for a deal counsel, treasury will need one too

Thanks, cherzeca. With the market volatility, do you think a settlement is agreed to in calendar year 2020? Won't hold you to it, of course, just curious of your opinion as of today.

I just think the virus has an end date sometime this summer. viruses usually do and this one seems to have a similar profile, although perhaps more infectious and debatably higher mortality. and lower oil prices are bad for the oil patch but good for everyone else so I just dont think GSEs are affected beyond the short term, when everything is affected

Thanks.

-

thanks Luke. just fyi, nothing will be done with fhfa general counsel or treasury general counsel. each will need to hire deal firms that can handle this negotiation. while it is good to see fhfa look for a deal counsel, treasury will need one too

Thanks, cherzeca. With the market volatility, do you think a settlement is agreed to in calendar year 2020? Won't hold you to it, of course, just curious of your opinion as of today.

-

Posted with permission from Todd Sullivan:

http://www.valueplays.net/2020/02/28/subs-fhfa-is-looking-for-lawyers/

FHFA is looking for a law firm. The backstory that I am hearing is that they are not satisfied with the current pace of negotiations with shareholders. As we’ve said many times before, with the litigation outstanding, there is no way the GSE’s can emerge from conservatirship.

Here is the solicitation: https://valueplays.net/wp-content/uploads/RFP-FHF-20-R-0029.pdf

Scope of work: https://valueplays.net/wp-content/uploads/Attachment-A-Statement-of-Work.pdf

I am not aware that there have been any negotiations. Todd can be "off" at times

Todd explains a bit further starting at 14-minute mark: https://valueplays.podbean.com/e/mar-7-2020/

-

Apparently Joe Biden and Gary Hindes are friends. Did a Google search and the first few articles tell the story.

If Biden wins the Democratic nominee, which it looks like is highly probable at this point, it's possible that election risk for this investment is reduced.

-

Dear @stevenmnuchin1 @USTreasury @MarkCalabria @FHFA Your risks are rising. The #SolicitorGeneral highlighted to the #SupremeCourt the risk of an adverse decision in #Selia. Unlike #DFA, #HERA, has no #severability. @FannieMae @FreddieMac #FannieMae #FreddieMac #GSE @larry_kudlow

attachment...

-

you may have noticed that there was no discussion of FSOC in the oral argument (or briefs) in Seila.

If at all, how do you think this impacts FHFA and/or the GSE's? Thanks.

not at all. as I recall this was argued before a merits panel that included one senior judge, who would not be included in any en banc hearing. I would expect that Ps would petition for rehearing en banc and get it, though likely not before Seila scotus comes out

Thanks.

-

you may have noticed that there was no discussion of FSOC in the oral argument (or briefs) in Seila.

If at all, how do you think this impacts FHFA and/or the GSE's? Thanks.

-

-

We'll have more on the ruling today in #CFPB v. All American Check Cashing but count us among the shocked who didn't expect an appellate court to rule on the constitutionality of the bureau the day after the Supreme Court heard arguments on the issue.

In Collins, the majority noted that the FSOC had some measure of oversight of the #CFPB in a way the FHFA did not have. Judge Smith didn't buy it: "Undeterred, the majority stubbornly asserts that the FSOC’s presence somehow makes the CFPB accountable. Not so."

Dodd Frank Update

@DoddFrankUpdate

Judge Smith: "The #CFPB and FHFA are sister institutions. Only a judge who plays 'semantic games of reformulation and hair splitting in order to escape the force of a fairly resolved issue' can conclude ... that the agencies are sufficiently different."

Final note: Fifth Circuit becomes third appellate court to affirm #CFPB constitutionality (9th, D.C.) Federal courts in Mississippi, Montana, California, Minnesota, Pennsylvania and Indiana have ruled similarly. Only the NY and D.C. districts (vacated) ruled it unconstitutional.

-

Will the Seila Law case mean no more CFPB? Our expert says no. Check back later at http://respanews.com for our reaction piece.

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

in General Discussion

Posted

Understood, it's your primary area of expertise. I found it interesting that SCOTUS isn't holding oral arguments right now. Perhaps an opportunity for them to spend the extra time completing orders for pending cases like Seila.