-

Posts

2,816 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Luca

-

-

Our investment gains are someone else's spending. There has to be a mass consumer class for investors to get rich on Starbucks, Apple, and Nintendo investments. If everybody becomes a Ramsey hustler and saver, then one won't have spectacular gains. Yes, you can get rich if you save and invest your money but this depends on circumstances. If you went to a good university, studied something like engineering, accounting, etc, then are able to lay things aside while maintaining a reasonable quality of life with your family->you will make reasonable money over your life. On the other hand, if you come from a family with poor educational background, live in a bad neighborhood, local state school that has low quality, etc, your odds are really not in your favor, and sure, you could pull yourself up and still make a living but over the last 30-40 years society in the west became a lot more gentrified...many people are left behind, family background and networking is more and more a predictor of your financial future then it was in the 60-70s. Corporate America has been and is shifted against the normie worker and politics play a role here for what its worth.

-

1 hour ago, james22 said:

You confuse easy with achievable. Getting wealthy is not easy, but achievable.

People who are not fit just don't diet or exercise and it's their fault!

It's not a matter of opinion: people can get wealthy by saving and investing.

Everybody can become a billionaire!

-

I think that 95% of the board thinks that getting wealthy is as easy as you described (janitor can make it to 8m), people who are not wealthy just spend their money on useless junk and its their fault! Why does this thread even exist? To reconfirm your opinions and circle jerk on the dumb fucks that cant save? xD

-

7 minutes ago, nsx5200 said:

I don't buy that narrative, as described by the typical left, in whole. If a janitor with sub average wage can save and invest to have a net worth of 8 mil at the end of the run way, I think the the majority of the population can find ways to save, even a couple dollars a paycheck to slowly bootstrap themselves out of a situation. (yes, extreme frugality is, IMHO, like saving sex for when you're old, as Buffet would describe it. In the case of the janitor, it may be like saving sex for after death).

https://www.ramseysolutions.com/retirement/the-national-study-of-millionaires-research Outside of the high wage types (CEO/lawyer) typical millionaire is your everyday CPA/engineer/teacher. What do they really have in common: financial knowledge and willingness to grind, which essentially is deliberate delayed gratification. IMHO, the ability to fight all the forces to get you to spend and actually save is a skill that must be learned, and honed over time. If I met my younger self today, I would admonish my younger self for a lot of the unnecessary spendings that was done (but would give my younger self a thumbs up for willingness to grind).

I read somewhere that language provides the framework in which the mind thinks. A language like Chinese has less focus on time, so Chinese speakers are forced to consider the past, present and future, whereas a language like English with clear delineation for the past, present, and future are only consider one of those three states. So an English speaker will typically think in the now, and not consider their future self, and thus affecting their default savings, which I think shows up in the difference in savings rate.

Sorry, since when is an "engineer" somehow representable for the average worker? 8m net worth for a janitor? I am jealous of your worldview, people just need to buckle up, system works wonderful and you only need to stop buying your Starbucks coffee! Easy!

-

Certainly, this board is not representative of the average worker because they don't have the time to read 10ks or do not have the education to do so, they have kids at a reasonable healthy age of 25-30, and probably mommy stays home for a while maybe, then if they are lucky and have some capital they can buy a house otherwise you will just be renting forever looking at rental prices for a family of 4-5...and then you spend some money with your kids eating out, going into parks or whatever, buying little jonny lego toys and then the salary is gone, surprise!

-

13 minutes ago, Cigarbutt said:

Interesting.

Going back to one aspect of the thread, why 78% are not saving...

The lack of saving for the bottom 90% is a fact and this trend has been worsening.

Apart from evolutionary, individual weakness, gender issues, social media etc, any other explanation?

-----) The atypical animal spirit of the typical American consumer?

Purchasing power has been increasing but there has been a significant slowdown in disposable income growth. Present consumption has been maintained by lower saving at the individual level (bottom 90%) and by higher government debt.

Going through the pandemic, the US has been a relative outlier with an extraordinary debt-financed stimulus (including printed money) and with the consumer spending that excess money and lowering savings rate (driving the consumer economy higher, domestic and international).

One has to wonder if this lower income growth is not behind the unusual resentment and anger displayed by the bottom 90%. People ('We') are getting ahead but not as much as before and not as much relatively.

A potential side effect is that real GDP growth used to require a log adjustment on the Y-axis in order to transform the exponential curve into a linear one:

Not any more. Note: a linear curve here means decreasing rates of growth:

Why?

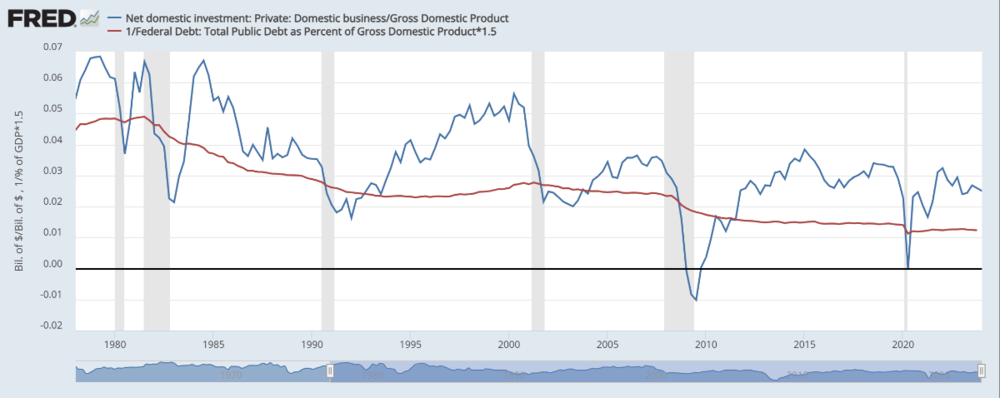

Potential unknown unknow but one has to wonder about the crowding out effect (controversial topic , i know). Lower national savings, even if slightly mitigated by foreign savings, means, by definition, lower investments and, absent a productivity miracle, means lower growth going forward. Of course that doesn't mean stocks won't do well but perhaps something to take stock:

For the bottom 90%, some commentators have suggested that there may be a reconciliation to be made between expectations and reality.

Is there that much disposable income for the bottom 80% to save? I mean, if you look at the median salary of 60k USD a year, housing prices, rent prices, health insurance and possible medication/illness expenses, basic living expenses, some fun activity with family, etc? If they take out a mortgage now the interest is insane too so there is even less possibility to save anything. Is it that complicated to understand that salaries are just not high enough to save significant amounts after living a reasonable lifestyle with the median salary? GDP per capita, GDP per person etc are all meaningless numbers. What matters is which cashflow reaches the worker and not how much the rentier class makes with increasing rents, charging absurd amounts for health insurance, reshuffling homes at higher prices etc that all gets counted as GDP but is unproductive income

-

On 5/17/2024 at 4:29 AM, Spekulatius said:

Very nice interpretation from the Danish National orchestra of the Fellowship of the Rings theme:

Thanks for sharing!! Love the soundtrack...great composing...its on the same level as great classical composers....

-

Pretty cool clips, relevant for met coal understanding. Fascinating process.

-

For some time now, one of the most successful tactics of the ruling class has been responsibilization. Each individual member of the subordinate class is encouraged into feeling that their poverty, lack of opportunities, or unemployment, is their fault and their fault alone. Individuals will blame themselves rather than social structures, which in any case they have been induced into believing do not really exist (they are just excuses, called upon by the weak). What David Smail calls ‘magical voluntarism’ – the belief that it is within every individual’s power to make themselves whatever they want to be – is the dominant ideology and unofficial religion of contemporary capitalist society, pushed by reality TV ‘experts’ and business gurus as much as by politicians. Magical voluntarism is both an effect and a cause of the currently historically low level of class consciousness. It is the flipside of depression – whose underlying conviction is that we are all uniquely responsible for our own misery and therefore deserve it. A particularly vicious double bind is imposed on the long-term unemployed in the UK now: a population that has all its life been sent the message that it is good for nothing is simultaneously told that it can do anything it wants to do.

We must understand the fatalistic submission of the UK’s population to austerity as the consequence of a deliberately cultivated depression. This depression is manifested in the acceptance that things will get worse (for all but a small elite), that we are lucky to have a job at all (so we shouldn’t expect wages to keep pace with inflation), that we cannot afford the collective provision of the welfare state. Collective depression is the result of the ruling class project of resubordination. For some time now, we have increasingly accepted the idea that we are not the kind of people who can act. This isn’t a failure of will any more than an individual depressed person can ‘snap themselves out of it’ by ‘pulling their socks up’. The rebuilding of class consciousness is a formidable task indeed, one that cannot be achieved by calling upon ready-made solutions – but, in spite of what our collective depression tells us, it can be done. Inventing new forms of political involvement, reviving institutions that have become decadent, converting privatised disaffection into politicised anger: all of this can happen, and when it does, who knows what is possible?

-

1 minute ago, ValueArb said:

I saw that too...crazy times

-

EXCLUSIVE: ICC seeks arrest warrants against Sinwar and Netanyahu for war crimes over October 7 attack and Gaza war

-

22 minutes ago, formthirteen said:

I would assume good money (tax payer money) is used to pay for bad investments made by companies (state/city officials?). Seems they have that in common with every country in the world. I don't think this will make their economy more effective, but it might make officials and even some citizens happy. Anyways, the Chinese should decide what they do with the money. I don't really care as long as they don't become as aggressive as the Russians. Oh wait, they (Xi and Putin) already seem to be (literally) on the same road hugging each other:

Well, I think they see what a mistake it was to give real estate developers that much market freedom, and future regulation will prevent this situation from occurring again. For now, something has to be done and I agree that the government can use the situation and make the best out of it.

Russia has deep cultural ties with China, they share a huge border and there are countries in China with many Russian-speaking people that have close ties to Russia. It is not in China's Interest to join Washington's sanction games and hostility towards Russia so IMO they are doing just what's fine for China.

-

31 minutes ago, formthirteen said:

Weird, I thought the agenda was common prosperity not unequal distribution of wealth or common misery.

How do you infer unequal distribution of wealth? Looks like they are gonna make social housing out of it but financing and further detail not revealed yet. This sounds good to me so far and sensible.

-

29 minutes ago, AzCactus said:

I'm sure I'm going to get some sh** for this but is it me or does it seem like they aren't doing such a great job as investment managers. A few thoughts:

- They have both been with Berkshire 10+ years

- The amount they manage doesn't seem to have grown so significantly given how big Berkshire is

- Warren doesn't appear to bring them up a ton

My thoughts based on being a shareholder is that Buffett praises publicly but these two guys don't seem mentioned very often. Additionally, the amount they are managing while obviously a lot doesn't seem insane. I kinda wonder if they just bought VOO for Berkshire if shareholders might be better off.

I just want to be clear-I'm not saying they aren't great investors with smallish sums I'm saying that maybe they are a bit outside their element or something. Anyone else kinda feel like this or am I just an a**hole

Their previous track record before Berkshire was insane.

Right now it does seem kind of mehh indeed.

-

I rewatched this clip recently:

Lost was such a great series...one of the best.

-

On 5/14/2024 at 9:46 PM, crs223 said:

This is what Biden is afraid of:

Yeah, it's crazy. The same costs 2-3x in the West and you have to pay 200 USD extra for every coup holder or whatever...but people won't be allowed to have it because it's unacceptable to Western government to have their protected car players lose margins and get all this competition...does it matter for the worker if they work at BYD factory or Tesla factory? Primarily the very big family shareholders are protected meanwhile US investors who bought Nio shares have to suffer the competition

-

8 hours ago, Hektor said:

https://www.nytimes.com/2024/05/17/business/china-property-mortgages.html

China Says It Will Start Buying Apartments as Housing Slump Worsens

Signaling growing alarm, policymakers ramped up efforts to stem a continued decline in real estate values.

Chinese officials on Friday took their boldest step yet, unveiling a nationwide plan to buy up some of the vast housing stock languishing on the market. They also loosened rules for mortgages.

The flurry of activity came just hours after new economic data revealed a hard truth: No one wants to buy houses right now.

Interesting move, still need to read up on this.

-

https://asiatimes.com/2024/04/the-myth-of-chinese-overcapacity/

Interesting read:

QuoteWhile some may marvel at how Japan, South Korea, Taiwan and, of course, China exported their way to riches, it was, in reality, an arduous, grueling and brutal process that has left lasting scars. Economic development really is not supposed to happen this way.

The East Asian export model is swimming upriver, playing the video game on hard mode, running up the down escalator. What kind of development strategy requires poor countries to scrimp and save only to lend that money to rich customers to purchase one’s manufactures?

QuoteEast Asia had to do battle with the Lucas paradox. East Asia won not because the export model is so effective; it won because East Asia is East Asia. The Lucas paradox is the observation that capital does not flow from rich country to poor as predicted by classical economics. In theory, as capital experiences diminishing returns in rich economies, it will flow to poorer economies which still have low-hanging fruit. In practice, however, rich countries have hoovered up capital from developing economies, leaving much of the world starved for investment. East Asia, starting with Japan, was able to develop despite the Lucas paradox. After WWII, Japan’s Ministry of International Trade and Industry (MITI) husbanded the nation’s meager resources to invest in strategic industries – steel, autos, electronics, semiconductors etc. The country bought treasuries with export revenues and slowly accumulated capital through reinvestment of retained earnings – bit by excruciating bit. This didn’t reveal the efficacy of the export-driven development model as much as it demonstrated the diligence and self-sacrifice of the Japanese people as well as the managerial expertise of MITI.

QuoteThe Asian Tigers followed suit, achieving even more spectacular results and also accumulating similar costs. Ultimately, the biggest player came on the scene running a version of the model that, because of China’s size, is causing Western politicians to mash panic buttons.

QuoteThrough methods fair and foul, the US had long since dismantled Japan’s export growth model and is now desperately targeting China. The acid-tongued venture capitalist Eric Li recently quipped that China’s biggest economic problem is that it can’t go out and get itself a bunch of colonies. Imperialism is the other development model that has worked spectacularly well. But like the East Asian export model, it too has left lasting scars. On balance, overworked salarymen is probably less objectionable than colonial ills. Economists twist themselves into pretzels trying to figure out the cause of the Lucas paradox. But is it all that mysterious?

QuoteUS Treasury Secretary Janet Yellen’s recent trip through China kicked off a round of hand-wringing in the Anglo press over industrial overcapacity in China. Without a single Chinese electric vehicle (EV) sold in the US, Senator Sherrod Brown has already called for their ban, declaring, “Chinese electric vehicles are an existential threat to the American auto industry.” Western progressives are mired in cognitive dissonance over long-trumpeted climate commitments when the solution presented to them is low-cost, made-in-China solar panels. This entire overcapacity issue is another tiresome demonstration of Western solipsism. As Asia Times’ David Goldman likes to say, “China’s just not that into you.”

QuoteWhen the US imposed “voluntary” export quotas on Japan in the 1990s, it constituted 40% of the world’s car market. That has fallen to 13% in 2023. China does not export cars to the US and, given geopolitical realities, will likely tip-toe around the US by building factories in Mexico for regional markets. Around 35 million cars were sold in developed markets (North America, EU, Japan, South Korea, Australia) in 2023, unchanged since 1990.

The Global South cannot accumulate capital through imperialism and it should not accumulate capital through the backbreaking East Asian export model. They are in luck because China’s “overcapacity” is exactly how development should work under classical economics. Excess capital in China should flow to developing economies in the form of loans and investments along with capital goods – 5G base stations, railroad equipment, electrical systems, commercial trucks and, yes, cars. This is the entire theoretical basis of President Xi Jinping’s Belt and Road Initiative (BRI). Without “overcapacity” in China, the Global South would have access to neither capital nor capital goods. Given its current account deficit and capital account surplus, it is mathematically impossible for the West to provide development assistance to the Global South on an appreciable scale. Long-forgotten initiatives like Build Back Better World (B3W) and the Blue Dot Network die on the vine because the US does not suffer from “overcapacity.”

QuoteThe Communist Party of China appears to have embraced its Industrial Party faction. The Industrial Party is an ambitious political identity that dispenses with the hoary left-right divide and believes that industry, science and technology will determine China’s future. While not necessarily an economic ideology, Industrial Party precepts have an intuitive understanding of the necessity of China’s “overcapacity” and that it is up to China to reverse the Lucas paradox. Wang Xiaodong, a vocal Industrial Party champion recognized the trends as far back as 2011, exhorting China to globalize its industrialization: We must go out to meet the world. Not only do we want our products to “go global,” we also want our industrialization to go global, and our high-quality talent to go global. We can spread industrialization to every corner of the world. Many of our scientists and technicians will travel around the world to work, bringing with them civilization, a dignified existence, and relief from poverty. This is one thing that Westerners have been unwilling or powerless to accomplish. China’s Commerce Minister Wang Wentao has dismissed Secretary Yellen’s accusations of overcapacity as groundless, insisting that China’s industries are just more competitive. Both the US and EU are likely to erect trade barriers as China appears unlikely to compromise. When all is said and done, the squabble between China and developed economies is ultimately a sideshow. The real action will be the flow of Chinese capital and goods to the Global South.

Regarding the EV bans its also interesting to look at Teslas subsidies and compare that to the likes of BYD. This is not because of chinas subsidies, their EV market is margin to the bone super hard competition and the west has subsidies themselves. The problem is that these companies are more efficient in every way and provide more value per dollar. GM does tens of billions of buybacks, no innovation, little investment...we cant have Chinese EVs!

-

Market order in for more Prosus NV

-

-

-

Put another buy order in for PDD

-

6 minutes ago, dartmonkey said:

I have the same problem, 50% in Fairfax after the big share price increase in the last few years, but nowhere too tempting to go if I sell my stake down to a more reasonable size. And 10% in coal/gas/oil which seem like the best alternative for the moment - Yancoal, Suncor, CNQ, Petrobras...

Yes, same situation. I still see a ton of potential upside in Fairfax and love the defensiveness of it in the current macro and pricey market...its also not a stock where I would feel uncomfortable being overweight considering the quality of management etc...I like where I am, still a continuos buyer in China and maybe we get nicer prices in met coal coming months as q1-q2 seems to be weak regularly...i think I can settle with the thought that prem really was just overweight and wants to have some eggs at the side lines which is fair.

-

15 minutes ago, ander said:

Fairfax 6-K

"“As previously announced in 2020, I purchased in the market an additional 482,600 subordinate voting shares of Fairfax at a price of US$308 per share, or approximately US$150 million in total. At the time, I believed, and I said publicly, that the trading price for Fairfax shares was ridiculously cheap and very significantly below intrinsic value, and I was acquiring these shares as an investment. Even though I believe our shares continue to trade well below intrinsic value, I decided to sell a portion of the shares I acquired in 2020, representing only a small portion of my total holdings of Fairfax, for estate planning reasons. As a controlling shareholder, my salary has been fixed at C$600,000, and I have never had a cash bonus nor received any shares as compensation for decades. I continue to control the 1,548,000 outstanding multiple voting shares and 519,828 subordinate voting shares of Fairfax, representing greater than 90% of my net worth, and I am not contemplating further sales. As I have said many times, Fairfax is not for sale, and I am confident that our future is very bright. As always, the best is yet to come,” said Prem Watsa, Chairman and Chief Executive Officer of Fairfax."

Not great, not terrible. He doesn't see the shares as materially undervalued as in 2020, understandable. Still, cashing out now after this run...has a certain smell of less upside downside

78% of Americans live paycheck to paycheck

in General Discussion

Posted

Haha well said, sometimes I go fishing in the nature reserve around the corner, and I pay 30 USD a year for a license, it's fucking free and absolutely stunning when the sun goes down, just me and nature, the silence, some good pikes...

Right now the opportunity set in the US and West is different than in the 70s, GDP is growing slower, the West faces birthrate crises, the market is expensive and more efficient, housing is comparably more expensive, the market has become more concentrated...nonetheless, the ones who want to find opportunities will find them.