-

Posts

42 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Posts posted by Gamma78

-

-

On 8/3/2024 at 11:04 PM, Viking said:

Perhaps the most important thing we learned from Fairfax's Q2 results (and subsequent conference call) concerned stock buybacks.

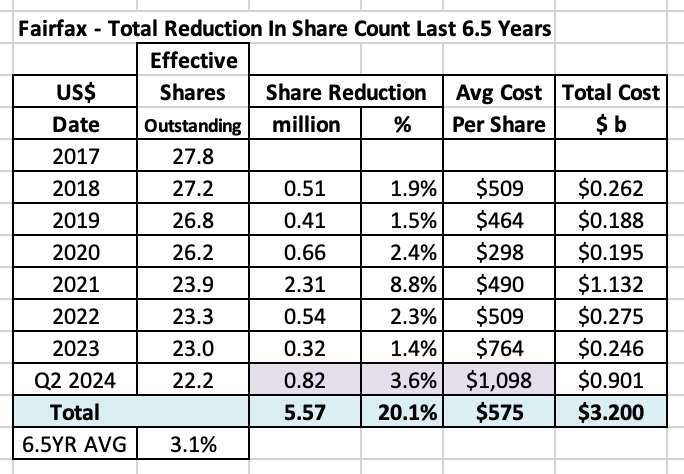

Summary: Over the past 6.5 years, the size and profitability of Fairfax has increased dramatically. Fairfax has also been aggressively buying back a significant number of shares at a very low valuation. As a result, Fairfax shareholders now own 20% more of Fairfax’s much larger and much more profitable P/C insurance / investment operation. And it appears the company is putting its foot on the stock buyback accelerator...

The big picture

Three factors drive stock returns over the long term:

- Earnings

- Multiple

- Shares outstanding

The last factor is often ignored by investors.

Capital allocation

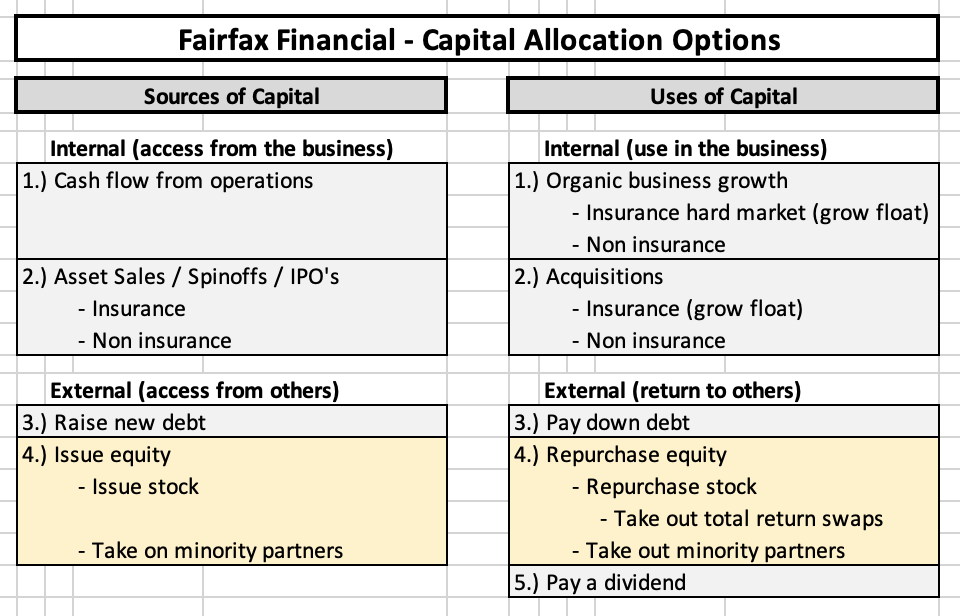

Capital allocation is the most important function of a management team and stock buybacks are one of many options that are available.

Share buybacks can be very beneficial for shareholders if they are done in a responsible manner (purchased at attractive prices) and sustained over many years.

It is counterintuitive, but for long term shareholders a low share price can be a big benefit - if the company is buying back shares and in a significant quantity. Especially if it persists for years.

How does Fairfax approach buybacks?

Prem laid out Fairfax’s strategy regarding share buybacks in the 2018 annual report:

“I mentioned to you last year that we are focused on buying back our shares over the next ten years as and when we get the opportunity to do so at attractive prices. Henry Singleton from Teledyne was our hero as he reduced shares outstanding from approximately 88 million to 12 million over about 15 years.” Prem Watsa – Fairfax 2018AR

Fairfax approaches share buybacks from the framework of a value investor: buy back shares when they are cheap and back up the truck when they are really cheap.

What has Fairfax been doing in recent years?

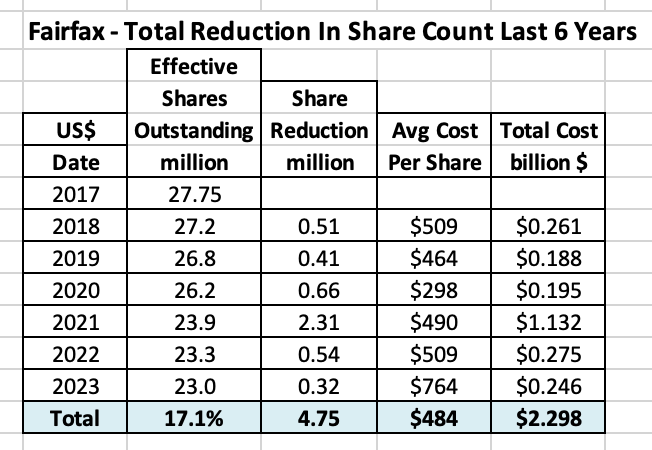

Fairfax’s year-end ‘effective shares outstanding’ peaked in 2017 at 27.75 million. Fairfax issued a total of 7.2 million shares in 2015, 2016 and 2017 to help fund its aggressive international expansion in insurance. The new shares were issued at an average price of about $462/share.

At June 30, 2024, the ‘effective shares outstanding’ at Fairfax had fallen to 22.2 million shares. Over the last 6.5 years (2018-Q2 2024), Fairfax has reduced its share count by approximately 5.57 million shares or 20.1%. The average price paid to buy back shares was about $575/share.

That is a significant reduction in shares outstanding.

Did Fairfax get good value with its buybacks?

- The average price paid for the shares repurchased by Fairfax over the past 6.5 years is slightly higher than the price that shares were issued at from 2015-2017.

- Fairfax’s book value at June 30, 2024 was $980/share.

- Fairfax’s intrinsic value is well above its book value.

Fairfax has been able to buy back a significant number of shares at a very attractive average price – at a significant discount to book value and intrinsic value.

Is Fairfax done with buybacks?

In 1H 2024, Fairfax reduced effective share outstanding by 820,000 shares or 3.6%. That is significantly more than the average for the past 6.5 years of 3.1% (that is the annual increase). So far in 2024, Fairfax is buying back stock at 2 times the average pace from the past 6.5 years.

Why is the pace of buybacks picking up?

Likely for three key reasons:

- Robust cash generation: Fairfax is generating an enormous amount of free cash flow.

- The hard market in P/C insurance is slowing: The P/C insurance companies no longer need capital to grow. In fact, the opposite is happening – the P/C insurance businesses are generating excess capital, which is being sent to Fairfax.

- Cheap stock: Fairfax’s stock trades at a big discount to its intrinsic value (and peers).

For the stock repurchased in 1H 2024, Fairfax has paid an average price of $1,098/share. This price is a slight premium to current book value ($980/share). Importantly, book value does not include the following:

- “At June 30, 2024 the excess of fair value over carrying value of investments in non-insurance associates and consolidated non-insurance subsidiaries was $1,514.5 million.” This is about $68/share pre-tax.

- “The company's current estimated pre-tax gain on sale of its holdings of approximately 13 million common shares of Stelco is approximately Cdn$531 million (US$390 million)…”

Bottom line, in 2024 Fairfax has been buying back shares at around 1x 2024 year-end ‘adjusted’ book value (if we include the two items above). That is great value.

On Fairfax’s Q2 conference call, Peter Clarke suggested that Fairfax would continue to be aggressive with stock buybacks.

Over the past 6.5 years, the size and profitability of Fairfax has increased dramatically. Fairfax has also been aggressively buying back a significant number of shares at a very low valuation. As a result, Fairfax shareholders now own 20% more of Fairfax’s much larger and much more profitable P/C insurance/investment operation.

This is just another example of the outstanding job the management team at Fairfax has done when it comes to capital allocation.

Looks like markets are in for a little bit of a storm - I really really hope Fairfax takes advantage of this bigly.

You don't get too many chances like this.

-

By his logic all insurance companies are no-moat.

Yet the sector has not done badly long term. And some standouts (Chubb, Fairfax, Berkshire, Markel) have done spectacularly well. The lack of curiosity as to understand why that is is the marker that defines his lack of intellect.

-

On 7/31/2024 at 6:49 PM, Viking said:

Fairfax - The Influence of Henry Singleton

“History never repeats itself, but it does often rhyme.” Mark Twain

In my last post I did a short review of Henry Singleton. He has been an important influence/mentor to Fairfax. Today we are going to try to connect some of the dots. We are going to focus on capital allocation and one tool in the capital allocation toolbox - shareholders’ equity. And how, when it is used properly, it can build significant long term per share value for shareholders.

But remember… when comparing the present with the past we will never find an exact ‘repeat.’ That is not the point/objective of doing this exercise. However, if we look closely, we can find important examples of where the present does indeed ‘rhyme’ with the past. And that, in turn, can help improve our understanding of Fairfax - what they are doing and what they might do in the future.

---------

Link to my previous post on Henry Singleton

----------

Let’s start with the big picture

A CEO has two basic responsibilities:

- Operations (run the business)

- Allocate capital

When allocating capital, the basic choices available to the management team at Fairfax have been captured in the table below. In this post, we are going to focus on one tool in the capital allocation toolbox - shareholders’ equity - both as a source of capital (issuing stock) and as a use of capital (repurchasing stock).

Shareholders’ equity

The playbook of how a management team can use shareholders’ equity to drive long term per share value for shareholders is pretty simple:

- Issue stock when it is overvalued - and buy assets that are undervalued.

- Buy back stock when it is undervalued.

- Be aggressive at extremes (overvaluation and undervaluation).

- Keep doing both as long as conditions remain favourable.

There are two key reasons this strategy works so well:

- Mr. Market’s behaviour can very irrational at times - and it can persist for years.

- The management team knows what the intrinsic value of the company is - it has a big information advantage over Mr. Market.

The proper execution of this strategy over time can lead to extraordinary results for long term shareholders. Henry Singleton taught us this when he ran Teledyne.

—————

Fairfax Financial - Shareholders’ Equity - A 38-Year Journey

Let’s review how Fairfax Financial has used shareholders’ equity over their 38 year history to see what we can learn.

We will break our analysis into two time-frames:

- Phase 1 - 1985 to 2017 - Building out the P/C Insurance Platform

- Phase 2 - 2018 to today - Optimize the Operating Businesses and Aggressively Shrink the Share Count

Phase 1 - 1985 to 2017 - Building Out the P/C Insurance Platform

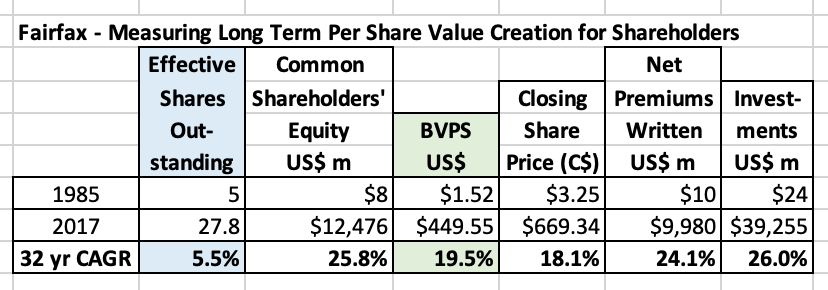

In 1985, the year it was founded, Fairfax began its journey with 5 million shares outstanding.

From 1985 to 2017, Fairfax:

- Issued 29.5 million shares

- Repurchased 6.7 million shares

As a results, effective shares outstanding at the end of 2017 were 27.8 million (5 + 29.5 - 6.7) - they increased by a total of 22.8 million over the previous 32 years.

Over the first 32 years of their existence (from 1985 to 2017), share issuance was used aggressively as a source of cash - and this cash was used to grow Fairfax’s global P/C insurance platform. From 1985 to 2017, Fairfax issued a total of 29.5 million shares. Shares were generally issued at a premium to book value (sometimes a significant premium). Proceeds were used to buy other P/C insurance companies trading at a much lower valuation. Bottom line, looking at share issuance in aggregate, Fairfax got good value.

Share buybacks have also been a meaningful use of cash for Fairfax. From 1985 to 2017, Fairfax repurchased a total of 6.7 million shares. Repurchases were 22% of issuance - over the years, for every 5 shares that were issued, Fairfax repurchased 1 share back. Share were generally repurchased when Fairfax’s stock was trading at a discount/on sale. Like with share issuance, Fairfax got good value when they repurchased shares.

So in general, Fairfax issued stock when its shares were trading at a high valuation and used the cash to buy P/C insurance companies that were trading at a much lower valuation. Fairfax also bought back modest amounts of stock at times when its shares were trading at a low valuation.

This looks like it was textbook application of the principals of what a management team should do.

Is there a way we can actually measure how successful this strategy has been?

Yes. We can look at the change in long term per share book value (BVPS).

From 1985 to 2017, Fairfax increased:

- the share count at a CAGR of 5.5%.

- common shareholders equity at a CAGR of 25.8%.

- BVPS at a CAGR of 19.5%.

Using its stock to drive the growth of its P/C insurance platform resulted in enormous long term per share value creation for shareholders.

From Fairfax’s 2017AR:

—————

An important strategic change in 2017

With the purchase of Allied World in 2017, Fairfax officially completed the aggressive 32-year build out of their global P/C insurance platform. Moving forward, Fairfax would be focused on two things:

- Continue to do smaller bolt-on P/C insurance acquisitions.

- Optimize its existing insurance operations and investment portfolio.

Truth be told, Fairfax got to work optimizing its insurance operations back in 2011, when Andy Barnard was appointed President and COO to manage Fairfax’s total insurance business. When it comes to investments, fixed income has always been a strength of Fairfax. The issue at Fairfax in 2017 was its equity portfolio - it was stuffed full of underperforming companies, many of which were significant cash drags (they were not delivering cash to Fairfax - they needed cash from Fairfax).

By optimizing the insurance operations and investment portfolio Fairfax would be able to improve the ‘cash flow from operations,’ the most important source of cash.

What was the company planning on doing with the future free cash flow?

In the 2017AR, Prem told investors what was to come - Fairfax intended to get much more aggressive with share buybacks.

“Henry Singleton, at Teledyne, reversed this trend (of growing share count), as you know, and over the next ten years we expect to do the same - use our free cash flow to buy back our shares!”

At the time, Prem was laughed at (pretty loudly) for what he said.

Let’s look at what has happened at Fairfax since then.

Phase 2 - 2018 to Today - Optimize the Operating Businesses and Aggressively Shrink the Share Count

What did Fairfax do?

2018-2023: Aggressively reduce the share count

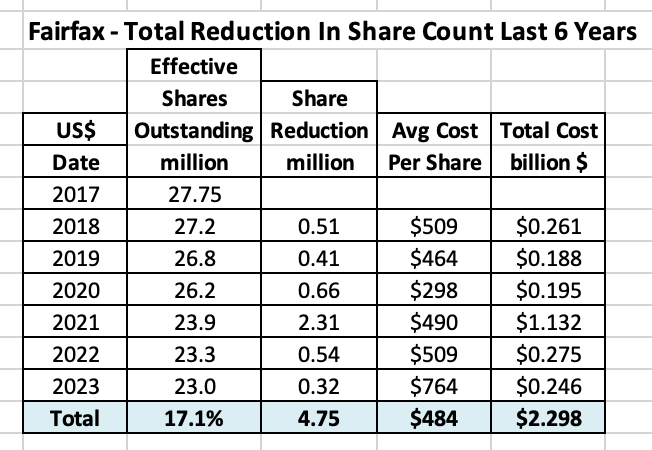

Effective shares outstanding at Fairfax peaked at 27.75 million in 2017. Over the past 6 years (to December 31, 2023), Fairfax reduced effective shares outstanding by 4.75 million, or 17.1%, at an average cost of $484/share.

From 2018 to 2023, Fairfax was able to repurchase a significant amount of shares at a very low valuation. This is a great example of exceptional value creation by the management team at Fairfax.

What does this do to the important per share metrics?

Here is Prem’s slide from Fairfax’s AGM in April 2024.

Before moving on, we are going to take a minute to review a couple of things Fairfax did in 2020 and 2021. Because they provide some great insight into how Fairfax thinks about and executes capital allocation.

—————

Classic Fairfax - Turning Lemons into Lemonade

Fairfax’s share price got historically cheap in 2020/2021. I won’t get into the reasons as to why that happened (I have covered that topic in detail in many past posts).

2020 and 2021 was a great time for Fairfax to buy back a meaningful amount of its stock. The problem Fairfax had at the time was they were cash poor.

What to do? Classic Fairfax - get creative.

Fairfax made two brilliant moves in late 2020 and 2021.

1.) Fairfax Total Return Swap

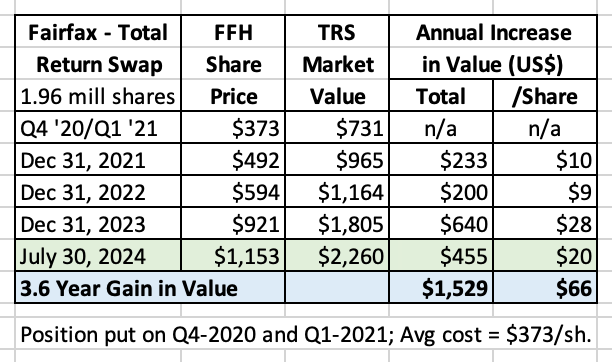

In late 2020/early 2021, Fairfax established a position in a total return swap giving it exposure to 1.96 million Fairfax shares at an average price of $373/share. Although not technically a buyback, establishing this position serves as the next best thing. This position gave Fairfax exposure to 7.5% of its effective shares outstanding (26.2 million at Dec 31, 2020). That is a massive position.

2.) Dutch Auction

In late 2021, Fairfax executed a dutch auction and repurchased 2 million Fairfax shares at $500/share. To fund the repurchase, Fairfax sold a 9.99% equity stake in their largest P/C insurance company Odyssey Group to CPPIB and OMERS for proceeds of $900 million. This was a wicked smart way to quickly source a significant amount of cash from trusted, external sources. In turn, this allowed Fairfax to capitalize on a short term opportunity (share price trading at crazy low price).

How have these two moves worked out?

1.) The FFH-TRS position is up $1.5 billion over the past 3.6 years (before carrying costs). This has turned into one of Fairfax’s best ever investments.

2.) Fairfax’s book value is $945 at March 31, 2024. Buying back 2 million shares at $500/share only 2.5 years ago was a steal of a deal for Fairfax and its shareholders.

Both of these moves executed by Fairfax scream Henry Singleton. They were:

- Very creative - establishing TRS and selling 9.99% of Odyssey to external partners.

- Very rational - Fairfax’s stock was trading at a historically low valuation.

- Highly opportunistic - seize the moment.

- Executed in scale. Both of these moves were of a significant size.

- Very unconventional - both were classic Fairfax moves.

Most impressively, these two deals were executed at a time when investors in Fairfax were literally ‘freaking out.’ But the management team at Fairfax was not ‘freaking out.’ Instead, the management team at Fairfax saw the opportunity and made two outstanding investments - the temperament the senior management team displayed during these dark times shows, among other things, great character. This should speak volumes to investors about the quality of the management team in place at Fairfax. This bodes well for the future.

It should also be noted that before Fairfax made either of these two investments, Prem told Fairfax shareholders very loudly that he thought Fairfax’s shares were dirt cheap. In June of 2020 he purchased $149 million in Fairfax shares at an average price of $309/share.

—————

OK, let’s circle around and get back on track.

Has Fairfax continued to buy back its shares in 2024?

My guess is when Fairfax reports Q2 results later this week, effective shares outstanding will come in at less than 22.4 million at June 30, 2024. Fairfax is on track to reduce effective shares outstanding by 1 million in 2024. This is at a much higher pace than we have seen in recent years.

Why is the pace of buybacks picking up in 2024?

I can think of two reasons:

1.) Low valuation: Fairfax’s stock continues to trade at a cheap valuation - its valuation is well below that of peers.

2.) Record free cash flow: Fairfax is now generating a record amount of free cash flow. It is coming from two sources:

- Record cash flow from operations (primarily operating income)

- Significant cash from asset sales

Since 2018, Fairfax has been working hard at optimizing its cash flow from operations. Importantly, the equity portfolio has been fixed. All three of Fairfax’s economic engines are now performing at a high level at the same time - and they have never been positioned better for the future:

- Insurance

- Investments - fixed income

- Investments - equities

Asset sales have historically been an important source of cash for Fairfax (and investment gains). This strength of Fairfax continues. The most recent example was the just-announced sale of Stelco. In 2023, it was the sale of Ambridge. In 2022 it was the sale of pet insurance and Resolute forest Products. All four sales were executed with the buyers all paying a premium price.

As a result, Fairfax is generating record free cash flow. And this looks set to continue in the coming years.

Summary

From 1985 to 2017, Fairfax was focussed on building out its global P/C insurance footprint. To fund this growth, Fairfax used its stock - usually issued when the stock was trading at a premium valuation.

In 2017, with the Allied World acquisition, Fairfax was officially done building out its global P/C platform. The focus of the company shifted to optimizing the cash flow from the insurance operations and investment portfolio.

From 2018 to today, Fairfax has reduced effective shares outstanding by more than 19%. Fairfax was very opportunistic and shares were repurchased at a very low valuation.

Over the past 38 years, Fairfax has put on a clinic on how to use shareholders’ equity to build long term per share value for shareholders. Henry Singleton would be proud of what they have been able to accomplish.

But the Fairfax story is still being written. Free cash flow at Fairfax has exploded over the past three years. The size and certainty of future earnings have both markedly improved at Fairfax in recent years. Buffett teaches us that certainty is the key variable to properly value an investment. At the same time, Fairfax’s management team is best in class among P/C insurance companies - measured though the growth in book value per share over the past 5 years.

Fairfax continues to trade at a significant discount to P/C insurance peers. Given what we know, this makes no sense. And if we know it, I think it is safe to say that Fairfax knows it.

As a result, like Henry Singleton, it would not surprise me to see Fairfax continue to buy back a meaningful amount of Fairfax’s stock in the coming years. After all, Prem told us what the plan was all the way back in 2017.

PS: This post is long. Thanks for hanging in there and making it to the end. As I was writing, it became clear to me that the influence of Henry Singleton on Fairfax goes far beyond just shareholders' equity (issuing stock at a premium valuation and then buying it back at a low valuation). Henry Singleton's influence on Fairfax was likely much bigger - how to structure the company, how to run the operations (focus on cash generation) and how to think about capital allocation (be rational, use all the tools in the toolbox, be creative, go big, don't be afraid to be unconventional etc). And to focus on building long term per share value for shareholders.

Looks like Fairfax has repurchased 850k shares in the first 6 months for just shy of $ 1 bln, and now has 22.2 mln shares outstanding.

-

6 hours ago, dartmonkey said:

Following the Henry Singleton example, periods of overvaluation can help, too. Singleton issued stock when valuations were high, and repurchased stock when they were low. He is known for the period when he retired almost 90% of outstanding shares at low multiples, sometimes <10 times earnings. But he also succeeded by raising capital at much higher multiples, typically 40-70 times, in an earlier period. The ideal would be to have both kinds of periods.

By the way, here is what Watsa had to say about Singleton and buybacks, in the 1997 annual letter (my emphasis):

While we have had very minimal stock buybacks in the past few years, we should remind our newer shareholders that we have bought back significant amounts of our shares in the past (i.e. 1.6 million shares or 25% in 1990). By the way, you may not know, but the Michael Jordan of stock buybacks was Henry Singleton at Teledyne. Henry began Teledyne in 1961 with approximately seven million shares outstanding and grew the company through acquisitions while shares outstanding peaked in 1972 at 88 million. From 1972 to 1987, long before stock buybacks became popular, Henry reduced the shares outstanding by 87% to 12 million. Book value per share and stock prices compounded in excess of 22% per year during Henry’s 27 year watch at Teledyne– one of the best track records in the business. We will always consider investing in our stock first (i.e. stock buyback) before making any acquisitions.

Would love to see more stock repurchases. Loved it when they repurchased 10% of the outstanding a couple of years ago below book value. Even at these valuations today it should be a no-brainer. There is a lot of talk about Singleton and Teledyne - I certainly hope they go this route with the valuation where it is currently. I'm not quite seeing them move exactly that way just yet though. After all, they just made a big capital allocation decision on Country Sleep. I'm fully prepared to give them benefit of doubt given the moves they have made recently. I would be lying if I said I understood that as a better deal than buying back their own shares.

-

9 hours ago, Viking said:

I think share buybacks are an important input. Fairfax is open/keen to buy back stock - and a significant amount. Especially in their current phase as a company - they are likely done with big P/C acquisitions and they have robust/record free cash flow.Fairfax has reduced effective shares outstanding by about 19% over the past 6.5 years (since share count peaked in 2017). Effectively they are aggressively shrinking the size of the company.

My guess is Fairfax could continue to trade at a discount to peers for years (due to complexity of business, etc). If this happens, Fairfax will have a the opportunity to continue to buy back a meaningful amount of stock over the next couple of years (3% per year). Long term shareholders of Fairfax should be praying that the stock stops going up so much

Over a decade this strategy really starts to add up. One big benefit is it keeps the company small. And that makes it easier to outperform - it keeps the opportunity set large. And the impact from good decisions can be material.

—————I also don’t think Fairfax wants to become a conglomerate. It wants to have some wholly owned non-insurance businesses. Cash cows. Like Recipe and Sleep Country. This provides a steady income stream for the company that is not tied to the insurance cycle. And it provides assets that could likely be quickly liquidated at a fair price should the need ever arise.

But i don’t think Fairfax wants to aggressively grow the company in the conglomerate direction.

—————This all suggests to me that Fairfax will not likely follow in Buffett’s footsteps in terms of capital allocation (in a big way) at least over the next couple of years. I see Fairfax doing more of the same (what we have seen from them since 2018).

The one caveat is if we get a big stock market sell off - at the same time Fairfax is flush with cash. Back in 2008? I think they loaded up with large cap ‘quality’ US stocks - only to sell a couple of years later (for a very nice gain) because they needed cash to offset the losses from the equity hedge/short position (with hindsight, they sold their positions way too early - they admitted this in one of the later annual reports).

—————-i think effective shares outstanding will be less than 22.4 million at Q2, 2024. We will know in a couple of days.

Thanks for your response @Viking your points are really improving my understanding of Fairfax and the investment I have in it - which I love! It's deepening understanding like this that makes it considerably easier to be an ultra long term shareholder, which is what I want to be. The more you understand the less short term issues freak you out, and you can let compounding work its magic.

Your point of "shrinking" the organisation via share buybacks, meaning that size doesn't become the same barrier it did with berkshire is an interesting one. And compelling. Basically its like a hedge fund returning capital to investors to be able to continue its strategy. Yes, I can see that working. For a while.

Though I suspect that a continuous repurchase of shares leads itself to valuation gaps closing over time, and hence the size issue coming back to the fore. For that not to happen, Fairfax would have to continuously trade at a discount such that share buybacks are a viable and value enhancing option. But the medicine of buybacks is likely to cure the malady of discount, so that arbitrage will wither away.

As I said though in my previous post, we are in the early innings. There is a long way to go yet before size restricts opportunity. And yes, share buybacks extends that time.

-

Just now, Gautam Sahgal said:

Well in Stelco, to your point, management is a moat. In Fairfax's own case, culture (which is a follow-on from entrepreneurial management). I note that a lot of Fairfax deals are really about partnering with a savvy operator/entrepreneur on an opportunity. Stelco was that. I think Sleep Country is too. So is BDT, Poseidon. In many ways Fairfax India is like that too. Fairfax really seems to almost identify the entrepreneurial partner first and the opportunity second. They believe in the management as a moat piece.

Your point of appreciating the differences and embracing them is fine, but I would note that Buffett was not a "buy and hold forever", moat driven investor earlier in his career. He was much more like Fairfax. I think the evolution to "buy quality and compound" comes as a reaction to size. After a certain point of size, finding the marginal transaction becomes hard. And at that point you better have compounders, otherwise buying and selling just won't get you there. Noticeably, after "compounders" he is now going for infrastructure because it is just about the only thing he can chuck money at that moves the needle for him.

As Fairfax grows, I think it is an inevitability we will see similar shifts. But we are still in the early innings of Fairfax.

What I mean is, you are seeing the Berkshire / Fairfax strategies as trade-offs.

I see them as being on a continuum, where Berkshire is later stage and Fairfax is earlier.

-

1

1

-

-

18 minutes ago, Viking said:

Management is a moat (look at Jamie Dimon) - look at what the management team at Eurobank has done over the past 5 years. Yes, Greece electing a pro-business government has helped. And the end of zero interest rates.

But I think focussing too much on 'moat' can box an investor in (that hammer thing Munger liked to talk about so much). All of Fairfax's equity investments are investments. At the end of the day, what I really care about is what kind of a return the equity investments will generate for Fairfax over the next 3 to 5 years.

What was Stelco's moat? That is debatable (perhaps it was one thing - Kestenbaum). And what a great investment for Fairfax. Overly focussing on moat when looking at Stelco would have probably messed an investor up. Fairfax has lots of investments like Stelco. Trying to evaluate them primarily through the lens of a moat misses the key point - Fairfax's business model is very different than Berkshire Hathaway's (or how Fairfax execute's within the model). Both companies are very good.

It's like having two kids as a parent. One kid does something a certain way and is good at it. And a parent keeps wishing the other kid, who is successful in their own right, would be more like the first kid (at that certain thing). For a parent, this approach is usually not a recipe for success. If both kids are successful - be happy. And appreciate/embrace their differences.

Well in Stelco, to your point, management is a moat. In Fairfax's own case, culture (which is a follow-on from entrepreneurial management). I note that a lot of Fairfax deals are really about partnering with a savvy operator/entrepreneur on an opportunity. Stelco was that. I think Sleep Country is too. So is BDT, Poseidon. In many ways Fairfax India is like that too. Fairfax really seems to almost identify the entrepreneurial partner first and the opportunity second. They believe in the management as a moat piece.

Your point of appreciating the differences and embracing them is fine, but I would note that Buffett was not a "buy and hold forever", moat driven investor earlier in his career. He was much more like Fairfax. I think the evolution to "buy quality and compound" comes as a reaction to size. After a certain point of size, finding the marginal transaction becomes hard. And at that point you better have compounders, otherwise buying and selling just won't get you there. Noticeably, after "compounders" he is now going for infrastructure because it is just about the only thing he can chuck money at that moves the needle for him.

As Fairfax grows, I think it is an inevitability we will see similar shifts. But we are still in the early innings of Fairfax.

-

9 hours ago, petec said:

I'm not sure Eurobank has a moat - at least not one that protects its economics. Banking is highly commoditised, and net interest margins are dependant on Eurozone interest rates not going back to 0.

Distribution would be a moat (so retail footprint) and scale of deposits. Retail deposits are the lowest cost financing a bank can have (though they carry their own risk). Replicating Eurobank's retail footprint and deposit scale for a newer entrant is tougher. Brand I guess would be a third, but I think that is actually very tied to retail footprint. I think that is about the biggest moat a bank can have

-

"So much advantage in life comes from being willing to look foolish in the short term".

Was thinking about this sentence tied to a lot of Fairfax's portfolio.

Also, just a great blog: https://fs.blog/brain-food/august-14-2022/

-

I don't think the issue here is that people think Sleep Country is a terrible business. It isn't. It's grown reasonably well for a very consistent period of time.

Mainly it's hard to immediately see it as a "great" opportunity. But I'll keep an open mind and willing to learn more as the investment unfolds. The recent spate of investments are all "in partnership" with a great founder / owner / entrepreneur. I imagine here the quality of the existing ownership played a role too.

-

15 hours ago, Viking said:

Exiting the BlackBerry debenture investment has freed up $500 million in capital that has been re-invested into better opportunities where Fairfax should be able to earn a much higher rate of return. When Fairfax does this it is like they are

On reflection I think at specific points in the past 10 years Prem and the team have made calls on positions keeping in mind a "political backdrop" as justification for the investment. The "animal spirits" unleashed by Trump. The Modi narrative in India. The "help Canada" position on Blackberry (and some other investments as well). We even heard it as a reason for investment in Eurobank (Greece political backdrop). I suspect some of this comes from investing in bonds, where macro conditions are taken into account by definition.

I would much much prefer that on the equity component Prem and Fairfax act like Warren B. The "political backdrop" is not the main consideration (or perhaps is even irrelevant). Look at the quality of the company and the compounding it can have over time first and foremost.

The problem is that in some ways we've discussed this on the board before - and the concept of "quality" can get murky. Right now to me it looks like "quality" in the eyes of the team at Fairfax is determining who their entrepreneurial partner is (Sokol, Byron Trott, etc). Though I don't always understand it, I am A-OK with that.

-

3 hours ago, SafetyinNumbers said:

My assumption is that FIH would earn management and performance fees from the LP investors which would be worth more than zero. It’s certainly considered a negative from investors that FIH has to pay them to FFH, so presumably if FFH is paying fees to FIH, that will be a positive.I don’t have any idea if this is even being considered but I hope if they do it, it’s in a way that vastly reduces net fees that FIH pays. The exclusivity on investing outside of insurance in India for FFH is being valued negatively right now but if they do a deal like this, it would demonstrate its value.

Yes is FIH is receiving the fees that would be interesting. Can't argue the point in math.

Personally I still think too cute. FIH receives fees from LPs and then pays management fees to FFH.

-

5 hours ago, SafetyinNumbers said:

I think it was me that raised that idea. Is your reason for not liking it because it’s complicated which in your opinion offsets the potential increase in intrinsic value?

tbh the structure can work. But would FIH be the GP or would it be FFH? And that question would merely be the tip of the iceberg.

My point is there would be too many "cute" arrangements that would be potentially distortive or look really weird. The 2 / 20 structure is already enough (to my mind).

It's not that it can't create value as a structure (it can) but the sidecar would lend itself to too many things I don't like. Devil of course is very much in the detail.

-

someone (I think on this board) raised the prospect of potentially creating a sidecar fund where FIH is effectively the GP and attracts funds from LPs. But man, that would be a further complication on an already complicated structure between FFH and FIH.

I hope they don't do that. Which however does leave us with the limited options of equity issuance, IPO of BIAL / sale of assets

-

@rajpgokul wow thanks so much for those comments on IDBI - that was a learning experience for me.

This statement has my mind in a whirl: "IDBI bank has an overall cost of funds of 4.3% (almost 280 bps below Indian GSec) for its 34 billion USD of liabilities. This itself would allow it to earn ROA's of 1.5% without taking any credit risk on their balance sheet."

Wild!

Just wondering - you mention that private sector banks will continue to take market share from public sector and grow 16-20% compounded. Who do you see being the biggest winner? HDFC again as in the last 30 years?

............asking for a friend

-

7 hours ago, TwoCitiesCapital said:

I don't disagree with

I don't disagree with your logic of using the share repurchases as a floor for their incremental capital, but there's already a thread here discussing if FFH will break $2,000/sh by then. And it's a good probability it just might.

So am not sure we can just assume that all repurchases will be done at prices or multiples available today.

Either way - debating the return on their return is such a small part of the big picture that I'm not sure it really matters if we get this piece right.

"not sure we can just assume that all repurchases will be done at prices or multiples available today"

They better hurry up then!

-

Yes all your assets above a $2 million threshold are deemed to have been sold, hence you pay capital gains as an exit tax.

Which is crazy. I haven't seen any other country do that (though the UK is trying to do that now with inheritance tax liability for people who decide to leave the UK).

-

Ok noted so there are about $4bln over 2 years of unallocated cash earnings which should allow faster compounding if invested (even if invested in boring old bonds), net of any one time investment gains.

Yes this is likely to be conservative, so book growth should beat the 15% mark. Depending on externalities, perhaps even handily.

-

@Viking this may be a silly question - but apart from the repurchase of shares in your model (which I think is about $700 million or so at today's prices) the residual earnings from the forecasted years are accumulating cash on balance sheet? Or what else? I mean, if all invested in bonds wouldn't that itself throw off a couple of hundred million per year incremental in interest & dividends? Am I missing something?

-

10 hours ago, Viking said:

If you wanted to understand the 'transformation' that has happened at Fairfax over the past 4 years in one chart this would probably be it.

The 5 income streams below flow into Fairfax's earnings:

1.) The total from all 5 income streams has increased from $1.8 to $5.9 billion.

- from $68/share to $267/share or 293%.

2.) Operating income has increased from $1 billion to $4.87 billion.

- from $39/share to $219/share or 466%.

High quality operating income now represents 82% of all income streams, up from 55%. That is a game changer.

Wow that is a really great way to capture the change. The thing I take away really is that while some believe there is a risk of results reverting to the previous time period's averages, the reality is that in that world of 0% interest rates float was worthless and interest/dividends were unrewarding. So even in a softer insurance market results should still on average be better than the past. Let alone the stellar results we are seeing now in a hard market.

Someday that will be reflected fully in the price. Someday.

-

3 hours ago, Xerxes said:

In the short term democracy will always have its fits and starts, but in the long run it always pay off.

my brainwashed simplistic Western view

I completely agree. Which is why the results of this election are in no way a barrier to development and perhaps increase resilience over time of the growth story. India's growth is fascinating and very significant. But then again it must be - because it has a huge population of young people that need jobs. So growth is literally the only way forwards.

@Viking - India doesn't really need to "choose" capitalism. It did that ages ago. Every capitalist society has its restrictions in terms of how open the economy is - the US has them (ask Chinese companies....). Europe certainly does (and gets a lot of shit for them). China has them in spades. So does Japan, Taiwan, etc etc. There are very few completely laissez faire capitalist economies - if any.

India is on its own path. "India needs to become capitalist" is old hat. That happened around 30 years ago. GDP growth since 2000's has consistently been pretty stellar - only drowned out by China's even more stellar growth in the early 2000's. FDI has been steadily increasing (across every government type, you name it). Restrictions have been steadily and continuously lifted. Perhaps not at the pace that some investors would have liked (particularly Indian billionaires, who frankly love having close friend they can fawn over in the government - again no matter what stripe that govt is). But continuously nonetheless.

We will still see very significant growth in India for a generation. And all of Prem's remarks will still hold true (for example regarding expected growth of the banking sector).

People tend to confuse their own personal return (I want an airport IPO this year or to buy a public sector bank tomorrow) with the overall issues of the country. Maybe things slow down, maybe they don't.

But the Indian equity story is still strong as hell. Don't sell now, for crying out loud. This party is still just getting started.

-

10 hours ago, nwoodman said:

I am no expert but there are times in a countries economic development that you need a strong leader with a mandate in order to get stuff done. I wouldn’t call that a dictatorship but perhaps a “necesssary evil’. The risk here is that we go back to horse trading and India loses some of its momentum. An issue in terms years but irrelevant in the context of decades.

Taking a glass half full perspective, perhaps it is “the pause that refreshes’ and it results in a better outcome long term. The market thinks otherwise.

"Need a strong leader to get stuff done" is as alluring as it is dangerous.

Once the dust settles people will see this for what it is - a relatively minor setback in the grand scheme of things. Firstly because power hasn't exactly shifted. It's the same coalition in power, with a different dynamic. Who knows, maybe even better longer term. Markets always overreact to short term news. if they didn't we wouldn't be here selecting individual equities, we would merely buy indices.

Economic development in India will continue, perhaps not on a vertical trajectory. But onwards and upwards as it has done, with fits and starts - compounding and increasing since 1990. I for one did not start investing in India only in 2014. And frankly I did very well after that. But I did very well before that too.

Buffett says that America has a secret sauce and that of course politics over time swings in roundabouts - but the ultimate trajectory is upwards. It's why he says never bet against America.

The Indian story of opening to the world and truly creating significant and participatory wealth started very small in 1991. Since then it has continuously compounded. It will continue to. This is still going to be the Indian century.

If your thesis relied only on one man, it was a very very shallow thesis.

This is really no great shakes.

-

There is a narrative that for privatization India needs Modi. While he has been a good accelerator to many development issues (and infrastructure in particular) make no mistake: India is a strongly growing country in of itself, no matter which party is in charge. And it has been a high growth country pretty much since 1990 with alternating governments of different types and stripes. That is the real testament to the strength of growth. Zoom out and you see that this result works just fine over time.

-

15-30% is something I would actually characterise often as de-facto control, in particular if vested in one person or family. In particular frequently rights on the shares are slightly distinct from quantity.

I hear your argument, and I would say that family control is not unlike leverage. Cuts both ways. In the right hands it explodes value. In the wrong hands it decimates it.

I am comfortable with Prem, the Google-guys, Buffett, the Agnelli family and Arnault because they have control and a long history of rational decision making. To me control in their hands is a competitive advantage.

Fairfax India new issue

in Fairfax Financial

Posted · Edited by Gamma78

had written soemthing but then realised the article was a decade old.