Pedro

-

Posts

55 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Pedro

-

-

Loved this one didn't see a thread on it yet.

-

Does this mean that FFH increased stake has been approved?

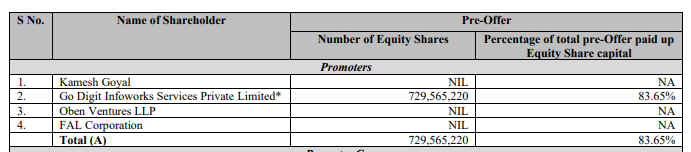

Prospectus is showing their vehicle for owning Fairfax India at 83.65%?Am i reading this wrong?

-

I'm seeing going private offers as the priority not buybacks. Is the dry powder I was expecting going to buy back shares now going to takeout offers? Why did Prem say buybacks are priority in the Q2 call if their second priority to take out offers?

-

Is it possible for a CDN investor to buy these ibonds?

Is there a CDN equivalent if the above is big fat no?

-

Seems like the odds of success at digits new reinsurance unit are in their favour. These are very favourable rules of engagement that dont exist in most countries

“As the sole domestic reinsurance company, GIC already gets first right of refusal to provide quotes, after which foreign branches are allowed to quote.

If Go Digit does establish a reinsurer, it would get the second priority where it would be given a chance to match the quotes given by GIC and sign onto a reinsurance placement at the same terms” -

If it was me I'd do option 1. Family first -always. I'd want to be close as possible to my family and I'd never look back at what became of the toronto real estate prices.

Option 2 is all trying to time the toronto housing market and no-one knows what will happen.

Good luck!

-

Vetern qtrade user. Just make sure you have the right account chosen. Qtrade has a drop down for all your accounts on the tax slip page. I remember i kept looking for a slip but it defaulted to a tsfa and needed to change to an rrsp. I doubt that fixes your problem but you never know. Happened to me so I thought id mention. Cheers

-

Agree with the pupil - it doesn't pass the smell test. Wrecks of overconfidence and dare I add arrogance. I wouldn't bite on this sales pitch but I Aurelius could hedge/buy puts to protect his downside so its not his personal money he is paying if its not profitable with 4 years.

-

I'm fine with FFH continuing to slowly reduce its stake in Brit to buyback shares that these prices. Ki seems hopefully but I'm not convinced they are underwriting prudently over there. Their uw results over the long term are not good and FFH has a Lloyd's presence with Allied so less Brit and more buybacks are fine with me.

-

Brit is a disaster. FFH needs to move executives from their profitable underwriting companies to fix shop. Good lord.

-

So how can a third world country use MMT principles to get out of their powerless situation? The IMF/USD are going to continue to hurt them long term. Does a solution for them under MMT exist?

I'm assuming this country has their own currency. How do you create more demand for their currency without having citizens flock to USD. Close the economy?

Just freeballing here to see if MMT principles have any way to help these nation get out of a spiral. -

Does MMT have a playbook for struggling third world countries to follow the MMT ways to get off the IMF/USD tit and find a way to become more in control of their monetary future?

I would love to read anything about this if you know it exists.

-

But without the ability to wave a magic wand to instantly transform the unemployed into teachers, skilled health care workers, and engineers specializing in energy alternatives, more spending in these areas would compete for scarce workers rather than soak up idle ones."\

I wouldn't mind one lick if the government during tough times paid for someone to come take care of my homefront. Nothing a few online training classes for them and boom they can come help the homelife if they are willing and able to have that kind of work. Lots of jobs could exists thats productive but not highly skilled. Anyhout I wonder if universal basic income would work here instead althought doing something porductive with labour sounds better.

Thanks for the paper to read. Its on my list once I finish re-reading the book.

-

Great Book. Haven't finished it yet but ripping through it pretty fast. Really enjoy it and has really explained MMT well.

@KJP - Thanks for putting the book on my radar. Re your comment - This part of the book is hard to take too seriously because it’s never squared with the fundamental point that we’re always limited by our real resources.She addressed this constraint in the introduction.....literally on the second page of the book. See exert below. I don't agree with your assessment that she hasn't made clear that we are limited by our real resources. She did in the beginning of the book and makes references to this throughout the book as well.

Do I believe the solution to all our problems is to simply spend more money? No, of course not. Just because there are no financial constraints on the federal budget doesn’t mean there aren’t real limits to what the government can (and should) do. Every economy has its own internal speed limit, regulated by the availability of our real productive resources—the state of technology and the quantity and quality of its land, workers, factories, machines, and other materials. If the government tries to spend too much into an economy that’s already running at full speed, inflation will accelerate. There are limits. However, the limits are not in our government’s ability to spend money, or in the deficit, but in inflationary pressures and resources within the real economy. MMT distinguishes the real limits from delusional and unnecessary self-imposed constraints.

-

On 7/25/2021 at 5:38 PM, omagh said:

Given some recent property loss events due to flooding and fires, the hard market may continue a while longer. Insurance companies in this low interest rate period have increasingly used sub-100 CRs as the mechanism to provide returns. It means that the best underwriters will do best over longer periods of time and those that have access to equities (many stick to bonds and other yield products) will similarly do better over time.

I was suprised how long the market stayed soft when cats kept rolling in in greater severity and frequency. I'm specifically talking about the 2008-2019 time frame . Threads were full of comments on how some expected the

*insert cat name here* to drive a hard market across the board but it only really came in certain segments. This recent hard market effected almost all lines of business -except work comp. My point is i'm not sure the increased cat activity is sufficient to keep rates increases coming.I know thats counter intuitive but the way i see it, managements everywhere see the market prices on good business at the best they've been in a decade and everyone wants to grow. When everyone wants to grow that's a good sign that rate increases are going to come down and insurers have to start defending their book.

-

I mean I can't give you names or policy numbers but it's real from my seat

All the front line peons in the business see it. Find them and ask. I think you'll start to see Q3/Q4 rate numbers not being as sexy but for the sake of my net wealth being tied up in insurers, I hope I'm wrong.

-

I'm a foot solider in the industry and can say the hard market is in 9th inning. Insurer's books have had 2 renewal cylces to get their prices up/get off unprofitable business. More capacity is coming back online since prices are at attractive level in the p&c lines.

All insurers now sees the rates as attractive and want to grow. I've seen this play out of before and it only goes one way - prices drop/capacity increases at sillly prices. his is why the business remains cyclical.

I'd be suprised if by end of Q2 2022 if the majority of the P&C industry has postive rate increases on their book. New business wont be written at atttractive prices as the competition to keep accounts will be fierce with everyone wanting to grow grow grow!

My point here is that forecasting the hard market beyond 2022 is aggressive. I think the bunch bowl is almost empty. Could be wrong but all signs I see on the front lines are pointing to the power balance shifting from a desperate need for capacity to markets writing at silly prices.

-

I thought the renewed focus with excess cash was to reduce debt, buying out minority interests and buyback shares. I thought the acquistion train left the station.

Am i missing something? -

14 hours ago, obtuse_investor said:

Agreed. I put the back of the napkin aside and did some real math on the BVPS annual return since very first filing. The return has been 11.3%. Note that this return is after fees to FFH.

For comparison, stock has returned about 3% over that same period. Buyer from 2015 IPO (with cost of $11) lost about 8% each year on multiple compression.

Full disclosure, I am not planning to tender my shares. And no, I fortunately didn't buy at IPO.

I appreciate all the discusion on this. It helps a novice investor looking for differing opinions.I'm one of those IPO buyers who bought on the opimistic business case thinking it would be at least a 2 bagger by now. I dont want to miss a good time to cash out with this tender specially if something happens in India again and this thing craters to sub $10 again after the tender expires.

I think its the first time meaingful shareholder friendly action has been taken in 6 years & for whatever reason the stock doesnt' keep pace with BV increase so I'm leaning towards just tendering at $15 and moving on.

-

Is anyone here going to tender?

I'm debating it. I understand the bull case going forward but part of me wants to just move on from holding this for so long with pretty dismal return compared to what an index fund could have done in the meantime.

I'm on the ledge. Should I step back or be pushed off?

-

I see Stelco and Resolute as strategic investments for a vertically integrated P&C insurer. When your insurerd property burns or crashes, its always good to know own part of the suppliy chain to fix them. I'm fine if their acquired for a higher price or end up as long term holds that hopefully end up paying consistent dividends. The entry price for resolute was not great but the future is bright now at least.

I continue to see BB out of the circle of competance and rationalized as a patriotic CDN investement. Happy to cut that off whenever they can and move on. Expensive lesson in poor position sizing.

-

I get the sense the two lieutants - have short duration trades that pay well and prem brags about. Could explain XOM and BAC not making the list

-

Thanks the for repsonse.

My sense is that the downside is more risky at 0.9BV then it was 6 months ago at less than 0.7BV. I'd rather they close the TRS now with the win and not have any potential cash settlement to drag down postiive quaterly results. Realistcally any number of situations come bring the market/FFH down - cat event, someone sneezing in another country that the market doesnt' like - any FFH could trade back again at a large discnnect to intinsic value which would cause FFH to take cash out that could be used to buyback shares/delever.Close the swap and move on with the small win. Thats my advice.

-

Just trying to invert here so I understand the downside of the TRS .

If the market goes into correction territory (ie the market and FFH drop 20%) the TRS are marked down, FFH has to pay cash to settle?Isn't this the same sort of vehicle they said they'd avoid?

I understand all the tailwinds for FFH but I'm just trying to understand the downside of the TRS here if things dont go as planned...

Fairfax 2022

in Fairfax Financial

Posted

Hopefully Mr Thompson can turn the Brit. Would have liked to see an exec from NB or Allied or one of their other historically profitable ins ops take over but at this point change is clearly needed. Hardest market in 20 years and the Brit consistently finds way to burn capital. Brutal. Change is needed

“Former RSA Canada chief executive Martin Thompson has taken over as group CEO at Brit Ltd., the Fairfax Financial-owned complex risk specialist. He succeeds Matthew Wilson, who had held the role since 2018. Mr. Wilson returned to Brit in September after a leave of absence to undergo treatment for blood cancer. He will remain with Fairfax in an advisory role. Mr. Thompson was CEO of RSA Canada from 2016-2021 and joined Fairfax last year. He served as interim CEO of Brit during Mr. Wilson’s leave of absence. London-based Brit operates globally and trades primarily on the Lloyd’s platform. “