Xerxes

Member-

Posts

4,321 -

Joined

-

Last visited

-

Days Won

6

Content Type

Profiles

Forums

Events

Everything posted by Xerxes

-

I think in Prem's mind those famous table they put, covers what he considers as investment portfolio (be it long term or short term). Funded by the float. Whereas, the typical one-off asset sales that were part of the operating business, do not show up there. I had noticed the same omissions in other operating assets he sold off. Just remembering now.

-

Shouldn't this be included in their table On October 31, 2022 the company sold its interests in the Crum & Forster Pet Insurance Group and Pethealth, including all of their worldwide operations, to Independence Pet Group and certain of its affiliates, which are majority owned by JAB Holding Company, for $1.4 billion, paid as $1.15 billion in cash and $250.0 in debentures, as a result of which the company recorded a pre-tax gain of $1.2 billion and an after-tax gain of $933.9 million.

-

Those of you who are interested in the Chinese Re/MAX balloon would probably enjoy this episode on Aviation Week Podcast: Hot Air Or High Tech? China’s Spy Balloon | Aviation Week Network

-

The Big Short fella Steve Eisman had a great podcast with the OddLots folks. He came back few days later on Bloomberg Surveillance as well, but only for 10 min.

-

Public Company Share Repurchase-Cannibals

Xerxes replied to nickenumbers's topic in General Discussion

On large energy companies, it has become fashionable to say that they are always off on their share buyback program. Buying their own shares at cyclical high (as commodity prices soar) and not doing so when it is at a cyclical low. I think what is being missed is that, energy companies (and I could add mining as well) are always in the business of depleting and replacing their reserves. A barrel of crude produced today (to generate revenue) need to be replaced. Otherwise, energy companies production will just drop. Therefore, it makes perfect sense that the oil majors are investing and leveraging their balance sheet to counter-cyclically invest in assets, organically or otherwise, in a downturn, while foregoing the share buyback programs. Of course in an up cycle, they have that excess free cash, which they utilize to re-charge their balance sheet via de-levering, while the rest is return to shareholders, simply because it is cheaper to buy the one asset they know well (their own company) than to invest in expensive drill bits, assets, labor and acreage when prices are at an all time high. Also, better for the shareholder to decide what to do with the excess cash. This model as seen from the outside, in a vacuum (i.e. without considering opportunity cost), paints a picture of a clueless management team, that does not understand it is better to buy your own shares when they are low. The only reason the Exxons and the Chevrons of the world are still standing tall after a century of being in business is precisely because they are investing through their balance sheet counter-cyclically, and de-levering in good times (of course mistakes happen ex: XTO). It is just that the financial community is over-obsessed about share buyback and ignores the opportunity cost aspect of re-investment which is massive in commodity businesses. -

I Need a Laugh. Tell me a Joke. Keep em PC.

Xerxes replied to doughishere's topic in General Discussion

-

@changegonnacome You are welcome. always a pleasure. On Bolton, he maybe a hawk. But he knows what he is talking, notwithstanding being clever in some of his answers. ref: when asked about US and how it maintains its sphere of influence militarily. He gave the Canada example (that it is Canada telling us what to do) as oppose to his own mess in Iraq. (He was U.S. Ambassador in U.N. then and was banging the war drums pretty hard). He is hawk with an agenda but knows his stuff. I can respect that.

-

In the last 5 years, it was the Blackberries/Resolutes that drove the headline and with it the optics as it was the only proxy available that outsiders could gauge their investment prowess. The outsiders had no gauge or proxy on the “pet insurance” like organic growth and other internal gems where value could have been crystallized. Part of that it is the investor fault for lacking imagination but part of it is the management fault that likes to play things close to the vest. And just says “trust us”. looking forward to Friday.

-

Bed Bath Beyond Canada is up for sale !

-

agreed. That horse has been beaten to death. But one does wonder about the inner working of the company and how ideas and thoughts flow from different asset managers.

-

you could have made the same arguments in 2006-07. Don’t look and ask for the actual counter arguments as you won’t find them. what could de-rail the thesis is precisely something that you won’t see coming in 2023 and you won’t know what it will be. knowing that you don’t know, the only thing you can do is to stay humble. in 2018-19, there was nothing stopping the aerospace industry. Absolutely nothing. Firing on all cylinders with projection being fuelled by massive expansion of middle class in Asia. And then …

-

I posted this on the War thread. Perhaps it belongs here. ——— Jeff Curie talks also about the Russian sea-bound crude embargo that went up in Dec as well as the one refined products that went up in Feb. Unrelated to Russia, Jeff has been talking the same line for the past year that energy prices today have the same setup they had in 2006-07 during the Fed hiking cycle (that pushed USD all time high) which in turn kept oil prices in check (notwithstanding its bullish setup) but when the rate plateau and ultimately dropped in 2007-08 or so it uncorked one the biggest rally in crude. The difference of course is that 2008 we ended up with a banking crisis. If 2023 will indeed have a soft landing (as oppose to hard) the rally may just sustain.

-

Jeff Curie talks also about the Russian sea-bound crude embargo that went up in Dec as well as the one refined products that went up in Feb. Unrelated to Russia, Jeff has been talking the same line for the past year that energy prices today have the same setup they had in 2006-07 during the Fed hiking cycle (that pushed USD all time high) which in turn kept oil prices in check (notwithstanding its bullish setup) but when the rate plateau and ultimately dropped in 2007-08 or so it uncorked one the biggest rally in crude. The difference of course is that 2008 we ended up with a banking crisis. If 2023 will indeed have a soft landing (as oppose to hard) the rally may just sustain.

-

While at the company level they may have nail the portfolio-duration and having optionality, it does make one wonder why their bond guys couldn’t talk to their equity guys !?! The same pin that in 2022 burst the bond bubble also bursts the growth equity side. Ultimately while their equity short view was not wrong, it was totally wrong in terms of execution, which means somehow the folks in Fairfax did not appreciate (or didn’t figure out) how much of the equity bubble was underwritten by very low rates.

-

Awesome interview with John Bolton. The “Hawk” nails it. It is part of the PBS Frontline documentary called “Putin and the Presidents” which I think non-Americans cannot watch without VPN. I couldn’t even find it. In any case you can watch the interviews.

-

I found this interesting. Not the content of it, which I have not read in details, and is a different discussion altogether, perhaps not suited for this forum where extreme biases dominates, including my very own without-proof-Poles-did-it theory. But the fact that the author behind this is someone I never heard about, yet as I was browsing his name on line, I actually found that I have his bombshell book (unread) in my own very library. How America Took Out The Nord Stream Pipeline (substack.com) The plot thickens ! The Price of Power: Kissinger in the Nixon White House: Hersh, Seymour M.: 9780671447601: Books - Amazon.ca Tucked in neatly in between the Dead Hand (read) and the Iron Kingdom (unread). I got to get Price of Power ahead of the line !!

-

Is it me or they forgot to announce conference call for Q4

-

Movies and TV shows (general recommendation thread)

Xerxes replied to Liberty's topic in General Discussion

I started watching English on Prime. I having hard time getting past episode 2. Yet people say it is good !! Interesting thing about “English” and I cannot quite put my finger on it, but the shots seem to be composed of a lot of sharp contrasting colours. Also they seem to there are a lot wide shots follow by close-up followed by wide shots. I am not used to this type of filming. I think like eating particular food your brain gets used to one way of shooting a film and has problem digesting new ways. speaking of entertainment, I bet Walt Disney earning tonight will be entertaining. -

SJ, For educational purposes, are there any readings on the history of these bond trades for 2000 and 2008-09 that you mentioned. I never traded bonds but always found them to be interesting read. If you have any additional qualitative comment (aside from what is on annual letters) please share or point me to the right direction. I do recall the ones in 2020, related to Walt Disney corporate bonds. That is about it.

-

Not current news but pretty interesting. Notes for the French-speaking gunner on how to identify German tanks and their “soft” spot. The last one with a “deux” next to it is a Tiger II (aka King Tiger)

-

For me the concept of "wining a war" has only value, if achieved within weeks/months of launching a war. After that time value element kicks in and everything gets to be relative and discounted. Ukrainian "winning the war" or Russian "winning the war" are going forward highly relative concept.

-

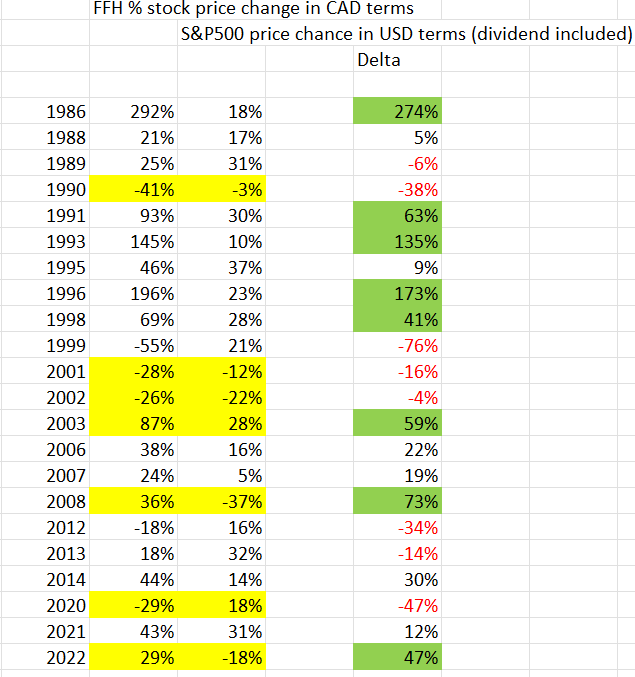

@nwoodman @Viking If the big technology firms get a bid and S&P500 bottoms out and money flows into them (ala post Dec 2018), wouldn't that take some air from FFH like names. I am not talking about the underlying business just the stock price. Prem himself endlessly talks about how FFH does outperform the S&P500 coming out of a crash (not FFH book value he is talking, but FFH share price). We had that massive contrarian outperformance in 2022, which followed outperformance (though mild) in 2021 by FFH. What is the likelihood of that repeating itself, if S&P500 rallies hard, third time in a row. I think low. I get all the "it is cheap" arguments. That is being for me, as a core position at 11% (not counting FIH), it is a hold, so it is not like I am missing out on anything but I will wait before adding more money in 2023. Lastly, the mountain has two sides, as I like to say. At some point when FFH rallied hard in 2014 from $400 to $700. There were all kinds of reasoning that made sense at the time, why it was a buy at $700. "Don't you see the deflation coming". Hindsight is 20/20, 8 years later now we know better. That was the "left side" of the mountain. And 2020 was the "right side" of the mountain. When the share price revisited the same dollar value. I could say the samething about any other stock. Say Microsoft. $248 today in Q1 2023. And it was $248 in Q1 2021. In 2021, you were crazy for not owning, and in 2023, there is a "tectonic shift". FFH may go (will?) to +$,1200. But there could be really good reason for it to take a dive some years down the road. I guess, i am looking at this with an eye to long-term capital deployment. I am too busy enjoying life than trade around. Of course one could trade Microsoft around that step change in outlook etc. And one can trade FFH as well.

-

After having finished reading Robert Massie's massive work on Peter the Great, I took a break and read short ones: Feathermen, a not so clear if it is real story about the aftermat of an SAS operation in Oman, and Psychology of Money, I am now back to my Russian studies. I started reading this book on the Crimean War, another world against Russia story. A major conflict that defined an entire generation. A war that brought hints of how future wars may look like. I will skip Robert Massie's work on Catherine the Great for now, and come back to it after Crimean War, eventhough the chronological order is in reverse. That said, I also bought the recently written work of Lawrence Freedman: Command: The Politics of Military Operations from Korea to Ukraine. Will be reading this in parallel. The Crimean War: A History: Figes, Orlando: 9781250002525: Books - Amazon.ca Command: The Politics of Military Operations from Korea to Ukraine: Freedman, Lawrence: 9780197540671: Books - Amazon.ca Below are few snapshot from the introduction of the book, now doesn't that (specially the first snapshot) sound familiar and can it not apply to 2022-23

-

I heard about 100, 31 of which are M1s. I agree about the "land bridge". That said, I don't think you will see Abrams being used in Crimea directly. I think there is an unspoken understanding with the Americans in terms of priorities and objectives when it comes to Crimea. Ukraine may consider Crimea its soil, but I don't think any U.S. administration (republican or democrat) would be pushing Kiev hard to re-conquer Crimea. Air strikes against military targets are of course legitimate. Besides, there is a ton to do, before even getting there. First of which is to blunt the coming Russian offensive. EDIT: we are sending 4x Leopolds ! Ukraine is saved. https://www.cbc.ca/news/politics/trudeau-donate-leopard-battle-tanks-1.6725868