indythinker85

-

Posts

296 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by indythinker85

-

-

Buffett's advice to investors not to treat the stock market like a casino is further strengthened when you understand how he feels about actual gambling. Buffett described gambling as "a tax on ignorance" during Berkshire Hathaway's 2007 annual meeting.

He once installed a slot machine in his home and tested his children on it by giving them their allowance in dimes. He said he had all of their allowance back by the evening on the day in which he gave it to them, which illustrates how easy it is to lose while gambling—whether it's on the stock market or in a casino.

Buffett believes that since humans tend to enjoy thrill-seeking, it may be why so many people like to gamble. However, it's easy to get in trouble by gambling by taking on debt to buy stocks, as many investors have found when they've fallen victim to a margin call.

From https://www.valuewalk.com/2020/10/buffett-warns-stock-market-casino/

-

Can anyone who has more info DM me?

-

Many questionable labor practices at this plant of theirs https://www.valuewalk.com/2020/04/sps-technologies-precision-castparts/ - its a pretty big one it seems as well, 5000 plus employees https://www.dnb.com/business-directory/company-profiles.sps_technologies_llc.d298457fd640833efc3d80a968ab5532.html

Curious if this is true, would Buffett know about stuff like this?

-

Was just posting this thank you~!!!

-

Full CNBC video from today (would love whole thing in one if anyone sees it) https://www.google.com/search?q=cnbc+buffett&client=firefox-b-1-d&tbs=qdr:d&tbm=vid&sxsrf=ALeKk02X0A_qfHCa-HyT6XmgN5PkiQV7bQ:1582566122123&tbas=0&source=lnt&sa=X&ved=0ahUKEwjSsquc3urnAhWfgnIEHdZoC40QpwUIIA&biw=1920&bih=923&dpr=1

Transcript here http://www.valuewalk.com/2020/02/billionaire-investor-warren-buffett-cnbc/

-

The latest from Dick Bove https://www.valuewalk.com/fannie-mae/

-

-

-

A letter gives a rare glimpse into one of the world's most secretive — and most successful — hedge funds

http://www.businessinsider.com/brian-spector-leaving-baupost-letter-2015-11

Great stuff also more here http://www.valuewalk.com/2015/11/baupost-group-q3-letter/

-

-

-

-

According to this his performance was pretty good - in 2010 from inception:

http://www.marketfolly.com/2011/04/t2-partners-attributes-poor-performance.html

In 2011, he was down 25% according to this"

http://www.reuters.com/article/2012/01/11/us-hedgefunds-idUSTRE80A1CV20120111

"One example is Whitney Tilson. His $250 million T2 Partners LLC has generally outperformed the major stock market indexes, but last year was a far different story, with his main fund tumbling 25 percent after losing big on stocks like Iridium and Netflix."

They went their separate ways in 2012...so I'm assuming that year wasn't going well either.

http://www.businessinsider.com/whitney-tilson-and-glenn-tongue-part-ways-at-t2-partners-2012-7

Tilson is a nice guy just he never knows when to stop. After the 60 minutes interview he came out looking very good - he could have done Bloomberg and CNBC that morning and then just kept quiet. Instead, he has done CONSTANT emails, interviews, articles etc. He does not know when to stop. Tilson could really use a good PR agent who would tell him when its enough!

Anyway, here is his updated track record.

http://www.valuewalk.com/2015/02/whitney-tilson-letter-2014/

-

-

-

-

-

http://www.valuewalk.com/2015/01/jeff-gundlach-on-oil-prices/ Jeff Gundlach: Geopolitical Consequences Of $40 Oil “Terrifying”

-

Does anyone know what happened to Denali Investors from Q4 2009 to Q4 2012?

The fund since inception in late 2007 is up 187.9%. From inception to end of Q4 2009, the fund was up 59%. 2013 was 66% and 6 months ending Q2 2014, the fund was up 33.7%. If we take out 2010, 2011, and 2012, the gains from 2007 to 2009, and 2013-Q2 2014 should be 252%. So, from beginning of 2010 and end of 2012, Denali was down 26%. Down 26% in a three year time period is substantial. Short term volatility tends to work out in a 3 year period. Anyone know what happened during that time period? In the G&D interview, Kevin mentioned that he had a "Come to Jesus" moment in 2011 regarding his strategy. Can anyone shed any lights on this?

http://manualofideas.com/files/content/kevin_byun_denali_investors_letter_2009-q4.pdf

It was mostly 2011 H2 - Denali performance 2010 +10.3%, 2011 –34.4% , 2012 +15.4% - cant post the full letters but can help you if you contact me

-

look in the Coinstar thread on buybacks. If current market cap is lower then future cash flows added up of say next 10-15 years, then a buyback is good for shareholders. It is bad if the stock is overvalued. So my guess is, some buybacks with borrowed money are good, and some are bad. If you think the stocks on average doing those buybacks are overvalued, then they are destroying value. But that is an average. Some are creating v alue, but some are destroying more value then the others create, so on average value would be destroyed if you think there are more overvalued companies buying back stock.

The thing I see Dalio not really mentioning is productivity. You cannot discuss debt markets without discussing productivity too.

More from Dalio http://www.valuewalk.com/2014/10/bridgewater-judges-sovereign-nations-success-economic-scale/

He said that it matters most in the long run. What i am missing is how in the world all the different ecnomies work together. At the moment we have a beautiful deleveragin in the US, but a deflation with austerity in europe and a debt bubble in china. Now is the US importing deflation through the currency and killing the beauty?

-

THat guy gottfried is interesting. Is there a way to publicly track his holdings?

Besides the ones he mentions at VIC, I don't think so. The guy doesn't even have a website.

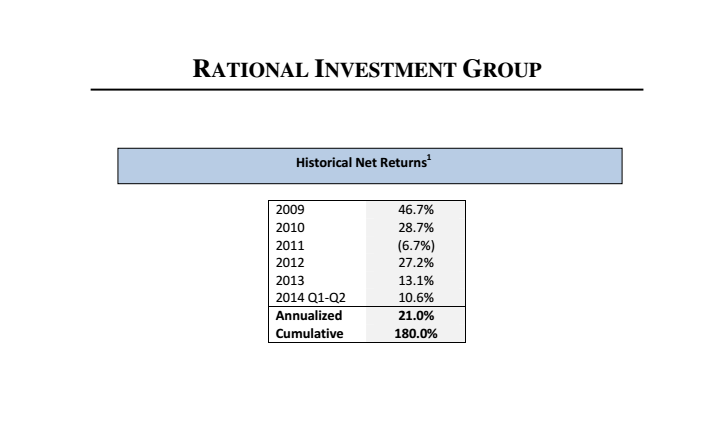

Yes, I was very impressed with his interview. If anyone has more info on him, please share. His returns have been great as well:

"Since inception, we've generated net returns of 21% a year. That compares to 13% for the TSX Composite Index in Canada, where the vast majority of our portfolio has been invested over the years. We've beaten the index by about 8% annually while averaging 24% cash."

Recent VIC presentation:

http://www.valuewalk.com/2014/09/guy-gottfried-radar-underfollowed-gems/

Gottfried pitched these two stocks a few days ago at capitalize for kids.

http://www.marketfolly.com/2014/10/guy-gottfrieds-presentation-on-tree.html

For the board here is a screenshot from his letter of returns - cant reveal more as he has a small base of ppl receiving this info and dont want anyone to get in trouble

-

Importance of ROIC Part 5: A Glance at the Last 42 Years of Wells Fargo http://basehitinvesting.com/importance-of-roic-part-5-a-glance-at-the-last-42-years-of-wells-fargo/

-

FWIW - Ackman said he was buying more - Michael Price owns the prefs- Perry sounded a bit more downbeat but still decided to mention he's bullish at the conference- http://www.valuewalk.com/2014/10/gibi-conference-2014/

-

[amazonsearch]Outines and Orgies: The Life of Peter Cundill[/amazonsearch]

Just a heads up since i really liked the first one, got advanced copy of this one but havent got a chance to read it yet.

Warren Buffett opposes gambling in casinos and the stock market

in Berkshire Hathaway

Posted

Gambling in the stock market goes beyond mere speculation. One of the habits Buffett has especially spoken out against as a form of gambling is borrowing money to buy stocks. The Financial Industry Regulation Authority (FINRA) reports that investors have started to buy more and more stocks on margin, meaning they're borrowing money to buy them.

In September, investors had more than $654 billion in margin debt. That's an increase from August when the number was in the $645 billion range. If this trend continues, there could be a new record for margin debt soon. The current record was set in January 2018 when investors held $665.7 billion in margin debt. Buffett has said there's no reason to buy stocks on margin unless they are "in a hurry to get rich and willing to go broke." He also advises investors to "get rich slowly."

Buffett has also said in a CNBC interview in 2017 that China's stock market sometimes has casino-like characteristics because it is relatively young compared to U.S. stock markets. The Shanghai Stock Exchange opened in 1990, while the New York Stock Exchange has been in operation since the late 18th century.

Warren Buffett is often referred to as the "Oracle of Omaha," so investors would do well to listen to his advice about the stock market and gambling. Many people could probably say they have gotten rich from listening to Buffett's wisdom on investing.

https://www.valuewalk.com/2020/11/buffett-opposes-gambling-stock-market/