Ghost

-

Posts

77 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Ghost

-

-

16 hours ago, SharperDingaan said:

Sadly, I'm nowhere near as eloquent as James Joyce!

Just to throw some random numbers out ...

Start at 1400 pre-announcement. Short 1,000 shares, long 10 out-of-the-money puts at 1300, publish report, media tour

Drive the price < 1300 by expiry date. Have the 1,000 shares assigned, off exchange. Long 20 calls between 1300 and 1400.

AR is announced, squeeze the shorty! Price moves to 1500, sell the 20 calls at 1500, return the 1,000 shares to the lender.

Buy today at 1260. Sell at 1500 post AR (240 profit), buy back at 1260 on MW round-2 (240 profit). MW eventually walks away, shares sold for 1500 (240 profit). Total gain of 720 on a 1260 investment is 57%. If you only capture 2/3 of this ... about a 38% return.

Just one of many possibilities .....

SD

I hate ask again...what options market for FFH? Last time I checked no public options exist. Buy the stock or short the stock...only "options" I see. .

-

20 minutes ago, SharperDingaan said:

Hopefully, a good $300+/share on the turn before any option/margin leverage!

We would also be very surprised if MW didn't intend to exercise on existing options, as the mechanism by which to raise the shares to repay the short loans; plus accumulate some additional - offered for a buyback. We also expect them to have used the drop to lay in a stack of out-of-the-money calls; FFH buys in the stock at a price well < 1401, MW walks away, the price quickly returns > 1401 & all those calls go deep in the money.

.... Now of course, if an enterprising lad had learnt from ericopoly, and also knew how to work this trick!

Interesting times

SD

I am most likely missing the obvious, where would one find call options on FFH?

-

8 hours ago, Parsad said:

What? Have you actually read the report?

Key takeaways:

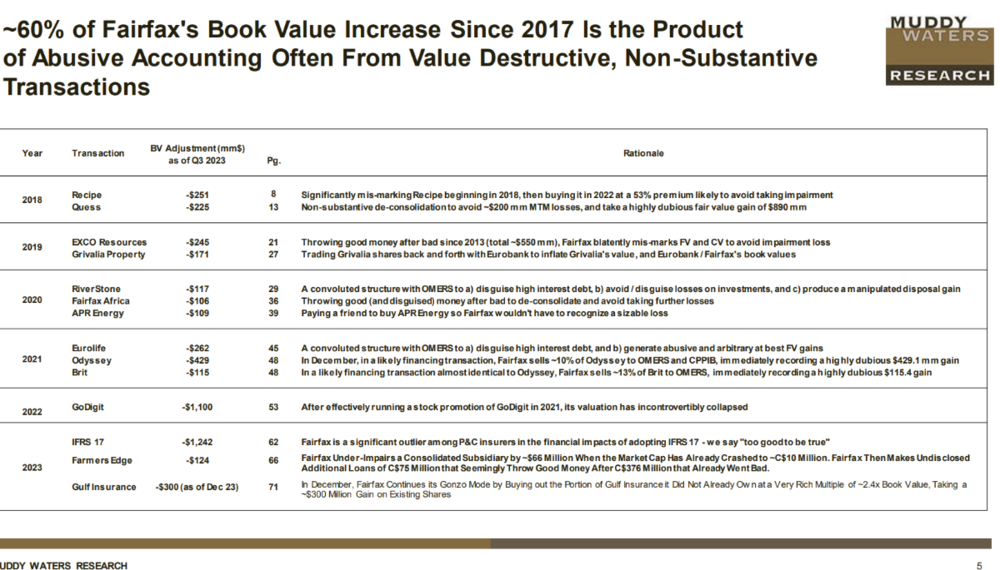

- Fairfax is GE, not Berkshire Hathaway

- MW believes that there should $4.5B in adjustments to assets on the balance sheet

- Fairfax is pulling financial levers to improve results and book value since 2018

- Fairfax has missed their ROE target of 15% for several years

Ok, the 4th one is pretty much a joke. Buffett and Munger have talked for decades about lumpy 15% versus an even 12% return every year. Fairfax is an insurance company that invests its float for income, so there will be volatility in annual returns. With that, you can get rid of the 1st one as well, since GE was engineering earnings to get a consistent annual return, not accepting volatile annual returns. I'm glad Block really studied GE!

Slide #4 of MW's report shows how Allied put pressure on Fairfax and they wrote a 107% CR in the year acquired. Then I guess somehow, Fairfax finagled a 97.3% CR since. Last I checked, writing below 100% was the target for insurance companies, not what they necessarily wrote historically. Again, not sure why he brings up Allied, since CR's are well under 100% for the last 5 years.

For mispriced assets:

Recipe

- They talk about the $15.30 takeover price for Recipe being artificial...well they have to talk to the PCAOB about that, because under IFRS fair value tests, the last market price or takeover price is what they have to use.

- They say that PWC restated goodwill and intangibles in 2021 compared to Recipe's previous auditor KPMG. Although, they don't note that PWC also restated the 2020 goodwill and intangibles for Recipe. So there was no real net tangible gain after acquiring Recipe if you simply look at Section 12 in the 2021 FFH AR showing total goodwill and intangibles for Recipe in 2020 and 2021 since the increase would have also been reflected in the restated 2020 financials for FFH in the 2021 report.

Quess

- They argue that Quess was deconsolidated to create an artificial accounting gain. You can look at that whatever way you want. It was treated fairly under IFRS. Again, if there are issues, it's a PCAOB issue.

- Also, they don't account for the fact that Indian companies have not transitioned yet to IFRS and there might be adjustments in valuation between Indian Accounting Standards and IFRS.

EXCO

- They say it is overstated by $220M or so on the books. I'll leave it to someone else with more understanding of the long history of EXCO to comment.

Grivalia/Eurobank

- Essentially saying that Eurobank overstated goodwill by $62M...you can quibble this whatever way you want, but $62M is barely material here relative to Eurobank's equity and assets.

Riverstone

- Suggested that the sale to OMERS and then subsequent sale from OMERS to CVC Capital was financial engineering to hide losses at Riverstone and show a profit at FFH. Yes, OMERS took the risk of buying Riverstone simply to help out FFH. Not that anything like that could risk OMERS entire being as a public pension plan, cause sanctions and fines against the investment team at OMERS, bar those managers from working in the industry, and possibly lose their CFA/Advisory designations. Sure, let's help a friend out with some financial chicanery and risk everything, including our reputation.

- As an aside, they mention that CVC Capital acquired Riverstone from OMERS with asset note guarantees by Fairfax for 4 years...they also suggest that the associate shares Fairfax put up as collateral were simply stuffed into Riverstone to hide paper losses on those associate shares. The funny thing is, most of those shares have recovered significantly since the pandemic and Fairfax would have been able to book tons of paper gains if they held those shares. No comment on that of course!

- Also no breakdown by MW's if any losses have been paid on the 4 year guarantee!

Fairfax Africa/Helios

- They state that Helios was booked at $5.25 USD while the price on the date of deconsolidation (December 8, 2020) was $4.04 USD. No mention that the stock traded up to $6 USD on the days after December 8, 2020. Total gain...$43M...on $21B of shareholder equity.

APR Energy

- They say that Fairfax sold APR to Atlas (a friend) so they wouldn't have to show a loss. Hmmm, funny how FFH hasn't bought it back, nor the fact that David Sokol and Bing Chen were willing to destroy their reputation solely to help Fairfax out.

Bizarre Take on Prem's sale of Atlas shares - Prem sold shares of Atlas at the $15.50 tender offer and accepted the same number of shares from Poseidon...simply to align himself with the $1B investment by FFH into Poseidon. MW's states without any real issue of criticism that they don't understand why Prem would sell ahead of the minority shareholders. No idea what the argument is here.

Eurolife/OMERS transactions - again, I'll leave this one for Fairfax to comment on, because there are a number of transactions that make it more convoluted than I have time to examine it. Essentially, MW's says that there was a $262M gain that should not be on the books. Ok, again that is 1% of shareholder equity and one tenth of what they will earn in 2024.

Brit/Odyssey/OMERS transactions - MW's says it boosted book by $421M when portions of those were sold to OMERS because the remaining amounts were now carried at fair value. They say they were essentially financial transactions to boost book with a call option to buy back. Not sure how this is any different than any company under IFRS boosting liquidity by a partial sale of a fully consolidated entity. Berkshire, Markel, etc would all book this the same way.

The most hilarious section of the analysis is Fairfax's accounting adjustments for Digit in 2021/2022 and the use of the FFH swaps. They say Fairfax began booking the gains on valuation of Digit later than they should have by a quarter so that they could juice the results for those quarters. Yet, the irony is if they had began when MW's suggests, then the gain in book value would have been inflated for 2021, a year which they say Fairfax was inflating gains widely through their transactions. They also note that they haven't made any adjustments to book based on the value of the swaps! In terms of a downward valuation of Digit that they suggest...I'm not sure I agree with the number, but Fairfax may have to adjust that based on prices for all fintech companies in India. Depending on markets, it could just as easily be valued upwards again. But I'll leave it to the auditors on this...I'm certain Muddy Waters has no clear idea either. Even MW notes that Sequoia invested $3.5B into Digit and relegates it to Silicon Valley's lack of discipline.

Here's another big one that you can argue either way. They say that under IFRS 17 Fairfax received too much in adjusted gains. That their adoption gain divided by contract liabilities was about 6%...higher than the industry. Yet, they don't note that Fairfax also generally books higher redundancies on statutory capital compared to the industry and it is around that 6% mark. Could FFH book that more conservatively...sure. Did FFH book that accurately...yes.

Farmer's Edge - another one that I'm not 100% up to speed on, but it's a $71M adjustment according to MW's. That's in the negligible territory when you look at $26B in equity.

Lastly, they suggest that the 46% acquisition of Gulf Insurance is the latest piece of financial engineering by Fairfax and they purposely overpaid at 2.4 times book for the new stake. Yet Gulf made $125M in 2022 and 26% would be about $58M. The $860M cost amounts to about 15 times earnings. Which isn't expensive when you are paying up for a leading, quality insurer. One which also had a closing condition that the $2.00 per share price could not be lower than the 6-month moving average market share price leading up to the closing of the deal. Thus why the premium offered was 100% to market price rather than 60-70%...to ensure the deal would close and KIPCO couldn't walk away.

Anyway, I'll leave it to brighter minds to approve or disapprove of the MW report. But to lackadaisically say that an ex-partner of the audit firm sits on their BOD's is somehow irregular and that what happened in the past regarding the short seller attack and financial restatements without even glancing over the facts...well that's just bloody lazy analysis!

Not too mention the liability that the auditors could be exposed to, Fairfax could be exposed to, employees jobs, shareholder's account values...does anyone really think that Fairfax and the auditors would risk all of that for plus/minus 2-5% of book value?!

Cheers!

Thanks Sanjeev...I believe that would be game, set, match...

-

18 hours ago, SharperDingaan said:

Folks, the reality is that FFH is going to go a good bit lower before this is all over. Simply do a swing trade, buy your stock back later at the lower price, and take your cash difference off the table. MW drives the share price down; FFH does a share buyback at below book, and books both a gain on cancellation, and a higher EPS.

SD

Promises...promises.

-

I am a bit disappointed that the stock didn't fall some more. I already added to my positions, would love to add more at another 10% decline.

One can dream.

-

-

Oh and a really good Sanjeev rant.

-

I would be curious to here what Viking has to say on the MW report

-

RIP Charlie

“The big money is not in the buying or selling, but in the waiting.” - Munger

-

Thank you Viking for all the work you have done.

Perhaps a very minor edit...adding USD on the worksheet "23 Earning Est". (but I believe most people here would know the figures are quoted in USD)

-

2 hours ago, Malmqky said:

Thank you, that is a 2.2 billion change in accounting treatment. Does that imply in a large cat claim, the losses would be magnified with the new accounting methods?

-

Good day all,

FFH press release on May 11th had a BV for Dec 31 2022 of $762. FFH press release on Feb 16 2023 had a BV for Dec 31 2022 of $657. Does anybody have a clear indication why the increase of roughly a $100?

May 11 2023

Book value per basic share at March 31, 2023 was $803.49 compared to $762.28 at December 31, 2022 (an increase of 6.8% adjusted for the $10 per common share dividend paid in the first quarter of 2023).

Feb 16 2023

Book value per basic share at December 31, 2022 was $657.68 compared to $630.60 at December 31, 2021 (an increase of 6.0% adjusted for the $10 per common share dividend paid in the first quarter of 2022).

-

Thanks

-

wow...look at this go.

Interesting to watch.

-

Look at this one go.

Past 145$ this am.

-

Not that I understand technical analysis, but it seems all the markers for today point higher.

-

Past 110.

tough being on the short-side of this.

-

Looks like another chance, to make a move.

-

-

Enjoyed the video, thanks for posting

-

http://www.thepostgame.com/blog/spread-sheet/201409/warren-buffett-nebraska-cornhuskers-football

Lucky guys who spotted him in Vegas.

-

Sanjeev now that you are the CEO, when should we start looking for employment opportunities? Internships? :o (Avoid anyone named Monica)

-

We can see the Sanjeev effect.... up 66% already :o

-

Duncan hood editor-in-Chief of MoneySense magazine described it best for our situation in Canada.

http://www.moneysense.ca/columns/did-i-just-make-a-big-mistake-by-buying-a-house

It really comes down to is the original poster buying a house or a home?

Fairfax 2024

in Fairfax Financial

Posted

This situation that FFH is currently in (attack by short sellers) reminds me of the Gamestop saga, except of course FFH today is actually undervalued.

As much as I love this board, perhaps we should all start posting on Reddit to help our friends at FFH and really stick it to MW.