-

Posts

1,859 -

Joined

-

Days Won

14

Content Type

Profiles

Forums

Events

Posts posted by UK

-

-

1 hour ago, kab60 said:

There's a lot of stuff right now that seems cheap, but I think Fairfax has some pretty unique attributes. While I like the absolute risk/reward, I also like it from a portfolio perspective. While insurance is cyclical (soft/hard markets), it's not affected by the typical business cycle and could stay strong going into a recession. And then you have a ton of rate sensitivity, but unlike the banks you don't have to worry about a loan book, which typically means bank stocks 'doesn't work' in a downturn as investors start to fret about losses despite NIM climbing up (and it's nice to have some stock moving up while the market moves down). I'm looking for other rates plays, but Fairfax is the one I found with least downside. Not least as I prefer not losing my shirt even if rates fall.

These a great points! I also feel similar re FFH vs banks. FFH is as cheap as banks, provides same or better rate upside (banks will not be able to fix much higher rates for next 5-7-10 years as FFH maybe could?) while possible risks are smaller or different. Does anyone has good idea on how FFH could position their bond portfolio in the nearest future? Is it possible for them to go for much longer duration at some point in the future? Have they said anything about this or it will be totaly opportunistic?

-

26 minutes ago, Xerxes said:

Pershing Square is trading at 30% or so discount to NAV, is it a “legacy trust” issue going back to the go-go days of Valeant now like 5-6 years ago.

I would quess this has more to do with 1. their fees 2. listing place / tax treatment than with trust?

-

4 hours ago, Parsad said:

Let's use the historical average for ROE over the last 20 years. Book at the end of 2021 was $630.60. Book at the end of 2001 was $117.03. That's a ROE of 8.8% annualized.

Using current book of $570 ending Q3 2022 times 8.8% equals $50 per share. P/E then equals last week's low of $480 divided by $50 or 9.6. Cheap, but not dirt cheap

I think their patience and this years massive change in bond yields provides opportunity for FFH for the first time in like 10 years to make their 15 per cent return target actually work without any heroic assumptions? That would lead to a at least 1.5 BV or 10-12 normalised PE and vs current price we have almost 50 MoS? If it is cheap or dirty cheap, I do not now, maybe not dirty cheap but quite cheap or cheap enought for such a company. Now we are discussing linguistic like those analysing fedspeach:)

-

https://www.understandingwar.org/backgrounder/russian-offensive-campaign-assessment-november-6

Key Kremlin officials began collectively deescalating their rhetoric regarding the use of nuclear weapons in early November. The Russian Ministry of Foreign Affairs (MFA) released a statement on “the prevention of nuclear war” on November 2, stating that Russia “is strictly and consistently guided by the postulate of the inadmissibility of a nuclear war in which there can be no winners, and which must never be unleashed.” The Russian MFA also stated that it is committed to the reduction and limitation of nuclear weapons.[1] Russian President Vladimir Putin stated on October 27 that Russia has no need to use nuclear weapons against Ukraine and claimed Russia has never discussed the possibility of using nuclear weapons, only “hinting at the statements made by leaders of Western countries.”[2] The deputy chairman of the Russian Security Council, Dmitry Medvedev, has similarly increasingly downplayed the fiery nuclear rhetoric he used throughout October and is now focusing on promoting Russian unity in the war in Ukraine.

Time for Leopards to show up?

-

-

19 hours ago, Spekulatius said:

Sold $ADDYY on CEO change news. I was hoping for a go private when i saw shares jumping or something like similar.

Why such a strong reaction?

-

Solutions is waiting just around the corner...gee such things probably shows, that this downturn is not over yet:)

-

8 hours ago, Gregmal said:

Probably the most reasonable assessment I’ve heard is from Jeff Gundlach. Can anyone explain to me how we top May/June/July/August ‘22 prices next year? It seems far more likely we get something negative than it is we see 4-5%+.

Maybe if some really substantial decouplimg from China occured? But maybe it is possible that it just to far for the market participants to look untill some time after year end.

Also, what I do not understant: so Japan not even tries to raise rates, UK just has ackknowleged, that its economy (or financial system) can not bear substancially higher rates. I am sure EU will soon follow them too. US is in the best position, but I do not understant how is it that different and if it will be able to have very high rates for long, when the whole world around can not afford it? And somewhat normal rates, like right now, is nothing to freak out about, it would be healthy for a long term.

RE high/low FCF, value vs growth, sure some reversion and justice is due:), however, if growth is real, than it is part of the formula. Just put terminal growht rate of 10 or even 6 percent into any FCF / (i - g), and see where that gets you. Not growing FCF at a 10 per cent discount is worth 10x, IF it is growing by 7 percent for at least 10 years, then that current multiple quickly goes to more than 15x etc. The question is ofcourse if the growth is real, and before this year it was overprojected and overvzlued on steroids. This is changing very fast this year:). Another thing, not every time, but ussualy these higher FCF / jam today companies are much inferior in other ways: roe, capital intensity, leverage, structurally disrupted etc. so you also have yo be carefull with them.

-

On 11/3/2022 at 11:55 PM, Parsad said:

I'm always restless when markets are like this. Like a kid waiting for Christmas morning. I go to bed really late because I'm reading, and then wake up after just a few hours of sleep to see what is happening in the markets and put any orders in. Cheers!

This is exactly how I feel too. Excited, probably to much or to early or both:). Only I try to sleep longer, few hours does not work for me in a longer term:). I had more pain earlier this year and after unsuccessful "trip" with china, by dumb luck in timing, in the summer I was back to mostly BRK and cash in my portfolio. Usually I am fully invested or use some leverage and only if markets are really crazy I would go to no more than 1/3 cash and some defensive, not very overvalued things (this happens very rarely) . BRK usually fits that well, I do not remember it to be overvalued since after GFC. Changing mind in summer on China was still very painful since I took risk and waited for better exit prices than was immediately after Russian invasion. I have never owned any FANG (only AAPL indirectly through BRK) before (only similarly "long duration" non tech companies), but in general am very biased to owning them (no leverage, diversified globally, pricing power, high roe etc), so now I am in a process in spending my cash on these kind of companies (e.g. UMG, GOOGL, META etc). If Prem is right and they will have fall another 50 per cent (as from CC), then again, not for the first time, I am too early. I am EUR based, so also have this strong USD benefit this year (possible problem in the future) and not sure what to do about this. Also we have a crazy (probably temporary) situation with RE prices where I live since they are still like 20+ per cent up from a year ago. In 2008 they also lagged stock market substantially and it was an opportunity then and perhaps even more is now. This time residential RE prices are especially distorted (for the benefit at this point in time) because of war in Ukraine. We were quite used to this, but suddenly it is like half of people around you are either from Belarus, Ukraine or Russia itself. However much more painful or harder to make any moves in RE, than in stocks, but I feel some pain from just watching and not doing anything about this:)

UK

-

3 hours ago, Gregmal said:

Then again I’m always amazed at how they come up with the actual figures so who knows. Like it’s still hard to believe cpi in July of 2021 was 5%….there are normal things that from July 2020-July 2021 increased hundreds of percent. Everything increased 20-30%. CPI 5…..then a year later, when there really wasn’t even a fraction of the increases we saw from 2020-2021…9%….so who knows.

-

8 minutes ago, Xerxes said:

I am not used to see FFH doing a jump post earning. Uncharted territories for me.

Using TwoCitiesCapital rule of thumb, it usually takes a few days post earning for FFH to react.

Seems like some pivot in markets attitude towards FFH:)

-

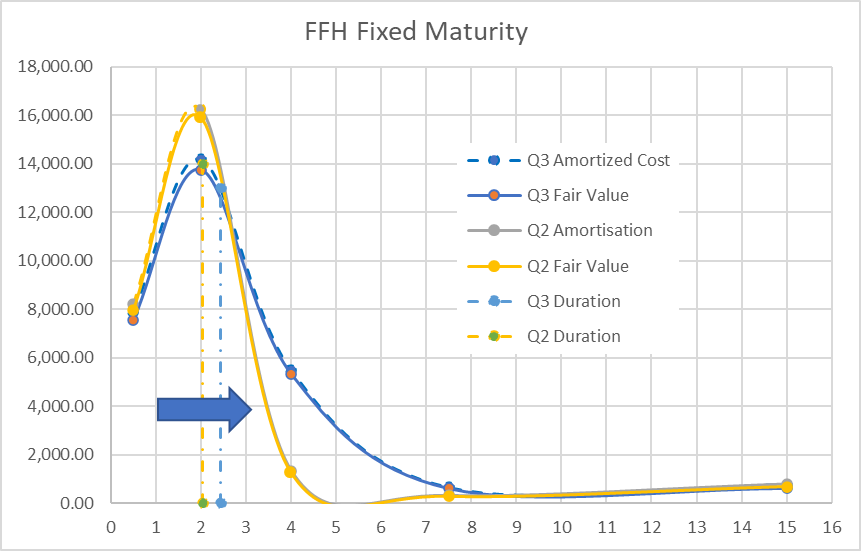

9 hours ago, nwoodman said:

Good to see them rolling out the curve. You can't argue with their bond-investing prowess! Those 3-5 yields look pretty sweet, and 3-5 year treasuries are hardly "reaching for yield". Good on them; they deserve to be rewarded for their patience.

A similar graph for MKL They will continue to get hit if rates keep on rising. Good thing their CRs remain in the low 90's, even with an "Ian"

Nice charts! Thanks!

-

-

Like medicine, there are side effects. So the condition today is excessive inflation and the medicine is monetary tightening, quantitative tightening and … when you slow the economy, some people get hurt.” That will create opportunities for Oaktree, which specialises in distressed debt investing. “Clearly we are excited about the future because the bargain hunter, the value investor, does not have many opportunities to find bargains when everybody has money and they’re too eager to put it to work. We want some difficulty, we want some risk aversion,” he told AFR Weekend in an exclusive interview. He was in Sydney to meet clients in a broader funding effort.

“In the real world, things fluctuate between pretty good and not so hot. In the market, they fluctuate between flawless and hopeless. We’re not at hopeless. Hopeless is October 2009 or March 2020. But at least we’re not flawless anymore.”

Mr Marks isn’t the only high-profiled investor to warn on the state of the economy. This week Paul Singer, founder of activist hedge fund Elliott Management, warned the world could be on the path to hyperinflation and “global societal collapse and civil or international strife” due to inaction by central bankers. But Mr Marks urged investors to ignore the endless debate about when inflation might peak or how high interest rates might go, which he said epitomised the macro-driven, trading mentality that dominated the market. He said his next addition to his famous series of memos to investors would be entitled What Really Matters. “We try to buy the stocks of companies that will become more valuable over time, and the bonds of companies that will pay interest and principal as promised. This is what matters.”

Mr Marks said Oaktree was in the mindset of “patient opportunism”. “When there’s nothing clever to do, our job is really to avoid mistakes. And when there’s nothing clever to do, the mistake lies in trying to be clever. I think now we’re in transition from a very challenging period to I think a period when we will have access to more bargains. The job today is to wait.”

“The Opportunities Fund group maintains a list of the things that are on their radar screen. In March, it was maybe 20 lines. In June, it was the whole page. And now I think it runs to five pages. So there’s a dramatic upturn in areas to look at, that conceivably can give us the returns we want. “Usually the things that give us the most opportunity are the things that were most warmly embraced in the good times.”

But even after this year’s tightening cycle – the Federal Reserve has taken rates from zero in March to 3.75 per cent, and the RBA has moved from 0.1 per cent to 2.85 per cent – Mr Marks said pressure around the world would be for rates to move lower as quickly as possible. “Everybody wants low interest rates. The government, because it makes it easier to service the debt. The homeowner, to service their mortgage, and the LBO [leveraged buyout] operator, because it makes it easier to finance his deals. The only people who don’t want low interest rates are savers and lenders. “I think that there’s going to be a strong bias toward low rates for a long time. And even if rates were to stop here, or end up at 4.5 per cent on the Fed funds rate, or 5 per cent, this would still be historically low.”

-

The Bank of England delivered its biggest interest rate increase in 33 years but strongly pushed back against market expectations for the scale of future increases, warning that following that path would induce a two-year recession. Staying on the market path used in the forecasts, which peaks at around 5.25% next year, would knock 3% off GDP and ultimately push inflation to zero, the BOE said. An outlook based on rates staying at their current 3% level implies a shorter, shallower recession and sees inflation fall close to target in two years’ time. “We think bank rate will have to go up less than what’s currently priced into financial markets,” BOE Governor Andrew Bailey said at a press conference. “That is important because, for instance, it means that the rates of new fixed-term mortgages should not need to rise as they have done.” The remarks mark a sharp contrast with Federal Reserve Chair Jerome Powell, who said Wednesday that US rates will probably go higher than people are thinking. UK government bonds and the pound fell after the BOE’s decision. Investors had already tempered their view for UK rates, suggesting a peak around 4.75%.

Not in US, but this sounds like some pivot, no? So Japan, UK, EU probably soon. What if:

In his view, the US inflation data will cool off in 2023, and if the Fed is successful in bringing down inflation to the 2% area by the end of next year, it will continue declining and would go well below 2%. “It is implausible” to think that inflation will halt at the 2% range and stay there. “It will go negative,” he says.

-

https://www.ft.com/content/6ca9a470-59ee-4809-8a5b-35f6073c9907

Ottawa has ordered three Chinese groups to divest their stakes in Canadian critical mineral companies after a defence and intelligence review concluded that the investments posed a threat to national security.

In a move that reflected a significant hardening of Canada’s stance towards China, the government ordered Sinomine (Hong Kong) Rare Metals Resources to exit its stake in Power Metals, a Canadian lithium miner.

Ottawa also instructed Chengze Lithium International to divest its stake in Lithium Chile and told Zangge Mining Investment (Chengdu) to unwind its investment in Ultra Lithium, another Canadian resource developer.

Industry minister François-Philippe Champagne said Canada welcomed foreign direct investment from companies that “share our interests and values(opens a new window)” but would “act decisively when investments threaten our national security and our critical minerals supply chains”. -

58 minutes ago, dealraker said:

One day I am surely destined to discover somebody somewhere who has thrived either investing in hedge funds and/or going all cash repeatedly with perfect timing. I'll let you know. One thing is certain...the day a market falls these guys will get their stories out. And when markets really tank reposts will be shared to such extent suicide hot lines will overload to levels of shut down. CNBC might even avoid Cathie interviews, now that will be something!

I agree, nothing to add:). In 2008-2009, when I was younger but much dumber, it almost cost me a lot to listen to much to such scaremongering. Thanks god, that autumn, I think in October 2008, biography of WB just came out, and my wife accidentally decided to buy one for me, while returning home from some foreign trip. After reading it and then all BRK letters, I quickly become much more balanced in terms of who you should follow and listen to:). Signer is smart investor, but he costantly tries to sell you an idea, that world is super dangerous and becouse of that you should almost always be hedged, of course only they know how to do this, therefore, you cannot invest without them.

-

I remember reading similarly very scary letter from them somwhere in 2020 spring or early summer:), but just to keep this discussion alive:

https://www.ft.com/content/f3bb0f96-1816-4481-8318-4f7583326a4a

The world is “on the path to hyperinflation”, it said, which could lead to “global societal collapse and civil or international strife”. While such an outcome is not certain, this is currently the direction that the world was headed, it added.

However, Elliott said markets had not fallen far enough, given the many risks present, and warned of a further reversal of the so-called ‘everything rally’ seen near the top of the bull market of recent years, as sky-high investor exuberance lifted all manner of risky assets. There are so many “frightening and seriously negative possibilities” that it is hard not to think that “a seriously adverse unwind of the everything bubble” is coming, it said.The hedge fund estimates a 50 per cent fall from peak to trough would be “normal”, suggesting further large falls to come in major equity markets, although it added it was impossible to know whether or when that would happen. Elliott, which is up 6.4 per cent in 2022 and which has only lost money in two calendar years since launch in 1977, pointed to a handful of areas of potential stress that could accelerate market falls. It highlighted banks’ losses on bridge financing, potential markdowns of collateralised loan obligations and leveraged private equity as areas of potential risk for markets.The firm was also critical of investors who believed market falls will always prove shortlived and can be “ignored”.The idea that “‘we will not panic because we have seen this before’ does not comport with the current facts”, it said.

-

Sitting in front of his screens, he pinpoints tanks, barracks or other military objects and relays coordinates to artillery teams firing satellite guided shells, which hit within a yard or two of their intended targets. “From a typical howitzer, you create a sniper rifle,” he said of the combination of drone surveillance and satellite guided artillery shells, something Russia lacks. “One shot, one kill.” The partial destruction of bridges over the broad Dnipro River through the summer slowed Russia’s movement of heavy equipment to the river’s western bank, even as Western weaponry helped Ukraine whittle away at what was already there. The combination cost Russia its artillery advantage on the river’s western bank. “Think of the orcs in their trenches,” Lieutenant Oleh said, using a derisive term for Russian soldiers. “They have no heavy weaponry, no supplies, it’s cold and raining. It’s a really difficult state for morale.”

-

15 minutes ago, Gregmal said:

I actually think a basket of the NKE, LVMH, etc outpaces the FANGs. The FANGs had a half decade of indisputable fad like following. It’ll take more than 6 months to unwind that. My guess is 18-24 months.

You may be right. Also these non techs have better visibility. But i think most of the speculations and extremes were in profitless "fake tech", and even FANGs are not all equal, e.g. I just cannot see Netflix on par with others. But Apple, Google, Microsoft, Amazon, maybe even Meta, these are very strong companies, growing faster then most other (maybe not every year OK) and I think that will continue in the future. Just look at the cloud or world digitisation in general, it is nowhere close to the end.

-

1 hour ago, dealraker said:

Old dealraker is chatty this a.m.; don't take me too seriously.

Some amount of look-back as to macro posts during all the previous era's would probably produce some amount of lessening of intense worry. Years ago in the 1990's I simply loved Bill Fleckenstein's posts about the dot com and subsequent profitable tech severe over-valuations, he was perfectly right. Then Hussman comes along, he's a terriffic read too, his stuff at one time literally made more sense than anything to me.

Still, I just read and held stocks and such. March 9, 2009 was also entertaining for me...you say "that's sick Charlie" but remember I'm hardened from the 1980-82 period when prime was 20 and I had a $500,000 personal baloon loan out that I was not able to make bank delivery on. But anyway...

We have leaders...elderly supposed billionaires who literally, and I mean literally, are out scaming and begging the poor for money every day --- along with elderly, extremely elderly who can barely read the teleprompter, in office leadership. They are elderly for so many reasons...they are all out-of-it via age and their completely separated from reality life. Day-traders...very old leaders of the USA are insider trading and my guess is that's more their focus than you think.

Ain't it awful?

Kennedy, in my growin' up era was 3.5 decades younger. Clinton, comparatively young, in my view was simply brilliant. No, I do not align with a political party! I like the quick thinkers who are scheming enough to force others to compromise.

In any event I picked a few things out of the blue. One of the posts changegonnacom made included "I woke up and..." All I will add is that all kinds of "stuff" is in your guys future and more so on average than me because I'm older than most of you. You have absolutely no clue whatsoever what this "sfuff" is.

Again, I always state that what you are obsessed with now is missing what is far more relevant and important...that you aren't even aware of. I assure you it is there and waiting to (as changegonnacom would say) wake you up. My guess is that it is so significant that the macro you write about today will be lost from your memory.

In any event I processed all that was "awaken" in this discussion years ago, you should have too. We quote hedge fund runners, they'll be new ones and we'll quote them too. Jim Chanos will be out and shout; Hussman's still looking for "he was right high five's" (that's called fees no matter the performance) from his bunch. My guess is we'll have difficulty going forward with having free elections and some of you will initially like that, but then most will eventually engage to stop such and it will be very ugly trying to stop what "we" allowed.

My guess too is that if you don't go nuts one side or the other and get yourself killed or imprisoned you'll live a lot longer. And investments, not cash, will be the way to go. Along with that I'll further say that avoiding the current euphoricly supported winners will enhance your investment outcome.

We seem to be obsessed with Meta and Google. Old dealraker will simply say one thing: Bet cha the bargains are elsewhere...'cause that's almost always the case.

Don't take me too seriously, just chantin' and chatting up some of my biased and slanted stuff. Wife and I are headed out for a few days of NC hiking in the mountains.

Was just yesterday, October 2021, ARK was supreme...SAAS stock raging and

I hear you and agree on almost all points, especially re trying to nail macro. I find your posts very interesting and informative! However I disagree a little, in that we should not be obsesed with Google, Meta, maybe even Amazon etc and other fine companies, not necesseraly from tech sectors (Nike, LVHM, UMG just to name a few), which litteraly went on sale this year. I think there could be very rare oportunity to invest in some of them at reasonable or even undervalued prices. And yes, with most of them, then you can just stay patient for long. If it is allready time to go all in or not yet, I have no idea, but time to be obsesed-for me yes!:)

-

I know that he is not like universally loved here:), but I think it is really good discussion on this whole situation we are in, rates, possible risks etc, especially from ~20 min:

-

1 hour ago, Viking said:

Canada has had a 20 year housing boom. In recent years housing has become a massive % of total GDP. Look at all the condo development in Toronto (i think it leads North America). Building has been robust (single and multi family). Where are all the housing units going?

Yes, building will slow moving forward. But i wonder how much of current supply is under-utilized. I just have a hard time understanding how we have had a housing bubble of epic proportions for 2 decades and still have a shortage. And i readily admit - i am a real estate idiot.

And also migration of capital from China etc in search of safety not returns?

-

I understand, that BRK and FFH would benefit, at least as a bussineses (if not on valuation side) if interest rates will be higher in the future. Is it the same with BAM? Or are they on the oposite side? There are a lot of discussions recently about bussines models build on low interest rates and leverage, such as CRE, which just does not work so well if rates are going much higher. How one should look at BAM in this light, would higher rates benefit or hurt their perspectives?

Fairfax 2022

in Fairfax Financial

Posted · Edited by UK

Also: https://www.wsj.com/articles/insurers-are-facing-a-steep-rise-in-reinsurance-rates-11667858056?mod=hp_lista_pos2

Insurers are in the middle of negotiations with reinsurers, which are trying to boost rates by 10% to 30%. Nearly two-thirds of U.S. property-catastrophe coverage renews each Jan. 1, including for many large diversified U.S. and European insurers.

Allstate Chief Executive Thomas Wilson said the price increases being sought by reinsurers are due to their recent losses, worries about climate change and the dollar’s recent strengthening, which hurts some reinsurers because they sell coverage in U.S. dollars yet hold their capital in another currency.

“The combination of those three things will make for a really tight reinsurance market,” Mr. Wilson said. “It seems likely to me that the price will go up next year.” Allstate won’t face the hit all at once because its reinsurance program staggers renewals over three years, he said.

Rapidly rising interest rates are also hurting reinsurers. Higher rates reduce the value of the bonds they hold. If the companies face payouts, for example from a quick succession of major hurricanes, they might have to sell some of their bonds at a loss. The inflation being experienced by carriers is driving up reinsurance prices, too.

With so many issues stacked up, “this is really the most challenging renewal year probably since Katrina,” said David Flandro, head of analytics of Howden Group, a London-based broker. In the January 2022 renewal period, year-over-year property-catastrophe reinsurance price increases worldwide came in at 9%, according to Howden data.

Reinsurers haven’t been shy about the price increases they anticipate. Swiss Re’s Group Chief Financial Officer John Dacey said in an Oct. 28 earnings call that “prices will not show some sort of an evolutionary adjustment, but rather a fairly radical adjustment up.”