Candyman1

-

Posts

119 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Candyman1

-

-

At March 31, 2023 the company's fixed income portfolio duration increased from approximately 1.6 years at December 31, 2022 to approximately 2.5 years at quarter end, with $14.1 billion remaining invested in cash and principally short-dated investments (comprised of cash, short term investments and the bond portfolio invested in short-dated U.S treasuries), enabling the company to benefit significantly from increased interest income in the remainder of 2023 and provides an opportunity for the portfolio to be deployed into longer-dated bonds.

-

44 minutes ago, giulio said:

@Candyman1 thank you for this perspective!

I think this article does a good job of summarizing IFRS 17

https://www.footnotesanalyst.com/prudent-versus-unbiased-ifrs-17-insurance-liabilities/

"IFRS 17 requires that the fulfilment cash flows included in the best estimate liability must be unbiased probability weighted expected values. This component of the total insurance liability should not depend on management policies and should therefore, in theory, be fully comparable between companies. In particular, the amount should not be affected by the insurer’s policies regarding prudence or conservatism, sometimes previously referred to as the ‘strength’ of reserving"

Not only will insurers need to discount liabilities (change in interest rate will affect both sides of BS now), but they need to report liabilities in a more standardized way.

If an insurer estimates a loss reserve to be 80, they cannot report 100 for the sake of conservatism anymore. Please correct me if I am wrong.

G

Insurance companies were already somewhat limited in their ability to book reserves. Reserves already needed to be somewhat in line with expected cash payouts. Now they are finetuning it even more in order to get as close as possible to "the exact number". To me it feels like regulators trying to be too perfect. It will lead to FFH, and the rest of the insurance industry, being more closely to the line and we will likely in the whole insurance industry see more case of reserve development volatility because of this. Leaving some leeway for somewhat conservative reserving was a good idea. In the end, the only thing that matters is how much cash were you paid for providing the insurance, what were your cash returns on the float, and how much cash did you payout for a specific vintage closed. The rest is just all assumptions. But I do understand why regulators want to do this. It is not the people that are too conservative they are targeting, it is the people/companies that are not conservative enough with their reserving assumptions. FFH has had plenty of experience buying insurance companies in the past that had used to optimistic reserve assumptions in order to be able to book better results in the short-term. And the regulators think they have a "perfect formula" which is bs. The perfect formula for me would be to take the actuarial assumptions and double them, but I am side tracking. That is why you see Prem almost dismissing IFRS 17 and he would rather not implement it, but he has no choice.

Over reserving is not just good policy for insurance companies, but it is also for other companies and even people. All my regular bills I pre pay many months ahead of time. I do not have a mortgage on my residence, I pay cash for cars, etc. Yes, as many have said, those prepaid bills are float I could have used to invest, but one never knows what setbacks happen, I am now 55 and believe me, setbacks happen to people, I have seen plenty of it as well have experienced them myself, and if I end up with a setback I have many months where I can figure out how to replace income for my coming bills. Now at this time it has way less impact as I have enough money to not have to work again, but it has been a great principle the live by till now. Well, those principles could be just as relevant for companies.

In the long-term for FFH the impact of IFRS 17 will be small.

A similar thing hit BRK recently as now they have to include the unrealized part on their public asset book in their earnings statement, while the past it just was the realized part. And we have seen the impact of that recently. On paper one could argue that it represents the exact situation at a specific time of BRK better, but I would not call this new system an improvement over the old one.

-

1 hour ago, Parsad said:

Correct. The one net benefit is that analysts and investors could never properly value their over-reserving as it wouldn't be apparent till years down the road.

Now it is clear in the underlying book value, so the stock should price more accurately relative to actual book value compared to how it was priced historically.

Fairfax has become easier to understand...from the quality of the insurance businesses, earning power of the insurance businesses, income power from the bond portfolio with higher rates, simplifying the investment holdings, laying out succession plans, etc.

All of this may help elevate FFH to A credit ratings and more consistent valuation relative to book value. I think if they reduced debt over the next few years we would get those A ratings and it would be priced more in line with MKL or BRK.

Cheers!

+1

-

3 hours ago, gfp said:

I agree that it will likely be positive for the stock, but on a net basis, we just took likely over reserving out of the liability side of the balance sheet. I always expected FFH to be over reserved and over time the over reserving of those past years would have made it in into the income statement anyway. That overall has been going on for some time at FFH, but since they are growing their book long term, it tends to be hidden. So yes, likely people will look at book value per share is higher and stock could trade up, but operationally nothing seems to have changed. That $94 dollars in book value per share was just moved from the liability side of the balance sheet to equity.

-

Anyone worried for FFH about the risk of large floods out west due to coming melt off. I live near the mountains and man is there a lot of snow currently. Not sure if FFH has a lot of exposure. I remember a smaller snow year, but it stayed colder than normal for longer, like this year, and suddenly the temps shot up into the 70s and just those few days took out a number of bridges. Similar thing might happen now on much larger scale.

-

Wow, prem referred to making $100 a share for a number of years.

-

16 minutes ago, valuesource said:

19.11 bv per share

Just a thought ... isn't Adani kinda played out ... seems like he was absorbing massive amounts of investments in India ... I wonder if it made the investment space for Fairfax India better ... now India is a lot bigger than Adani, but it seems to me he was absorbing massive amounts of infrastructure investments. Just a thought.

-

1 minute ago, Xerxes said:

Shouldn't this be included in their table

On October 31, 2022 the company sold its interests in the Crum & Forster Pet Insurance Group and Pethealth, including all of their worldwide operations, to Independence Pet Group and certain of its affiliates, which are majority owned by JAB Holding Company, for $1.4 billion, paid as $1.15 billion in cash and $250.0 in debentures, as a result of which the company recorded a pre-tax gain of $1.2 billion and an after-tax gain of $933.9 million.

Yeah, good point ... I think they might want to only include going forward assets ...

-

book value per share of 657 plus about 13 in per share in carrying value of non insurance subs

this is interesting "On January 1, 2023 the company adopted the new accounting standard for insurance contracts ("IFRS 17") which will first be presented in the company's consolidated financial reporting in the first quarter of 2023, with comparative periods restated. IFRS 17 brings considerable changes to the measurement, presentation and disclosure of the company’s insurance and reinsurance operations. It will not, however, affect the company's underwriting strategy, its prudent reserving, management's use of the traditional performance metrics of gross premiums written, net premiums written and combined ratios, or the company's cash flows. The company anticipates recording a transition adjustment to increase opening common shareholders' equity as at January 1, 2022 which is not expected to exceed 2.5% of common shareholders’ equity as at December 31, 2021, primarily reflecting a decrease to insurance contract liabilities from the introduction of discounting claims reserves and the deferral of additional insurance acquisition costs which were previously expensed as incurred, partially offset by a new risk adjustment for uncertainty related to the timing and amount of cash flows arising from non-financial risks. Given the increasing interest rate environment experienced throughout 2022 and the beneficial impact it will have on the discounting of claims reserves under IFRS 17, the company anticipates recording a material benefit to the restated consolidated statement of earnings for the full year of 2022 and common shareholders’ equity as at December 31, 2022."

Looks like in Q1 2023 we will see "a material benefit to equity per share based on the above. Had no idea this had happened.

New shares FFH outstanding end q4 was 23.3 million.

My guess is that on the bonds we should get back between 15 and 25 dollars per share from the 2022 losses just from runoff ...

38 billion in cash and fixed income with duration of 1.6 years ... new fixed income run rate is 1.5 billion and about 9.4 billion in short term/cash and 28.6 billion invested in fixed income, mostly 1 to 3 years ...

Looks nice overall ...

-

26 minutes ago, Cigarbutt said:

Take the following as potentially reasonable answers to your questions.

Statutory accounting for bonds (at least NAIC based in US and similar elsewhere) requires bonds to be recorded at cost with an asset valuation reserve recorded immediately against surplus. For NAIC class 1 and 2 bonds (investment grade), this charge used to buffer future losses (mostly default-type losses) is between 0 and 2%. Then, unless an impairment needs to be recognized or somehow the insurer cannot demonstrate that the bonds can be held to maturity (also regulators look (and account for) idiosyncratic market exposure), there is no additional charge to surplus along the way to maturity. Note that, for the overall insurers' float portfolios in bonds, 94% of bonds are NAIC 1 or 2.

Here's a decent reference for the statutory accounting part:

-----

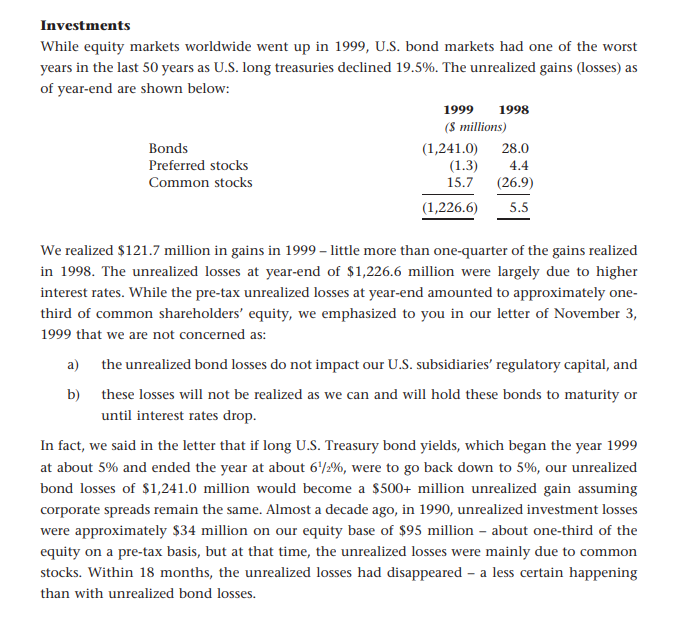

Just for fun (relevant for Fairfax now?), there was a time (annual report 1999) when potentially unsettling unrealized bond losses were not considered unsettling at head office (although the unusual concentration likely raised questions in some regulators' minds). Then, it seems that FFH wanted to protect against (and benefit from) the deflationary consequences of bu**ble bursting. That was then and now is now.

Thank you for clarifying.

-

For what it is worth, an estimate of about $60 billion in insured losses. Reasonable estimate of about $600 million for FFH, so I guess the loss will be between $20 and $30 per share for FFH.

Risk-modeler Karen Clark & Co. on Friday estimated that the privately insured loss from Hurricane Ian would be close to $63 billion, including wind, storm surge and inland flood damages, while total economic damage will be well over $100 billion, including uninsured properties, damage to infrastructure and cleanup costs.

-

Just wondering, if one looks at the price declines of bonds in general and specifically long dated bonds.

- How much of a dent has that been to capital in the industry? I would expect a decent impact.

- Do regulators allow the insurance industry to treat those bonds like either for sale (mark to market) or to maturity (no mark to market) as they do with banks? One argument that is being made is that they often match their bond portfolio to their liabilities. I would like to know the actual treatment works overall.

- My guess is that most of it is mark to market. And if so, given leverage in insurance industry, isn't there an additional argument for maintaining the hard market for a while?

-

Viking, any chance you have that FFH investment spreadsheet available to post? Would like to see where we sit compared to Q1 2022.

-

1 hour ago, bluedevil said:

Great points, Petec.

The fact that this boom in shipping has gone on for so long seems to me to have two big consequences for Atlas (other than its shareholders like me being sad that they missed the boom!): (1) It has greatly lessened the counterparty risk that Atlas faces with the liners, which is a big plus. (2) It has taken a field of competitors that were weak, and made them flush with cash and 3-5 ship lease contracts at very high prices. The vision of Atlas rolling up these weak lessors and consolidating the industry is probably gone, at least in the medium term, and the company is more likely to look to invest in other fields.

In terms of the relative attractiveness of the stock, i'm curious in terms of what you see as more attractive. The company will earn about 55% of its market cap by the end of 2024, has an excellent management team, and in 2025 will still have something like 13B of contracted revenue on the books, even if it doesn't book a single new contract until then. In terms of risk/reward, it is hard for me to identify other stocks that are largely indifferent from a revenue/earnings perspective to what happens in the broader economy over the next couple of years and yet still have this kind of earnings yield.

I think with Atco, the main issue to think about is what happens to container shipping prices (and thus ship leasing prices) over the next few years. What I am afraid of is that a. demand for container shipping declines for some reason and b. how many ships are on order. If container shipping goes into a large downturn, I think it will reflect on ATCO's stock price.

- What will happen to demand for container shipping long-term (i.e. will it continue to grow the way it has over the last few decades? Or not?) I know there is a lot of talk about de-globalization and on shoring. I think that will be way harder to achieve than politicians think.

- I looked at the 2022 investor day presentation on page 27 it lists a global container fleet of 25.4 million TEU (which was a 4.9% increase over last year) and a backlog of newbuilt orders of 6.1 million TEU, that is about 25% of the current fleet, and very few demolitions (which is to be expected and demolitions will increase if container shipping prices come down.) Still that seems that ballpark the container fleet capacity is increasing for the next few years at between 4% and 6%. How will that impact the value of ships and the value of ATCO if we go from a shortage of ships to a surplus? Despite that amazing contracted cash flow, will people even consider that?

- One issue that worries me a lot is what happens if for some reason it turns out we built too many ships and the industry goes into one of those long down shipping cycles, as they tend to do? Could it be that some of the lessors just break the contracts? I remember dealing with coal companies and in pr releases they kept talking about that new contract of X millions of tons for the next five years, until I found out that in a down period, these coal burning utilities just would not allow the trains on their terrain to unload and said f... off to the coal miners. Could the same happen to ATCO? Not saying it will. Lets say Maersk has leased a number of ships at higher prices, will they be willing to blow up their reputation for a short-term gain? Also, how will ATCO have to deal with Maersk? Do they look for a compromise and lower the price? Not sure how the dynamics will work. I think ATCO's position will be pretty good, still it worries me.

On the other hand, lets not forget that the people running ATCO are great. I believe that APR business has a decent chance of doing much better over the next few years. Given the transition to more renewables, it looks like there might be a fair amount of demand for leased generating capacity as there will be bumps in the road. Just read a WSJ article about many grid operators worry that too many cabon based utilities have been shut down and renewable project have not booted up yet. Also wind and solar are intermittent, so more backup capacity will be needed anyway.

Also, I would not be surprised if Sokol is thinking way beyond the current APR business. The guy has built a number of businesses and will likely continue to push growth.

Btw. I remember when I had access to Bloomberg (about 12 years ago), that one could lookup in a fairly detailed way all ship orders on Bloomberg. If someone has access to Bloomberg, feel free to post that info here. I would appreciate that. ATCO did inform us about the total orders, but I would like to see if there is data of container shipping orders by size.

-

-

On 1/22/2022 at 6:22 PM, Viking said:

It is interesting to compare Fairfax’s current situation to what happened when we had the last big financial market dislocation in March of 2020. In March of 2020 Fairfax:

1.) insurance: losses from pandemic were unknown; lock downs were throttling business activity

2.) equities: many of Fairfax’s holdings were getting crushed (cyclicals, small cap, hospitality, financials, emerging markets).

3.) bonds: more of a mixed picture for Fairfax. Plunge in government yields would increase earnings and BV of holdings. Short spike in higher risk yields of higher risk bonds were an opportunity. Pain from much lower yields would only be felt in future.

Bottom line, Fairfax BV and earnings cratered. And the shares cratered.

Fast forward to today:

1.) insurance: hard market continues to roll. Economy expected to expand above trend in 2022. Prospects took very good.

2.) equities: we are seeing a bear market in speculative Nasdaq stocks. Fairfax’s top positions (Atlas, Eurobank, FFH TRS) are holding up well (so far)

3.) bonds: with yields across the curve spiking Fairfax should see interest income start to move higher again. There will be a hit to earnings and BV as current bond holdings are re-valued at quarter end (but Fairfax will be hit much less than most other insurance companies who have much more duration in their bond portfolio). If Fairfax is able to re-deploy some of its significant short term cash/holdings into longer dated bonds (yielding higher amounts) that will be a big, big win for shareholders (boosting interest income and locking in higher operating earnings in future years - something that would be highly valued by investment community).Bottom line, Fairfax in a much better situation to withstand the current market turmoil. And that is likely why we are not seeing shares sell off aggressively. At least not yet

I wonder what happened to the TRS. For the last few weeks we had a lot of shares trade on the open (from 100K to 400K) daily. I wonder if FFH decided to cash in on the TRS. I would have thought they would have waited somewhat for higher prices still, but you never know.

-

After two days of 100K shares on the open we just had 400K shares trade on the open. I would have thought there should have been a bigger selloff if someone was trying to push that much volume of FFH stock like that. I wonder if FFH is laying off the TRS or maybe another investor wants more.

-

2 hours ago, newtovalue said:

Hi all!

First off wanted to say thank you for all of the great discussion on this board. I have learned a lot just reading along and appreciate all the efforts you all give to this.

Wondering if there has been any news on Digit? On the Q3 earning release - FFH stated they expected the common share placement to occur in the fourth quarter (i.e. by Dec 31) after which they recognize $1.1BB in additional book value gains. Was hoping they were able to sneak that into this year - as it will further push up book value.

Has anyone heard anything with respect to this?

- newtovalue

They are waiting for Indian regulators to finalize the regulations I understand. One would think FFH management has a good feel as to what is happening, but again, they are dealing with regulators. All persons I know that work for the US government only talk to me about how many more years before they get to retire. Not the most motivated bunch. I assume it will happen somewhere in 2022. Still, I hope it happens earlier as it might open the way for a Digit IPO. Anyway, now that I lowered expectations, FFH will probably announce the execution of the Digit transaction tomorrow morning.

-

Better than zero .... "The decision represents a significant shift from September’s forecasts, when the FOMC was evenly split on the need for any rate hikes in 2022. The new projections also show an additional three rate hikes as appropriate in 2023, with two more in 2024—bringing the fed funds rate to 2.1% by the end of 2024."

As of Q3 FFH had 18.4 billion in cash and short dated. Not sure how much of that is denominated in USD.

-

6 minutes ago, StubbleJumper said:

3) Valuation is still ridiculous. End of quarter book was US$562/sh. Tack on another ~$18/sh for excess of fair value over carrying value, and you're at US$580. The shares closed at US$410 today. That's like 0.7x adjusted book. What will we see for an end-of-year adjusted book value? If we don't see some significant market gains in the share price over the next 7 weeks, valuation ratios will be absolutely silly at year-end.

Not sure why you are excluding the $37 related to Digit in your pro forma book value calculation which gets one to a pro forma book value of $617.88.

-

11 hours ago, TwoCitiesCapital said:

+1 same boat here. It's all about the price. All the excuses for the current discount existed back in 2018 when it was at a premium. Other than interest rates, not much has been said that sufficiently explains why we should expect this to persist.

+1 It is all about the price (multiple). Not sure why so many seem to not be able to grasp this. I didn't buy FFH 10 years ago at 1.2 times book, I bought it at less than 70% of book less than a year ago for the second time after buying it in the low $100 early in this century and selling it close to 1.5 times book. It is eerily similar how that time resembles today. Trust me, people were just as critical back then. There was no way that FFH would get a revaluation of its multiple. Literally I had to fight tooth and nail to stop my boss from selling it and holding on to FFH carried a lot of employment risk for me. I can see that something similar might be the case today with many institutional investors.

Yes, there is much to be said about the last 10 years which justified not buying FFH at 1.2 times book then, but at less than 70% of book now I believe we are being compensated for the risk we take. It is my belief that the next few years will look better than the last 10 years and that there is a reasonable chance we get compensated for taking that risk. Yes, there is a scenario where FFH under performs and at 70% of book I believe my downside is protected.

For those that swear that FFH will trade at X valuation or will never trade at Y valuation, good luck, you guys have a self confidence I do not have. The longer in years I invest, the less certainty I find in my picks. I do know that margin of safety has served me very well over the years. Who the hell knows that FFH trades at less than 70% of book because it is too complex or that BB is what is keeping the valuation down or that Digit is already included in people's valuations of FFH, etc. What seems to be the case to me is that currently people project forward the last 10 years into the future and that holding FFH holds employment risk for people at many funds. And when FFH shows that is changing and we get some reasonable growth in BV we will see a reasonable revaluation to 1 to 1.2 times book, maybe higher, but who knows really.

-

17 hours ago, Viking said:

India looks very well positioned right now to attract investment $:

- Modi is pro business and is moving forward with more economic reforms

- global economic recovery from covid in 2022 should benefit EM like India

- China is making some head scratching decisions that will likely slow new $ flows from West that should benefit other regions (deterioration of China / US relationship also a factor)

Fairfax’s publicly traded Indian stock holdings have been on a tear the past 10 months.

I am looking forward to seeing what Fairfax India has planned with Anchorage. The Seven Islands IPO is also pending.

And of course, there is the rumoured Digit IPO in 2022

Lots to like.

Look at the population pyramid for India. It is not just that the overall population is expected to still grow by another 300 million people by 2055, but the current population of India is pretty young. If the government keeps the pro business policy trend somewhat on the rails we will see significant growth in India over the next decade(s).

https://www.populationpyramid.net/india/2020/

-

-

23 minutes ago, Viking said:

Is cybersecurity a big deal? Are we in the late innings?

Blackberry is in the sweet spot with a few of its core businesses. And it looks to me like we are still in the early innings with lots of runway ahead. And as been mentioned already, Fairfax likely has a pretty good view of the company / industry and where the business is going over the next 12 to 24 months.

So i do understand why Fairfax is not in a panic to unload.

However, i also understand why shareholders are banging the table for a sale (especially those who have owned shares for years). There is simply too much emotional baggage with this holding… SELL and make the pain go away

Emotionally, investors simply want to move on.

Emotionally, investors simply want to move on.

personally, i hope Blackberry gets bought out

Remember not too long ago Buffett mentioned weapons of mass destruction, pandemics and cyber crime in one sentence and said "we ain't seen nothing yet" when it comes to cyber crime. Same with CEO for Chubb. It was the interview in Munger's back yard, pretty recent.

Post the recent cyber crime events with Colonial Pipeline and JBS, I must assume many management's will start focusing on their vulnerability to cyber crime.

I saw a piece on the JBS situation and according to the journalist JBS still has a system running Windows 95 overseeing operations in their plants. Not sure if they got in that way, but that kinda tells you something.

Fairfax 2023

in Fairfax Financial

Posted

Rumors of a take over bid on BB. Not sure how to think about it ... it seems after all the trials and tribulation with BB it would be nice to get money for BB and have it off the plate of FFH. On the other hand they seem to be making progress. Deep down, I think I would rather get rid of it. In the end it is now fairly small percentage of FFH.