zzzyx

-

Posts

109 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by zzzyx

-

-

25 minutes ago, RichardGibbons said:

But if one is too frustrated, it's fine to ignore science. Lots of people ignore evidence and correlation is not causation. It could be that the co-slept kids are better adjusted and happier not because of the co-sleeping, but because their parents are more loving and kind. Maybe their parents are less authoritarian, when the non-co-sleepers care much more about control. Maybe co-sleepers simply care more for their kids or pay more attention to their kids than non-co-sleepers, and that's what causes the difference in outcomes.

Heck, once one starts saying, "it's ok if I mess up my kid by not co-sleeping. No big deal", one could imagine similarly saying, "No big deal if I yell at my kid." Then "No big deal if I hurt my kid because I'm angry", or whatever. Maybe not co-sleeping is an indicator of which parents are willing to justify trading their kids' health for their own short-term happiness.

LOL....the appeal to "SCIENCE"....and then the extrapolation to child abuse. Too funny!

-

Our first kid had a terrible time getting to sleep. We ended up using the Ferber method...which was tough for a couple days but ended up saving our lives. Other 2 kids were pretty good sleepers from the get go but we also didn't let them trick us into bad habits (manipulative little devils).

-

Nothing really to add...concur with your thoughts. Have a sub-1% position here in several accounts....some of it purchased back in '20 in the low 50's. Most recent purchase was at $77.

-

51...still playing basketball at least once a week. Bike rides, stairs, and push ups fill out the rest of the activity schedule. Personal rule: have to get a workout in in order to have beer that day. And I love beer.

-

"Everyone has a plan until they get punched in the mouth"

- Mike Tyson

-

7 minutes ago, thepupil said:

not to beat a dead horse, but the company went from 153,000 units to 638,000 units (12.5mm to 53mm sf) over the last decade w/o share issuance. gonna go out on a limb and say some of the capex was growth capex.

LOL

LOL

-

25 minutes ago, LearningMachine said:

That is extremely high. This means they need many many years of FCF to replace their fleet at inflated prices.

You do understand the difference between replacing the fleet and buying/building new self-storage buildings, right? From this statement it doesn't really seem like you do.

-

15 hours ago, LearningMachine said:

U-Haul is an example of a business that Munger and Buffett would say is one of the worst in inflation.

LOL....appeal to authority without really looking at the business. OK.

-

Well this one says that 1 in 6 have made a late payment....a bit different from 1 in 6 being delinquent.

With unemployment being virtually nonexistent, the claim that any significant portion of the population can't pay their utility bills is pretty silly.

-

I put U-Haul in this group....no doubt. And it is not expensive either.

-

Jean Su, Energy Justice Program Director, Senior Attorney, oversees and develops the Energy Justice program’s campaigns, dedicated to hastening the clean, democratic energy future so urgently needed to protect wildlife, communities and the climate. Jean also works to challenge wall construction in the U.S.-Mexico borderlands and serves on the boards of Climate Action Network International and SustainUS. Before joining the Center, she worked as a renewable energy project finance attorney and in the climate change and international development fields in Africa and Asia. She’s an inaugural class member of the UC Irvine School of Law and holds a master's degree from the London School of Economics and Political Science and a bachelor's degree from Princeton University.

-------------------

LOL...a real economic and energy expert here.

-

-------------------------

Ah....now I get it

-

2 hours ago, Parsad said:

1 in 6 American households are behind on utility bills! Cheers!

https://finance.yahoo.com/news/expect-tsunami-shutoffs-20-million-173000860.html

There is no frickin' way this is true. Just laughable, really.

-

29 minutes ago, Spekulatius said:

I don't know if this is comparable or not but those issues are part of safety studies. Also see above study about mortality of COVID-19 unvaccinated vs vaccinated cohorts for non-COVID-19 causes.

Anyways, the vaccine is almost certainly not to blame for excess death here. There are likely other leading causes like deferred medical care, long COVID-19 fatalities, increased drug overdose death at play here.

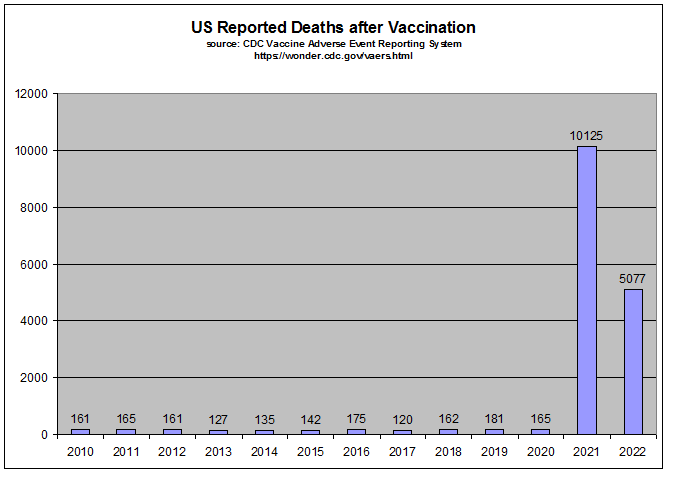

All those factors are likely contributing, including the "vaccine". The one controlled testing of the shots ended up with more of the vaccinated dead than placebo recipients. And the VAERS data indicates these shots are very bad for some people.

-

Well the Pfizer/Moderna shots carry some risk....pretty clear from the VAERS data and other reports. Hopefully the risks are short term and not long term.

The following is an interesting look at heart health. Pretty amazing that the press and health authorities ignore this stuff. Like they believe there is a free lunch out there somewhere.

---------------------------------------------------------------------

This report summarizes those results. A total of 566 pts, aged 28 to 97, M:F ratio 1:1 seen in a preventive cardiology practice had a previously scheduled PULS test drawn from 2 to 10 weeks following the 2nd mRNA COVID shot and was compared to the pt’s PULS test drawn 3 to 5 months previously pre-shot. Each vac pt’s PULS score and inflammatory marker changes were compared to their pre-vac PULS score, thus serving as their own control. There was no comparison made with unvaccinated patients or pts treated with other vaccines.

Baseline IL-16 increased from 35+/-20 above the norm to 82 +/- 75 above the norm post-vac; sFas increased from 22+/- 15 above the norm to 46+/-24 above the norm post vac; HGF increased from 42+/-12 above the norm to 86+/-31 above the norm post vac. These changes resulted in an increase of the pre vac PULS score of predicted 11% 5 yr ACS risk to a post vac PULS score of a predicted 25% 5 yr ACS risk, based on data which has not been validated in this population. No statistical comparison was done in this observational study.

https://www.ahajournals.org/doi/10.1161/circ.144.suppl_1.10712

-

WTF kind of garbage were they in? LOL, I guess the 2020 performance provided some foreshadowing.

-

Probably the wrong place for this....would have liked to see VWTR get a higher price.--------------------------------Vidler Water Resources: D.R. Horton (DHI) will acquire Vidler for $15.75 per share in an all-cash transaction8:36 AM ET 4/14/22 | Briefing.com

Under the terms of the merger agreement, D.R. Horton, through its directly owned acquisition subsidiary, will commence a tender offer to acquire all outstanding shares of Vidler for $15.75 per share. Upon the successful completion of the tender offer, D.R. Horton's acquisition subsidiary will be merged into Vidler, and any remaining shares of Vidler will be canceled and converted into the right to receive the same consideration payable pursuant to the tender offer. Following completion of the merger, the common stock of Vidler will no longer be listed for trading on the Nasdaq. The total equity value of the transaction is approximately $291 million, and the transaction is expected to close during the second calendar quarter of 2022 subject to customary closing conditions.

$FMG’s insane investor deck

in General Discussion

Posted

Wow....this is amazing....LOL stuff!