LearningMachine

Member-

Posts

1,747 -

Joined

-

Last visited

-

Days Won

6

Content Type

Profiles

Forums

Events

Everything posted by LearningMachine

-

Thank you for sharing. Great how it called out interesting parallels to today that led to 1989 Nikkei 225 peak of 40,000 in Japan: "[S]ince interest rates remained low and the rising yen discouraged investors from taking their money abroad, the Japanese people were left with no alternative but to continue investing in the domestic stock market." "Nomura had five million loyal domestic customers, mainly Japanese housewives, who daily put their savings into special Nomura piggy banks, played stock market computer games on Nomura software, faithfully followed Nomura's stock tips…" "Encouraged by low interest rates, people took out fresh loans against the equity of their homes." Nikkei 225 subsequently fell by 80% to 7700 over the next 13-14 years by 2003 even though the "Official Discount Rate was successively cut until, in September 1995, it reached an all-time low of 0.5 percent. The rate remained unchanged until September 1998, when it was cut to 0.25 percent."

-

What do folks think Li Lu means by following? Is he saying Chinese indexes are not good to invest in because China hasn't yet "entered the modern age," or is he saying they are good to invest in? Chinese indexes haven't gone anywhere over the last 10 years. Wonder if it is because companies have been making false accounting statements/projections, companies have been printing shares, CCP hasn't been letting companies exercise pricing power, new companies have been entering at a fast rate & increasing competition, existing companies have been expanding & competing too much, P/E multiples have compressed, or something else? Has anyone looked into it?

-

20210629 CNBC interview with Warren & Charlie?

LearningMachine replied to kiwing100's topic in Berkshire Hathaway

His comments about Jack Ma and communists were indeed the most interesting parts :-). I also found the following interesting: -

Different instances of the same reinforcement-learning based AI model also generates a 'range of answers' just like different instances (humans) of same/similar reinforcement-learning based human neural net. Even the same instance of the reinforcement-learning based AI model will also generate a 'range of answers" as it learns or accumulates bias just like the same human neural-net can generate a 'range of answers' as it learns or accumulates bias. I believe if you've enough computation power and signals, you can model human behavior. What some of the tech companies do today in terms of rewarding reinforcement-learning based neural nets for being able to predict and get human neural-nets to do what it wants to do is a start of modeling human behavior. Over time, I think human neural nets will be no match for silicon-based neural nets that have access to way more data and computation power.

-

Thank you @Cigarbutt and @Gregmal for sharing. This is a fascinating multi-disciplinary look at the issue. I haven't read the book yet, but have been thinking about this topic through the lens of multiple disciplines, including the ones you mentioned. I'm still synthesizing, but the discipline that has helped me the most so far in reaching a deeper understanding here was probably AI. When trying to improve accuracy & precision of decisions made by AI neural nets running on silicon-based-computation, sometimes you go back and try to figure out what led to each incorrect decision. Sometimes it might be noise or bias in your raw input, a lot of times it might be missing signals, and other times it might be an issue in one of the intermediate signals in your machine learning ensemble or one of the layers of the neural net. The interesting thing is issues end up being some of the same things @Cigarbutt mentioned above for human neural nets running on hydrocarbon-based-computation. One of the most fascinating moments for me was when the team was analyzing an incorrect decision made by AI to try to figure out why it made the incorrect decision, and then the team realized that the decision made by AI was actually the right one and the human expert in the team had made the wrong decision and labeled it incorrectly. The look on the human neural net's face was priceless :-). He was defending his decision up to some point, but finally went all red and said, "Humans can't get all decisions right, you know." When silicon-based-neural-nets can start outperforming hydrocarbon-based-neural nets for some decisions at such an early stage of AI, it really makes you realize that maybe life is broader than our hydrocarbon-focused view.

-

Buffett/Berkshire - general news

LearningMachine replied to fareastwarriors's topic in Berkshire Hathaway

I'm curious here too. Because he did this in an IRA account, I wonder if he was willing to hold things for much shorter time periods as he didn't have to worry about capital gains? What do folks think? Also, has anyone figured out a way to distinguish between Ted's and Todd's investments on the Berkshire 13F? Do we know any of the investments in Berkshire portfolio that were definitely made by Ted? Also, wonder how was Todd's record before Buffett took him on? I wouldn't be surprised if he looked for a great record there as well. -

Buffett/Berkshire - general news

LearningMachine replied to fareastwarriors's topic in Berkshire Hathaway

Thank you for sharing. Almost 30% annual return over 35 years without having to worry about taxes. -

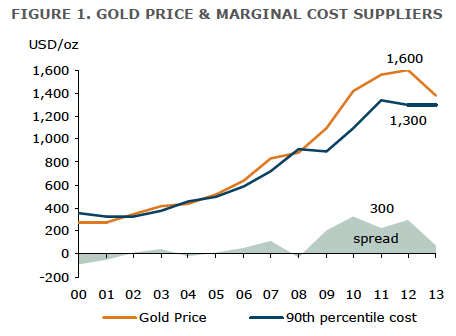

@spartansaver, that is a good point. Turns out gold production has gone up lately, and there was also gold production boom in 1970s. Your point is taking me back to my earlier comment that there are really two different logical premises here: (a) Buy gold below or around marginal cost of production for all production at the time ---> You will not lose money (b) Buy gold below or around marginal cost of production for amount of supply needed by tech, jewelry & industry --> You will not lose money I think arrow (b) is much stronger and more likely to withstand test of time than (a). Looks like you might be implying that as well.

-

I wonder if gold price has even stronger correlation with the the answer to the question whether the price is below or about same as marginal cost of production? In other words, if you buy close to or below marginal cost of production, does it ever drop a lot from that? I thought data would be hard to get, but then I just did a Google search and found this article that I don't have full access to but was able to snap the picture and text before access went away. Normally, I wouldn't place any credibility on a SeekingAlpha article, but this article does have references to original sources of data. The article goes on to state, "The gold price has always followed the marginal cost of suppliers throughout history (figure 1). The correlation between gold prices and gold mining cash costs between 1980 and 2010 stood at 0.85, which means that the correlation is quite high (source: CPM Gold Yearbook 2011)." Source: https://seekingalpha.com/article/1472081-gold-prices-finally-hit-marginal-cost-of-production I'm wondering what would be that correlation between the answers to the two questions I posed at the beginning? Even higher than 0.85?

-

How long do you think it would take for profits to double? If 10% inflation and subsequently 10% risk-free rates really happen, discount rate will have to be more than 10%, i.e. P/E could go below 10 like it did in 1974. So, I should really be asking how long do you think it would take for profits to triple or quadruple given today's Shiller P/E is 37.47 and S&P 500 P/E is 44.88 at https://www.multpl.com/s-p-500-pe-ratio. Any chance we might get opportunities in the years it takes for profits to double, triple or quadruple to get to appropriate P/E for the new inflation rate/interest rate/discount rate?

-

-

@no_free_lunch, for probabilities, looks like you are saying: p1=50%: Mild inflation in 3-4% range for 5 years p2=20%: High inflation in 5-10% or higher range at some points in the next 5 years p3=30%: Inflation below 3% Let's go further and assume conservatively in the p2=0.2 scenario that gold will go to $3,528 (2x of $1,764), and that in p1+p3 scenario (0.5+0.3=0.8), gold will go down back to around $1200 (68% of $1764). Then, the expected value gold will get to is (0.2 * 2) + (0.8 * 0.68) = 0.4 + 0.544 = 0.944, i.e. 5.6% loss To get to break-even expected return on buying gold with these probabilities, you have to buy Gold at $1600 (so that downside $1200 is only 75% of paid price). If you wanted expected return to be positive on these probabilities, you have to buy Gold below $1600. $1200 purchase price would be ideal because that's the price it stablized before, likely because that's when it started approaching production cost for high-cost miners. I understand this might not be applicable to @wabuffo and @Spekulatius as they believe minimum gold price has nothing to do with marginal cost of production. I think marginal cost of production still matters for gold. I do think if gold production were to shut down completely, e.g. if gold price dropped to $800, jewelry, tech & industrial uses will start to drive price up to restart production unless central banks & investors were selling at that time for those uses.

-

Inflation expectations are at highest they have been since 2004. So, both (1) monetary supply and (2) inflation expectations criteria are now being met to get inflation going... https://trends.google.com/trends/explore?date=all&geo=US&q=inflation

-

Here is how I worded my Scenario 2: "High inflation in 5-10% or higher range at some points in the next 5 years (p2= 65%?)" I'm not saying don't buy stocks at all. I'm saying Scenario 2 has a 65% probability of happening, and interest rates have a high likelihood of following at least at some points during five years if that scenario happens, and discount rates have a high likelihood of following if that scenario happens, and that we will likely get some opportunities if that scenario happens.

-

10% inflation --->10% interest rates ---> 10% cap rates I'm saying 10% inflation should lead to 10% interest rates, which should lead to 10% cap rates. I understand the first arrow hasn't been happening even for 5% inflation because of intervention from Fed, and Fed calling it intermittent. However, I think either Fed will lose credibility or Fed will have to start admitting that it is not intermittent, and interest rates will likely move up.

-

It impacts a subset, but a big part of the economy that is measured by CPI. It also has downstream effects. Long-long term, I understand it will be mitigated by productivity increases. I'm saying it increases the probability of us seeing high inflation figures within the next few years.

-

@no_free_lunch, I understood your question, but my point is that even a single-time doubling of minimum wage is drastic, and hence I switched to the comparison between U.S. and Luxembourg. I am not claiming that minimum wage will continue to double all the time. Single-time doubling of minimum wage over 5 years results in 15% sustained inflation over five years in some goods/services. My point is if that 15% figure shows up even once in a wide range of goods/services, it will be drastic.

-

By cap rate is a function of NOI, I understand you mean cap rate = NOI/Price of CRE. In other words, Price of CRE = NOI / cap rate Value of CRE with $100K NOI with cap rate of 3%= $100K/3% = $3.333 million Let's say inflation hits 10% and NOI goes up 10% to $110K, and interest rates follow, and cap rates follow Value of CRE with $110K NOI with cap rate of 10% = $110K/10% = $1.111 million. I understand things won't be this drastic, but even if they are half as drastic, not great. I understand if you're saying you don't need to refinance or sell during that time, and can ride the inflation and hold, you might do fine. For that, you need long term mortgage. To be balanced, better to have some cash ready to also buy.

-

Yes, if you go to McDonald's in Luxembourg with high minimum wages, McChicken is more than double compared to U.S. Imagine mass market goods & services doubling in price in the U.S.

-

Once you start doubling minimum wages, everything starts almost doubling. Goods & services with labor as a big component almost double, e.g. haircuts, nannies, maid service, restaurant meals, construction costs, etc. Mass Goods & services that are consumed by all, where minimum price is determined by what lower-income folks can afford go up, e.g. fast-food prices double over time. Those geographically-bound workers will compete for the same restricted housing supply with a third of their fruits of labor, causing rents for those workers to double over time, unless effective supply increases due to geographically-mobile higher-income folks spreading out to bigger estates, far out water-view, etc., which is a possibility. So, maybe high-density rent doesn't double. Doubling over 5 years is 15% per year inflation. Even it that inflation figure shows up once in five years, it will be deadly.

-

I think the other source of inflation is minimum wage inflation. Unlike lumber, where increased supply will bring prices back down, we can't decrease wages back down.

-

Of course, you want cash taken out at low long-term interest rates, and in the long run that should do fine. I'm talking about how you invest that cash, some of which is taken out at low long-term interest rates. You could either just put it all in long-term holdings that will do well over the long run, or save some for taking opportunities that might arrive.