-

Posts

1,828 -

Joined

-

Days Won

14

Content Type

Profiles

Forums

Events

Posts posted by UK

-

-

5 minutes ago, nwoodman said:

Transcript attached and some Claude summaries from Wade’s comments and the Q&A

Wade Burton

- The investment portfolio stands at around $65 billion, including $9.3 billion in cash and short-term treasuries, $46 billion in fixed income, and $19 billion in equities (associates, limited partnerships, preferred and common stocks).

- The fixed income portfolio is built for safety, with government bonds making up the vast majority. It has a short duration of 2.8 years and yields 5%.

- The mortgage book stands at $4.8 billion, all first mortgages with duration under 2 years, yielding over 8.25%.

- Fairfax is watching inflation data closely and thinks it may be difficult for the Fed to drop rates if inflation stays above 3%. Higher rates could persist longer than expected.

- Of the $19 billion in equity and equity-like investments, associate investments (strategic/significant stakes like Eurobank and Poseidon) make up the bulk and are generally performing well and undervalued versus carrying value.

- Common stocks are a small portion at under $5 billion. Not seeing many opportunities currently with North American markets at high levels.

- Overall, the investment portfolio is structured to prioritize safety, with good locked-in interest income, little credit risk, and equity investments that are undervalued, soundly financed and performing well. It is positioned to handle uncertainty around interest rates and inflation.

Q&A Summary

1. Fairfax continues to hold total return swaps (TRS) on its own shares as it believes it's a good investment. The TRS contracts expire in 2025 and 2026 but can be extended. Fairfax also continues share buybacks, balancing it with maintaining financial strength and ratings.

2. Premium growth opportunities still exist in many lines despite the market not being as hard as in 2019-2023. Cyber, D&O and workers' comp are seeing rate decreases over 10%. Excluding Gulf Insurance, premiums grew 5% gross and 7% net in Q1. Fairfax's scale and diversification provide growth potential.3. The reinsurance market remains strong but not as robust as 2023. Odyssey had a higher base to grow from after taking advantage of the hard market in prior years. Allied World and Brit also have reinsurance opportunities.

4. With premiums leveling off and earnings stabilizing, there is increased capacity to dividend funds from insurance subsidiaries to the holding company. In 2024, Fairfax can dividend $3 billion up based on statutory requirements. $451 million was dividended in Q1.

5. The consolidated expense ratio ticked up about 1 point in Q1 to 31.5% mainly due to the inclusion of Gulf Insurance which runs a higher expense ratio. Mix of business and continued investments in technology and people also contributed.

6. Fairfax has flexibility to reallocate from its defensive, liquid bond portfolio to equities if dislocations in the equity markets present attractive opportunities.Thanks!

-

13 hours ago, gfp said:

pdf of the article. Go ahead and remove it if an opinion section excerpt is some kind of copyright issue.

The Security I Like Best:). Nice!

-

5 hours ago, hasilp89 said:

https://docs.google.com/document/d/1rW-8uDJFJzlu0jzAaPWXX_P1XdvvOeKTABhEV6ouSKk/edit?usp=sharing

it is available on tikr also. in a google doc here.

Thank you very much!

-

3 hours ago, Cigarbutt said:

This line of reasoning raises the possibility that one comes to an incorrect conclusion.

The first issue is that float is based on net (not gross) insurance reserve liabilities (when premiums are ceded to another party of the reinsurance type so is the "float"). In 2017, FFH retained 81.8% of gross premiums and in 2023, 78.6% of gross premiums. So this partly explains why the growth in float was slower than the growth in gross premiums and is an issue unrelated to the "duration" of insurance liabilities.

The second and more important issue is more conceptual (and even mathematical). To assess the validity or signal when comparing the growth of premiums and float, one would have to assume some kind of steady state (for example, constant growth over time). Think of an insurer which decides to significantly curtail new business or even move to run-off. Then the negative growth in gross premiums would happen faster than the decline in float because of the lag effect and the shape of the payment distribution over time, an issue not linked to a change in the "duration" of insurance liabilities.

Recently, FFH has grown ++ the gross premiums component:

The relative float growth will catch up over time especially if the growth in gross premiums written settles down (it's just a timing issue at this point) and this temporary decoupling is essentially unrelated to a hypothetical change in the "duration" of insurance liabilities.

One way to support the above is to observe, over time, the composition and distribution of the insurance product lines. This appears to be quite constant. On a recent conference call, the CFO mentioned an insurance liability duration of 3.8 years and i would suggest that this duration hasn't changed much in the last few years.

-----

Reading the above, i'm not sure it makes sense? Being simple minded (thinking along first principles is above my capacity), i always try analogies. So, for example, if you try to be more friendly to others around you, eventually, people around you will become more friendly to you (no guarantee of course) but there is a lag effect and your rate of growth of being nicer to others will precede the rate of growth of others being nice to you. The opposite obviously can occur but there may be a lag effect in the other direction as well due to the accumulation of social capital. Makes sense?

Thanks!

-

-

-

21 minutes ago, giulio said:

Here are my notes on the 2024 FIH agm that just finished:

- Something worth keeping in mind -> in 2023 they bought back 2.9M shares, the share price was up 24%; yet, $14.9 is exactly the same price at which they completed a SIB back in 2021. A lot has happened in 3 years...

- slide 28 is a nice summary of the impact of fees on returns

-

BIAL will see "explosive" growth in the next years

- huge number of aircraft ordered by indian airlines (1200?)

- number of operating airports expected to roughly 2x to. 250 (?)

- Air India established its 2nd HUB in BIAL -> increase in international flights (EU/US) + other flights from other parts of India

- Watsa said that there are lots of structure that you can set up to raise money for big opportunities; seemed very confident that money will not be a problem for FIH

- Sold NSE because valuation was too high and they saw downside risk given that NSE makes a lot of profit from options trading

-

IIFL gold loans issues -> founder said there were minor "lapses", IIFL was used to set an example for others. He said they addressed all the issues raised by RBI and hope that RBI audit will confirm this (April 12th start)

- no fraud, no money laundering

- Lots of emphasis on the financial sector opportunity -> 7% real growth, 12% nominal, financials should grow at 1.5-2x the nominal = 18%

- I am not sure I got this correctly but Watsa said something like "we are targeting 20% rate of return, not 10-15%, need to offset some fx risk"

-

Sanmar had a terrible year with PVC prices down 30-60%

- improved efficiency in Egypt

- focus on specialty PVC

- growth ahead -> China has similar population to India and uses 20M tonnes per year vs India's 4M tonnes per year

- Maxop and Jaynix -> "unlimited growth", their only constraint is capacity and they are expanding, huge demand

- Anchorage still stuck in regulatory approval, nothing will move before the election (I would expect nothing before 2025)

- Privatization opportunities will unlock after the election

all in all, great enthusiasm as always. focused on integrity.

Deepak Parekh (founder of HDFC) is their consultant for everything and this is a HUGE plus in my view.

Curious if any of the guys who attended in person were able to gain other insights.

G

Thanks!

-

35 minutes ago, gfp said:

I sold just about 10% of the total shares for accounts that still own Berkshire. Even after selecting the highest basis shares possible (~$71.85 / b-share in these accounts) there is still a significant tax consequence to selling shares. But 10% is a lot of money and still a lot of tax will be owed. I don't personally own a lot of Berkshire anymore.

Thanks!

-

17 hours ago, gfp said:

Well I would just like to say thanks for the post nwoodman! I had just woken up, let out the puppy, and saw your post and said "What the fuck is the market doing??" and ran upstairs to start dumping BRK shares pre-market. Sold from 430 all the way down to 424. No clue what that market reaction was but I was like, "did they read the same report as me???"

Nimble move:). Curious if you sold it all / for good or until somewhat lower valuation?

-

9 hours ago, nwoodman said:

1. Forward Guidance

Prem Watsa“Now as I’ve said for the last number of quarters, the most important point I can make for you is to repeat what I’ve said in the past - for the second time in our 38-year history, I can say to you, we expect - there is of course no guarantees - sustainable operating income of $4 billion, operating income consisting of $2 billion-plus from interest and dividend income, $1.2 billion from underwriting profit with normalized catastrophe losses, and $750 million from associates and non-insurance companies. This works out to over $125 per share after interest expenses, overhead and taxes. Of course, fluctuations in stock and bond prices will be on top of that, and these fluctuations only really matter over the long term.’

Plus: "When you put all of that together, we look at that operating income of $4 billion as a pretty conservative number."

-

1

1

-

-

10 hours ago, Viking said:

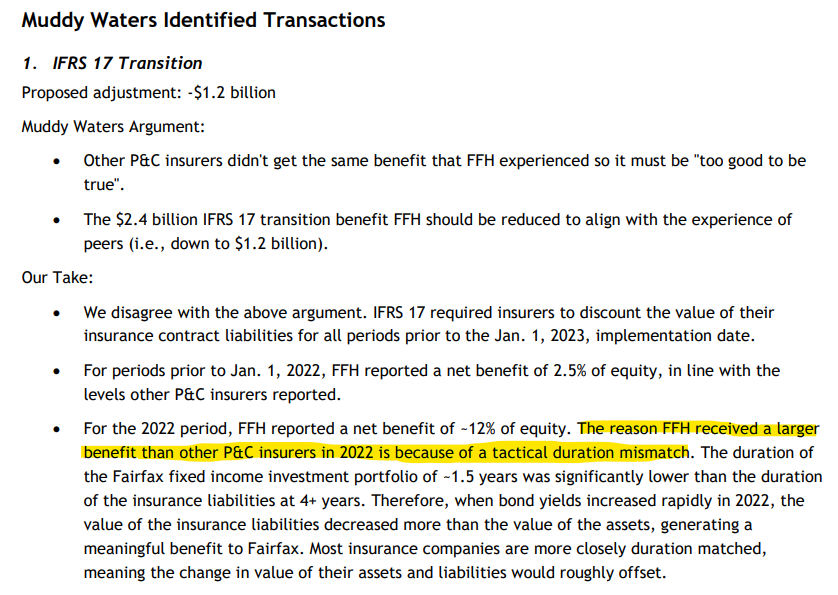

2.) What is the size of IFRS 17 impact?

TBD - but not a concern

"In the fourth quarter of ’23, the net earnings of $1.3 billion included pre-tax net expense of $781 million, and the net earnings in the full year of 2023 of $4.4 billion included a pre-tax net benefit of $210 million related to IFRS-17. The pre-tax amounts are reported within two financial statement lines in the consolidated statement of earnings."

It seems that this item has reversed back quite a bit in q4?

-

2 hours ago, benchmark said:

I need to go to Bangalore for business, but wants to spend around 10 days after to explore the country. Which area is too hot to visit during that time?

https://en.wikipedia.org/wiki/Hampi

I really liked this place and remember traveling to it via Bengaluru.

-

12 hours ago, Luca said:

Second bullet: "The aggregate projected loss of the top three concentrated stocks (and their derivatives) will be compared to what would otherwise be the aggregate portfolio margin requirement, and the greater of the two will be the margin requirement for the portfolio."

Does this mean that for an account, with a large position in FFH, margin requirement will be calculated as if it's top 3 positions were zero: at the extreme no margin, if an account has less than 3 positions, or a big reduction of it, by zeroing top 3 positions? Is this normal/common practice by IB?

-

Rotated some META into more FFH:)

-

-

14 minutes ago, MMM20 said:

It might also partially explain the low quality of the work vs. some others we’ve seen from MW.

+1:)

-

8 minutes ago, MMM20 said:

Low short interest just means it’s not a highly shorted stock and the borrow cost is probably cheap. In other words, it’s a contrarian short (at least not a crowded one) which is the best kind if you’re proven right.

Yes, but didn't they supposed to accumulate their position (short) before the publication?

8 minutes ago, MMM20 said:In this case, I think the odds are good that some big fund with a ~$50-100mm short decided to exit before earnings and therefore paid Muddy Waters to publish this (during the quiet period). This is quite common and somehow legal, though regulatory changes are apparently in the works right now.

This seems plausible and maybe also would explain the quality of the work:)

-

So I was reading about this whole situation and allegations (which seems quite silly and bizarre, nothing to add, and many thanks everybody for discussion on it), but one thing, if true, I do not quite understand:

"Block appeared on CNBC on before markets opened Thursday to reveal his short position. Data compiled by Bloomberg show that 0.7% of Fairfax’s float was shorted as of Thursday morning."

"Fairfax currently has a short interest of 0.65% of free float worth C$203.81 million ($151.36 million), with short sellers having made over C$21 million in paper profits so far today, according to data from Ortex."

How does this short selling operation even make any sense, If short interest is really so low?

-

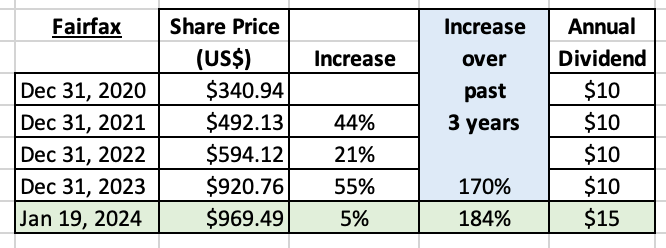

21 hours ago, Viking said:

Fairfax: The Big Fish that Got Away?

“The stock market is there to serve you and not to instruct you.” Warren Buffett

Investors have lots of regrets. Missed opportunities. Not buying a stock that afterwards turns into a big winner. Or selling a winning position way too early. ‘The big fish that got away’ kind of story.

In 2021, Fairfax’s shares returned 44%. An investor looking at Fairfax in early 2022 might have concluded ‘dang, missed that one!’ and not invested.

In 2022, Fairfax’s shares returned 21%. Most stocks got crushed in the bear market of 2022, so Fairfax’s performance compared to the averages was exceptional. That same investor, looking at Fairfax in early 2023, might have come to the same conclusion: ‘dang, missed that one! For the second year in a row!’ and not invested again. The fish story just got bigger.

Well, here we are now in early 2024. How did Fairfax's stock do in 2023? It was up another 55%. Over the past three years shares are up 170%. Investors who did not buy shares (or sold their position too early) over the past three years are left asking themselves what happened? How did they miss out? And what should they do now? The fish story is turning into a whopper of a tale.

Three weeks into 2024 the stock is up another 5%. This puts the total increase at 184% since Dec 31, 2020, making it almost a two-bagger in Peter Lynch’s parlance. Fairfax, the ‘big fish,’ continues to taunt investors.

What is the lesson to be learned?

By itself, the increase in Fairfax’s share price of 184% since Dec 31, 2020, tells you little (nothing?) about Fairfax’s valuation today. This is because price (if used by itself) is a terrible valuation tool. Over the past three years, 'investors' who used price as their primary valuation tool for Fairfax have been led astray.

As Buffett teaches us, a stock price exists to serve investors, not instruct them.

Let’s take the discussion in a slightly different direction to see what we can learn.

What happens if we increase the timeframe?

Let’s humour ourselves and play the price game for a little longer. But this time with a couple of added twists. Let’s zoom out - instead of looking at Fairfax’s share price for the past three years, let’s look at the share price for the past 9 years. And let’s include operating earnings - let’s make our analysis a little more robust.

From 2015 to 2019 (right before Covid hit), Fairfax’s share price traded in a pretty tight band around US$500. About 50% of the time Fairfax’s share price was over $500 and the other 50% of the time it was under $500. So for 5 years straight investors felt Fairfax was worth about US$500/share.

Over this 5-year span, operating earnings at Fairfax averaged about $1.07 billion per year. So from 2015-2019, investors felt $1.07 billion in operating earnings warranted a Fairfax share price of about US$500.

Let’s now compare this historical period to today to see what we can learn.

Let’s start with the share price. Fairfax’s share price closed today at about US$970/share. The stock is up 94% from the average of about $500/share from 2015-2019.

Let’s now look at operating earnings. Operating earnings are forecasted to come in at about $4.4 billion for 2023. That is an increase of 305% from the average of $1.07 billion from 2015-2019. My current estimate is for operating earnings to increase in 2024 to about $4.6 billion. Because the share count has come down meaningfully in recent years, this would put operating earnings per share over $200/share in 2024. This is 359% more than the average from 2015-2019 (about $44/share). Importantly, the increase in operating earnings is durable (the average duration of the fixed income portfolio was increased to 3.1 years in October 2023, which locks in interest income for the next couple ofyears, the largest component of operating income).

Let’s put the two together.

Fairfax’s stock is up about 90% over the past 9 years. And operating earnings per share - the high quality stuff - is forecasted to be up 359% (over the trend from 2015-2019). High quality earnings have exploded and the stock price has increased modestly.

Valuation: Buffet teaches us that a stock is worth the present value of the cash flows (things like operating earnings) that are expected to be generated in the future.

Conclusion

Looking at Fairfax’s share price and using a 3-year time horizon it is easy to conclude the stock must be crazy expensive today. Looking at Fairfax’s share price and using a 9-year time horizon (and including operating earnings) it is easy to conclude the stock must be crazy cheap today. How can it be both crazy cheap and crazy expensive at the same time? The answer, of course, is that it can’t be both.

Let’s circle back to my original comment - using the share price, on its own, as your primary tool to value Fairfax is pretty dumb.

As we begin 2024, that big fish (called Fairfax) is once again staring investors right in the face. And guess what? It’s probably going to slip away from them yet again. And in another couple of years, they will think back to today and likely kick themselves. And the story of ‘the big fish that got away’ will get even bigger.

—————

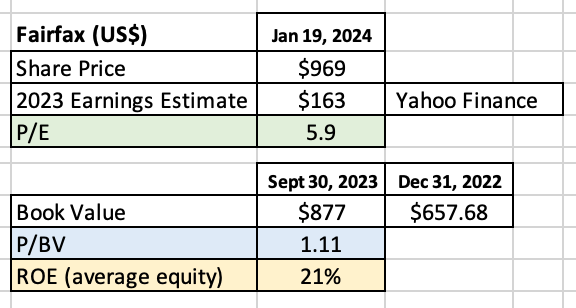

How do the traditional valuation metrics look today?

Fairfax’s stock has a PE of 5.9 (to Yahoo Finance’s estimate of 2023 earnings). The ROE for 2023 is tracking to be a little over 20%, which is very good. Price to book value (P/BV) is 1.11, which is very low - and this could come down to around 1.05 when Fairfax reports Q4 results in a few weeks.

Expensive? Really?

—————

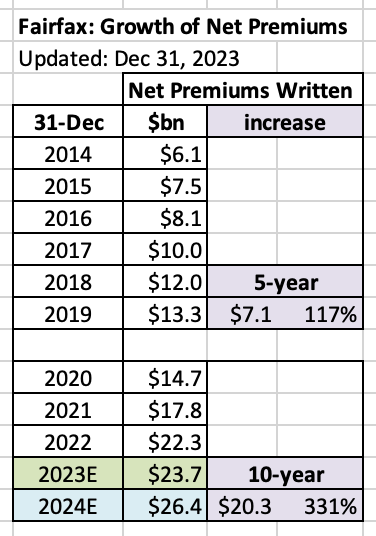

What happened in recent years to spike operating earnings so much at Fairfax?

Lots of things. Below is one of them. Fairfax is a P/C insurance company. Net premiums written have grown from $6.1 billion in 2014 to an estimated $26.4 billion in 2024 (my current estimate), an increase of 331% over 10 years.

Now over-lay this exceptional growth over 10-straight years with the much more modest increase seen in Fairfax’s stock price over the same time frame.

Things that make you go hymmm…

Great post! Thank you!

-

Nice start of the year!:)

-

It was a very good year:). Up 74 percent pretax in EUR.

META & other from magnificent 7, FFH, JOE, BRK and some lesser/more speculative things. Also was ~120 percent invested at the start of the year.

Big thanks to Parsad, Viking, Gregmal, gfp and many other participants of this wonderful forum!

-

1 hour ago, dealraker said:

Since the online investment world came about I've consistently underperformed as per my reading and observations. Before that I was embarrassed by the person-to-person interactions as to yearly performance.

1 hour ago, dealraker said:Suck it up and move on is the game I play; grit and grind...sneak around and meekishly hide in the shadows from the out-and-about peformance bunch.

LOL. Thanks!

-

All across Wall Street, on equities desks and bond desks, at giant firms and niche outfits, the mood was glum. It was the end of 2022 and everyone, it seemed, was game-planning for the recession they were convinced was coming.

...

Blended together, these three calls — sell US stocks, buy Treasuries, buy Chinese stocks — formed the consensus view on Wall Street. And, once again, the consensus was dead wrong. What was supposed to go up went down, or listed sideways, and what was supposed to go down went up — and up and up. The S&P 500 climbed more than 20% and the Nasdaq 100 soared over 50%, the biggest annual gain since the go-go days of the dot-com boom.

...

For some on Wall Street’s sell-side, doubts are creeping in. At TD Securities, Gennadiy Goldberg, now the head of US rates strategy, said he and his colleagues “did some soul searching” as the year wound down. TD was among the firms predicting solid 2023 bond gains. “It’s important to learn from what you got wrong.” What did he learn? That the economy is far stronger and far better positioned to cope with higher interest rates than he had thought. And yet, he remains convinced that a recession looms. It will hit in 2024, he says, and when it does, bonds will rally.

-

Merry Christmas!

Berkshire Hathaway Annual Meeting 2024

in Berkshire Hathaway

Posted

AAPL holdings reduced by ~13 per cent?