DocSnowball

Member-

Posts

394 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

DocSnowball's Achievements

-

48, physician-educator, born in India and immigrated to the US in 2004. Joined this forum in 2015 when studying value investing as an elective for my MBA at U Mass Amherst. Grateful for the community and the advice on lessons learned looking back. The greatest gift has been the grounding and the attitude to learn every day. Have only made 5-6 equity investments in all these years, with individual stock allocation <20% of portfolio limited to one IRA account. Each decision and ownership has brought a world of education. Grateful for this community and the moderators and posters. Onwards 2025, cheers to making each decade the best one yet!!

-

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

DocSnowball replied to twacowfca's topic in General Discussion

FHFA director would be the next catalyst now. Would shed more light on the desired direction of GSEs. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

DocSnowball replied to twacowfca's topic in General Discussion

Still waiting for this to play out fully. This story has had so many twists and turns. I'm in the skeptical camp, yet hold 10% of portfolio at this point. Waiting a little more to decide, the tide has definitely turned on expected outcomes, and the market agrees. A while back, I had calculated the net present value of FNMAT using the dividend rate promised in the prospectus (8.25% dividends unless called back at par, valuing it as a perpetuity). If dividends are turned on in future it will be a delayed perpetuity and discounted further based on when dividends are turned on. Revisiting this today to compare this option to alternative investment decisions and whether to hold or sell. NPV = Dividend/(r-g) where r is the discount rate and g is the growth rate (assuming zero growth rate of dividend, and beta =1 for a low risk utility when released) Discount rate = Risk free rate + Implied Equity risk premium at current level of index*Beta = 4.43%+ (5*1) = 9.43% (approximating 5% as current ERP) NPV whenever dividends turned on (example one year from now) = 2.06/0.0943% = 21.85 FOR FNMAT NPV if dividends turned on after capital raise completed 12/31/2026 - more realistic 21.85 discounted back another year at 9.43% = 19.97 for FNMAT Multiply this by your OWN JUDGMENT of probability of success for various outcomes and you get your expected value Let’s say: 1) 25% chance of this outcome of dividends turned back on 12/31/26 = 25% of 19.98 = 5 2) 25% chance of getting par value on 12/31/25 = 0.25*25=6.25 current value, discounted back one year at 9.43% = 5.71 3) 25% chance of getting 50% of par on 12/31/25 = 0.25*12.5 = 3.125 current value, discounted back one year at 9.43% = 2.86 4) 25% chance of zero = 0 Net present value (sum of all the possibilities) = 13.57 Current market price = 9.48 Please point out the blind spots -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

DocSnowball replied to twacowfca's topic in General Discussion

Had given up hope on these for the next few years. Seems like prices are steadily going up, nearly a double in 3 months and now with volume, with no real public information or chatter. Not sure what to make of it but waiting to see if there is any insider info that will become public in the next month. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

DocSnowball replied to twacowfca's topic in General Discussion

It was built in from the get go by putting the word "endeavor". Truth is no one knows anything and no one cares enough to change the status quo. Inertia may take it all the way to when the warrants expire, but even then what. We all got legal lottery tickets and are wondering if we are holding on to worthless stubs or will even breakeven eventually. This is as expensive an education as they come! -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

DocSnowball replied to twacowfca's topic in General Discussion

Agree. I had come into this investment with the thesis that this is a takings. However, the Supreme Court ruling has little mention of acknowledging any injury to shareholders, in fact they write that prospective relief is not an issue anymore with the 4th amendment (really?). Not surprised with the decision but surprised that they did not give any directions for the shareholder injury (rather left it to lower courts whether it even occurred, and if it did contingent to the unconstitutional structure rather than the fact that it did occur). They sized up the tree but didn't care to do anything about the forest. Not a lawyer but not relying on courts anymore. Won't be surprised if they limit any damages to holders before 2012. Personally I had around 6% of portfolio in this, so a significant setback. It is the second large one for me in the last 3 years, and leaves a lot to reflect on. I've been moving away from security selection to Vanguard style, Vanguard funds based asset allocation for 80% of my portfolio and that may be the best fit for me. This investment has shown me to never rely on the story even again, no matter what the reasoning - the importance of avoiding binary investments, people in management/ control really matter, and avoiding special situations as an amateur. Still holding the stubs at least until Sept 30th, yet it is more anchoring and rationalization than anything concrete. Perhaps seeing this in my portfolio will be a reminder never to make this mistake again. -

RIP David Swensen, one of the greats. In this lecture, he distilled more for me about markets and investing than anything else I've learned. What a legend. https://oyc.yale.edu/economics/econ-252-11/lecture-6

-

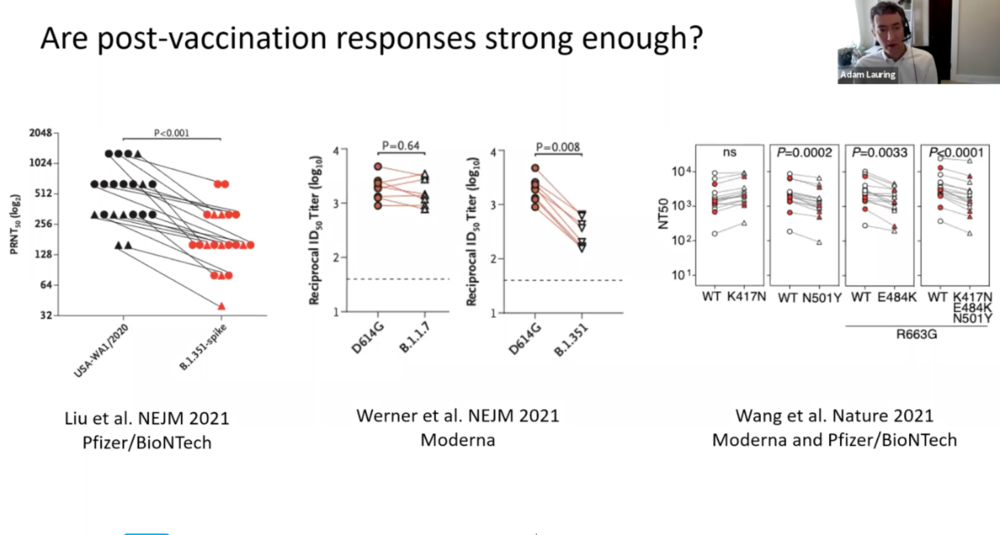

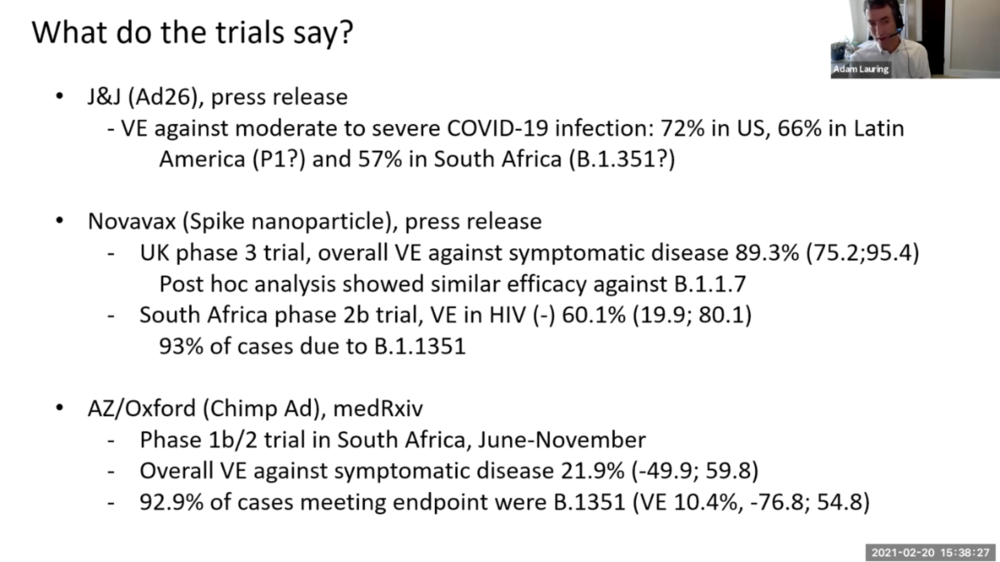

Thank you for your kind words. Sorry for the long posts, perhaps just looking for a release valve. I went in believing the vaccine will protect me (should have been more humble) -spent two weeks also taking care of my sick mom and brother at home. Had two days of symptoms but PCR never turned positive. The other two US physicians I talked with had documented disease. I tried to talk to the Government lab folks to get their viruses sequenced, but too much red tape was involved. I think the cases were down so low mid-March, both Govt. and people lowered their guard. Public gatherings, religious festivals, election rallies, markets and malls, along with early vaccine euphoria contributed. Preparedness was eased, including getting rid of additional hospital beds and supplies etc and focusing on vaccination efforts. Unfortunately the AZ vaccine didn't bring the results hoped, esp with one dose which most people had received. Then the new variants took hold and the rise in cases was exponential - nearly 100 fold in Delhi within 4-5 weeks (200 cases a day early-mid March to 25,000 cases a day mid-April) Trying to make my brain work a little now and looking back at vaccine info vs variants. Attaching two summary slides from mid-Feb from our society's presentation about vaccines vs variants- pay attention to the B.1351 (S African strain) or the E484K/Q mutation results - approx. two fold drop in antibody titers with mRNA vaccines but still some efficacy is expected. Limited trial results from across the world for other three vaccines - note the poor AZ results in S. Africa, no different than placebo really. What we know/ What we don't know: 1- terrible epidemic in India overwhelming the healthcare system - medicines, beds, oxygen shortage/ ?how long this will last and what it will do to the economy 2- new doubt mutant strain identified, more infectious plus has E484Q mutation conferring some vaccine resistance/ ?is this strain the reason or was it behavior or ineffective vaccine 3- lot of documented severe cases who had AZ vaccine, mostly one dose, some two doses - implications for countries relying on this esp other developing countries. Consistent with S Africa trial with this vaccine showing poor efficacy. /? will the vaccine be similarly ineffective in Europe 4- lot of documented cases in those who had disease last year, raises question of duration and effectiveness of natural immunity beyond 1 year/ against this strain - implications for places relying on "herd immunity"/ ? depends on whether these were mostly just mild cases or severe cases. 5- ? anecdotes of failure of mRNA vaccine, but the only way to know is when a population gets exposed (?Israel or a US state likely to be first placed with good data capture). /?The hope is that even partial immunity may be enough to prevent a collapse of the healthcare system, fingers crossed, although the unvaccinated may suffer disproportionately. Implications for mRNA vaccines becoming preferred vaccines, both because a bit more protective now and because they can be adapted quickly for booster doses. 6 - ? we don't know how these variants will spread in different weather and population conditions. What happened in one place may not/ will not happen everywhere. But it could happen in a few other places unfortunately.

-

Greg, thanks for refreshing this thread. It is a time to reflect isn't it. Humility and confidence is the winning dichotomy in the age of Coronavirus, if that makes any sense. All those posters were wrong about the markets and not humble enough about what the future holds, myself included. On the medical side, things are turning out very differently than imagined in 2021. I'm just returning back from Delhi, India, where I lost my father to this current wave. It is an order of magnitude worse than 2020, who could have ever imagined? Everything we feared last year has come true now in terms of loss of life. Every third home has someone sick (usually entire families), every 10th home someone is in the hospital - if lucky enough to find a bed, every 20-25th home someone has died. The hospitals are completely full, in the last two days I know of two people who died just looking for a bed all day and not finding it. Doctors don't have a place where they can admit family members, and are taking care of them at home with Dexamethasone, anticoagulant injections, and the odd oxygen cylinder if you can find one at all. It is tragic beyond description. The only key metric that the Government cared about was collapse of the healthcare system, and the magnitude of the wave made it happen. Hospitals ran out of oxygen killing 20-30 people over minutes. This led to mass closure of excess admissions, as no hospital now wants to admit sick people and have them die in house due to lack of oxygen. Given no beds available for sick people, Government had to call a lockdown - now into its second week in Delhi. A few more states have had to do the same. The situation is no better across the country, with peak expected in the next week or two. I know of two other physicians who were there from the US, fully mRNA vaccinated - both got symptomatic disease. Scores of Astra Zeneca vaccinated folks who died or are in the hospital critically ill. A significant chunk under 50 years. A new variant, the double mutant strain, appears to be behind a lot of this. Flights have been flying out the entire last month, now taking this strain across the world. I can't even think of second order impact at this time, but I'm sure others can. There is a certain sense of deja vu to what happened in Wuhan early 2020.

-

Thank you for your wonderful work Sanjeev, and much gratitude for allowing free access to existing members. This is a wonderful community that brings so much joy and learning, the best is yet to come!

-

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

DocSnowball replied to twacowfca's topic in General Discussion

Interesting to hear something after a period of quiet. Such principles in the past have not led to much, so take it FWIW. I guess what Congress can offer, that others cannot, is explicit guarantee and additional charters. This from Senate housing page: https://www.banking.senate.gov/newsroom/minority/toomey-outlines-housing-finance-reform-principles The additional quote is not on the website, and adds color: -

What about VT (world index) or SP500 index? It may be empowering to know they own a tiny piece of many businesses all around them.

-

If Mr. Market is unstable, what is Dr. Market given their easy access to mass amounts of prescription drugs? Eternally optimistic capitalist who loves fairy tales, believes trees can actually grow to the sky and valuation is for excel geeks. Invests all money in Mr. Market's ETFs on margin.

-

Heard this term in a valuation lecture over the weekend. Move over "Mr. Market"! Whether it is predicting that a vaccine will be developed within a year for the first time, or that cases will decline and the economy will have a V shaped rebound, the collective epidemiological predictive abilities of market participants ("Dr. Market") are matched up against "experts". Interesting to note that the Markets are growing as a family, and might I add have the ear of Presidents and people in positions of power. Thankfully, Dr. Market has generally been in a good mood for the last few months 8)

-

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

DocSnowball replied to twacowfca's topic in General Discussion

He seems to be quite gleeful about the current state of endless status-quo and its continuation. Filled my cup with joy hearing of Parrott, Deese et al. Supreme Court ruling will be interesting. We have gone from depending on the kindness of strangers to asking for mercy from looters...I think cherzeca you are correct when you say we are back to the legal thesis. And in the longer term (2-3 years), weighing the TINA factor for GSEs and comparing the rate of expected return/risk premium in this investment to alternatives.