Luke 532

Member-

Posts

2,931 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Luke 532

-

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

I recommend reading chapter 8 again of The Intelligent Investor. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

he may be a fannie guy, but he is even more a mnuchin guy Agreed. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Fannie guy to be part of Treasury... http://financefollow.com/2017/06/fannie-maes-brooks-to-be-nominated-u-s-deputy-treasury-secretary-axios/ -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

June 6th... https://www.nationalmortgagenews.com/news/bankers-at-odds-over-gse-recapitalization-proposal "The Independent Community Bankers of America supports the plan developed by the investment banking firm Moelis..." ICBAVerified account @ICBA 9m9 minutes ago .@HaynieRon: @ICBA aligned w/ @Moelis proposal bc it provides GSEs w/ capital & there is process for that under law -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

From the Wikipedia page... Tilt is a poker term for a state of mental or emotional confusion or frustration in which a player adopts a less than optimal strategy, usually resulting in the player becoming over-aggressive. This term is closely associated with "steam" and some consider the terms equivalent, although steam typically carries more anger and intensity. Placing an opponent on tilt or dealing with being on tilt oneself is an important aspect of poker. It is a relatively frequent occurrence due to frustration, animosity against other players, or simply bad luck. Experienced players recommend learning to recognize that one is experiencing tilt and avoid allowing it to influence one’s play. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Emily, I appreciate your comments and thoughts on this board. With that said, I do get the hunch that you're on tilt. About two weeks ago you were very worried about this investment, then a few days ago you wondered if you should even sell common at the low price of $20, and again today you are convinced that something needs to be done within 2 weeks or we're toast. I understand emotions can cause swings but just wanted to caution against letting that drive your decisions. I hope this is well received, not meant to be preachy, just hopefully helpful. Thanks. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Great point, investorG. I don't think that fact is lost on Carson (very, very familiar with management that backed the blueprint). And it's awfully convenient this plan came out when it did just before Mnuchin, Calabria, and others are ready to tackle the GSE issue in the 2nd half of the year... -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

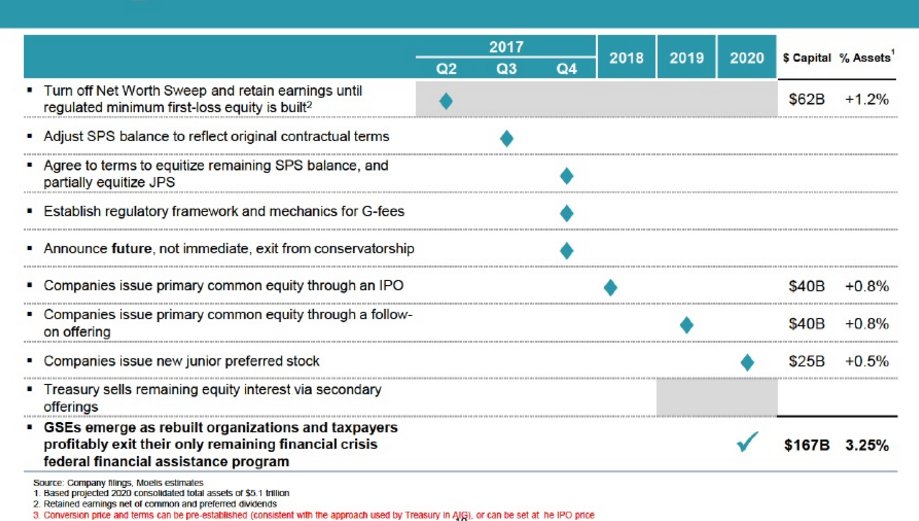

Good discussion so far. I dialed in, but kept getting interrupted by work and missed this slide. Was there any mention made behind the though process of equitizing current junior preferred shareholders only to re-issue another 25B in preferreds? Is it simply the rate differential that can be achieved? I didn't hear them discuss that in detail. Attached is the full presentation. And their website: http://gsesafetyandsoundness.com/ 6-1-2017_Safety-and-Soundness-Blueprint.pdf -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Paraphrased during Q&A: "The steps we lay out can be implemented by FHFA and Treasury without involvement from policymakers, while policymakers work on reforms." Jerome Corsi (InfoWars), Joe Light, and Josh Rosner (among one or two others) asked questions. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

-

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

I would think so given the following: "while realizing a significant financial gain for the U.S. taxpayer" Although the U.S. taxpayer has made a nice return on dividend payments alone, not counting the warrants. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

And facts that Mnuchin, the most important player in this game, is well aware of. If so, why sit on it? Why not do anything? Mnuchin doesn't even want to stop NWS. Because there are consequences (both good and bad) for Mnuchin personally, for the party he represents, for the economy, for the job market, for various bills he wants to pass, etc. that would all be impacted to some degree by major changes to the GSE's. And many of these variables are impacted by time. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

And facts that Mnuchin, the most important player in this game, is well aware of. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

https://www.insidemortgagefinance.com/imfnews/1_1115/daily/-1000041476-1.html May 26, 2017 By Paul Muolo, pmuolo@imfpubs.com There was scant mention of Fannie Mae and Freddie Mac in the new Trump budget but the White House did take note of the Housing Trust Fund and Capital Magnet Fund, two federal programs that provide money for affordable and low-income housing. The cash comes from Fannie and Freddie. Not too long ago, Federal Housing Finance Agency Director Mel Watt ordered the GSEs to forward the money to HUD, which administers the programs. The money assessed on the GSEs totals roughly $627 million. The White House wants to eliminate the programs… If Trump is successful on this score, presumably the money would flow through to the bottom line of Fannie and Freddie and be counted toward earnings. This, in theory, would increase the amount of dividends swept into the U.S. Treasury… As we all know, FHFA chief Watt wants to prevent another GSE draw of Treasury funds, something that could happen if their capital positions fall to zero next year and there’s a large hedging charge. Across the industry, there’s mixed views on whether this is a good idea. But what would the harm be in allowing Fannie and Freddie to hold, say $2 billion in capital, and cap it there? What’s wrong with that? One fear – so we’ve been told – is that by doing so there would no pressure on Congress whatsoever to pass GSE reform legislation. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

A fight is brewing between the U.S. Treasury department and the Federal Housing Finance Agency over Fannie Mae (FNMA) and Freddie Mac (FMCC). Investors would do well to ignore it. Instead, investors and other housing market participants should focus on a promising consensus that is beginning to form about the ultimate future of Fannie Mae (FNMA) and Freddie Mac (FMCC). The recent news around these two government-controlled housing giants has focused on an intragovernmental dispute over whether they will continue to pay their full quarterly profits to the U.S. Treasury, as they have since 2012. Less noticed has been Treasury Secretary Steven Mnuchin's opening of the door for the first time to an explicit government guarantee for the mortgage market. In an exchange last week with key Senators Mike Crapo (R., Idaho) and Bob Corker (R., Tenn.), Mr. Mnuchin said he would consider a government backstop for the mortgage market. "If there is a guarantee, we would want to make sure that there is ample credit and real risk in front of that guarantee, so that taxpayers are not at risk," he said. These comments suggest the Trump administration's thinking is in line with a range of compromise proposals put forward by private think tanks, the Mortgage Bankers Association and others. These plans would dramatically restructure Fannie and Freddie, and put in place a federal guarantee on certain mortgage securities. This protection would kick in after private investors have taken initial losses through the new "credit risk transfer" market. Under most of these plans Fannie and Freddie would still exist, but with a more limited role, perhaps as utility- like mortgage guarantors. That may not be the most profitable outcome for Fannie and Freddie shareholders, but they are far from the only stakeholders in this debate. The new government guarantee would ensure a steady flow of investment into the trillion- dollar mortgage-backed securities market, keeping mortgage rates low. Investors willing to take on some repayment risk in exchange for higher returns could do so in the new credit-risk transfer market. Fannie and Freddie have been unloading credit risk on mortgage pools with securities and reinsurance contracts through this experimental market since 2013. There remain important questions on compromise plans like these, notably how the system would cope with a pullback of private risk capital during a housing downturn. It is also unclear if conservative Republicans in the House of Representatives would support any federal role in housing finance. But a limited, explicit guarantee would strike many policy makers as preferable to the alternative arrangement of huge implicit government backing for Fannie and Freddie. Housing market participants across the board should look past the weekly Washington battles over Fannie and Freddie, and be encouraged that a long-term solution is now emerging. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Fannie and Freddie Endgame Takes Shape https://www.wsj.com/articles/fannie-and-freddie-endgame-takes-shape-1495618202?mod=djemheard_t -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

That's the wise part of you that wants to do that. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Collins case dismissed. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Fair enough, but in any situation involving politics (and Fannie/Freddie qualifies) one should factor in the consequences (both good and bad) that impact the primary political decision-maker. The consequences of GSE reform, housing, HUD, etc. are all paramount on the mind of Mnuchin. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Anybody know off-hand how much of the $33B of junior prefs is owned by hedge funds and/or plaintiffs of pending litigation? -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

I'm not so sure optics matter, but given Mnuchin is now a politician that hopes to get stuff done over the next 4 (8?) years then the hedge funds win coupled with teachers and cops losing is much more damaging to him than hedge funds win but so do teachers and cops. The latter is based on the principle that shareholders of all kinds deserve something (no bias). The former is based on the principle that Mnuchin doesn't care about anybody but hedge funds (bias). That likely wouldn't go over too well for his next 4-8 years in office. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

At what percentage of par were the retail shareholders converted? That certainly could happen, but probably unlikely given the optics that the hedge funds won, pensions (teachers, cops, etc.) lost and taxpayers lost* (by paying some money to hedge funds). That really would be hedge funds (and one mutual fund) won and everybody else lost (pensions by losing their investment, taxpayers by paying money to hedge funds). In other words, all investors except hedge funds (and Berkowitz) lost. *of course, taxpayers don't lose (except the pensions) but that would be the optics of the situation. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

May 30th is the deadline for gov't to submit the status report for compliance with court order to produce documents to plaintiffs. Haven't seen any filings from Fairholme complaining about not receiving documents, so perhaps in fact they have received some. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Here's what was retweeted with a link to the Rosner/Carlson interview: "Obama took billions from Fannie and Freddie to fund Obamacare... and he's still trying to cover his tracks." -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

I haven't added a single share to my already significant position in prefs since March of 2016. I'll likely be adding if it drops a little more. Chapter 8 of The Intelligent Investor in action.