73 Reds

-

Posts

259 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Posts posted by 73 Reds

-

-

20 minutes ago, Dinar said:

@Xerxes, no since I am not calling for killing civilians. Transfer yes, like has been done since time immemorial, and just this year done by Muslim Azeris to Christian Armenians. It will also sound absurd, but this will save lives on both sides, since if it is not done, wars there will go on forever will larger and larger casualties.

This has already gone on forever and depriving a population of food & water and trying to force your way into another country to offload tens of thousand of unwanted human beings will absolutely cause larger casualties. Israel does not need a conflict on a third front. What do you think might happen to these people if they were somehow deposited in Syria - it would create another version of Southern Lebanon or existing territories with conflicts along yet another border. Moreover, what do you think happens to people who are wholly unwanted by a terrorist country in which they happen to reside? I think we were on the right track with the Abraham accords. From a Middle East perspective, I hope Trump gets another opportunity - it won't happen under any current Democratic administration.

-

2 minutes ago, Dinar said:

It is that easy. Israelis are afraid of public opinion, but time is NOT on their side. No other country wants them? Well, dump them into Syria, how can Syria stop it? If it is not done now, it will get much worse, and in the next war US will NOT help them.

Syria would place troops at the border. It can't logistically be done as much as we might want it. And withholding food and water will ensure Israel's complete isolation world-wide.

-

5 minutes ago, Dinar said:

Hamas is rather easy. Stop all water, food, etc... into Gaza, allow all, except for males between 12 and 60 to leave freely. Males between 12 and 60 will have to go through POW camps to figure out whether they were members of Hamas in which case they should be tried as terrorists or innocent civilians, in which case they should be allowed to go to a country of their choice or into Syria.

Hezbollah - start by blocking all food and energy into Lebanon. Then you have to fight a very bloody war, at the end divide Lebanon into northern and southern halves. Christians get southern half, Sunnis get northern half and Shiites go to Syria; just as losers in every war.

I'm afraid if it were that easy, it would already have been done. And if you think Western public opinion is bad now, just wait. Then there is the issue that NO OTHER COUNTRY wants these people and you can't force anyone to take them.

-

3 minutes ago, Dinar said:

You are missing the forest for the trees. While Israel is busy racking up tactical victories, it is losing the war - nothing has been done about Iran's nuclear threat, Western public opinion is increasing anti-Israel, and in the next war Israel will not be able to count on weapons shipments from the US. Israel needs to wipe out Hamas, Hezbollah and Iran's nuclear threat today, otherwise it may easily get destroyed in the next war. Had Hezbollah attacked at the same time as Hamas, the situation could have been very different.

Agreed that Israel needs to wipe out all of these threats but precisely how do you propose that they do it?

-

22 minutes ago, Gregmal said:

Yea the valuation is rather stupid to me. The balance sheet is great. Profitability is unquestionable. Just really a matter of when with the Terminex integration. No shortage of acquirers for it as well. Just seems like a case where people are short term and impatient.

Is debt the issue or is it something else? I haven't been following this; why would activist investors want to push out American management of an American subsidiary?

-

18 minutes ago, ICUMD said:

That's the issue I struggled with.

It boils down to management and how they go about translating IV / BV to market value.

For the greater part of 8 yrs, they have not been able to execute while they collect their fees based on BV.

Not supporting share price during this time with aggressive buybacks is not investor friendly.

The other catalyst - the privatization of BIAL through Anchorage seems to be always just around the corner for the last 3-4 yrs

Even if the share price rises to $25 overnight, that would be a poor 8 yr return.

Many other options in the investible universe with better management.

This discussion demonstrates some of the issues involved with "value investing". As prior posters have mentioned, proper sizing is important, along with properly discounting management that may have a history of not always acting in the best interests of minority shareholders and/or failing to unlock value. Personally, I own shares of Fairfax India but few enough shares that capital allocation by management or the timing of an IPO is not terribly important. For me, there are times when parking money in these types of investments is superior to riskier investments where there is a significant opportunity for loss and capital impairment.

-

26 minutes ago, gfp said:

I think that's a "no" but we'll probably be able to tell in the next 10Q. There are several clues, including that it was an average price over multiple transactions on the same day, the high price, the optics of buying shares directly from a reporting insider/vice chairman of the board, and whatever the legal complications Greg references when mentioning that JOE can't buy Bruce's shares directly. Prem and Fairfax did it, of course, but that may be a Canada thing.

BRK never directly bought stock blocks from the Gates Foundation, even though they were known to be a large daily seller of B-shares (and still are).

Now, why didn't Ajit convert the A-shares into B-shares before selling? I'm sure Warren would have preferred that.

Yep, but an interesting prospect nonetheless. In any event Ajit certainly advised Buffett of the sale in advance.

-

9 minutes ago, ander said:

Is Ajit selling really a concern given that he's had a long history of selling / gifting? It is of course not a positive signal, and I understand it is a large proportion of what is remaining, but I do not believe it is necessarily a suggestion of impending doom at Berkshire (remember if there is impending doom in the broader market, that is where Berkshire often does the best so one would not want to be a seller of shares right into it).

The far more interesting question would be if Berkshire was the buyer of Ajit's shares.

-

7 hours ago, Eldad said:

Plus since he is the best odds maker in the world he would know that the GOP are almost guaranteed to win the senate this year (70+% odds) with Tester of MT finally getting the boot and Joe Manchin WV seat going GOP. So tax hikes are not happening.

WB tax talk on Aapl was BS, let’s be honest.

Agreed. Not sure why so many folks pay so little attention to the legislative branch when it comes to new tax legislation. Odds are slim to none unless one party sweeps Executive and Legislative branches of Congress. And it really doesn't take the geniuses on this board to recognize that Berkshire is trading at a price above its historical valuation. So what? Ajit Jain sold a block of Berkshire - capital gains taxes and all - that represents a significant portion of his net worth for one or more purposes that he chooses to remain private. Personally, I believe that this does have something to do with estate planning, i.e., ultimately reducing the size of his taxable estate but otherwise, it really doesn't matter and it says nothing whatsoever about the long term prospects of Berkshire going forward.

-

4 minutes ago, dwy000 said:

I tend to agree with the transparency argument. While complexity and customization is definitely a factor, in other industries most outsized broker or agency rates have come down due to transparency (as well as the internet taking away information advantage). When you buy or sell a house, you know exactly how much you're getting for the house and how much the broker is getting. When you buy a stock, bond or option, you know exactly how much the stock costs and how much the commission is (often free now!). But when you buy insurance, all you see is the premium(s). You have no idea how much of that is true underwriting risk, how much is administration and how much is commission. If they were forced to break out those numbers in your premium it would be too easy to go to another broker and say "beat this price" and they could do it with the exact same underwriter. I can't see a circumstance where anyone (other than the customer) wants to have that level of transparency and kill the golden goose. So maybe the anomaly continues for the indefinite future.

Back in the day OTC stock commissions were hidden in the "spread". And frankly, its not that different than going to your doctor and then getting a bill for the "uninsured" portion.

-

Just now, Munger_Disciple said:

Ajit's sale is not related to charitable giving (he could have gifted shares to avoid capital gains taxes), but it is highly unlikely that it is related to estate planning.

My own guess is that Ajit (the best odds maker in the world) sees future capital gains taxes (especially under a democratic administration) going up significantly so he is taking some chips off the table at a high end of Berkshire's intrinsic value if not higher.

I'd take the other side of that bet. He knows Berkshire as well as anyone and unless he is planning on retiring (or even if he is), doesn't believe that Berkshire will not be more valuable in the future.

-

7 minutes ago, Munger_Disciple said:

Why would estate planning involve selling stock? That makes no sense.

Selling stock to then give the proceeds away to charities makes no sense. He may want to start giving away his fortune to individuals/non-charities in increments less than the equivalent of an A share. Does he have a large family or non-charitable (501c) causes that he supports? Estate planning = reducing the size of your taxable estate.

-

1 minute ago, adesigar said:

Probably making a $100 million donation to a charity that he supports.

But then why sell the stock and pay CG taxes rather than donate the shares directly?

-

5 minutes ago, sleepydragon said:

It’s almost exactly $100m after tax. Is there a possiblity that Ajain is buying a huge house?

The most expensive house in CT is around $50m, but there are a lot of big houses in Florida

The most expensive house in CT is around $50m, but there are a lot of big houses in Florida

LOL, one would think he'd have no trouble qualifying for a mortgage. Or Berkshire would lend him the money. Do we know what else he owns besides BRK shares? My guess this is part of an estate plan.

-

1 minute ago, gfp said:

If Fairfax exits a bit early and doesn't hold out for a high valuation, there is always the possibility they are an interested buyer for the "hedge blocks" for lack of a better term. They bought Prem's block - another case where "Fairfax" was both interested in buying and selling at a certain price - so it isn't too far fetched. If they wait for over-valuation to exit, which I doubt, they may not be a buyer of the hedge shares.

Yes, I am in New Orleans proper, inland and east of the track. Plenty of rain today. The hurricane doesn't look too bad, we should be fine. Just waiting around to leave town until after the storm so we can check the properties.

"Just waiting around to leave town until after the storm so we can check the properties."

Yeah, know that feeling all too well.....

-

2 minutes ago, gfp said:

The counterparties are the major Canadian banks. They are hedged. It is a routine transaction for them, not some big losing directional bet.

If hedged, one might anticipate a rather dramatic drop in the price of the stock when the TRS is terminated.

BTW, you are in New Orleans, right? Stay safe.

-

37 minutes ago, dartmonkey said:

I think owning these swaps is pretty much the economic equivalent of just buying back shares, so I would be interested to hear what management thinks about selling the TRSs and using the cash to buy back shares - would it give a roughly equivalent outcome? Are there advantages (I presume there must be) to holding the TRSs indefinitely, rather than buying back the equivalent number of shares with the proceeds of the TRSs? Do the TRSs better satisfy capital requirements for insurance companies, for instance? And one additional quesiton that occurs to me, given the fact that there is now a 2% tax on buybacks, is this avoided (or postponed) by holding the swaps instead of actually doing the buybacks?

Since management is unlikely to spell this out for us, I would be curious to hear thoughts from members of this board about this comparison!

The most compelling feature seems to be that Fairfax can put a floor on the price of the stock as long as the price remains cheap and the company has enough cash to continue repurchasing shares. The biggest concern (to me at least) is that Fairfax has the power to terminate the TRS if and when desired for little or no added cost. Also, the identity of the counterparty(ies) would be good to know; unless the TRS is hedged, this has not been a good bet for any such counterparties.

-

3 minutes ago, TwoCitiesCapital said:

Fairfax is receiving the return on a number of shares, as if it owned them, in exchange for a financing rate (LIBOR or whatever iteration it exists today plus a spread).

Typically, the return and financing costs are better and paid either monthly or quarterly.

In cases where the return on Fairfax shares exceeds the financing cost, Fairfax receives cash.

In cases where the return on Fairfax shares is less than the financibg costs, Fairfax pays cash.

Thanks @TwoCitiesCapital. Can Fairfax terminate this transaction at any time? Otherwise, how long does it last? I would think that if the company anticipates an operational rough patch of any duration it might want to terminate the TRS in advance.

-

19 minutes ago, Viking said:

Here are some comments on the FFH total return swaps.

1.) Fairfax holds them as an investment - at least that is what they have said in the past.

If they still own them, that suggests they still like the risk / reward trade off. And it is probably heavily skewed in a favourable way. Given the risks, why hold them otherwise?

For those who think Fairfax should sell… can you also indicate what you think fair value is for Fairfax’s stock?

When i was at Fairfax’s AGM this year my question for other attendees was “What is a reasonable P/BV for Fairfax?” Consensus was Fairfax should trade at a minimum P/BV of 1.5x.

Book value of Fairfax today is $980/share. Q3 earnings should come in around $40 (with the Stelco gain) which means ‘real time’ BV at Sept 30 = $1,020.

- 1.5x BV = $1,530. Stock closed today at $1,211, which is significantly below $1,530.

We also know book value is understated. Excess of FV over CV is large. Other assets like BIAL are also likely significantly undervalued in reported BV.

As a result, US$1,600 or even $1,700/share might represent a reasonable fair value for Fairfax today.

2.) Fairfax is aggressively buying back stock. They have been doing this for the past 7 years. But the pace of buybacks has picked up in 2024. This is likely because the hard market is slowing. What will the insurance subs do with the excess capital? Send it to Fairfax who will buy back stock.

3.) Fairfax has very robust cash flow. Fairfax is also earning about $2.5 billion in interest income. A $2 billion number is largely locked in for the next couple of years. This is just one income stream. There are many more income streams. Fairfax also could sell assets. Even if adversity hits, Fairfax should have pretty robust cash flow.

4.) Fairfax appears to be the marginal buyer of its stock this year. what determines the value of Fairfax’s stock?

By buying back stock Fairfax is driving value in two ways:

- buying stock at prices well below intrinsic value.

- significantly increasing earnings via gains from the TRS.

The value creation from this one-two punch over the past 4 years has been significant. My guess is there is more to come - and perhaps much more.

Again, it all comes down to what you think Fairfax’s stock is worth.

When Fairfax made the TRS investment at the end of 2020/beginning of 2021, Prem said he felt it would become one of Fairfax’s best-ever investments. And it has - in 3.5 short years.

Remember - how do you make the big money? Patience.

The irony is, the more stock Fairfax repurchases at ever-higher prices, the more the TRS grows in value. I'm not entirely comfortable with that relationship. Also there is at least one counterparty - do we know who is on the other side of this bet and what control, if any they may have? Given that the TRS is now one of Fairfax's largest equity positions, the details are worth knowing. I'd imagine there is a written contract somewhere but is it available to shareholders?

-

8 minutes ago, rogermunibond said:

Subprime auto delinquencies going up. $ALLY had a bad call. Bringing down KMX, CACC, CVNA, and even the dealership groups - AN, LAD, etc.

First inning for auto loan write offs.

However, mortgage delinquencies not affected. It's a bifurcated economy.

I think it is more reflective of the "haves" and the "have nots". Auto financing appeals to folks who cannot afford to pay cash for a vehicle, the rates tend to be high and the asset depreciates the minute you leave the dealer lot. Home mortgage rates for most current borrowers are historically low whereas it might cost some homeowners more to rent and/or sell and repurchase another residence and the underlying asset continues to appreciate in value.

-

14 minutes ago, TwoCitiesCapital said:

I still don't understand this argument. Sure it makes sense in theory - but then why was insurance so morose in the 2010s when interest rates were also at 0% for most of the decade?

Why did the hard market were seeing now start post-covid when interest rates were rising to a highest level they've been since pre-GFC?

Overall, the theory may be true - but it seems the lags in effects on profitability are so long as to be meaningless in forecasting anything in the next 1-3 years in terms of hardness/softness and earnings.

My main concern isn't a mark to market loss on equities in a down market, but a liquidity drain from the TRS if Fairfax gets sold off in tandem.

That didn't happen in 2022. It DID happen in 2020 and 2018 and 2007.

Perhaps the leverage is worth the quarterly liquidity risk. But I'd feel more comfortable if Fairfax didn't own the TRS in a down market.

For us novices when it comes to total return swaps, can someone explain the mechanics, i.e., how often payments are made, whether there are any added costs to Fairfax for maintaining the TRS and whether either party can exit some or all of the TRS at any time and if so at what cost? Also is there an expiration or maturity date?

-

12 hours ago, Viking said:

@73 Reds Here is perhaps another way to look at it. If an investor buys a stock and then the ‘story’ changes for the worse (for whatever reason) and they choose not to sell that investment. And then it drops precipitously in value 5 or 10 years later.

Who is primarily to blame? Is it:

1.) management of the company?

2.) or the investor - for not selling as soon as they knew the story had changed?

My view is the blame primarily rests with the investor.

Absolutely, the investor is responsible for all his/her decisions. But so is management. My point is the same management responsible for the equity hedge/short position is still in charge. Have they learned? We hope so. But that doesn't make folks wrong to ignore their history. Besides, who knows what people who passed on Fairfax did with their investment dollars; there have been other great performers and everyone's criteria for evaluating potential investments is different. You (and I) saw a stock that was too cheap to pass up. But that doesn't make not buying it (i.e. acts of omission) wrong.

-

16 minutes ago, Viking said:

Fairfax Financial - 10 Lessons Learned Over the Past 4 Years

“There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.” Jesse Livermore Reminiscences of a Stock Operator

What it takes to be a successful investor has not changed very much over the years. That is because capitalism is a wonderful economic system - our standard of living continues to improve. And human nature has not changed - people will continue to act like they always have. Learning from the past is an important way for an investor to get an edge - it can give you a preview of what is likely to happen in the future.

The Fairfax story

The last 4 years has been an amazing time to be invested in Fairfax. The company is executing one of the great comebacks in recent Canadian business history - both in terms of business and share price performance. It is both an interesting and instructive story.

As investors, what can we learn from Fairfax’s improbable transformation/performance over the past 4 years?

That is the question we will explore in this post.

But first let’s do a quick review of a very important performance measure.

—————

How has Fairfax’s stock performed?

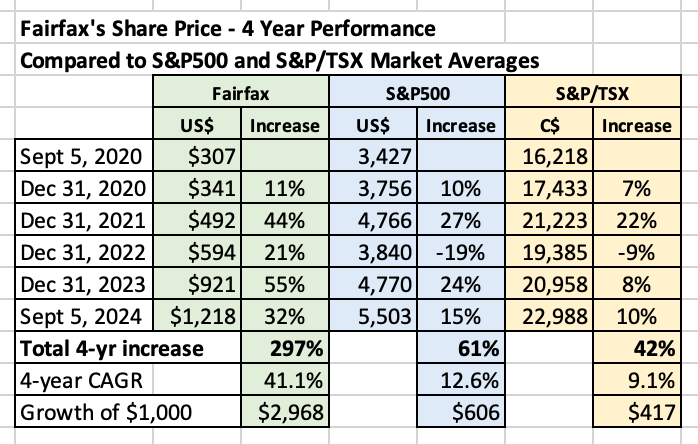

Fairfax’s stock is up 297% over the past 4 years. That is a CAGR of 41.1%. $1,000 invested in Fairfax 4 years ago would be worth $3,968 today, an increase of $2,968. That is a crazy good.

How does Fairfax’s performance compare to the market averages?

- The S&P500 is up a total of 61% over the past 4 years.

- The S&P/TSX is up a total of 42% over the past 4 years.

Fairfax’s outperformance of the market averages in the US and Canada has been breathtaking.

How does Fairfax’s performance compare to P/C insurance peers?

P/C insurance companies, as a group, have significantly outperformed the broad market averages over the past 4 years.

The big winner of the 6 companies compared below has been Fairfax - their performance has trounced P/C insurance peers over the past 4 years. Fairfax’s CAGR is about 2x that of peers. The big laggard (of the 6 companies compared below) has been Markel.

Fairfax’s performance over the past 4 years - in absolute and relative terms - has been epic.

—————-

"What we learn from history is that people don't learn from history." Warren Buffett

With that warning from Buffett, let’s get back to our original question. Let’s try and be inquisitive and open minded…

As investors, what can we learn from Fairfax’s improbable transformation/performance over the past 4 years?

Below are 10 lessons that come to mind for me.

What do other posters think? Am I way off base? I do like to stir the pot. Do you see anything missing? Please chime in.

—————

Lesson 1: Investors need to be rational at all times with their investments

Investing (buying stocks) is not like getting married. Or like joining a club/clique (sorry Tom Gaynor).

Ideally, we are able to buy stocks and hold them forever. But that is just not realistic for most stocks. And that is because shit happens. Facts change. Fundamentals / earnings change. Sometimes management teams lose their way. A great investment can become a terrible investment. But unlike marriage, exiting a broken stock is an easy thing for an investor to do.

When should an investor sell an investment?

According to Peter Lynch, a pretty smart guy, an investor should sell an investment when the story / fundamentals take a turn for the worse. Pretty simple.

The Fairfax ‘story’

Over its long history, a person usually invested in Fairfax because of their investing skills - not because of the quality of their P/C insurance business. (Yes, that has changed today.)

But something important happened at Fairfax from 2010 to 2020. Fairfax lost its way with its investing framework:

- The ‘equity hedge/short’ strategy was a disaster, costing the company an average of $494 million/year from 2010 to 2020. The issue with this ‘position’ was its size (massive) and duration (largely in place for 11 years).

- The equity purchases made from 2014 to 2017 were also largely a disaster.

This caused earnings at the company to stagnate. And the stock went sideways from 2010 to 2020. During this time, the S&P500 went up 200%. Measured in terms of opportunity cost, Fairfax investors ‘lost’ a significant amount of money from 2010 to 2020.

This, of course, violated Warren Buffett’s rule #1 (when investing) which is ‘don’t lose money.’

What was the learning - looking back, what should a rational investor have done?

By about 2012/2013 it was clear that Fairfax had lost its way on the investing side of the business. As a result, the Fairfax ‘story’ had changed significantly - and for the worse.

The correct course of action for an investor back in 2012/2013 was to sell their Fairfax stock - and move on.

This course of action would have saved many investors years of anguish and massive underperformance.

This does not mean that an investor could never again invest in Fairfax. Like any other opportunity, what an investor did in the future would depend on their assessment of the opportunity (fundamentals, management, prospects, valuation etc). Again, an investor needs to be as rational as possible at all times.

Now i am looking at things from the perspective of a small investor. If i do a good job with my investments my family eats. If i do a shitty job my family doesn’t eat. As a result, i need to be very rational at all times with my investment decisions.

The silver lining

"The most important thing to do if you find yourself in a hole is to stop digging." Warren Buffett

Fairfax’s problems were self inflicted. Therefore, the ‘fix’ was also in their control. So the situation was not hopeless. It deserved to be monitored. If Fairfax was able to fix its investing framework then it might make sense for an investor to buy shares. Logic, not hope, should drive the investment decision.

But given the stocks exceptional run the past 4 years, doesn’t this mean buy and hold was - with hindsight - the correct course of action to have taken with Fairfax?

No. Selling back in 2012/2013 was still the correct course of action. And that is because back then Fairfax had lost its way with its investing framework.

And back in 2012/2013 (and over the next couple of years that followed) it was clear that Fairfax did not yet recognize that they even had a problem.

Fairfax did not start righting their investing framework until late 2016 when they finally exited the equity hedges. By 2018 they were making much better decisions with new equity purchases. The final ‘fix’ was made at the end of 2020, when they exited the last of their short positions. It still took another couple of years for Fairfax to clean up the many problem children that were still residing in their equity portfolio. As a result, it was only around 2021 that investors started to trust that Fairfax had indeed righted the ship and fixed their investing framework. That was a full 7 years after it was pretty clear that Fairfax had a problem.

And back in 2012/2013 it was not a given that Fairfax would actually fix anything. This could have easily gone the other way - with their investments, Fairfax could have continued to go down their old disastrous path.

Long term shareholders have been very lucky with how their investment in Fairfax has played out over the past 4 years - not smart. Yes, Fairfax was able to execute a successful turnaround. But that is not what usually happens.

There is also an important lesson here for Fairfax

Fairfax wants to attract long term shareholders - that was pretty apparent during the Q&A sessions at the AGM this year. If this is the case, then Fairfax needs to hold up its end of the bargain - they need to run the business in a way that attracts/aligns with long term shareholders. When it comes to the type of shareholder base they have, companies generally get what they deserve.

—————

Lesson 2: Financial markets sometimes get it completely wrong - for years

"The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd." Warren Buffett

Pretty much everyone got Fairfax wrong 4 years ago.

Who got Fairfax the most wrong? The haters. Their hate stopped them from being rational. It stopped them from looking at the company objectively. As a result, they likely did not invest in Fairfax at all. So they missed out on one of the great investments of the past 4 years.

The haters are a pretty quiet bunch these days. But they were out in full force in 2020.

But even many of those who were positive on Fairfax 4 years ago were also very wrong. They grossly underestimated the opportunity. As a result they likely did not size their position properly. And many likely sold their position much too soon.

Who got Fairfax the most right 4 years ago? Some lucky guy named Prem Watsa who invested $150 million in Fairfax at US$308/share in June of 2020 at pretty much the bottom. If only he had not kept his investment (and his rationale) secret… we all could have learned and benefitted from what he knew!

Of course, Prem did tell investors what he was doing and why. Prem nailed it. And we all completely ignored him. (I guess this also explains why he is a billionaire and we are not!)

From Fairfax’s press release on June 15, 2020:

Mr. Watsa commented as follows in connection with this purchase: “At our AGM and on our first quarter earnings release call, I said that our shares are ‘ridiculously cheap’. That statement reflected my recognition that in the 35 years since Fairfax began, I have never seen Fairfax shares sell at a bigger discount to their intrinsic value than they have recently. I have now backed up my strong words by purchasing close to US$150 million of Fairfax shares in the market over the last few days, as I believe that this will be an excellent long term investment.”

—————

Be careful who you listen to

Who and what you let into your brain is super important. It is crazy how easily an investor can get messed up by their ‘information’ sources. Bad analysis and faulty logic can pollute rational thought / actions - once it gets into your head/thought process it can be very difficult to remove.

Ignore the haters

As we learned in lesson #1, successful investing is centred on being rational. Haters don’t care about fundamentals/earnings, management, prospects or valuation. Haters are blinded by the facts, especially at inflection points. The problem is the haters usually say things with a lot of conviction - and the old (wrong) narrative makes so much sense. This makes their views sound very persuasive at the time.

Back in 2020, the haters were out in full force. What were they saying? ‘Prem is an idiot.’ Or something similar. Their ‘analysis’ was exclusively rear-view mirror in nature. The positive changes happening at the company didn’t matter. The improving fundamentals / earnings didn’t matter.

This leads into our next lesson.

—————

3.) The Corner of Berkshire & Fairfax is an amazing resource for investors.

"You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital." Warren Buffett

Having the opportunity to hang out with, learn from and debate with many other successful investors from all walks of life and all over the world is amazing. Being able to do so for 20 years is priceless.

The Corner of Berkshire and Fairfax (CofBF) has been sprinkling pixie dust on its members for more than 20 years. Thank you Sanjeev for running this wonderful investment forum.

And when it comes to Fairfax, there is no better resource for investors out there. The analysis provided by board members over the years (20 and counting) has been simply outstanding. And for the past 4 years, members of CofBF have had a front row seat to Fairfax’s amazing turnaround.

Out of favour = under-followed

The fact that sentiment in Fairfax got so bad back in 2020 was actually a big help in this regard.

Pretty much no one was following the company back then. At the same time, the old narrative surrounding the company was completely wrong. That is a wonderful set up for an independently thinking, open-minded investor.

When it came to Fairfax as investment, this gave CofBF board members a massive information advantage over the entire investment community. This advantage has persisted for years.

But seeing an opportunity is not enough.

—————

4.) Knowledge without action often results in the biggest mistakes for investors.

“The most extreme mistakes in Berkshire's history have been mistakes of omission. We saw it, but didn't act on it. They're huge mistakes — we've lost billions. And we keep doing it. We're getting better at it. We never get over it.” There are two types of mistakes: 1) doing nothing; what Warren calls “sucking my thumb” and 2) buying with an eyedropper things we should be buying a lot of.” Charlie Munger

To make money an investor can’t just read/study and sit in cash. At some point in time they have to act on what they have learned and buy something. And they need to size their position properly (more on this later in the post).

Sanjeev (and others) were pounding the table very loudly on Fairfax during the entire summer of 2020. At the time, they provided lots of great analysis in support of their views. The opportunity in Fairfax was gift wrapped for the members of the Corner of Berkshire and Fairfax.

For a trip down memory lane, below are links to a couple of threads from 2020 with Sanjeev (and a few others) pointing out how cheap Fairfax had gotten - with pushback from lots of others. In the second link, Sanjeev suggests Fairfax could return 300% over a 5-7 year time frame. It got there in 4 years.

- https://thecobf.com/forum/topic/18079-remember-this-quote/#comment-411701

- https://thecobf.com/forum/topic/17401-fairfax-2020/page/12/#comment-401311

What is interesting is how fast the general stock market bounced back in 2020 - by August the S&P500 took out its pre-Covid high (reached in February) and was back at all-time highs.

In February of 2020, Fairfax was trading at $475/share. From March 17 to November 13, 2020, Fairfax traded below $320/share. Investors had about 8 months to do their research, get comfortable with the story and still buy Fairfax at a historically cheap valuation.

Fairfax did not take out its pre-Covid (February) high until December of 2021. It stayed cheap for years.

But how many board members actually invested in Fairfax in 2020? Or 2021? Or 2022? Or 2023?

Not acting on what you know - Buffett calls that ‘thumb sucking.’ My guess is when it comes to Fairfax, there has been a lot of thumb sucking going on the past 4 years.

What about me? What was I doing?

All through the summer I was listening to Sanjeev and others on the board - I just wasn’t doing anything about it (that ‘thumb sucking’ thing). That changed in late October 2020, when I re-established a position in the stock. I got very lucky with my timing. Not surprisingly, that is also when my posting on Fairfax started to increase.

—————-

Ton be continued: The final 6 lessons will come in my next long-form post which should be completed in the next week.

@Viking, while I largely agree with you, it is a stretch to suggest that those who did not invest in Fairfax got it wrong. It was, and frankly still is completely rational to look at management responsible for the company's stagnation in the 2010s and compare them to present management. Looks like mostly the same folks. Personally, management is the number one factor in any investment I make. Without management, i.e., decision-making, companies don't generate anything. My choice to invest in Fairfax was due solely to how cheap the price had become; I initially invested IN SPITE OF (not because of) management. Has management done better in the 2020s? Well yes, for many of the reasons of which you so eloquently write. But even so, I'd hardly be willing to give the same management a pass for 10 years of poor decision-making and don't blame prior shareholders at all for taking a pass on this stock. Unlike Berkshire, where for 40+ years I've never questioned management (even while admittedly not understanding many decisions, past and present) Fairfax is, and always will be on a relatively short leash.

-

40 minutes ago, SharperDingaan said:

It's very much a generational thing, and which immigrant generation you are; once it becomes your generations 'norm', nobody really questions the why any more. However, as the various generations move through life; norms and approaches change.

For many newer retirees, it's a lot logistically/financially smarter to simply AirBnB vs own a cottage/home in a 2nd country. It's also a lot smarter to spend time with cousins/family who remained in the home country, refreshing family links that grand-kids might use later. As you also aren't tied to any one spot ... you can also travel around a bit.

The approach radically changes things. Fly vs drive to the destination and the game changers are flight times/lay-over location, not the cost (assumes extended time in XYZ at living costs that are a lot lower than in Florida). Sure, not everyone can still fly ... but if that's you; you also aren't stuck with the operating costs of that 2nd cottage/home in Florida that you aren't using.

Live in Toronto ? fly/cruise to Argentina/Chile/South Africa/Australia/NZ in November, stay there for 5 months and come home; enjoy endless summer while keeping your Canadian health care. Similarly fly/cruise to an India/Asia for 5 months and enjoy time with the extended family of your generation. Live in Vancouver? use Lima (Peru) as your gateway to S America, and LA as your gateway to Sydney. Different strokes.

Nothing wrong with Florida, but in today's world there are many other options, and many that are better. Florida tourism isn't likely to suffer for a while, but all good things eventually come to an end.

SD

Indeed, there are many more world-wide options available today for folks everywhere, which perhaps explains why there are so many South Americans/Asians/Europeans who spend time and buy residences in Florida.

Iran - Israel - Gaza Conflict

in General Discussion

Posted

No argument but for the reasons stated earlier it won't happen that way. It would be far more feasible for these people to relocate to Egypt and/or Jordan but that is not happening either - unless or until a whole lot of compensation is put on the table.