BG2008

Member-

Posts

3,039 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Everything posted by BG2008

-

Some Foodie Instgrammers https://www.instagram.com/theskinnybib/?hl=en https://www.instagram.com/luxeat/?hl=en https://www.instagram.com/davidchang/?hl=en https://www.instagram.com/steveplotnicki/?hl=en https://www.instagram.com/wyahaw/?hl=en https://www.instagram.com/chefjgv/?hl=en

-

Best restaurant is also situational There are days when you are just craving for a salty fatty bowl of ramen on a cold winter day There are days when you are traveling along the east coast and you just want a bowl of mussels and a lobster roll (foie gras doesn't really cut it) When you want to be dressed up for a special occasion, then yes a 3 Michelin star restaurant experience would be great There's also the evolution of palates, when I was 18, I have woken up and ate a bloody steak for breakfast. Basically red meat was a must for lunches and dinners. As I have gotten older, I appreciate seafood and vegetables much more. I also appreciate what goes into a 3 Michelin star restaurant's preparation much more. When I was 18, I would've said, I still feel hungry after a tasting menu. At my age today, I would note on how the chef prepared the fish. Each plate and each bite is the result of a chef's creativity and their execution. For those of you that want to follow this more There's a Netflix documentary called Foodies. I follow Aiste on Instagram now. BTW, my admiration for TV chefs have gone way down in the last 10 years. Steve Plotnicki has an interesting list for ranking restaurants Andy Hayler has eaten at all the 3 Michelin star restaurants

-

This might be better use of time than some of the investment (??) threads you know. 8) Yeah, probably true. FWIW I've never been there, but this restaurant in Spain (Asador Etxebarri) where they cook everything on the grill has been on my wish list ever since I read about it. Chef's table on Netflix is great. https://en.wikipedia.org/wiki/Chef%27s_Table There is an uncanny similarity between emerging fund managers and those guys profiled. They are intensely dedicated to their craft. Their restaurants almost failed before they get their 2/3 stars. And the 2-3 star restaurants are probably less profitable than I have originally envisioned. I particularly self identify with Anexandre Couillon (La Amrine in France). Couillon means moron in French (turd according to Google translate). No body cared about his craft for years until a Michelin diner gave him a star. That obscurity lasted 7 years.

-

You guys are a-holes for having this thread. I'm going to waste so much time on this.

-

This comment needs to be highlighted. For all of those that thinks buy vs rent is simply a number/financial decision, it's not. This especially applies when the decision involves your SO and your kids.

-

Hey! At least we aren't Gary, Indiana! But ya, agree with what you said and always nice to read your views on real estate. I am definitely biased against nearly any RE-based investment idea. I think local RE conditions have made me jaded on the whole asset class. Rochester is a particularly unique RE market where prices seem to go up 1%-2% annually over almost any 5-year period. Never much more or less. I mentioned Rochester specifically because I stayed with Packer and we drove around. He mentioned that home prices barely moved during his time there. We drove through endless plots of land and it made sense that there are almost zero barrier to entry. Very few markets are like SF, NYC, and London where people want to go to and live there. I worry about concentration risk. With the new tax policy punishing high cost coastal cities, I wonder if I'm better off with Texas, Nevada, and Florida. What's critical today is that so many jobs can be done remotely. Take myself for example, there is no need for me to stay in NYC. I can run a fund in the states like Texas, Nevada, and Florida. The fact that my whole family is here and that fact that you can get soup dumplings at midnight is what's keeping my wife and I here in NYC.

-

I will share some personal experience. 15 years ago, my best friend and I were both recent college graduates. We both noticed that our parents and family built up wealth by investing in real estate. We do not really understand why, but people who own real estate just seems to be rich or better off. This is 2004. We were both working in the NYC area. Now, let's put things in perspective, interest rate in the US went from teens in the 80s to about 6% during that time. So any real estate buy decision is a genius move in hindsight. In 2004, the US just lowered its interest rate after 9/11. These are important context. It's also important to point out that the US has 30 year fixed rate mortgages. With family help, my friend and I both bought property. He bought on Long Island a suburb of NYC accessible by train. And I bought in Queens, NY a burrough of NYC accessible by subway. Commuting into NYC cost $2 for the subway and $6 for the train. I bought in an ethnic neighborhood with predominant working class immigrants. My friend bought in a middle class neighborhood where people tend to own. His carrying cost, lawn, property tax, misc fix are rather high. $15k total for a single family home with 5-6 rentable bedrooms. My is less than $2k. His renting window is to get six students at a local college to share the rental of his house. My renting window is constant since my building is a 5 minute walk to the subway station. At one point, we both lived in the city. When stuff breaks, he has to go fix it which takes longer. When stuff breaks, I tend to have some handyman who can go in my place. I tend to have family who can help out. I'm a bit more handy than him. The 2008/2009 recession was really the divider between our investments. I had to deal with some issues like theft/robberies of my tenants. Things got stolen and crime went up a bit. By the way, back when we bought. My neighborhood in Queens would be considered kind of "too ethnic" for most people. He bought in our hometown which is a 1/3 Catholic, 1/3 Jewish, 1/3 Protestant. Over the years, I've had 99-100% occupancy. The longer the years go on, the higher the occupancy rates goes. My tenants don't want to move. If they do, I put a For Rent sign up and I get a tenant in there in a few days. My friend has a 4 week leasing window. If he miss out on that, he loses rent for the whole year. His best outcome is if the existing tenants "pass down" the house to new undergraduate or graduate students. He once rented to the dance team at the local college, as single guys in our 20s it was always fun to go repair stuff and chat up with the gals. As married men with kids now, this isn't a perk anymore. New York City really took off after the recession. The suburbs recovered much later. But the issues of not being able to rent so easily drags the value down. He gets stressed out from having to constantly get tenants every couple of years. Also, his tenant base is very unique. Most people don't rent on Long Island. If they do, you find some of the sketchiest people ever. The one that can pay and makes a lot of sense to rent are servers. But they look to party and will literally destroy your house. We had to rent out our family home when we moved into the city. Our house got trashed and I had to act like an asshole to get the 20 year old party animals to move out. After a few years, his house barely appreciated and my building has appreciated by 80% over 10 years. Given that we both bought at the peak of the housing bubble, I think I did much better than he did. What is the takeaway? 1) What is the prospect for rent growth over time? All real estate is local. You need to pay attention to the local dynamics. Is the area getting gentrified? Is there a big corporate client moving their HQ there? HQ2? Is there an emerging art scene? Is your place hidden? Are they building a new train stop? 2) 30 year fixed rate mortgages are awesome. Exploit them if you can. If you can't get them in your country, the decision gets trickier. 3) Long term trends really matter and probably matter more than the discount you get initially. If you feel that a neighborhood is starting to go bad or start to gentrify, those characteristics maybe more important. 4) Cover your mortgage payment. If you can cover it, then the asset becomes a call options (30 year fixed mortgage, does not apply to 5 year trends). The dynamics that I outlined is very different if you live in a non-land constraint area. If there are endless supply of land, then you need to buy at a high cap rate. What appreciates over time is land value, not the interior decoration. The appliances and interior really do depreciate. As yourself, are there more land? Ask yourself, will it cost more money in the future to put up a structure and pay for all the labor and materials? If you live in a city like NYC, Londong, SF, then the answers point you in a specific direction. If you live in Rochester NY, the answer point you in another direction. This is why I hate those rent vs buy calculators. People need to think, how hard is it to rent? Is the area getting better or worse? What kind of financing do I have. If I need to move, can I rent it to someone in 30 days? For the right situation, buying a piece of RE is a "buy it and forget about it" type of investment that compounds in the teens for 10-15 years. Another anecdote, my family are barely getting by in my teens. We took some risk and bought some properties. We're not the Trump family today. But we're doing okay. We collect rent. As we get older, as I look at my friends from college who are highly educated. They moved to the city and never bought property. They still pay rent today. In away, the poor immigrant family now rent property to the college educated middle class. I think you need to reverse engineer why that happened. I suggest looking at your local town/city and see if it's a high quality compounder with ability to increase rent over time or if it's a suburb where everyone will own their property. If you look at your own town/city and try to determine whether it is a high quality company or a low quality company and think in terms of barriers to entry etc. You may find that buying is a good decision as long as you have the staying power to hold onto it for a long time.

-

As someone who loves seafood, the thought of MCD depleting all the shrimp in the world scares the heck out of me.

-

Buffett's 10K -> 51M S&P calculation seems wrong

BG2008 replied to Graham Osborn's topic in Berkshire Hathaway

Have fun with this attachment guys What was very telling when I analyzed the attached data points is that you can have 10 year CAGRs of -1.4% and -1% in the year ending in 2008/2009 in you own the S&P 500 index with dividend reinvested. The other 10 year CAGR that was negative was the years ending 1938 and 1939 with -2 and -1% 10 year CAGRs. My key takeaway from investing in the S&P 500 index is that when you go out 15 years, the worst CAGR is -0.2% over 15 years and there are some low single digit 15 year CAGRs like 2% in year ending in 1944, 0% in 1943, 4% in 1974, 5% in 1978, between 4 and 5% for the years ending in 2011 and 2015. This was a bit surprising given the preaching of long term holds. I think 10 and 15 years are pretty long and yet the S&P 500 index can produce negative and low single digit returns. What's my take away from this. I think the S&P 500 is not some perfect solution for everyone. In the real world, people have to pay to eat, the IRS, and send their kids to college. So you can't reinvest every single dividend. With the personal expenses and inflation, if you generated -2 to 5% CAGR over a 10 or 15 year period, I think you became a lot poorer. The other take away is that when the S&P hits a hot decade, it can have 10 year CAGRs of 18-19% like the years ending in the 1997-2000. That blows my mind a bit. Historical_SP_500_returns_For_Corner_of_Berkshire_and_Fairfax.xlsx -

Rock Pits returns come from the land parcels once they are done mining on them. You won't find that in the ROA. Try using ROA on any REIT. You'll think real estate people are retarded. This is my biggest pet peeves with ppl who overly focus on ROA and ROE. Accounting can be weird for particular industries like RE or companies that are rolling up competitors and have a ton of amortization. Pricing power is volatile? Vulcan Materials increases their unit price in 2009 when their volume got cut in half! I guess sometimes you should just forget about the ROA and look at who's rich and stays rich over time and what they own. I would speculate that there are a lot of 3rd generation "ham sandwich" heir that own rock pits. Do people have other powerful insights from reading that they can share?

-

I was browsing the reading list and it dawned on me that I owe one of my punchcard investment success to reading Peter Lynch's book. He said that Rock Pits are great businesses because it sells for $10 a ton, but it cost another $10 a ton to ship. So a rock pit owner has tremendous pricing power. He can draw a circle that is roughly 50 miles and no one from outside of that circle can compete with him. He can basically raise his pricing power up to the trucking cost of the competitor bringing rocks into his territory. In short, Rock Pits businesses are either monopolies, duopolies, or oligopolies depending on how many are in a local market. This invaluable concept made so much sense and I was able to absorb it so quickly that it lead me to dig deeper into FRP Holdings Some sell side analyst had valued the rock pits at $25mm based on some DCF with 10% discount rates. I came up with a value that was closer to $200mm. At the time, the market cap of FRP Holdings was only $300mm. So this was a big swing factor in my analysis. FRP Holdings was at one point 80% of my IRA. Are there other concepts like Rock Pits, Mr. Market, Network Effects, etc that are very important yet very readily understood that you have come across either in reading or in business where the light bulb just went on and you're like Holy Crap! Please Share!

-

Well, at least you have bragging rights, right? Or is it worse to be right but have made almost no money than not to have invested at all..? :-\ Somewhat off-topic, but "having bragging rights" reminds me of this comic about exposure: http://s3.amazonaws.com/theoatmeal-img/comics/exposure/exposure.png This made me feel a little bit better about not having 30 baggers. I've done 2x a few times where I've sized the position at 10, 20, 30%. They really move the needle when they are sized large.

-

My CHTR thesis is something along the line of: Some business' replacement value is very real and compounds over time. This is typical of businesses that require a lot of blue collar construction labor, materials cost, political zoning, scale, and right-of-way. One way of looking at CHTR is kind using a railroad analogy. No one in their right mind today will go out and build another railroad. It simply can't be done. Railroads has structural advantage over trucks (although self-driving cars may erode or even usurp this advantage) due to lower cost. You can't go through towns etc because they are not the wilderness anymore. They are populated and you can't use eminent domain and get all the politics lined up to build a railroad. My thought is that you can't do that with cable today either. Imagine going to residents and say "I'm going to dig up your roads and bring in all this loud noise etc" to build a competing network" Please give me permission to do it. Also where do you find the labor? Apparently we don't have tough blue collar guys left who knows how to work with their leathery hands. We have a bunch of wimpy millenials these days. They have no efficiency in digging ditches etc. What this all implies is that as time goes on and populations get denser and more buildings get built and the roads gets traveled more, it becomes ever more difficult for people to go out and dig up roads and climb up poles and connect coaxial cables or lay down fiber optics. This is a true case of a replacement cost being real, tangible, and compounding over time. The 5G stuff that could be a threat, if I remember correctly from my "physics of waves" in college. Basically, lower wavelength can't penetrate buildings unlike long radio waves. So you need lots of little antennas and you need lots of power. If you want to build it from scratch, how do you get access to buildings? How do you get permission to mount stuff on buildings, light posts etc? Where do the labor come from? What if YOU ARE the cable company. You have the access point already. You are sending a tech out to repair something already. I think these are overwhelming structural advantages that only compounds over time. This implies price hikes over time. If I learned anything about owning real estate in a land constraint location (NYC) is that if you're able to pass through 3% price increases a year and you leverage your assets the right way, everything else takes care of itself. Rant over.

-

Is the paint industry really competitive when everyone plays nice? I'm trying to figure out what is it in the structure that allows everyone to play nice? I'm starting to notice that any industry that is heavily consolidated with 3-5 major players where it is hard to bring on new capacity can do quite well over time even if it seems like the industry is competitive. Car rental is heavily consolidated yet they try to under cut each other all the time. Regarding the financials, I simply took a peak year and a bottom year and compared the two. I would beg to differ that painting is not such an expensive product. I would say that it is cheaper relative to knocking down walls and putting in fixtures. But it's still a $500-$2,000 cost to paint a 1,000 sqft space. Where I live, that's really just for the supplies and does not include the labor.

-

I downloaded 30 year financials on Sherwin Williams from Gurufocus and I was astounded to learn that Sherwin Williams revenue only fell from a peak of $8.0bn in 2007 to $7.1bn in 2009. Given how the housing bubble bursting put a screeching halt to new construction and how most people will probably elect to defer painting their homes in 2008/2009, why did the revenue held up so well? What is it about the paint and coating business that makes it such a good business? The ROA and ROE are just astounding. I know that Sherwin actually pushed through price increases in 2009. Sherwin_Williams_30_Year_Financials.xlsx

-

China Says Anbang’s Founder Defrauded Investors of $10 Billion

BG2008 replied to alpha's topic in General Discussion

It's funny how similar this is to the Japanese acquisition of US RE property at market peaks. History doesn't repeat itself but it often rhymes. -

Does anyone know why Valuewalk is so Spammy lately? I get 2-3 e-mails a week from them and frankly the content is more along the line of Cryptocurrency and No Fail "5 Year" retirement plan. What happened?

-

Speaking to start-up hedge funds - what to look out for

BG2008 replied to tol1's topic in General Discussion

I think the most important thing is qualitative and character related. I am assuming that you are considering joining a start up fund in a role of co-founder, partner #1-5, or as a primarily asset raiser. In case these are correct assumptions, I would suggest that you try to figure out the following: 1) Who are you getting in bed with? Is the guy/gal someone that you would let your wife and kid manage money with in case you got hit by a bus. If the answer is absolutely yes, great. If the answer is no or maybe, you're probably better off not going forward and I can save you a lot of time. Keep in mind, there are two aspects to this. One is the your perception of the person's ability to compound capital on a risk adjusted basis over a long period. The second part maybe more important, the person's character. There are a lot of people who will pass the first test by a mile, but I will not partner with them due to the second part. If they are the takers type in the classic taker, giver, and matcher examples, I would suggest that you back away. A taker will try to take something from you at every opportunity. 2) What is your role? Will you be co-portfolio managers? If yes, I would recommend you stop. The track record of Co-Portfolio managers is terrible. I guess it's because the fund eventually run into performance issues. Then the finger pointing starts. If you are the sole CIO, then you look in the mirror and you said, I screwed up, let's regroup and move on. Investment by committee is usually a terrible idea. This doesn't mean that you can't let your trusted friends smell test your ideas. I actually endorse smell test by your friends. Typically roles where your function is vastly different than your partner tend to work better. For example, your partner does all the capital allocation and you bring the fund raising capabilities. Those relationships tend to be healthier and enduring. The only example of co-portfolio manager that seems to have endured and prospered is Scoggin Capital Management. 3) How will you guys pay bills? What about the most basic research items like travel and subscriptions etc. What is the AUM at launch date? Do you have W-2 wages now? Just understand that you maybe going from a stable paying job to something that is likely bootstrapping. You generally need $10-20mm of AUM to kind of pay for expenses and pay yourself a living wage assuming you guys actually charge a management fee. This is lesser of an issue if you guys have a good chunk of savings yourself. I think if you are very passionate, this is lesser of an issue. I think item 1) and 2) are deal breakers. Item 3) is more along of the line of how willing am I to live below my means for an extended period of time. 4) Follow the the advice others have mentioned. Once you're past 3) I think you're good to follow the process and line of questions that a job seeker at a HF would consider. -

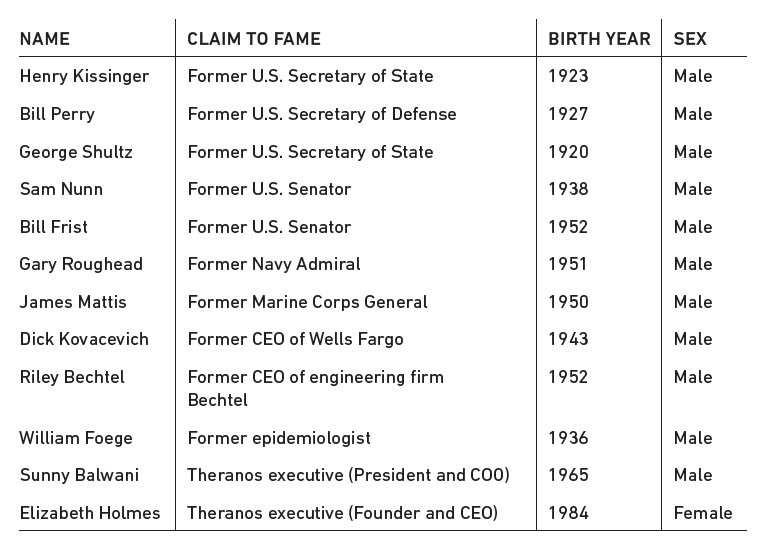

I wonder what would've happened if they had a woman on the BOD. Maybe another female would've smelled the bullshit? That's a pretty crazy BOD of who's who.

-

There's a big difference between selling a future dream/vision and lying about past and present facts. I think that's where Theranos crossed the line. If you read SEC's complaint, they highlight multiple instances of egregiously false statements originating from the top, just to keep the story alive. Theranos went beyond simply "highlighting the amazing stuff." It began fabricating facts that it knew didn't exist. For instance, Holmes told that Theranos’ technology had been deployed by the DOD in Afghanistan when that was never the case. I don't know if Bezos ever made factually incorrect claim, that he knew was false, to raise capital. Such lies are not the same as consistently overestimating future production levels because investors treat, or should treat, a statement of fact issued by a company differently than forward looking projections. There's a HUGE difference between saying "our company has $1B cash on the balance sheet today" VS "We predict our company will have $1B cash on the balance sheet by next year." I think the only reason Theranos' BoD were such accomplished heavy weights (that had nothing to do with the medical field) was to keep the story alive and to fly under the radar for as long as possible while arousing minimal suspicion. Textbook definition of a "con artist." Lie about the future - No biggie Lie about the past - Jail Time Likely

-

Tilson's latest intrinsic value on BRK as at 27 Feb 2018

BG2008 replied to kiwing100's topic in Berkshire Hathaway

Is the intrinsic value increase of 6% appropriate? It seems like it should be higher from my experience (assuming no market collapse which will drag the equity portfolio down significantly). -

Thanks for the note. I'll reach out to Gio

-

"If you're going to somewhere like Naples, then you do want to be a bit more careful than Milan." - Could you elaborate on this? Could you elaborate on the pick pocketing? Ways to lower the chance? I've gotten my stuff stolen in Spain before. It's annoying because you have to get new Drivers License, CC, etc. Anything else I should be aware of? Generally, we're doing a Milan, Venice, Rome, and Florence trip I want to clarify and give a perspective on my question. If I had a good friend booking a flight to NYC and they said that they were about to book an Airbnb in East New York and will take the subway to Manhattan. I would tell them "hold on a minute." I would also tell them don't make eye contact with people asking for money. Once you make eye contact, they know they've got you. I have no idea what it is like in Europe. As a value investor, I am just trying to do the best for my family with the research and risk mitigation etc. In short, I don't want to book a nice AirBnb in the European equivalent of "East New York." Yes, there are more No-Go Zones in the US.

-

What about GE? Yes, there's a lot of issues. But they tend to be #1 or 2 in most of their product categories. Clearly Immelt has been a waste of space for the last 15-20 years. I remember him speaking to my Mech/Aero engineering class at Cornell in the early 2000s. I always felt that Welch's shoes were too big to fill. Maybe 3G's strategy may actually work at GE by streamlining that business.

-

Well, it is the most important investment.