giofranchi

Member-

Posts

5,510 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by giofranchi

-

Reduction in Equity Hedges to 50%

giofranchi replied to valueinvesting101's topic in Fairfax Financial

Goodwill is high basically for two reasons: 1) In recent years FFH has bought high quality insurance companies at a premium to BV. This is imo why their underwriting performance has improved so much (together with the outstanding job done by Mr. Barnard of course!). Therefore, I am not really worried. 2) In recent years FFH has bought more non-insurance companies: for instance, last quarter goodwill went up $415 million Are you worried they have paid too much for non-insurance businesses? Cheers, Gio -

I agree: 15 years is definitely a very long time! And many (bad) things can happen to a business in the meantime. This being said, while I manage my own businesses for the medium term, I also always plan for the long term. And I hope they might continue to grow for many years to come. Therefore, I don’t think it is completely futile to look for businesses that could perform well over the long term. BRK.B: as diversified as a company can be, with a unique culture. ACGL, FFH.TO, MKL: the same business model that made BRK great, with strong and proven management. DIS: –Roy Disney (“Walt Disney – The Triumph of the American Imagination”) IBB: I like biotechnology, I just don’t know who will win and who will lose. JNJ: the first one mentioned in this thread! LBRDA, LMCA: jockey stocks with a possible time-frame of 10 years. NKE: –Phil Knight (“Shoe Dog”) Certainly more competition these days, but imo still lots of opportunities to grow. QQQ: I like technology, I just don’t know who will win and who will lose. SBUX: (“Onward”) Cheers, Gio

-

Reduction in Equity Hedges to 50%

giofranchi replied to valueinvesting101's topic in Fairfax Financial

Ok Joel! Thank you very much. Always enjoy sharing thoughts with you. Cheers, Gio -

Reduction in Equity Hedges to 50%

giofranchi replied to valueinvesting101's topic in Fairfax Financial

Thank you! Gio -

Reduction in Equity Hedges to 50%

giofranchi replied to valueinvesting101's topic in Fairfax Financial

It will be interesting, I guess, to read what Prem will have to say about equity hedges in his 2016 AL. He has always defended equity hedges in his letters so far, for the very same reasons Parsad has written about. I tend to agree with you that in Prem's mind they were not just meant to protect a levered company, but were a call on the stock market too (a macro bet). This being said, I wouldn't call his behavior so far "dishonest": equity hedges have always been very well documented and presented to shareholders, and each one of us could have formed his/her own idea about them. Someone sharing Parsad's view, others sharing yours, others still being somewhere in between (like me). Until a trade is over, you shouldn't really expect a 'mea culpa', should you? Even if a trade performs poorly for a long time. You should know this very well! Now I am sure your fund is having extraordinary results, but for a long time you kept defending your strategy even if it was lagging behind the general market. And I have admired you very much for the strength of will you were showing! Now that the "equity hedges" trade seems to be over, or at least radically changed, I agree it would be great to hear Prem reason about what went wrong and why. Cheers, Gio -

Reduction in Equity Hedges to 50%

giofranchi replied to valueinvesting101's topic in Fairfax Financial

Joel, You and Vinod might be right of course! But I also understand Parsad's reasoning. What we all can I agree with is the last 5 years BVPS growth has been disappointing. Therefore, mistakes have been made: equity hedges have cost lots of money and equity investments have performed so poorly they sometimes lost money in a rising market... On the other hand, bond investments have been very good and insurance underwriting has improved very significantly. That has been the recent past. Now the future: they have $10 billion of cash and are selling for 1.1xBVPS: is FFH going to be a good investment going forward? Most would say they have become good insurance underwriters and are still very good bond investors, and most would judge them as very poor stock investors. The question imo is: will they become once again good stock investors? If they succeed, FFH might perform very well from here. But of course I don't know the answer to that question. Cheers, Gio -

A decline of -9% last year (almost all due to the VRX position) is certainly weighing on my investment results during the last 5 years… On the contrary my results as an entrepreneur have been better than I had thought. The end result is I have compounded the equity of my company at slightly more than 15% annual during the last 5 years, which is my goal and essentially what I am interested in. Of course you might say this board is investment oriented and, as some have already “kindly” pointed out, my results as an entrepreneur shouldn’t even be mentioned… Maybe that reasoning is sound, but I on the contrary don’t think those two aspects of my professional career are so completely independent from one another. If I thought so, I would be probably investing in a S&P500 ETF and never devote any time following specific businesses. Cheers, Gio

-

But I really never intended to. I have only tried to say what I was doing and why. I use both Twitter and this board as means through which I can share ideas with people I would never have met otherwise. I manage my own businesses and my own money. I have no hidden goals. You might be right. But as I have said I don’t really care. Instead, what I care about is being involved in some businesses, thinking about their dynamics, and learning what works and what doesn’t. Being constantly aware of how things are evolving in the business world. Besides, I also think that Fairfax and the Malone family of businesses might differentiate somewhat my portfolio from the S&P500 (for better or for worse I cannot say… we’ll see). Cheers, Gio

-

Guys, I had lost this discussion until now. There is no doubt I have been very wrong with VRX (it was a large position), I have been wrong with AGN (it was a small position), while I had no particular view about Theranos except the article I had read and posted… Though I surely have learnt some lessons, basically I keep looking for great managers at the helm of great businesses that could be bought at fair enough prices. Over the long term I think this strategy could yield stock market returns that are in the range of 7%-9% annual, while my own businesses could on average generate 5%-6% of additional free cash. That is still my goal, but I am very aware of the fact I might never achieve it. Why do I choose to invest in specific businesses instead of simply investing in the S&P500? Because I enjoy the process of following real businesses and I believe that to understand their dynamics helps me very much in managing my own companies. At least, this has been my experience until now. Cheers, Gio

-

Their insurance operations kept performing satisfactorily. Therefore, I wouldn't consider selling. Though I won't add either, unless the stock goes south in the next days/weeks. Cheers, Gio

-

A quarter in which both returns from equities and from equity hedges have been negative... Gains from their bonds portfolio couldn't offset those poor results. Cheers, Gio 2016-Q1-Press-Release-final.pdf

-

Fairfax buys part of Bangalore airport

giofranchi replied to Granitepost's topic in Fairfax Financial

Thank you for posting! Cheers, Gio -

ECB's Gloomy Price Outlook to Be Confirmed Just as QE Grows http://www.bloomberg.com/news/articles/2016-03-28/ecb-s-gloomy-price-outlook-to-be-confirmed-just-as-qe-expands Cheers, Gio

-

Great investing cant be taught. Its in the DNA!

giofranchi replied to premfan's topic in General Discussion

At the risk of sounding too predictable, I really don’t care being in the top 1 percent… I work with my own capital only, I don’t depend on anyone else, I love what I do, and I know I’ll be able to take care of my loved ones and at the same time to increase our wealth over time (though of course I have no clue about the rate I’ll increase it). That’s enough for me. And I am saying this in all earnestness! Cheers, Gio -

Great investing cant be taught. Its in the DNA!

giofranchi replied to premfan's topic in General Discussion

As far as I am concerned, it is straightforward enough: 1) I must produce more than I consume (how much more depends on the circumstances); 2) I have businesses that give me cash at the end of each month; 3) I use part of that cash to consume and the rest to increase my ability to produce; 4) If I cannot reinvest the cash I don't use for consumption in my own businesses, because they don’t need it, these are the choices I have: a) Invest it in other businesses through the stock market; b) Invest it in some indexes; 5) I usually (but not always) choose a) because I like to follow businesses, because it helps me to keep learning about business, and because I find the process very useful for managing my own businesses better and better; 6) I finally take results as they come (overall they have been satisfactory till now). Cheers, Gio -

These are my main comments about the letter: Cheers, Gio

-

This is sad! His book has always been on my reading list, but somehow I never got to read it… Now I might decide myself at last! Cheers, Gio

-

http://www.investors.com/news/technology/artificial-intelligence-weaves-its-way-deeper-into-daily-business/?utm_source=dlvr.it&utm_medium=twitter Cheers, Gio

-

Thank you for posting. It looks like Fairfax is trying to leverage its connection with the University of Waterloo and their expertise in technology. Of course, it is using shareholders money to do so… But it looks like a very small investment has been done till now, while to payoff could be interesting. We’ll see! Cheers, Gio

-

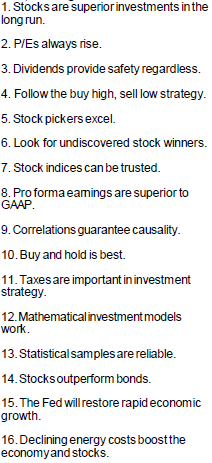

The latest Gary Shilling Insight is one of the best I have read. In it he analyses 16 "market myths" (in attachment). Cheers, Gio

-

Ray Dalio on the Future of Monetary Policy

giofranchi replied to ni-co's topic in General Discussion

+1! Very interesting. Cheers, Gio -

+1! Except that maybe BRK is not the only company which fits those criteria... Cheers, Gio

-

Fairfax Financial to raise C$735 mln via equity issuance

giofranchi replied to ourkid8's topic in Fairfax Financial

Mmm… We might very well be in an historical period in which a 10-year track record changes dramatically in just a few months. Of course I don’t know, but this is surely what Prem and others at Fairfax believe. If they are right, I’ll be glad I own a large position in Fairfax. If they are wrong, I also own other companies. Cheers, Gio