DocSnowball

-

Posts

391 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by DocSnowball

-

-

On 9/29/2021 at 6:16 PM, orthopa said:

None that I am aware. A part of me asks how part of the PSPA can be ignored but the verbage leaves open missing the deadline thanks to the word "endeavor". I expect this to be missed and a permanent FHFA director to be named after the debt ceiling, infrastructure bill fiasco is voted on or more finalized. A part of me thinks that the whole Calhoun rumor was just that but Maxine acting out makes me think otherwise.

It was built in from the get go by putting the word "endeavor". Truth is no one knows anything and no one cares enough to change the status quo. Inertia may take it all the way to when the warrants expire, but even then what. We all got legal lottery tickets and are wondering if we are holding on to worthless stubs or will even breakeven eventually. This is as expensive an education as they come!

-

10 hours ago, TwoCitiesCapital said:

We can dream. I don't think we should hope to rely on the courts any further.

Agree. I had come into this investment with the thesis that this is a takings. However, the Supreme Court ruling has little mention of acknowledging any injury to shareholders, in fact they write that prospective relief is not an issue anymore with the 4th amendment (really?). Not surprised with the decision but surprised that they did not give any directions for the shareholder injury (rather left it to lower courts whether it even occurred, and if it did contingent to the unconstitutional structure rather than the fact that it did occur). They sized up the tree but didn't care to do anything about the forest. Not a lawyer but not relying on courts anymore. Won't be surprised if they limit any damages to holders before 2012.

Personally I had around 6% of portfolio in this, so a significant setback. It is the second large one for me in the last 3 years, and leaves a lot to reflect on. I've been moving away from security selection to Vanguard style, Vanguard funds based asset allocation for 80% of my portfolio and that may be the best fit for me. This investment has shown me to never rely on the story even again, no matter what the reasoning - the importance of avoiding binary investments, people in management/ control really matter, and avoiding special situations as an amateur. Still holding the stubs at least until Sept 30th, yet it is more anchoring and rationalization than anything concrete. Perhaps seeing this in my portfolio will be a reminder never to make this mistake again.

-

RIP David Swensen, one of the greats.

In this lecture, he distilled more for me about markets and investing than anything else I've learned. What a legend.

https://oyc.yale.edu/economics/econ-252-11/lecture-6

-

44 minutes ago, Libs said:

>I know of two other physicians who were there from the US, fully mRNA vaccinated - both got symptomatic disease. Scores of Astra Zeneca vaccinated folks who died or are in the hospital critically ill. A significant chunk under 50 years. A new variant, the double mutant strain, appears to be behind a lot of this. Flights have been flying out the entire last month, now taking this strain across the world. <

Doc

Really sorry for your loss. What's going on there is unimaginable.

Regarding the above, this is not what is being reported....we are told the vaccines are effective against new strains. Hopefully we'll get some decent data on this soon. From what I can tell, Moderna, Pfizer and JNJ shots have not been given in India, which leads me to wonder if we really know if they protect. Ugh.

Thank you for your kind words. Sorry for the long posts, perhaps just looking for a release valve. I went in believing the vaccine will protect me (should have been more humble) -spent two weeks also taking care of my sick mom and brother at home. Had two days of symptoms but PCR never turned positive. The other two US physicians I talked with had documented disease. I tried to talk to the Government lab folks to get their viruses sequenced, but too much red tape was involved.

I think the cases were down so low mid-March, both Govt. and people lowered their guard. Public gatherings, religious festivals, election rallies, markets and malls, along with early vaccine euphoria contributed. Preparedness was eased, including getting rid of additional hospital beds and supplies etc and focusing on vaccination efforts. Unfortunately the AZ vaccine didn't bring the results hoped, esp with one dose which most people had received. Then the new variants took hold and the rise in cases was exponential - nearly 100 fold in Delhi within 4-5 weeks (200 cases a day early-mid March to 25,000 cases a day mid-April)

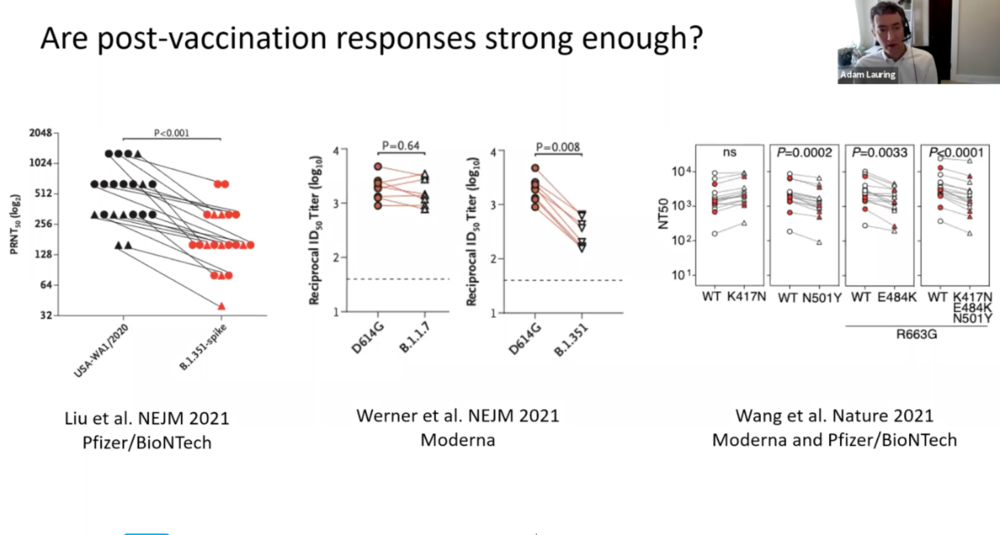

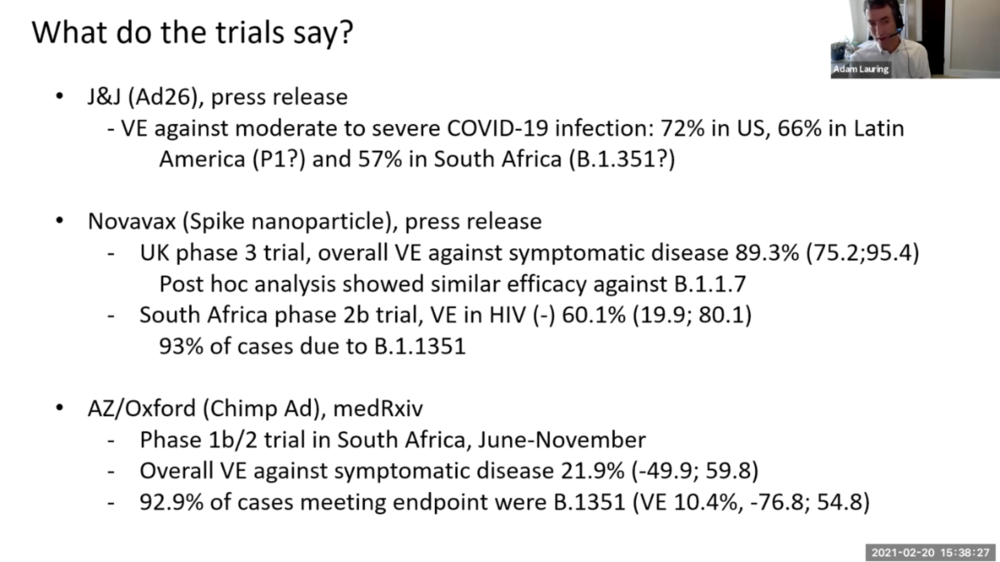

Trying to make my brain work a little now and looking back at vaccine info vs variants. Attaching two summary slides from mid-Feb from our society's presentation about vaccines vs variants- pay attention to the B.1351 (S African strain) or the E484K/Q mutation results - approx. two fold drop in antibody titers with mRNA vaccines but still some efficacy is expected. Limited trial results from across the world for other three vaccines - note the poor AZ results in S. Africa, no different than placebo really.

What we know/ What we don't know:

1- terrible epidemic in India overwhelming the healthcare system - medicines, beds, oxygen shortage/ ?how long this will last and what it will do to the economy

2- new doubt mutant strain identified, more infectious plus has E484Q mutation conferring some vaccine resistance/ ?is this strain the reason or was it behavior or ineffective vaccine

3- lot of documented severe cases who had AZ vaccine, mostly one dose, some two doses - implications for countries relying on this esp other developing countries. Consistent with S Africa trial with this vaccine showing poor efficacy. /? will the vaccine be similarly ineffective in Europe

4- lot of documented cases in those who had disease last year, raises question of duration and effectiveness of natural immunity beyond 1 year/ against this strain - implications for places relying on "herd immunity"/ ? depends on whether these were mostly just mild cases or severe cases.

5- ? anecdotes of failure of mRNA vaccine, but the only way to know is when a population gets exposed (?Israel or a US state likely to be first placed with good data capture). /?The hope is that even partial immunity may be enough to prevent a collapse of the healthcare system, fingers crossed, although the unvaccinated may suffer disproportionately. Implications for mRNA vaccines becoming preferred vaccines, both because a bit more protective now and because they can be adapted quickly for booster doses.

6 - ? we don't know how these variants will spread in different weather and population conditions. What happened in one place may not/ will not happen everywhere. But it could happen in a few other places unfortunately.

-

Greg, thanks for refreshing this thread. It is a time to reflect isn't it. Humility and confidence is the winning dichotomy in the age of Coronavirus, if that makes any sense. All those posters were wrong about the markets and not humble enough about what the future holds, myself included.

On the medical side, things are turning out very differently than imagined in 2021. I'm just returning back from Delhi, India, where I lost my father to this current wave. It is an order of magnitude worse than 2020, who could have ever imagined? Everything we feared last year has come true now in terms of loss of life. Every third home has someone sick (usually entire families), every 10th home someone is in the hospital - if lucky enough to find a bed, every 20-25th home someone has died. The hospitals are completely full, in the last two days I know of two people who died just looking for a bed all day and not finding it. Doctors don't have a place where they can admit family members, and are taking care of them at home with Dexamethasone, anticoagulant injections, and the odd oxygen cylinder if you can find one at all. It is tragic beyond description.

The only key metric that the Government cared about was collapse of the healthcare system, and the magnitude of the wave made it happen. Hospitals ran out of oxygen killing 20-30 people over minutes. This led to mass closure of excess admissions, as no hospital now wants to admit sick people and have them die in house due to lack of oxygen. Given no beds available for sick people, Government had to call a lockdown - now into its second week in Delhi. A few more states have had to do the same. The situation is no better across the country, with peak expected in the next week or two.

I know of two other physicians who were there from the US, fully mRNA vaccinated - both got symptomatic disease. Scores of Astra Zeneca vaccinated folks who died or are in the hospital critically ill. A significant chunk under 50 years. A new variant, the double mutant strain, appears to be behind a lot of this. Flights have been flying out the entire last month, now taking this strain across the world.

I can't even think of second order impact at this time, but I'm sure others can. There is a certain sense of deja vu to what happened in Wuhan early 2020.

-

Thank you for your wonderful work Sanjeev, and much gratitude for allowing free access to existing members. This is a wonderful community that brings so much joy and learning, the best is yet to come!

-

Interesting to hear something after a period of quiet. Such principles in the past have not led to much, so take it FWIW. I guess what Congress can offer, that others cannot, is explicit guarantee and additional charters.

This from Senate housing page:

https://www.banking.senate.gov/newsroom/minority/toomey-outlines-housing-finance-reform-principles

Ranking Member Toomey’s principles call on Congress to enact housing finance reform legislation to:Transition the GSE duopoly toward a competitive secondary market;

End the conservatorships of Fannie Mae and Freddie Mac;

Establish a level playing field for other sources of private capital that bear mortgage credit risk;

Foster a liquid secondary mortgage market that promotes the continued availability of affordable 30-year and other long-term fixed-rate mortgage loans across the United States and throughout the economic cycle;

Protect taxpayers by ensuring that significant first-loss private capital stands in front of any government support and that taxpayers are appropriately compensated for that support;

Promote equitable access to the secondary mortgage market by mortgage lenders of all sizes, business models, charter types, and locations; and

Provide for a smooth transition to the reformed housing finance system by ensuring that reforms are incremental and realistic, leveraging the existing regulatory and market structure.

The additional quote is not on the website, and adds color:

Amanda Thompson, the communications director for Toomey and other banking panel Republicans, said the announcement signals an openness to creating something many GOP lawmakers have long resisted: a federal guarantee of the trillions of dollars of mortgage bonds that Fannie and Freddie issue. -

What about VT (world index) or SP500 index? It may be empowering to know they own a tiny piece of many businesses all around them.

-

Heard this term in a valuation lecture over the weekend. Move over "Mr. Market"!

Whether it is predicting that a vaccine will be developed within a year for the first time, or that cases will decline and the economy will have a V shaped rebound, the collective epidemiological predictive abilities of market participants ("Dr. Market") are matched up against "experts". Interesting to note that the Markets are growing as a family, and might I add have the ear of Presidents and people in positions of power. Thankfully, Dr. Market has generally been in a good mood for the last few months 8)

If Mr. Market is unstable, what is Dr. Market given their easy access to mass amounts of prescription drugs?

Eternally optimistic capitalist who loves fairy tales, believes trees can actually grow to the sky and valuation is for excel geeks. Invests all money in Mr. Market's ETFs on margin.

-

Heard this term in a valuation lecture over the weekend. Move over "Mr. Market"!

Whether it is predicting that a vaccine will be developed within a year for the first time, or that cases will decline and the economy will have a V shaped rebound, the collective epidemiological predictive abilities of market participants ("Dr. Market") are matched up against "experts". Interesting to note that the Markets are growing as a family, and might I add have the ear of Presidents and people in positions of power. Thankfully, Dr. Market has generally been in a good mood for the last few months 8)

-

David Stevens on CFPB Investigations and GSE Update

https://thenationalrealestatepost.com/david-stevens-on-cfpb-investigations-and-gse-update/

He seems to be quite gleeful about the current state of endless status-quo and its continuation.

Filled my cup with joy hearing of Parrott, Deese et al.

Supreme Court ruling will be interesting. We have gone from depending on the kindness of strangers to asking for mercy from looters...I think cherzeca you are correct when you say we are back to the legal thesis.

And in the longer term (2-3 years), weighing the TINA factor for GSEs and comparing the rate of expected return/risk premium in this investment to alternatives.

-

Also to keep the thread organized - if willing, I would like to see:

1. What Happened?

2. Why it Happened?

3. How to rectify it in the future.

I mostly write these posts for myself, as I feel writing is an important aspect of clearing the mind of noise and solidify your thesis, while reinforcing good lessons and removing bad habits.

Here's your chance to do the same? ;D

One straightforward mistake that I made in 2020 was tactical, on the personal finance front - while I was re-allocating capital during the drawdown in March, I simply made selection changes in my kids 529 accounts to move them from cash to US equity, and after two such moves was told I was not allowed any more changes for 2020. Looking back, I missed out on pouring in the maximum allowed new annual contribution of $70,000 in each child's accounts simply because I took at face value what I was told on the phone and didn't think about pouring new money in. It would have made a world of difference to put more money in these tax-free Roth IRA like accounts with 10-15 year runways.

Another on specific company selection was missing out to emerging platform companies in my field of healthcare - not realizing how Teladoc is on its way to becoming one of the premier platform companies in telemedicine during the pandemic, while knowing well what it had done during the hurricanes in Texas and Puerto Rico. Why it happened - because I didn't think about long term effects of COVID-19, just focused on market timing in March and then held back when markets started going back up. Lesson learned - now I am looking closely at edu-tech companies on their way to becoming the platforms in higher education, TwoU being one of them that I hold - Coursera is another but is not publicly traded yet. Missing out on investing in Google at $1000-1200 was another hare-brained mistake, despite seeing how much of a moat Google was building in the classrooms from elementary education to graduate students.

The big picture lesson learned was that it is very difficult to think rationally on a consistent basis in the middle of a storm, there are so many things going on in life. There is a lot of value in thinking of how to make portfolio level changes well ahead of the year that lies ahead. This inspired me to take a course on Investment philosophies in Fall 2020 and reorganize my portfolio. I have also realized that the international financial system is inherently unstable, and hopefully this means more opportunities lie ahead for the brave and well prepared.

-

We haven't heard much from any of the major institutional players since the amendment, but Fairholme's annual report is out (http://www.fairholmefundsinc.com/Reports/Funds2020Annual.pdf). But keep in mind that there are 3 Fairholme funds and sometimes Berkowitz will write something a little different for each one even in regards to the same investment. So below I consolidated his relevant comments on F&F.

Fannie Mae and Freddie Mac's businesses are booming while in conservatorships. The U.S. Treasury has finally agreed to allow them to retain earnings for capital safety and soundness. Treasury still has not agreed that $191 billion of "loans and fees" have been repaid even after receiving over $300 billion of reimbursements and controlling 80% stakes. I expect The Supreme Court will remedy the rights of two highly successful private enterprises and further their exit from federal control. Until then, preferred shareholders remain in a volatile purgatory. A resumption of preferred stock dividends should benefit the Fund's current dividend of 2.0%.

That last line sure is interesting. Does he really expect dividends to be turned back on, as opposed to an exchange of JPS into common?

We are at 20% of par with Fairholme still digging in. If Supreme Court ruling is adverse and Fairholme decides to sell, we end up in much more "volatile purgatory".

Since it is not a class action suit and not the only suit, there is little hope of settlement at this beyond late stage imho from Treasury standpoint. Obviously I'm not a lawyer but as a layperson what I am perceiving is that the NWS "nationalization" was obvious to the Court without any earnings/dividends going to company or shareholders in/after the third amendment, but how will they rule if they feel it was unlawful but not exactly meeting the legal criteria for the claim presented which is not a "takings" case and not even considered ripe anyway? Is 'unscrambling the egg" of NWS part of the Court's job in handling this case? Maybe not, but looking away in writing the verdict when private rights are expropriated doesn't seem the right precedent to set either.

What I'm hoping for is that even if they don't reverse NWS to the original contract terms, which I seriously doubt they will, they rule in such a way as to ensure legal rights of private shareholders are protected going forward. This may be enough for market participants to close the gap between price and value. Feeling deeply uncomfortable using hope as an investment strategy here with hard earned money, but holding on.

-

I'm still absorbing what happened, and why the agreement was as such to be punitive to litigating shareholders. One thing to consider is that Paulson and co/Moelis sponsors were non-litigating shareholders, and perhaps the litigating shareholders and Treasury just could not come to a settlement between Nov 18th and Dec 9th, after which things went downhill. The new agreement leaves Treasury in a strong position as others have noted, and intends to bring litigating shareholders to their knees to settle. Perhaps they will throw the dice once again with SCOTUS, after which there will be little choice but to throw in the towel. I ended up cutting down my position in half, where I can live with it going close to zero slowly or overnight, because the new agreement made it a binary investment yet again. Neither liquidation (and taking), nor restructuring, rather the threat of an endless status quo which still leaves everyone except shareholders happy.

-

-

This is what the "too hard" pile feels like. This investment is an education in behavioral investing isn't it!

-

I think all opinions and offerings should be welcome but also all of them should be subject to ridicule and getting shit on. That keeps things honest.

Agree. One of the purposes of this is to listen to different opinions. Otherwise it's just an echo chamber...

-

Staying the course as well. Not sure what else to say. Either this moves dramatically in the next couple of weeks, or the hemorrhage continues. Eventually, either there is restructuring or a taking due to nationalization. It is a volatile investment, but the discrete events in 2020 have moved us forward rather than take us back. Thesis creep and sunk costs are also into play for sure, need to acknowledge that and not invest any more $ at this point.

If you are Calabria, what are you asking Mnuchin to do at this point before the balance of power shifts?

-

2020: ~11% pre-tax

Happy with the overall result given the tumultuous year we have had, although being in the field of healthcare could have done much better handling Coronavirus related market movements.

Gradually moved from low six figures to low seven figures from 2016 to 2020. Big positive for me this year has been crystallizing my investment philosophy - moving to asset allocation based for 80% of portfolio (mostly Vanguard and iShares index funds VOO, VEA, VWO, INDA, FXI), and security selection (special situations, healthcare, biotech, educational tech, emerging tech) for 20% of portfolio. IRR returns were reasonably good, but still ended up with 40% cash. High risk aversion and thus inability to remain fully invested, along with Fannie preferreds position, were major drags for 2020 returns.

----------------

Historical:

2019: 21%

2018: -19%

2017: 7%

2016: 192%

-

@John Hjorth so sorry for your and your family's loss. May your brother's soul RIP.

-

http://aswathdamodaran.blogspot.com/2015/09/the-fed-interest-rates-and-stock-prices.html

From 2015, but the Myth or Truth discussion in the post remains evergreen:

1. The Fed sets interest rates

2. Low interest rates are the Fed's doing

3. The reason stock prices are so high is because rates are low

-

LOL and this is why I really just dont GAF here and just let it be. God bless all you guys who do the work. But for the life of my investment in these, its basically been this....rumor this way, rumor that way, huge run, huge retrace, vice versa. Chicken with the head cut off. I'll care when its either worthless, or within a few ticks of par. Otherwise, not worth the brain damage.

LOL...yes have suffered a lot of it ;D

-

Ok here is my biased opinion.. Nothing has changed on what Mnuchin/Calabria might do before he left (Like Luke/Midas mentioned). Might be a good time to add more if you aren't fully allocated.

It is probably correct that nothing has changed about Mnuchin/Calabria plan. But our guess of what that plan is keeps changing. Since we don't know, the price goes low.

I disagree. Until this article, Mnuchin has been on record stating they are deliberating on the issue. Then these statements appear from a late in the day interview in the article - he would have known it will end up on the front page of the WSJ. Puzzling but definitely a negative coming from him (alternative being silence). WHY? Did talks breakdown? Was a decision to punt reached with concern for impact on the financial system? What changed for him to give these statements?

Mr Market letting prices freefall along with volume indicate some are getting the message.

-

I hate this investment >:(

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

in General Discussion

Posted

Had given up hope on these for the next few years. Seems like prices are steadily going up, nearly a double in 3 months and now with volume, with no real public information or chatter. Not sure what to make of it but waiting to see if there is any insider info that will become public in the next month.